The smaller your transaction amount, the more that per-trade commissions eat into your bottom line as a trader. While a $5 commission only costs 0.01% of a $50,000 trade, it would represent a whopping 10% of a $50 trade.

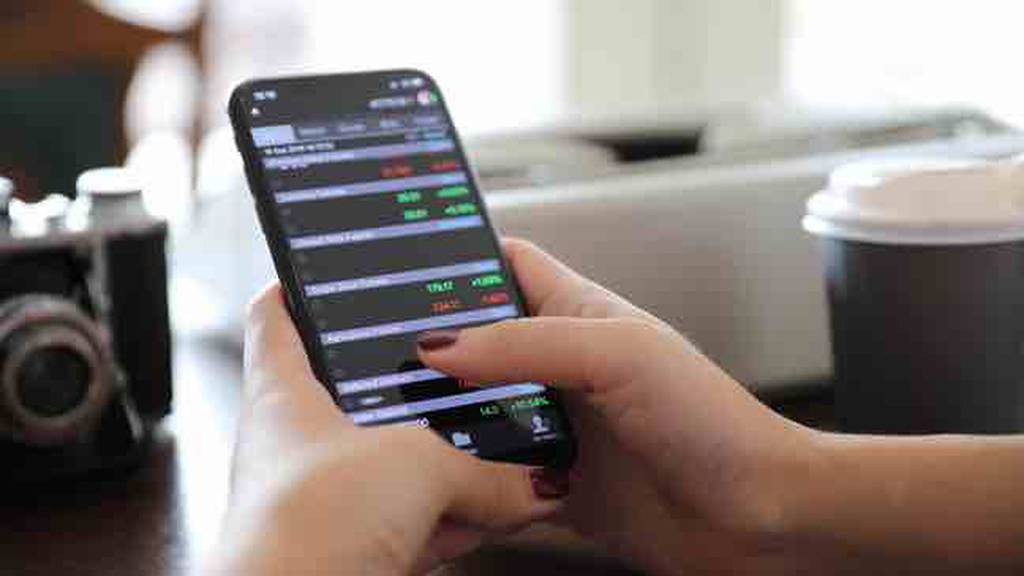

For this reason, active trading has traditionally been something that only institutional investors were able to afford. But over the past few years, there’s been a revolutionary shift. The introduction of low-cost stock trading apps has led to the commoditization of stock trading.

Now average investors can instantly trade stocks or other assets right from their phones or laptops. And many of the best stock trading apps offer advanced charting and study tools that had previously only been accessible to Wall Street professionals.

If you’re wanting to dedicate a portion of your portfolio to active trading, there are several apps available today that can help you succeed. Here are our 10 favorite stock trading apps for 2021.

Best Stock Trading Apps Overview

| Brand | Best For |

|---|---|

| E*TRADE | Options trading support |

| TD Ameritrade | Technical studies and indicators |

| Ally Invest | Tax management service |

| Robinhood | Free cryptocurrency trading |

| Public | Trading social network |

| ZacksTrade | Free broker-assisted trades |

| Interactive Brokers | International trades |

| Merrill Edge | Third-party research |

| You Invest | Seamless Chase bank integration |

| Acorns | Automatic investing |

Best Stock Trading Apps

All of the stock trading apps on our list offer low-cost and high-quality trading platforms. Here are our top picks for 2021.

E*TRADE

E*TRADE, now owned by Morgan Stanley, was one of the first brokers to begin offering online trading back in the early 1980s. Nearly forty years later, it’s still one of the leading options for stock traders both in terms of features and pricing.

In addition to its standard app, E*TRADE has built a separate platform just for active traders called Power E*TRADE. Power E*TRADE offers a host of trading tools including automatic technical pattern recognition, risk/reward probabilities, and 145+ chart studies and drawing tools.

Stocks, ETFs, and options trade commission-free with E*TRADE and it has over 4,400 no-load, no transaction fee (NFT) mutual funds, which are among the most available. Also, E*TRADE is one of the few stock trading apps today to offer 24/5 trading.

If you’re interested in options trading, E*TRADE may be the broker for you. It offers a powerful options trading platform, a library of educational content regarding options, and even has a dedicated support line just for options traders. Plus, its per-contract fee drops from $0.65 to $0.50 if you make 30+ trades per quarter.

