Robo-advisors have barely been around for 10 years, but in the past couple of years several have been steadily expanding their investment menus, and even offering valuable add-on services. One of the leaders in this regard is Wealthfront. The robo-advisor has been growing its investment capability in every direction, but is now even offering financial planning. The platform now bills itself as offering High-Interest Cash, Financial Planning & Robo-Investing for Millennials. If you’re looking for more than just investing, Wealthfront has it. And as has become their trademark, it’s all available at a low cost.

What is Wealthfront?

Based in Palo Alto, California, and founded in 2011, Wealthfront has about $25 billion in assets under management. It’s the second-largest independent robo-advisor, after Betterment. And while dozens of robo-advisors have arrived in recent years, Wealthfront stands out as one of the very best. There isn’t any one thing Wealthfront does especially well, but many. And they’re adding to their menu of services all the time.

Their primary business of course is automated online investing. You can open an account with as little as $500, and the platform will design a portfolio for you, then manage it continuously. Your money will be invested in a globally diversified portfolio of ETFs--just like most other robo-advisors. But Wealthfront takes it a step further, and also adds real estate and natural resources.

Like other robo-advisors, Wealthfront uses Modern Portfolio Theory (MPT) in the creation of portfolios. They first determine your investment goals, time horizon, and risk tolerance, then build a portfolio designed to work within those parameters. MPT emphasizes proper asset allocation to both maximize returns, and minimize losses.

But in a major departure from other robo-advisors, Wealthfront now offers the ability to customize your portfolio and get access to a variety of investment methodologies and portfolios, including Smart Beta, Risk Parity and Stock-Level Tax-Loss Harvesting. And more recently, they’ve also stepped into the financial planning arena. They now offer several financial planning packages, customized to very specific needs, including retirement planning and college planning.

If you haven't checked out Wealthfront in the past year or so, you definitely need to give it a second look. This is a robo-advisor platform where things are happening--fast!

How Wealthfront Works

When you sign up with Wealthfront, they first have you complete a questionnaire. Your answers will determine your investment goals, time horizon, and risk tolerance. A portfolio invested in multiple asset classes will be constructed, with an exchange-traded fund (ETF) representing each.

The advantage of ETFs is that they are low-cost, and enable the platform to expose your portfolio to literally hundreds of different companies in each asset class. With your portfolio invested in multiple asset classes, it will literally contain the stocks and bonds of thousands of companies and institutions, both here in the U.S. and abroad.

Wealthfront offers tax-loss harvesting on all portfolio levels. But they've also added portfolio options for larger investors, that include stocks as well as ETFs. The inclusion of stocks gives Wealthfront the ability to be more precise and aggressive with tax-loss harvesting.

Each portfolio also comes with periodic rebalancing, to maintain target asset allocations, as well as automatic dividend reinvestment. As is typical with robo-advisors, all you need to do is fund your account--Wealthfront handles 100% of the investment management for you.

More recently, Wealthfront has also added external account support. The platform can now incorporate investment accounts that are not directly managed by the robo-advisor. This will provide a high-altitude view of your entire financial situation, helping you explore what’s possible and providing guidance to optimize your finances.

And much like many large investment brokers, Wealthfront now offers a portfolio line of credit. It's available only to investors with $25,000 or more in a taxable account, but if you qualify you can borrow money against your investment account and set your own repayment terms in the process

Wealthfront Features and Benefits

Minimum initial investment: $500

Account types offered: Individual and joint taxable accounts; traditional, Roth, rollover and SEP IRAs; trusts and 529 college accounts

Account access: Available in web and mobile apps. Compatible with Android devices (5.0 and up), and available for download at Google Play. Also compatible with iOS (11.0 and later) devices at The App Store. Compatible with iPhone, iPad and iPod touch devices.

Account custodian: Account funds are held in a brokerage account in your name through Wealthfront Brokerage Corporation, which has partnered with RBC Correspondent Services for clearing functions, such as trade settlement. IRA accounts are held with Forge Trust.

Customer service: Available by phone and email, Monday through Friday, from 7:00 AM to 5:00 PM, Pacific time.

Wealthfront security: Your funds invested with Wealthfront are covered by SIPC, which insures your account against broker failure for up to $500,000 in cash and securities, including up to $250,000 in cash.

Wealthfront uses third-party providers to maintain secure, read-only links to your account. The providers specialize in tracking financial data, as well as employ robust, bank-grade security, and in general, they follow data protection best practices. In addition, Wealthfront does not store your account password.

