Overall Ranking

4.5/5

Overview

5/5

5/5

4/5

4.5/5

4/5

Whether for banking or brokerage services, you’ve likely heard the name Charles Schwab before. Founded in 1971, the company was a discount brokerage pioneer, building a strong reputation for great customer service and competitive fees.

Editor's Note

You can trust the integrity of our balanced, independent financial advice. We may, however, receive compensation from the issuers of some products mentioned in this article. Opinions are the author's alone. This content has not been provided by, reviewed, approved or endorsed by any advertiser, unless otherwise noted below.

Whether you’re a brand new investor or have a seasoned portfolio, Charles Schwab has something to offer. Let’s take a glance at exactly what the company is about and how they measure up.

Who They Are

Charles Schwab founded his company in 1971, diving head first into the discount brokerage business a few years later in 1974. The company quickly became the largest discount brokerage in the country, offering low prices and excellent service.

Today, the company serves over 10.5 million accounts worldwide. It has branched out from its discount brokerage roots, expanding to provide full-service investing and banking to beginners as well as experienced investors. The company offers 24/7 customer service, including online chat and a full-service mobile app.

Charles Schwab offers two online platforms for trading, depending on your own investment needs. You can choose to utilize either, without investment minimums or fees. (Some other trading companies require high account balance minimums in order to use “pro” versions of their platform, for instance.) They are either on the web or as a desktop application.

Opening An Account

To open an individual or joint brokerage account (or an IRA) with Charles Schwab, you’ll need to deposit the account minimum of $1,000. However, there are no fees to open an account, nor will you be charged maintenance fees or fees for an inactive account. Also, the opening minimum balance can be waived as long as you establish an automatic monthly transfer/deposit of at least $100 into the account.

If you want to close the account at any point down the line, you will be charged a $50 fee.

One neat feature about investing with Charles Schwab is that there is not a minimum investment for their Schwab Index Funds. This means that you can get the ball rolling on your investment portfolio, even if you don’t have much to start.

If you’re interested in automating your investment experience, you can also consider Charles Schwab’s robo advisor service, Intelligent Portfolios. The minimum to open an account is $5,000, but they don’t charge any commissions, advisory fees, or account service fees.

How Much It Costs

After a recent drop in commission prices, Charles Schwab is staying toward the bottom as far as trading expenses go. They now charge a commission of $4.95 for all stock trades, regardless of your trade frequency. For options, the cost is also $4.95, plus $0.65 per contract. This price stays the same no matter how active (or inactive) of a trader you may be.

This puts Charles Schwab directly in line with Fidelity, which also charges $4.95 per trade, regardless of frequency. They are more affordable than companies like E*Trade or Merrill Edge, though, which charge $6.95+ and offer different rates depending on how active of a trader you may be.

The brokerage is a leader in available ETFs and mutual funds. They offer over 3,000 no-transaction-fee mutual funds and over 200 commission-free ETFs to choose from, so you’re sure to find something that matches your investment style.

They offer customers an ETF Select List, where you can search for funds that interest you based on things like expense ratios and Morningstar categories. You can also use the Schwab ETF Portfolio Builder Tool. This online tool helps you build (or alter) your ETF portfolio based on your own, unique risk tolerance.

The Platform

As we talked about, Charles Schwab offers 24/7 phone and live chat support to customers. So if you want help with your account or placing your trades, a real live person is never far.

They also offer two investment platforms for managing your portfolio. You’re able to use either platform you choose, regardless of your account balance or trading frequency.

The web version is at StreetSmart.com and is a great place for beginner investors to start. It’s easy to navigate and customize, and lets you customize your view to accommodate your trading interests. You’ll get an immediate overview of your portfolio, history, and orders, as well as account details. You can quickly check info on certain symbols, view market data, and even place an order.

The other platform version is for your desktop but is cloud-based so you can easily access your account online. It is called StreetSmart Edge®, and includes advanced trading tools that make managing your portfolio intuitive and easy. It’s also completely customizable, allowing you to personalize what you see so that you can make quick, informed decisions. You can even set your risk tolerance so that you’ll receive buy or sell alerts based on your investment needs.