E*TRADE is offering a signup bonus of up to $3,000 when you open and fund a brokerage or retirement account. The offer ends June 30, 2021 and you'll need to use the bonus code: BONUS21. Visit the E*TRADE website for details.

Open an account with E*TRADE or read our full E*TRADE review.

TD Ameritrade

TD Ameritrade, recently acquired by Charles Schwab, is one of the most popular stock trading apps with seasoned traders. That’s thanks in large part to the popularity of its thinkorswim® trading platform, which is one of the most powerful available today.

Thinkorswim® is a dream tool for traders who rely on technical analysis. It offers 440+ technical indicators studies. For perspective, that’s three times the number of studies available on Power E*TRADE. And the software is available on a wide variety of platforms, including Windows, Mac, web, iOS, and Android.

TD Ameritrade also provides an incredible amount of free educational resources to investors. Its catalog of DIY content includes over 200 videos, tutorials, and publications. It also provides in-depth webcasts and courses and even hosts in-person seminars.

TD Ameritrade charges no commissions on stocks, ETFs, or options. There is, however, a $0.65 per-contract fee for options and futures. Like E*TRADE, TD Ameritrade provides 24/5 trading for certain securities.

Open an account with TD Ameritrade or read our full TD Ameritrade review.

Ally Invest

Ally Invest is a top brokerage for both long-term investors and short-term traders. Investors will appreciate its Robo Portfolios and traders are sure to love its Self-Directed Trading platform.

Stocks, ETFs, and options trade commission-free on Ally Invest and it charges a below-average per-contract options fee of $0.50. Its trading platform can also hold its own with the top players. Streaming charts, profit/loss graphs, a probability calculator, and more, are all included.

But Ally Invest is really able to set itself apart from the crowd by offering its customers free access to the Maxit Tax Manager service. This tool calculates your cost basis and will identify the best lots of shares to select when closing positions to maximize your after-tax results.

Open an account with Ally Invest or read our full Ally Invest review.

Robinhood

Robinhood was one of the first stock trading apps to offer commission-free trading. And its low-cost pricing is still its top feature today. In addition to charging no commissions on any of its products, Robinhood is one of the only brokers that doesn’t charge a per-contract fee on options.

Robinhood also sets itself apart by being one of the only major brokers to offer cryptocurrency trading. Currently, Robinhood Crypto customers can buy or sell the following currencies commission-free:

- Bitcoin (BTC)

- Bitcoin Cash (BCH)

- Bitcoin SV (BSV)

- Dogecoin (DOGE)

- Ethereum (ETH)

- Ethereum Classic (ETC)

- Litecoin (LTC)

Robinhood does have limitations, however. For one, it doesn’t support as many assets as other stock trading apps. Unavailable assets include mutual funds, bonds, futures, and more. There’s also no phone-based customer service and its extended hours of trading is limited.

Robinhood doesn’t offer cash bonuses to new customers, but it will award one free share of stock. The stock is chosen at random and could range in value from $3 to $225.

Open an account with Robinhood or read our full Robinhood review.

Public

Public makes our list of the best stock trading apps thanks to its unique social network for traders. Once you’ve created your account, you can follow popular investors, interact with its inclusive community, and increase your investing knowledge.

Public’s trading platform currently only supports stocks and ETFs. But it does offer fractional share trading of both and doesn’t charge any commissions.

Public also recently made the news by announcing that it would no longer participate in payment for order flow (PFOF) to better align its financial incentives with its customer’s best interests. Public also added an optional Tipping feature on trades that it hopes will help to offset the revenue that it will be giving up by eliminating PFOF.

Open an account with Public or read our full Public review.

ZacksTrade

ZacksTrade is geared more towards high-volume traders. It’s notably the only app on this list that doesn’t offer any commission-free trading tier. But it only charges $0.01 per share ($1 minimum) and advanced traders will love the fact that it uses the Interactive Brokers trading platform.

ZacksTrade could also be a solid choice for frequent traders due to the fact that customers get access to 20 free research subscriptions. And if you’re looking to dabble in international trading, ZacksTrade provides access to over 91 exchanges in 19 different countries.

ZacksTrade is also one of the only major stockbrokers to offer free broker-assisted trades. That could come in handy if you often find yourself in places with a spotty internet connection or would just like help from a human being when executing your trades.

Open an account with ZacksTrade or read our full ZacksTrade review.

Interactive Brokers

Interactive Brokers has long been one of the best stock trading apps for professional investors, thanks to its excellent order routing technology and charting tools. But the platform has recently begun to offer competitive pricing for lower-volume traders too.

IBKR Lite users pay $0 commissions on stocks and ETFs. And high-volume traders on IBKR Pro pay $0.005 ($1 minimum) per share. Interactive Brokers also offers some of the lowest margin trades (as low as 0.75%).

Finally, Interactive Brokers is a top pick for international traders. Customers can invest in 135 exchanges in 33 countries and the platform supports 23 different currencies. Plus, the Interactive Brokers platform provides market data from around the globe 24 hours a day, six days a week.

Merrill Edge

One of the reasons that Merrill Edge makes our list of the best stock trading apps is it offers tons of top-notch third-party research. Customers get access to ratings and rankings from Morningstar, CFRA, and more in addition to Bank of America Global Research.

Speaking of Bank of America (BofA), the level of integration that Merrill Edge offers to BofA customers is impressive. It’s easy to link your banking and investment accounts and fund transfers are instant.

If you’re looking to get involved in investing as well as trading, Merrill Edge could be a great choice. It has local branches scattered throughout the U.S. where customers can sit down with a financial advisor. Plus, BofA customers can earn a discount of up to 0.15% on Merrill Investing’s advisory service fees.

Visit Merrill Edge or read our full Merrill Edge review.

You Invest

You Invest by J.P. Morgan customers use the same Chase Mobile app as Chase banking customers. This means if you happen to bank with Chase, you can manage your investments, checking, and savings accounts all in one place.

It’s also easy to instantly move money back and forth between bank and investing accounts. Stocks, ETFs, and options can all be traded commission-free on the You Invest Trade platform. And customers receive exclusive access to research from J.P. Morgan analysts.

You Invest’s trading platform also offers many of the bells and whistles that traders have come to expect. You can create a custom watchlist in minutes right from your phone. And detailed forecast charts are available to inform your trade decisions.

Visit You Invest or read our full You Invest review.

Bonus Option

Acorns

Acorns is not actually a trading platform. It currently doesn’t allow clients to choose their own stocks, bonds, or other securities at all. So why did it make our list of the best stock trading apps?

Acorns was included because it’s one of the only apps that allow you to automatically invest your spare change. After connecting your debit or credit card, Acorns will monitor and round-up all of your transactions to the nearest dollar. And once your Round-Up balance reaches $5, it will automatically invest that money in one of its diversified portfolios.

Acorns also offers a debit card that will reward you with bonus investments (called Acorns Earn) from 300+ top brands. The micro-investing and robo-advisor platform applies a flat pricing model with two subscription tiers that cost $3 or $5 per month.

Visit Acorns or read our full Acorns review.

What Are Stock Trading Apps?

Stock trading apps allow you to buy and sell stocks, ETFs, or other stock market securities right from your phone. The best stock trading apps blend low cost with solid research and charting tools.

Not all investment apps are well-suited for stock trading.

Stock trading apps also differ from robo-advisors. A robo-advisor will automatically invest your money in one of its custom portfolios but typically will not allow you to pick and choose individual stocks, ETFs, or other assets.

Most Important Features to Look For in a Stock Trading App

How do you know when a stock trading app is great, just good, or downright terrible? Here are a few of the top features to pay attention to:

- Commissions and fees: Many of the best apps charge no commissions on stocks, ETFs, and options, but there may be a transaction fee for mutual fund trades and a per-contract fee on options and futures.

- Tradable assets: At a minimum, stock trading apps should support stock and ETF trades. But support for other assets (such as mutual funds, options, futures, bonds, forex, and cryptocurrency) will vary by the broker.

- Tools: What charting tools and studies are available? How many option chain legs are supported? Does the app provide free access to Level II quotes? These are just a few questions to ask as you try to compare the toolsets of stock trading apps.

- Ease of use: Is the stock trading app available on multiple platforms? And is the software easy to understand and use? Even an app with powerful tools may be a no-go in the end if its user interface is complicated and confusing.

- Customer service: Is phone customer service available? Also, what are the customer service hours? A few stock trading apps provide 24/7 phone support while others are only reachable by email.

- Education: If you’re just getting started with investing, look for stock trading apps that have taken the time to build resources that explain their tools and walk you through how to use them.

How Did We Choose the Best Stock Trading Apps?

To come up with our list of the best stock trading apps, we began by looking for companies that offered a solid blend of all the key features listed above. E*TRADE, TD Ameritrade, and Interactive Brokers, specifically, scored well on all six core factors.

Second, we looked for companies that offered standout features that set them apart from the competition. Examples would include Robinhood with its free cryptocurrency trading, Ally Invest with its Maxit Tax Manager, and Public with its trading social network.

Which Stock Trading App is Best For You?

The best stock trading app for you will depend on your experience level and your trading goals. For example, if you’re just getting started with investing, you may want to focus on brokers that offer 24/7 customer service and loads of education like E*TRADE or TD Ameritrade.

But if you’re a high-volume day trader, you may want to focus on apps that deliver superior price execution and offer low margin rates. ZacksTrade and Interactive Brokers are two stock trading apps that could fit well for such daily traders.

Finally, if you’re looking to do some long-term investing alongside your trading, you may want to consider apps that also offer robo-advisor or human advisory services. Examples would include Acorns, Merrill Edge, and You Invest.

Related: How to Create a Trading Plan

Compare Discount Brokerage Accounts

FAQ

Which is the best stock trading app for beginners?

E*TRADE and TD Ameritrade are two great choices for beginning traders due to the fact that they both offer many educational resources and 24/7 customer support. Plus, both brokers offer two trading apps — one for novices and the other for advanced traders.

Which stock app offers the best techology?

While many stock trading apps now offer an array of technical analysis tools and studies, many traders feel that TD Ameritrade offers the best technology. In addition to its powerful thinkorswim trading platform, the broker has been a pioneer in AI technology, chatbots, car infotainment system integrations, and more.

Are stock trading apps safe?

All U.S. stock trading apps that sell securities to the public are required by federal law to become a member of the SIPC (Securities Investor Protection Corporation). The SIPC provides up to $500,000 of protection if a member-broker goes bankrupt. You can see the full list of registered brokers at the SIPC website.

Can you really make money from stock trading apps?

Yes, you can make money from stock trading apps by buying stocks or other securities and then later reselling them at a higher price. To improve your chances of success, take the time to learn the basics of technical analysis and avoid taking a large position size in any one particular stock.

Summary Table

| Stock Trading App | Account Minimum | Commissions | Stand Out Feature |

|---|---|---|---|

| E*TRADE | $0 | $0 per trade | Options trading support |

| TD Ameritrade | $0 | $0 per trade | Technical studies and indicators |

| Ally Invest | $0 | $0 per trade | Tax management service |

| Robinhood | $0 | $0 per trade | Free cryptocurrency trading |

| Public | $0 | $0 per trade | Trading social network |

| ZacksTrade | $2,500 | $0.01 per trade | Free broker-assisted trades |

| Interactive Brokers | $0 | $0 to 0.005 per trade | International trading |

| Merrill Edge | $0 | $0 per trade | Third-party research |

| You Invest | $0 | $0 per trade | Seamless Chase Bank integration |

| Acorns | $0 | $0 per trade | Automatic Investing |

Bottom Line

Before you start using a stock trading app, it’s important to understand that trading is not the same as investing. While investors typically take a long-term approach, traders are often in-and-out trades within hours or days. Trading is riskier than long-term investing and may not be suitable for everyone.

That being said, there’s no reason that you can’t be both an investor and trader at the same time. For example, you could choose to dedicate 10% of your portfolio to active trading and the other 90% to long-term investing.

However, if you have a low-risk tolerance or simply don’t have the time to manage trades, you may want to stick with passive investing options, like index funds and ETFs. Or, for an even more hands-off approach, you may want to consider opening an account with one of our top robo-advisors.