Wealthfront Investment Methodology

For regular investment accounts, Wealthfront constructs portfolios from a combination of 10 different specific asset classes. This includes four stock funds, four bond funds, a real estate fund, and a natural resources fund.

Each portfolio will contain various allocations of each asset class, based on your investor profile as determined by your answers to the questionnaire. The one exception is municipal bonds. That allocation will appear only in taxable accounts. IRAs don't include them since the accounts are already tax-sheltered.

Notice in the table below that most asset classes have two ETFs listed. This is part of Wealthfront’s tax-loss harvesting strategy. In each case, the two ETFs are very similar. To facilitate tax-loss harvesting, one fund position will be sold, then the second will be purchased at least 30 days later, to restore the asset class. (We’ll cover tax-loss harvesting in a bit more detail a little further down.)

The ETFs used for each asset class are as follows, as of December 29, 2018:

| Specific Asset Class | General Asset Class | Primary ETF | Secondary ETF |

|---|---|---|---|

| US Stocks | Stocks | Vanguard CRSP US Total Market Index (VTI) | Schwab DJ Broad US Market (SCHB) |

| Foreign Stocks | Stocks | Vanguard FTSE Developed All Cap ex-US Index (VEA) | Schwab FTSE Dev ex-US (SCHF) |

| Emerging Markets | Stocks | Vanguard FTSE Emerging Markets All Cap China A Inclusion Index (VWO) | iShares MSCI EM (IEMG) |

| Real Estate | Real Estate | Vanguard MSCI US REIT (VNQ) | Schwab DJ REIT (SCHH) |

| Natural Resources | Natural Resources | State Street S&P Energy Select Sector Index (XLE) | Vanguard MSCI Energy (VDE) |

| US Government Bonds | Bonds | Vanguard Barclays Aggregate Bonds (BND) | Vanguard Barclays 5-10 Gov/Credit (BIV) |

| TIPS | Bonds | Schwab Barclays Capital US TIPS (SCHP) | Vanguard Barclays Capital US TIPS 0-5 Years (VTIP) |

| Municipal Bonds (taxable accounts only) | Bonds | Vanguard S&P National Municipal (VTEB) | State Street Barclays Capital Municipal (TFI) |

| Dividend Stocks | Bonds | Vanguard Dividend Achievers Select (VIG) | Schwab Dow Jones US Dividend 100 (SCHD) |

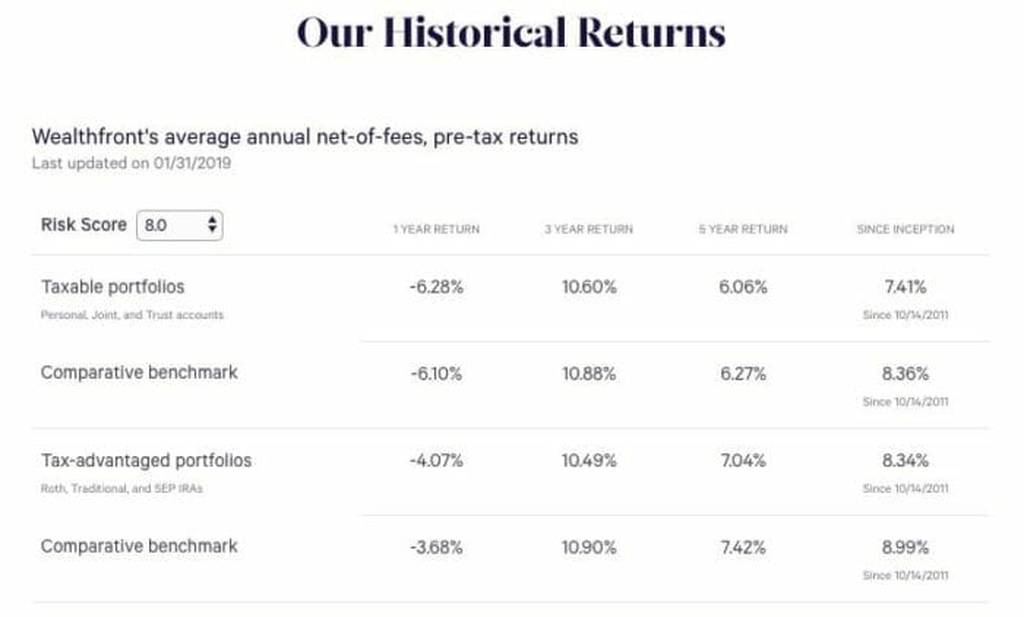

Wealthfront’s historical returns are as follows (through 1/31/2019). But keep in mind these numbers are general. Since the portfolios designed for each investor are unique, your returns will vary.

