Overall Ranking

4.5/5

Overview

4.5/5

4.5/5

4.5/5

4.5/5

4.5/5

One of the first major online brokers is still going strong–but is it the BEST? Read our complete E*TRADE review to help you decide if it’s right for you.

Editor's Note

You can trust the integrity of our balanced, independent financial advice. We may, however, receive compensation from the issuers of some products mentioned in this article. Opinions are the author's alone. This content has not been provided by, reviewed, approved or endorsed by any advertiser, unless otherwise noted below.

Founded in 1982, E*TRADE is arguably one of the most popular and better-known online investment brokers (perhaps this is partly due to their unforgettable “E*TRADE Baby commercials”). Not only is their platform easy to use–even for beginners–but they also provide tools and resources to help investors make wise, educated portfolio decisions.

This makes them a great brokerage to look into, whether you’re making your first trade or your five thousandth. Let’s take a glance at what E*TRADE offers and how it compares to its competitors.

What is E*TRADE?

E*TRADE is a financial services company that offers online brokerage services to its customers at an affordable price. They were responsible for executing the very first electronic trade by an individual investor (in 1983). And they have been a pack leader in the industry ever since.

The company has 30 brick-and-mortar branches nationwide, as well as two distinct online platforms for trading and services. Oh, and they have a mobile app. Plus, they offer 24/7 phone support, online chatting, and email support.

Through the E*TRADE platform, you’re able to trade stocks, bonds, mutual funds, ETFs (exchange-traded funds), options, and futures.

Online, you can find an entire library of educational resources, provided free of charge to customers. You’ll find information on building a portfolio, monitoring and rebalancing it, and analyzing stock market risks. E*TRADE also runs live e-seminars that can help you learn more about investing and retirement planning. These resources allow investors to make informed and wise decisions for their money, even if they are brand new and creating their very first portfolio.

How to Sign Up with E*TRADE

There is no minimum to establish a brokerage account with E*TRADE (and actually begin trading). If you want to open an IRA instead, there is also no minimum starting account balance required.

E*TRADE accounts have no basic management fees. There isn’t an annual charge, and you won’t be fined if your account is inactive for a period of time. However, if you decide to transfer your assets out of your E*TRADE account, there are fees involved. You’ll pay $25 for a partial transfer and $75 for a full transfer of the total balance.

Want more guidance? You can look into E*TRADE’s robo advisor portfolios. This cheapest option does require a $500 minimum investment and has an annual fee, but might be worthwhile if you determine that a robo advisor is right for you.

E*TRADE Costs and Fees

E*TRADE seems to be fairly average when it comes to fees.

If you’re looking to trade stocks, fees are $0 per trade. Over-the-counter stocks have a $6.95 commission fee or if you execute at least 30 stock, ETF, and options trades per quarter, the commission fee is $4.95.

For options, the cost is $0.65 per contract. If you’re a more active investor and place at least 30 options trades per quarter, the cost jumps discounts down to $0.50 per contract.

If you’re looking into ETFs or mutual funds, you’re in luck.

If you sell early (less than 30 days after purchasing), you will be charged a short-term trading fee of between $15.99 and $19.99.

As for mutual funds, the platform offers 2,500 options with no transaction fee. This is comparable to what you see offered from companies like Fidelity (who offers 3,600) and Charles Schwab (offering 3,000+). For those mutual funds that do have a transaction fee, the commission is $19.99. Like with the ETFs, if you sell early (less than 90 days after buying), you’ll be charged an early redemption fee of $49.99.

So, how do these fees measure up? Fidelity and Charles Schwab both charge a flat rate of $4.95 for trade commissions, regardless of the number of trades per quarter. Merrill Edge charges $6.95 per trade for automated phone trades.

E*TRADE Trading Platform

E*TRADE offers a few different options for trading, depending on your preferences.

As mentioned, they have 24/7 phone support available, as well as 30 local branches throughout the country. So, if you have questions or want assistance with placing your trades, a real live person is always available.

There are also two web platforms to utilize, which are incredible resources.

First is E*TRADE Web, the basic trading platform. It will give you access to live quotes and market commentary, as well as streaming and updated market data. You can track your accounts and pending transactions, design watch lists for investments that pique your interest, and even make trades.

However, if you maintain an account balance of $250,000 or more or place a minimum of 30 stock/options traders each quarter, you’ll have access to E*TRADE Pro. The Pro version, designed for more active traders, offers a few extra bells and whistles, such as a Strategy Scanner and the ability to back-test investments.