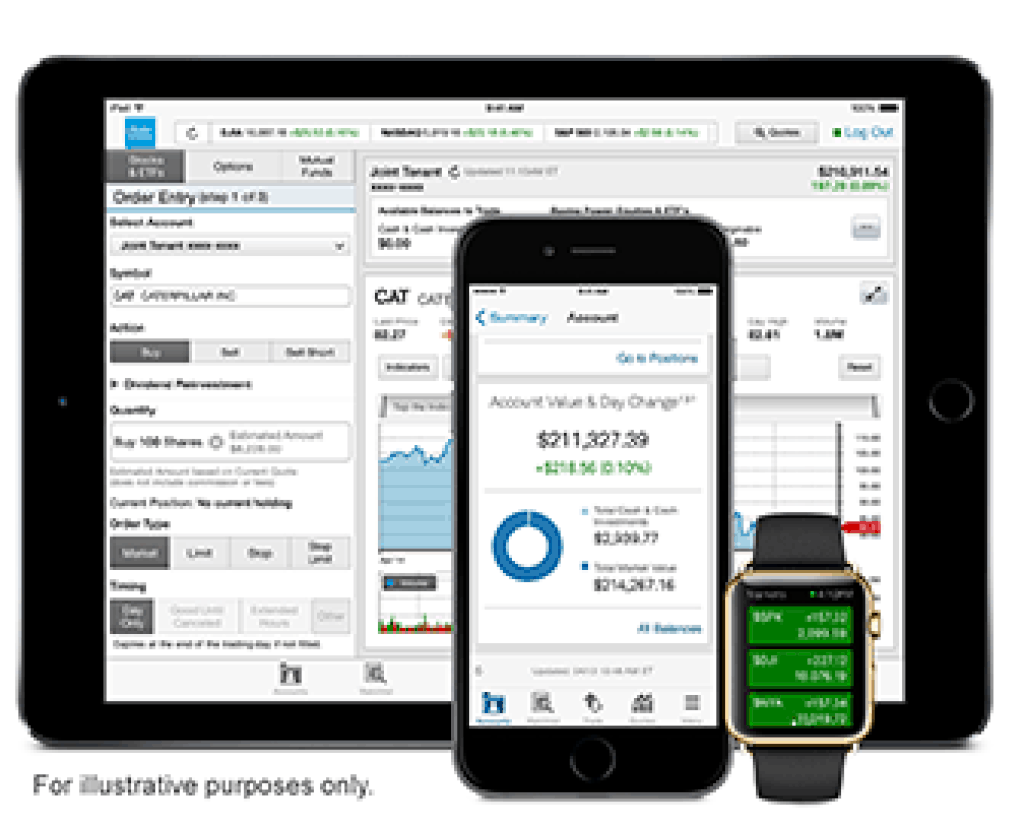

You can also download the Charles Schwab mobile app, which is known for being one of the best brokerage company apps available. Through the app, you can quickly and easily manage your account, get stock quotes, place trades, and view charts.

Pros and Cons

$100 Up Front Bonus

Very low $4.95 Flat Commission Cost

$1,000 Minimum Balance Required

Small List of Available Accounts

In Summary

Here’s a basic summary of what the Charles Schwab brokerage account offers, so you can decide whether this company is right for you and your investments:

- Minimum to open: $1,000 for IRAs or brokerage accounts

- Management fees: None through Charles Schwab and none through Intelligent Portfolios

- Ability to trade: ETFs, mutual funds, options, futures, stocks, and bonds

- Mobile app? Yes

- Cost-per-stock-trade: $4.95 regardless of volume

- Pros: Extensive educational resources for both new and experienced investors; low trade cost, even for less-active investors; plenty of fee-free mutual funds and ETFs to choose from; 24/7 phone and live chat support; stellar mobile platform and two desktop platforms

- Cons: Account minimum is $1,000, so this may exclude some newer investors. However, this can be waived with a $100/mo automatic transfer agreement

There’s a reason that Charles Schwab is leading the industry of low-cost brokerage companies. Are they right for you and your portfolio?