Specialized Wealthfront Portfolios

As mentioned in the introduction, Wealthfront has rolled out several different investment options, in addition to its regular robo-advisor portfolios. Each represents a specific, and generally more specialized investment strategy, and is typically available to those with larger investment accounts.

Smart Beta: You’ll need at least $500,000 to be eligible for this portfolio. Smart beta departs from traditional index-based investing, which relies on market capitalization. For example, since Apple is one of the most highly capitalized S&P 500 stocks, it has a disproportionate weight in strict S&P 500 index funds. In a smart beta portfolio, the position in Apple will be reduced based on other factors.

In general, under smart beta, the weighing of stocks in the fund uses a variety of factors that are less dependent on market capitalization. There’s some evidence this investment methodology produces higher returns. This portfolio is available at no additional fee.

Wealthfront Risk Parity Fund: This is actually a mutual fund--the first offered by Wealthfront. It involves the use of leverage with some positions within the portfolio. It attempts to achieve higher long-term returns by equalizing the risk contributions of each asset class. It’s based on the Bridgewater Hedge Fund, and requires a minimum of $100,000, with an additional annual fee of 0.25% (0.50% total). This is the only Wealthfront portfolio that charges a fee over and above the regular advisory fee.

Socially responsible investing (SRI): Wealthfront just recently began to offer a specific SRI portfolio option. Once you sign up, you’ll be able to customize your portfolio and add socially responsible ETFs.

Sector-specific ETFs: If you want to invest in a particular portion of the market, such as technology or healthcare, Wealthfront gives you the option to build a portfolio that focuses on certain industries to portions of the stock market.

Customized Wealthfront Portfolios:

Wealthfront also lets investors build their own portfolios, which is somewhat uncommon among robo-advisors.

Most robo-advisors will build your portfolio automatically based on your risk tolerance and goals. If you like that service, Wealthfront can do it. However, more hands-on investors are free to make tweaks to the automatically designed portfolio by adding or removing ETFs.

You can also build a portfolio entirely from scratch if you’d rather. You can choose which ETFs to invest in and how much you want to invest in them. You can then let Wealthfront handle things like rebalancing and tax-loss harvesting while maintaining the portfolio you desire.

Wealthfront Tax-loss Harvesting

If there’s one investment category where Wealthfront stands above other robo-advisors, it’s tax-loss harvesting. Not only do they offer it on all regular taxable accounts (but not IRAs, since they’re already tax-sheltered), but they also offer specialized portfolios that take it to an even higher degree.

Wealthfront starts with a tax location strategy. That involves holding interest and dividend-earning asset classes in IRA accounts, where the predictable returns will be sheltered from income tax. Capital appreciation assets, like stocks, are held in taxable accounts, where they can get the benefit of lower long-term capital gains tax rates.

But for larger portfolios, Wealthfront offers Stock-level Tax-Loss Harvesting. Three specialized portfolios are available, using a mix of both ETFs and individual stocks. The purpose of the stocks is to provide more specific tax-loss harvesting opportunities. For example, it may be more advantageous to sell a handful of stocks to generate tax losses, than to close out an entire ETF.

Given that Wealthfront puts such heavy emphasis on tax-loss harvesting, it’s not surprising they’ve published one of the most respected white papers on the subject on the internet. If you want to know more about this topic, it’s well worth a read. The paper concludes that tax-loss harvesting can significantly increase the return on investment of a typical portfolio.

US Direct Indexing

US Direct Indexing is an enhanced level of tax-loss harvesting that Wealthfront offers to people with account balances exceeding $100,000.

Instead of building a portfolio of ETFs, Wealthfront will use your money to directly purchase shares in 100, 500, or 1,000 US companies. By buying shares in so many companies, Wealthfront can emulate an index fund in your portfolio while owning individual shares in the businesses.

Owning individual shares in hundreds of companies makes tax-loss harvesting easier as it lets Wealthfront’s algorithm trade based on movements in individual stocks rather than in funds. This can increase the number of tax losses that Wealthfront harvests each year, reducing your income tax bill.

Other Wealthfront Features

Wealthfront Cash Account

Wealthfront offers a cash account where you can safely and securely store your money for anything--emergencies, a down payment for a home, or to later invest. By working with what they call Program Banks, Wealthfront has quadrupled the normal FDIC insurance on this account, so you’re protected for up to $5 million.

There’s also no market risk since it’s not an investment account and the money isn’t being invested anywhere. You can make as many transfers in and out of the account as you’d like, and it only takes $1 to start.

So what’s the catch?

There really isn’t one. Wealthfront will skim a little off the top to make some money before giving you an industry-leading 4.55% APY, but other than that, you’re just giving them more financial data. Since we’re doing this all the time with technology anyway, it shouldn’t make that big of a difference.

I see no downside, especially if you’re already a client of Wealthfront.

They’re really making a play to be your all-in-one financial services provider, too.

A new feature, just launched, is the ability to use your cash account as a checking account. This includes the ability to access your paycheck up to two days early when you set up a direct deposit. Additionally, you can invest in the market within minutes using your Wealthfront Cash account. Put the two together and you give yourself the ability to invest more than 100 days more in the market. The account also allows you to auto-pay bills and use apps like Venmo and PayPal to send money to friends or family. Account-holders also get a debit card to make purchases and get cash from ATMs. And you can use the account to organize your cash into savings buckets - like an emergency fund, down payment on a house, or other large purchase - and use Wealthfront’s Self-Driving Money offering to automate your savings into those buckets.

If you have cash that’s getting rusty in a traditional bank account and you want to earn more, the Wealthfront Cash Account is a great place to keep it.

Read more about the cash account in our Wealthfront Cash Account full review.

Wealthfront Portfolio Line of Credit

This feature is available if you have at least $25,000 in your Wealthfront account. It allows you to borrow up to 30% of your account value, and currently charges interest rates between 3.15% and 4.40% APR depending on account size. You can make repayments on your own timetable, since you’re essentially borrowing from yourself. And since the credit line is secured by your account, you don’t need to credit qualify to access it.

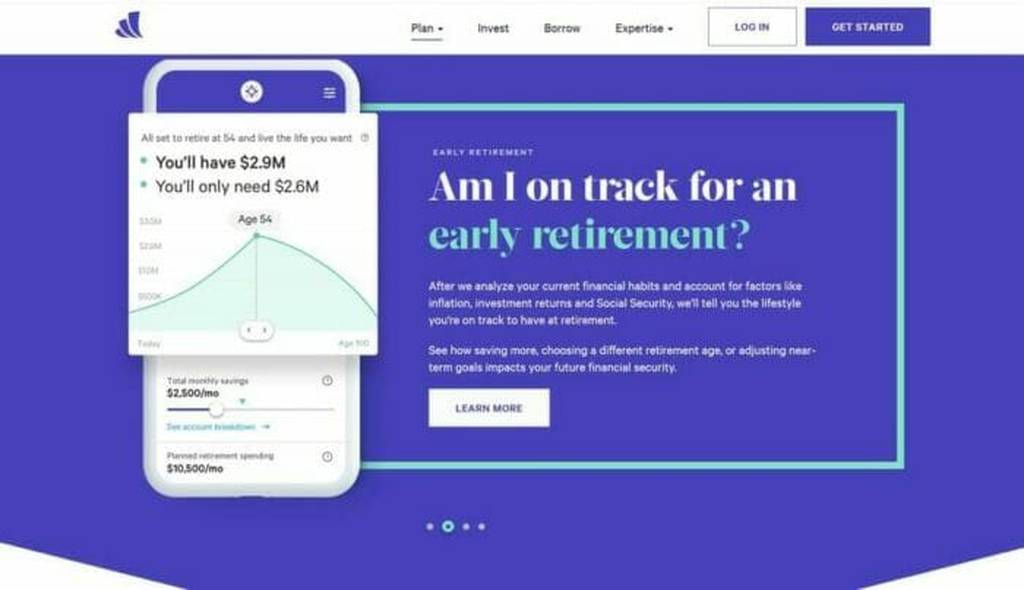

Wealthfront Free Financial Planning

This is Wealthfront’s entry into financial planning. But like everything else with Wealthfront, this is an automated service. There are no in-person meetings or phone calls with a certified financial planner. Instead, technology is used to help you explore your financial goals, and to provide guidance to help you reach them. And since the service is technology-based, there is no fee for using it.

The service can be used to help you plan for homeownership, college, early retirement, or even to help you plan to take some time off to travel, like an entire year!

Simply choose your financial objective, enter your financial information, and Wealthfront will direct you on how to plan and prepare.