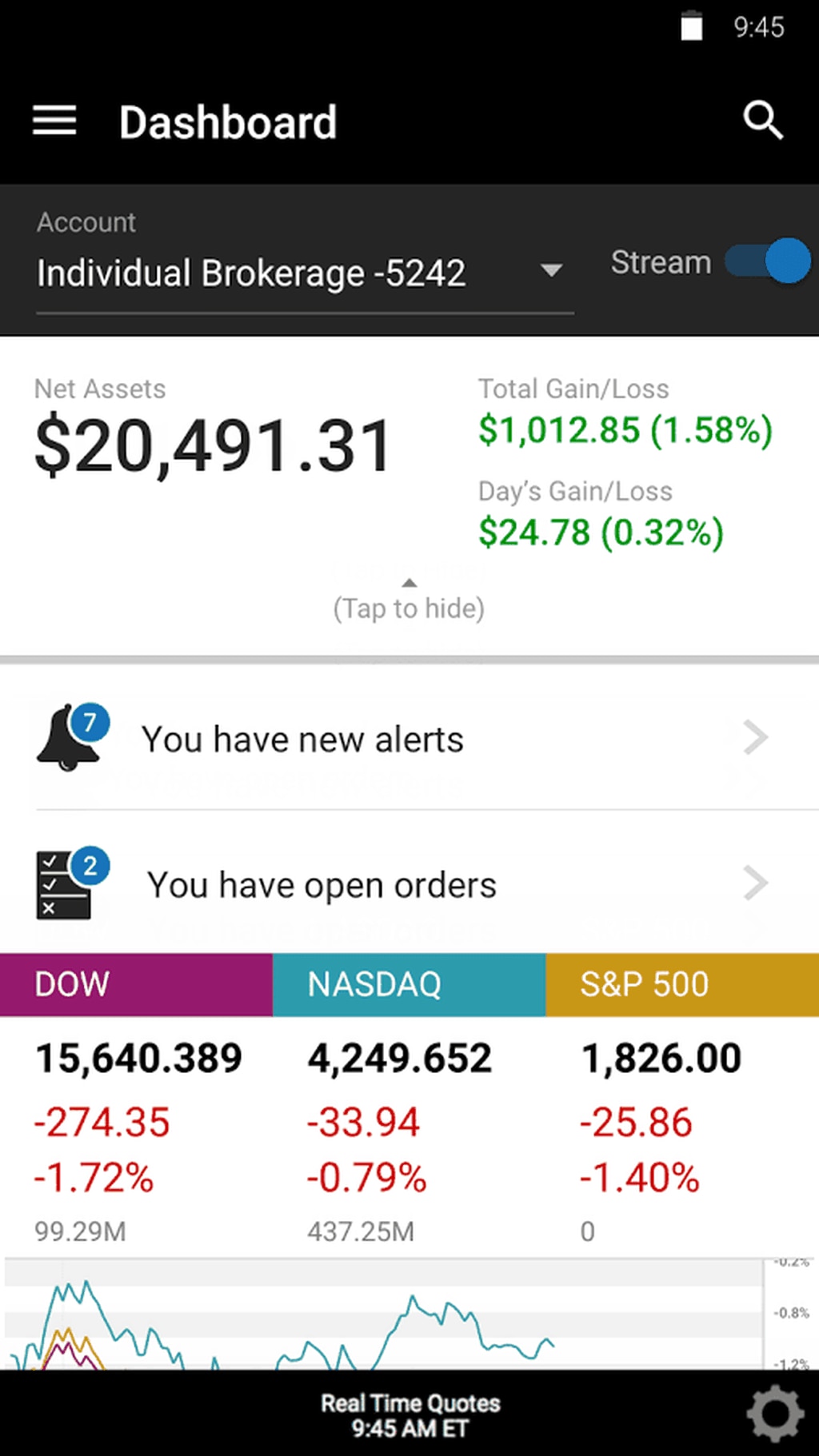

Lastly, you will have access to the E*TRADE mobile app, which is probably one of the cleanest and easiest to use in the industry. Through the app, you can quickly and easily manage your account, get stock quotes, place trades, and view charts.

Pros and Cons

Brick and mortar help if needed

OptionsHouse integration

Terrific mobile app

No sign-up bonus or promo

Fairly high margin rates which can get you into hot water

Bottom Line

Here’s a rundown of what E*TRADE offers, so you can decide whether this company is right for you and your investments.

- Minimum to open: $0.

- Management fees: None through E*TRADE (though their robo advisor service does have an annual fee)

- Ability to trade: ETFs, mutual funds, options, futures, stocks, and bonds

- Mobile app?: Yes

- Cost-per-stock-trade: $0

- Resources: Valuable educational resources for new and seasoned investors alike; 24/7 phone support (in addition to email and web support); excellent mobile platform; and two web platforms.

Considering how easy the platform is to use and the extensive library available for investor access (for free), E*TRADE is an excellent company to consider for your own brokerage needs.

After all, they executed the very first online trade over 30 years ago–you can definitely trust them to manage yours today.