Whether it has to do with trading commissions, broker assistance, trading tools, or educational resources, finding the online stock trading site that will work best for you can improve your investment returns by thousands of dollars over the years. In this article, that’s exactly what we’re trying to help you do.

Our Selection Methodology

In determining the best online stock trading sites, we looked at 10 popular investment brokerages. We narrowed the list down to the five that provide the broadest range of services and the most attractive pricing. After all, this is a list of stock trading sites, so fees matter.

Overall, we used the following criteria to determine the best online stock trading sites:

- Evaluations and ratings from major financial publications

- Platform pricing

- Range of investment options

- Quality of trading platform

- Availability of trading tools and educational resources

- Areas of broker specialization

Each of the five stock trading sites on this list excels in each of these categories. It came down to relative levels of strength in each and exemplary performance in one or more areas.

Read more: Which Is the Best Robo-Advisor?

Best Online Stock Trading Sites

1. TD Ameritrade

TD Ameritrade might just have the best overall trading platform in the industry. It also has more than 360 branch locations in major metropolitan areas around the country.

TD Ameritrade is particularly strong with its trading platform. It offers overnight trading on a 24/5 basis - trading 24 hours a day, five days per week. Its thinkorswim feature provides professional-level trading technology, streaming real-time data, customizable charts, and integrated one-click trading. It also offers Advanced Trading, investor education tools, and Technical Analysis (with more than 400 technical studies).

But perhaps most interesting is the TD Ameritrade paperMoney tool. It’s a virtual trading account that lets you test trading strategies before going live. It gives you two accounts, a virtual margin account in a virtual IRA, each with $100,000. It’s perfect either for a beginner or an advanced trader to test various investment strategies without the possibility of losing money in the process.

TD Ameritrade is simply one of the least expensive of the investment brokerage range, with a fee of $0 per trade for stocks and ETFs, plus $0.65 per contract. There’s free trading of load mutual funds and $49.99 per trade for no-load funds.

Related: Read TD Ameritrade Full Review

Advertising disclosure - DoughRoller.net is partnered with TD Ameritrade, and we may receive compensation from them depending on your action. All opinions are ours and not influenced by any advertiser.

2. E*TRADE

E*TRADE is another investment broker that’s coming up fast. E*TRADE made a deep plunge into options trading with the 2017 acquisition of OptionsHouse, a platform that specialized in that investment niche. In fact, E*TRADE has largely kept the OptionsHouse platform intact while adding its own specific services to the mix.

Much like other investment brokerage firms on this list, you can hold the widest variety of investments through E*TRADE. And while options are its strong suit, it’s also a major force with funds, offering more than 9,000 mutual funds, including more than 4,400 no-load funds with no transaction fees. It also offers a wide variety of target-date mutual funds.

With fees, E*TRADE is about the best you can do when compared to the major investment brokerages. It charges $0 per trade for stocks and ETFs and $19.99 per trade for mutual funds. For options, it charges the base fee of $0 per trade, plus $0.65 per contract.

Customer service is available on a 24/7 basis by phone, email, and live chat. It also has more than 30 local branches in major metropolitan areas around the country.

The trading platform is one of the best in the industry, particularly regarding options trading:

Related: Read E*TRADE Full Review

3. Charles Schwab

Charles Schwab virtually invented the discount investment brokerage concept back in the 1970s. But it steadily added services to the point where it’s a full-service broker, while still providing discount prices.

Charles Schwab offers everything Fidelity does and is an even larger firm based on assets under management. But we gave Fidelity the nod due to its stronger position in mutual funds.

But Schwab has plenty of strengths of its own. Its training tools and broker support are second to none in the industry. Its fees are comparable to Fidelity, and so is its investment selection.

If you’re a trader, especially a new one, it offers some of the best educational and training resources on the web. It also offers a full range of investment products, including stocks, bonds, options, mutual funds, and ETFs. At $4.95 per trade, its commissions are at the low end of the investment broker range. It’s, however, high on mutual fund commissions, at $76 per trade.