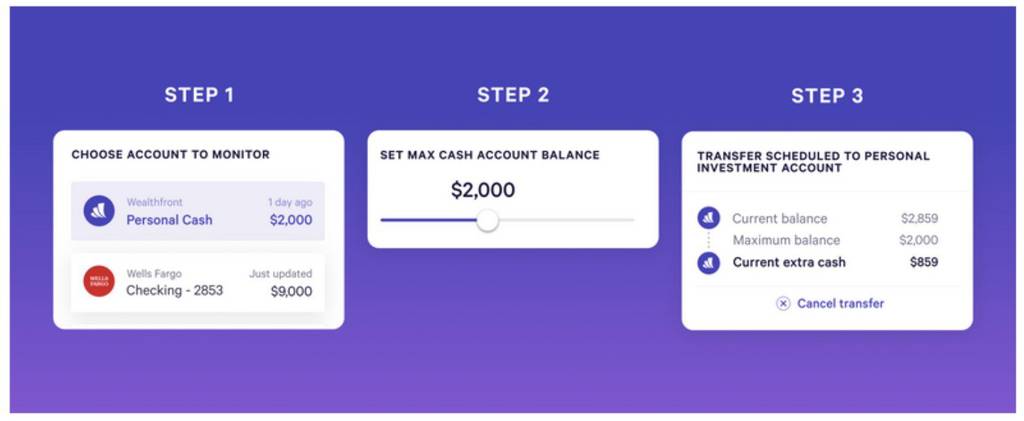

Self-Driving Money

One of the biggest and largely unrecognized obstacles for most investors is something known as cash drag. That’s when you have too much of your portfolio sitting in cash, which may earn interest, but it doesn’t provide the investment returns you can get in a diversified investment portfolio.

Wealthfront has addressed the cash drag dilemma with their newly released Self-Driving Money features. It’s a free service offered by the robo-advisor that essentially automates your savings strategy. It does this by automatically moving excess cash to help meet your goals, including into investment accounts where it will earn higher returns. And in the process, it eliminates the need to make manual cash transfers, and the judgment needed to decide exactly when to make that happen.

Our vision of Self-Driving Money is going to be a complete game-changer for people’s finances, said Chris Hutchins, Head of Financial Automation at Wealthfront. We want to completely remove the burden of managing your money so you can focus on your career, your family or whatever is most important to you.

You can take advantage of Self-Driving Money from the Wealthfront Cash Account. You’ll set a maximum balance for the connected account, which should be an amount that’s more than you expect to spend or withdraw on a monthly basis.

How It Works

When Wealthfront determines you’re over your maximum balance by at least $100 it will schedule an automatic transfer of the excess cash based on your goals. For example, you can tell Wealthfront you want to save $10,000 in an emergency fund, then max out your Roth IRA, then put the rest toward saving for a down payment on a house. Once you set the strategy, Wealthfront will automate the rest.

And before it happens, you’ll receive an email alert, then always have 24 hours to cancel the transfer if you need to cover unexpected expenses. You’ll also be able to turn on and off your Self-Driving Money plan at any time.

It’s usually possible to set up automated transfers from external accounts into most investment accounts. But what sets Wealthfront apart is the fact that it will make those transfers automatically. They will make sure you always have enough cash to pay your bills, then automatically transfer any excess into your savings buckets or investment accounts to improve the return on your money.

The strategy is designed to optimize your money across spending, savings, and investments, and to make it all flow with no effort on your part. You can simply have your paycheck direct deposited into your external checking account or Wealthfront Cash Account, cover your expected monthly spending, then have excess funds automatically transferred into the Wealthfront account of your choice.

By delivering on its Self-Driving Money vision, Wealthfront is taking the robo-advisor concept to a whole new level. Not only do you not need to concern yourself with managing your investments, but now even funding those investments will happen automatically. The result will be near complete freedom from the financial stresses that plague so many individuals.

Wealthfront Fees

Wealthfront has a single fee structure of just 0.25% per year for their advisory fee. That means you can have a $100,000 portfolio managed for just $250, or only a little bit more than $20 per month.

The one exception is the Wealthfront Risk Parity Fund, which has a total fee of 0.50% per year.

How to Sign Up with Wealthfront

To open an account with Wealthfront, you’ll need to be at least 18 years old, and a U.S. citizen.

You'll need to provide the following information:

- Your name

- Address

- Email address

- Social Security number

- Date of birth

- Citizenship/residency status

- Employment status

As is the case with all investment accounts, you’ll also be required to supply documentation verifying your identity. This is usually accomplished by supplying a driver’s license or other state-issued identification.

As mentioned earlier, you complete a questionnaire that will be used to determine your investment goals, time horizon, and risk tolerance. Your portfolio will be based on your answers to that questionnaire, and will be presented to you upon completion of the questionnaire.

For funding, you can use ACH transfers from a linked bank account. You will also have the option to schedule recurring deposits, on a weekly, biweekly, or monthly basis. The platform can even enable you to set up dollar-cost averaging deposits.

If you already have a brokerage account with another company, Wealthfront makes it easy to transfer your funds to your new account. If you’re invested in ETFs that Wealthfront supports, Wealthfront will assist with an in-kind transfer.

That means that you won’t have to sell your shares before transferring funds, which lets you avoid capital gains taxes that would be triggered by a sale.

Wealthfront Alternatives

Wealthfront’s closest competitor, and the robo-advisor that offers the most comparable services, is Betterment. They also have an annual advisory fee of 0.25%, but require no minimum initial investment. That could make it the perfect robo-advisor for someone with no money, who plans to fund their account with monthly deposits. Read the full Betterment review here.

Related: Wealthfront vs. Betterment

Another alternative is M1. Also a robo-advisor, M1 enables you to invest your money in what they call “pies”. These are miniature investment portfolios comprised of both stocks and ETFs. You can invest in existing pies, or create and populate pies of your own design. Once you invest in one or more pies, the platform will automatically manage it going forward. What’s more, M1 is free to use. Read more about M1 here.

Related: Wealthfront vs. Vanguard

Read More: The Best Robo Advisors - Find out which one matches your investment needs.

Wealthfront Pros and Cons

Investment options: Wealthfront offers more investment options than just about any other robo-advisor, particularly for investors with at least $100,000.

Reasonably priced: The annual fee of 0.25% is extremely reasonable, especially when you consider the degree of sophistication offered by Wealthfront’s investment methodology.

Tax-loss harvesting: This is available on all accounts, and Wealthfront is probably better at this investment strategy than any other robo-advisor.

Portfolio credit line: Gives you the ability to borrow against your portfolio with ease, and represents a form of margin investing.

Financial planning feature: The financial planning service is free to use and is available to all investors.

Limited access for smaller investors: Some of the more advanced investment portfolios and services are available only to investors with $100,000 or more to invest.

$500 minimum initial investment: It’s a minor issue, though some competitors require no funds to open an account.

FAQs

Does tax-loss harvesting involve any additional costs?

Nope. Tax-loss harvesting is a Wealthfront specialty, and they make it available on all taxable accounts, at no additional fee.

Do the ETFs used in my portfolio ever change?

Wealthfront may change the ETFs included in your portfolio if new ones are determined to be superior.

Can I transfer other accounts to Wealthfront?

Yes. A complete transfer can be accomplished using the Automated Customer Account Transfer Service (ACATS). However, in the likely event the assets included in the transferred account don’t match with the allocation determined by Wealthfront, those assets will be sold in favor of more appropriate funds. For taxable accounts, the sales will be accomplished in the most tax efficient manner.

What Retirement accounts can be transferred to a Wealthfront rollover IRA?

Wealthfront can accept a rollover from a 401(k), 403(b), 457 plan, TSP, or other employer-sponsored retirement plan. However, retirement plans from current employers are only possible if the plan administrator allows in-service rollovers. You’ll need to check with your current plan administrator to determine if that’s permitted.

Should You Sign Up for Wealthfront?

In a word, absolutely! Wealthfront is one of the very top robo-advisors, and you can't go wrong with this one. Not only do they offer far more services than most other robo-advisors, but they also allow you to grow along the way. For example, as your account increases in value, you can take advantage of more sophisticated investment strategies, including advanced tax-loss harvesting.

That Wealthfront offers its portfolio line of credit and free financial planning services only makes the platform a bit more attractive, But the real benefit is the actual investment service. Wealthfront’s investment service comes extremely close to that of traditional human investment advisors, but at only a fraction of the annual cost.

DoughRoller receives cash compensation from Wealthfront Advisers LLC (“Wealthfront Advisers”) for each new client that applies for a Wealthfront Automated Investing Account through our links. This creates an incentive that results in a material conflict of interest. DoughRoller is not a Wealthfront Advisers client, and this is a paid endorsement. More information is available via our links to Wealthfront Advisers.