For investors, research and due diligence are essential. You shouldn’t invest in anything unless you understand exactly what you’re buying.

If you want to invest in individual companies instead of or in addition to investing in mutual funds, research becomes even more important. You cant rely on the diversification investing in a mutual fund provides, so you have to make sure you believe in a company’s future before buying shares.

Tools to Research Stocks - Best Stock Market Investment News, Analysis & Research Sites

There are many tools that investors can use to research and learn more about companies or to find companies that fit their investment criteria. These are some of the best tools to use.

Best for Value Investors: Morningstar

Morningstar is an investing news and analysis website that is one of the best-known names in investment research. Morningstar provides analysis and ratings for individual stocks as well as mutual funds and exchange-traded funds (ETFs), making it useful for investors of all types.

The company is primarily focused on value investors who want to find good deals on strong companies and hold those shares for the long term. If you’re a buy-and-hold investor, Morningstar’s analysis will likely be useful. If you want to try your hand at day trading, the information on Morningstar’s site is likely to be less useful.

The company is also well-known for its industry-leading mutual fund ratings, making it a good resource for investors who like to use mutual funds.

Morningstar offers some of its content, including article archive and basic stock screening capabilities for free. Full access to its content, including analyst reports, investment picks, and its portfolio X-ray tool, requires a premium subscription, which costs $199 per year.

Dough Roller readers can get a discount on Morningstar Premium, saving $30 on a one-year subscription, $70 on a two-year subscription, and $100 on a three-year subscription.

Visit Morningstar or read about Making the Most of Morningstar

Best for Professional Investors: Seeking Alpha

Seeking Alpha is known for being the world’s largest investing community, with over 16,000 investors. Professional investors turn to Seeking Alpha for detailed analysis from trusted investment experts, as the content is created by investors for investors.

Seeking Alpha shows you the best-ranked stocks so you can make informed decisions on which companies to invest in based on current market news and trends. It will provide you with breaking news, newsletters, and exclusive tools that were only available to Wall Street investors.

While Seeking Alpha does have a free plan, you’re going to have to spend some money if you want more in-depth analysis. Here are the three tiers of plans offered by Seeking Alpa:

- Basic (free) - You still get access to stock charts and prices, along with email updates.

- Premium ($19.99/month) - You get unlimited access to premium content.

- Pro ($69.99/month) - This package has no ads, VIP service, and premium features.

As you can imagine, this is the ideal service for professional investors who want to stay informed on how their investments are performing.

Seeking Alpha also posts trending news and analysis frequently throughout the day so you can stay informed on how the market’s performing. You won’t miss a thing.

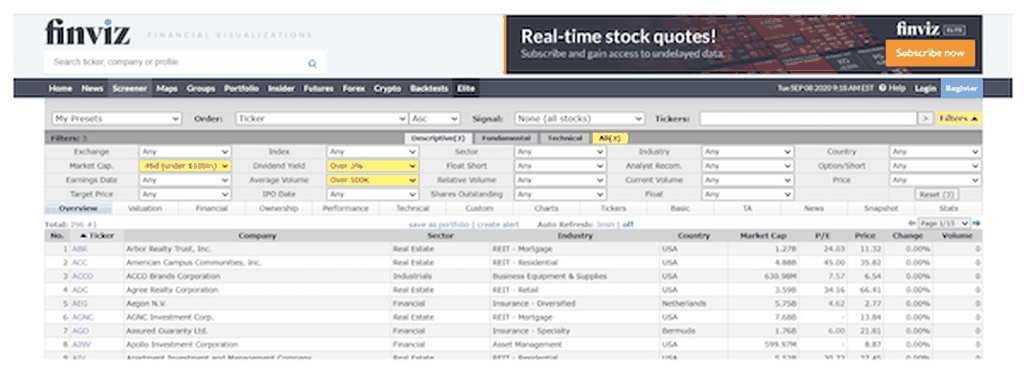

Best Stock Screener: FinViz

FinViz is a stock screener and news website that you can use to track different companies or identify businesses in which you might want to invest.

A stock screener is a tool that lets you search for stocks that fit specific criteria. For example, you might decide that you want to invest in companies with a market capitalization of $10 billion or less, an average trade volume of 500,000 shares per day, and a dividend yield of at least 3%. A stock screener can produce a list of every company with shares that meet those requirements.

FinVizs stock screener is completely free to use, so any investor can use the website to find companies they might want to invest in.

If you want to learn more about a specific company, FinViz offers in-depth charts and information for each stock.

You can use multiple types of charts, including candlestick and line charts. Each stocks page also has a list of recent news articles that discuss the company and analyst predictions about the stock’s future price movements.

FinViz offers a subscription service, FinViz Elite, for $24.96 per month. The service includes all of the tools that are available for free, plus:

- Advanced charting, including intraday charting

- Technical analysis backtesting

- Fundamental charting

- Email alerts

- Tracking for up to 100 hypothetical portfolios

- Up to 100 stock screen presets

- Custom stock screener views

Best for Active and Experienced Traders: Stock Rover

is known for its claim to be the best investment research platform online for investors looking to screen stocks. Stock Rover offers screening to help you rank stocks, compare different investment options, and research company reports that include everything you could want to know about a stock.

You can connect your brokerage account to Stock Rover (they work with over 1,000 brokerages) to compare the performance of your portfolio to market benchmarks and to receive portfolio analysis from experts. The experts can provide you with feedback on your portfolio so that you’re making the best investments possible.

Stock Rover has a free option, but you’re going to have to invest some money if you’re looking for more in-depth analysis to help find, evaluate, and compare investment opportunities in the market.

Here’s a look at the three paid tiers of plans offered by Stock Rover:

- - Over 8,500 North American Stocks, flexible stock screening, real-time alerts, and much more.

- - Everything with essentials plus 10 years of detailed financial history, trade planning & rebalancing tools, and so much more.

- - Everything plus custom metrics, top priority email support, and other extensive features.

The level of the tier you choose will depend on much research you’re looking for as an investor.

If you’re an active investor, is an ideal resource for extensive knowledge to help you make well-informed investment decisions.

Best Stock Picking Service: The Motley Fool Stock Advisor

The Motley Fool Stock Advisor is a subscription-based service that gives you two stock picks every month. Each pick will come with an in-depth analysis of why The Motley Fool chose it, including research on why the company has seen success, and what they see as the opportunity for growth.

From there, you can invest from your own account or use their investment tool to do so yourself. This isn’t a robo-advisor service that will manage investments for you; instead, it’s providing expert-curated stock picks for when you want to dip your feet into the water but don’t know where to start.

When anything exciting or new comes up this week and you need someone else’s opinion immediately or there’s a particular stock you’ve been tracking, The Motley Fool Stock Advisor is a great service to use for investing in individual stocks.

Visit The Motley Fool or read the full The Motley Fool Stock Advisor Review

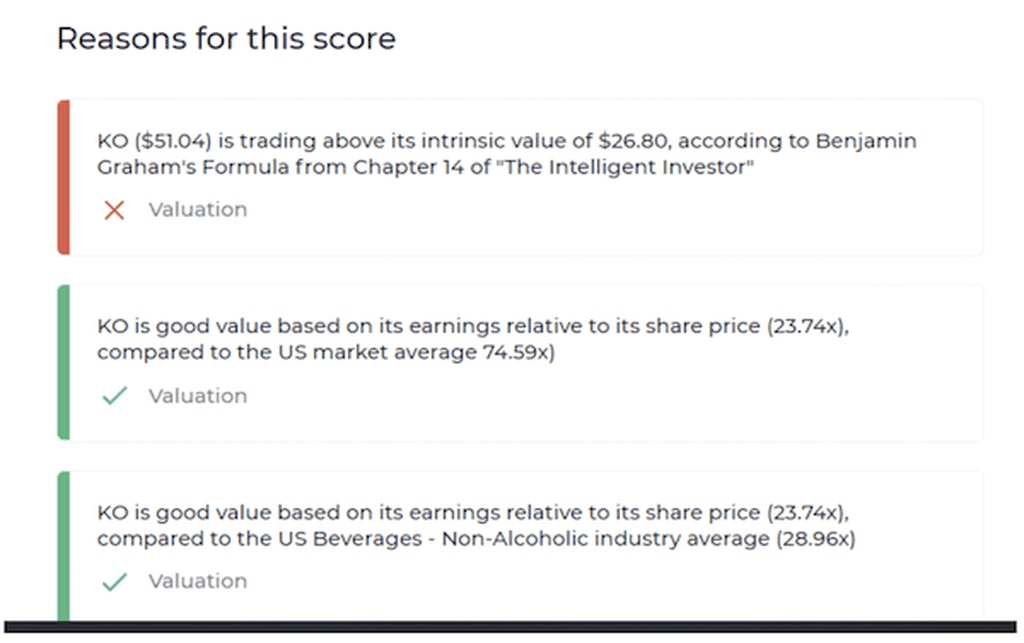

Best for Beginners: Wall Street Zen

Wall Street Zen is a stock research website that tries to keep things simple. Complicated stock screeners and charts are great for people who know what they’re looking at, but many everyday investors find candlestick charts and technical analysis overwhelming.

With Wall Street Zen, you can enter a company that you want to research. The site will bring you to an information page that includes basic details of the company, like its stock price, market capitalization, revenue, and price-to-earnings ratio.

Where Wall Street Zen shines is with its easy-to-understand analysis. Each stock has a Zen Score, which analyzes each company based on five factors:

- Valuation

- Forecast

- Performance

- Financials

- Dividend

The score is accompanied by details explaining how it earned its score.

If you want a deeper dive into any of the five categories, each stock page has easy-to-read charts for things like profit margin, cash flow, and revenue, as well as basic analysis. Each page also aggregates news articles that mention the company so you can read about recent happenings that could affect the company’s stock price.

The site is completely free to use, so it’s a good addition to any investor’s research arsenal.

Stockbrokers to Use

Ready to get started? These are some of the best brokers to use for research.

TD Ameritrade

TD Ameritrade is a well-known online brokerage company that also offers commission-free trading. One perk of TD Ameritrade is that it offers built-in investment research tools, making it easy to research stocks and place trades with a single interface.

If you want to buy shares using margin (borrowed money), TD Ameritrade also offers that option. Keep in mind that trading on margin is risky because you could lose more money than you have to invest, leaving you with a debt that you have to repay.

E*TRADE

E*TRADE is another low-cost online brokerage that offers commission-free trading of stocks, ETFs, and options. The company provides a full suite of account types, including taxable brokerages and retirement accounts, as well as the opportunity to trade in mutual funds, futures, and other types of securities.

Like TD Ameritrade, E*TRADE provides powerful investment research tools to its customers, letting you research and trade stocks from a single interface or augmenting your other research tools. The company also offers margin trading for those who want to borrow money to invest.

Ally Invest

Ally Invest is the online bank’s brokerage platform that offers both self-directed and managed investing services.

Keeping with Allys low-cost ethos, robo portfolios have a minimum investment of just $100 and no advisory fees. People who choose their own investments can place stock and ETF trades with no commission, making it easy to buy and sell securities as you adjust your portfolio.

If you already bank with Ally, keeping all of your money in one place can make managing your finances convenient.

J. P. Morgan Self-Directed Investing

J.P. Morgan Self-Directed Investing is Chase’s easy-to-use brokerage service. You have the option of managing your investments or working with one of J.P. Morgan’s professionally managed portfolios with a $500 minimum investment and a .35% annual management fee.

The self-directed brokerage account is inexpensive and fully featured. You can place trades with no commissions whether you’re trading stocks, ETFs, or options. There’s also no minimum account balance to worry about.

Disclosure: INVESTMENT AND INSURANCE PRODUCTS ARE: NOT A DEPOSIT • NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE

Related:

Bottom Line

Investing is an important part of everyone’s financial life. If you decide to invest in individual stocks, having the tools necessary to research those companies can help you find the best deals and grow your portfolio over the long term.