But one of the factors making Schwab one of the top firms in the industry is its robo-advisor platform. These days, virtually every major brokerage has one. But what makes its Schwab Intelligent Portfolios robo-advisor stand out is that it’s offered at no fee. The service invests your money in up to 20 different asset classes, including commodities and real estate. It’s a perfect option for a new trader who may want to keep some of their money in a professionally managed account while breaking into self-directed trading at the same time. That’s a big advantage for any investor, particularly a new investor. And even though we’re primarily evaluating stock trading sites based on actual trading features, it’s always a plus to have a good managed option as well. And one that’s free is even better!

But one area of particular benefit to new traders is customer service. Schwab has it available on a 24/7 basis, and it consistently gets high ratings from major financial media outlets. For example, in 2017, Charles Schwab was rated #1 in customer service by investors Business Daily.

They offer a wealth of investment tools, including Schwab Proprietary Research, which provides access to stock ratings, fundamental research, custom screeners, and much more.

Related: Read Charles Schwab Full Review

4. Fidelity

Wed like to say this was an easy choice, but it was anything but easy. It’s a matter of choosing between five very good investment brokerages, and Fidelity won the top spot by no more than a nose.

Fidelity is one of the world’s largest investment brokerage firms, with nearly $2.5 trillion in assets under management. The company started out as a mutual fund family, which is still one of its specializations. But it branched out into general brokerage services, and we feel its become the best in the business.

The platform offers something for every investor. You can trade virtually any type of investment, but perhaps what Fidelity is best known for is funds, particularly its own Fidelity Funds. It has some of the industry’s best-known and established mutual funds, including the $100 billion-plus Fidelity Contra Fund. And in addition to the Fidelity Funds, it offers thousands more from other fund families.

The popularity of fund investing - and the fact that Fidelity is the second-largest fund provider - gives it the nod over the competition.

It also offers all those investment options with trading fees at the lower end of the entire industry. Its basic trading fees for stocks, options, and ETFs are at the lower end of the investment brokerage fee range, at $4.95 per trade. Mutual fund commissions are $49.95 per trade, but they offer hundreds of funds commission-free.

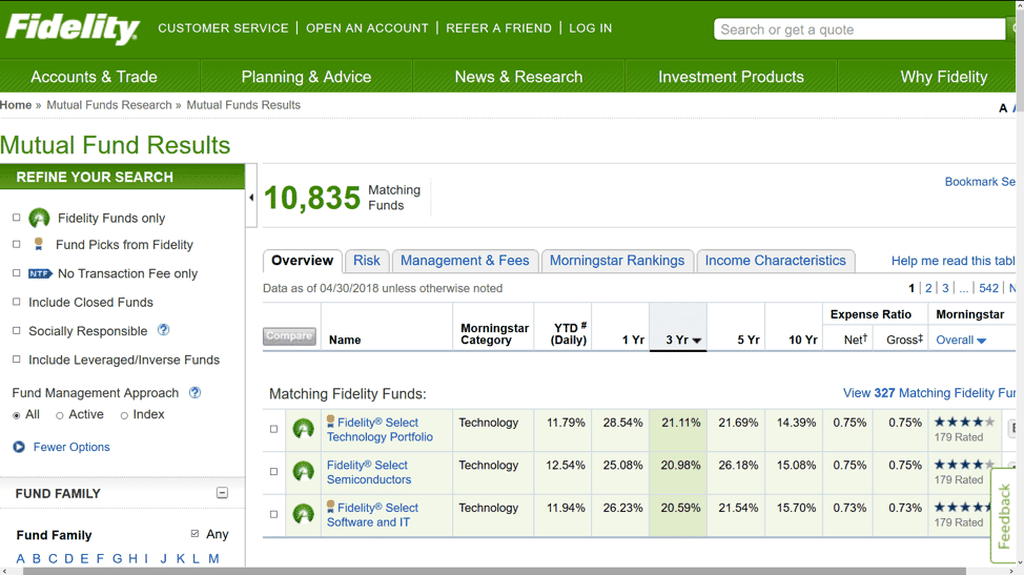

Their Active Trader Pro trading platform is one of the best in the industry, and it provides abundant trading tools and educational resources. Fidelity also offers specific tools for mutual fund investors. The Search and Screen by Fund Family tool offers an entire list of all funds available, broken down by fund family. It lists fund performance for one, three, five, and 10 years, as well as expense ratios and MorningStar ratings:

Fidelity also enables you to choose funds by specific sector and provides a list of the highest (four- and five-star) funds, as rated by MorningStar.

It offers 24/7 customer service and more than 140 brick and mortar branches around the country, a rarity in what is increasingly an online broker universe. Fidelity consistently rates highly among popular financial publications, like Barrons, Kiplinger, and Investors Business Daily.

Related: Read Fidelity Investment Review

5. eToro

eToro has been around since 2007 and wants to empower a global community of investors. The company is a social trading platform that mixes social media and investing. eToro has built an investment platform that’s all about social collaboration and investor education. It wants users to interact with each other to share and learn together.

You can invest in cryptocurrency, stocks, and ETFs with eToro. You can also copy the trades of other investors. The platform allows you to mirror the trades of successful investors with a proven track record so that you’re not stuck trying to figure things out on your own.

You can get started with an account minimum of $10. The process of opening an account with eToro is quick and seamless. The fees are transparent, so you’ll know what to expect. You get access to helpful resources and trades for free, and you’ll see what trades other investors make without paying for this information.

You can use eToro to get started in cryptocurrency and stock trading if you’re a beginner looking to get into investing.

A major setback for eToro is that it’s not available in every state yet, so you may not be able to sign up right now.

eToro is ideal for investors who like the idea of a social platform for cryptocurrency investing and trading. There are many platforms that allow you to invest in stocks and cryptocurrency in one place.

Related: Read eToro Review

Best Online Trading Websites For

Every one of the five brokerage firms on this list is one of the best in the industry and worthy of investigation or even as the destination for your investment portfolio. Each is good on multiple fronts. But we’ve identified specific categories where each stands out above the rest.

Here are the categories in which we believe each broker is very likely the best in the industry:

- Best trading platform: TD Ameritrade

- Options trading: E*TRADE

- Active traders: Ally Invest

- Stocks AND funds: Fidelity

- New traders: Charles Schwab

- Social investing: eToro

Factors to Consider

There are a lot of good investment brokerage firms available, including every company on this list. But no matter what you hear about a particular platform, the most important consideration is working with one that best suits your needs as an investor.

Some factors to consider:

- If you primarily invest in funds, selecting an investment broker with a wide selection of funds will be more important than choosing the broker with the lowest trading fees.

- Similarly, if you’re mostly a buy-and-hold investor, specific investment analysis tools may be more important to you than choosing the broker with the lowest fees.

- If you’re a new investor, you might want to go with a firm that offers strong educational and training tools, excellent customer service, and a virtual trading account that will allow you to learn the ropes without using real money.

- If you’re an active trader, commission fees will be very important since they will affect the net return on your trading activities. You’ll also need a trading platform that will facilitate high-frequency trading.

- For options traders, look closely at the features and tools available at a brokerage specifically for options trading. A platform that’s considered best-in-class based on individual stocks, funds, or even low fees may not be your best choice.

Related:

- Best Stock Research Tools

- How to Read a Stock Chart | A Step-By-Step Guide

- How to Create a Trading Plan

Final thoughts on the Best Online Trading Sites

Though we’ve specifically designed this article to discuss the best online trading sites, any of the five would also be suitable for just about any other investment-related purpose. Use this list as a starting point for your search.

And no matter how much you may hear that Broker X is the best, whether it’s from friends, the financial media, or the Internet, always remember that’s a general assumption based on the average investor. The best online trading sites are the best online trading sites for you. Make sure the one you choose is right for you. You’ll be investing your hard-earned money through the broker, and you’ll want to do that with a platform that will optimize your returns.

Related: