Evaluating your investment portfolio is a critical task for DIY investors. That’s particularly true if you have an investment advisor manage your money and are now considering taking over the reins. That’s exactly the situation of a reader named Dave who emailed me recently.

He’s five to 10 years away from retirement. His investments are managed by an advisor who charges 1.2% of AUM (assets under management). Most of his investments are inexpensive, actively managed funds. Dave plans to move his portfolio over to Vanguard’s Advisory services. He did ask, however, my thoughts on his current portfolio.

While I don’t give specific investment advice, Dave’s question gives us an opportunity to walk through how to evaluate our investments. The goal is not to provide specific advice. The goal is to arm you so that you can undertake your own analysis.

It's important even if you hire an advisor to manage your investments. The more informed you are, the better you can protect yourself against poor advice. With that said, here is Dave's portfolio (I entered it into Morningstar's portfolio tracker):

Listen to the podcast of this article

Step 1: Upload Your Portfolio to an Investment Tracking Tool

The first step is to input your portfolio into an investment analysis tool. A popular option is Empower. They offer a free financial dashboard that can import all of your investment accounts (retirement and non-retirement) and then provide a detailed analysis of your portfolio.

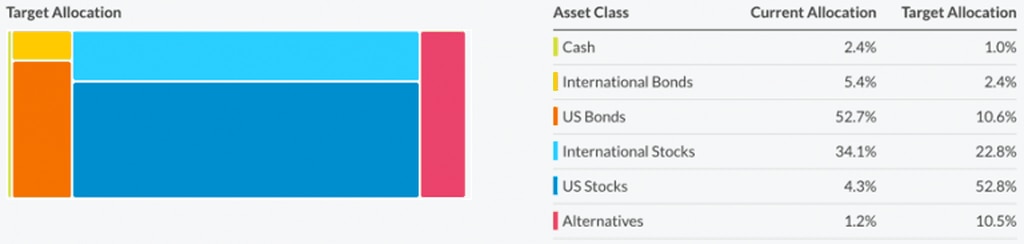

The analysis is part of Empower’s “Investment Checkup.” There are many aspects to the checkup, including an analysis of your portfolio’s asset allocation. Here’s what it looks like:

The tool is quick and easy to use, and the data analysis is excellent.

Since I don’t have access to Dave’s investments to use Empower, I used Morningstar’s Portfolio tool. It’s an excellent alternative that provides a wealth of data. The downside is that the portfolio has to be entered manually.

Related: Empower Review

Step 2: Evaluate Your Stock and Bond Allocation

The most important investing decision you’ll make is how much capital to commit to stocks and how much to bonds. For those with a decade or more until retirement, a portfolio heavily weighted to stocks is ideal, say 70 to 90%. Yes, these portfolios can go down significantly in a bear market, but with a decade or more until retirement, an investor has time to ride out the bad market.

Related: How to Recover from a Bad Investment

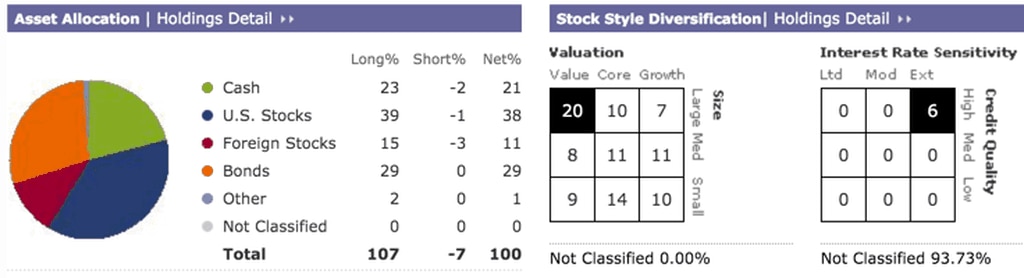

Things get dicier as one nears retirement. And that brings us back to Dave, who plans to retire in five years or so. With Dave’s portfolio in Morningstar, it’s a snap to evaluate his stock and bond allocations. Here’s a visual snapshot from Morningstar:

We can see that he has about 55% in stocks, 30% in bonds, and the rest in cash. Generally speaking, a 55/45 stock to bond allocation for a retiree is within a reasonable range. In Dave’s case, however, he still has at least 5 years until retirement. And once he retirees, he won’t be spending all of his money in year one (hopefully!). As a result, a good question for his current or future advisor is why his allocation is only 55% stocks.

Tip: One way to evaluate your stock/bond allocation is to compare it to target date retirement funds. For example, the Vanguard Target Retirement 2020 Fund (VTWNX) has a stock allocation of about 57%. The 2025 fund has about 66% in stocks. While these allocations should not be taken as gospel, they are a good starting point to evaluating your own portfolio.

In assessing the stock/bond allocation for those in or near retirement, it’s important to understand the relationship between that allocation and your withdrawal rate (the percentage of your next egg you spend each year). While a 4% withdrawal rate is a general rule of thumb, it doesn’t guarantee you’ll never run out of money.

If we assume a 30 year retirement, a 4% withdrawal rate offers an 85% chance your money will last, but only if your stock/bond allocation is at least 50/50.

Related: I interviewed Maria on the podcast and we talked in-depth about the 4% rule. You’ll find the interview here.

Step 3: Evaluate Stock Allocation

At a minimum you want a good mix of U.S. and international stocks. There are any number of ways to achieve this outcome, including the following:

- Vanguard Total World Stock Index Fund Investor Shares (VTWSX):

- Vanguard Total Stock Market Index Fund Admiral Shares (VTSAX) & Vanguard Total International Stock Index Fund Admiral Shares (VTIAX):

Other mutual fund companies such as Fidelity offer nearly identical options.

In Dave’s case, his portfolio raises several critical questions:

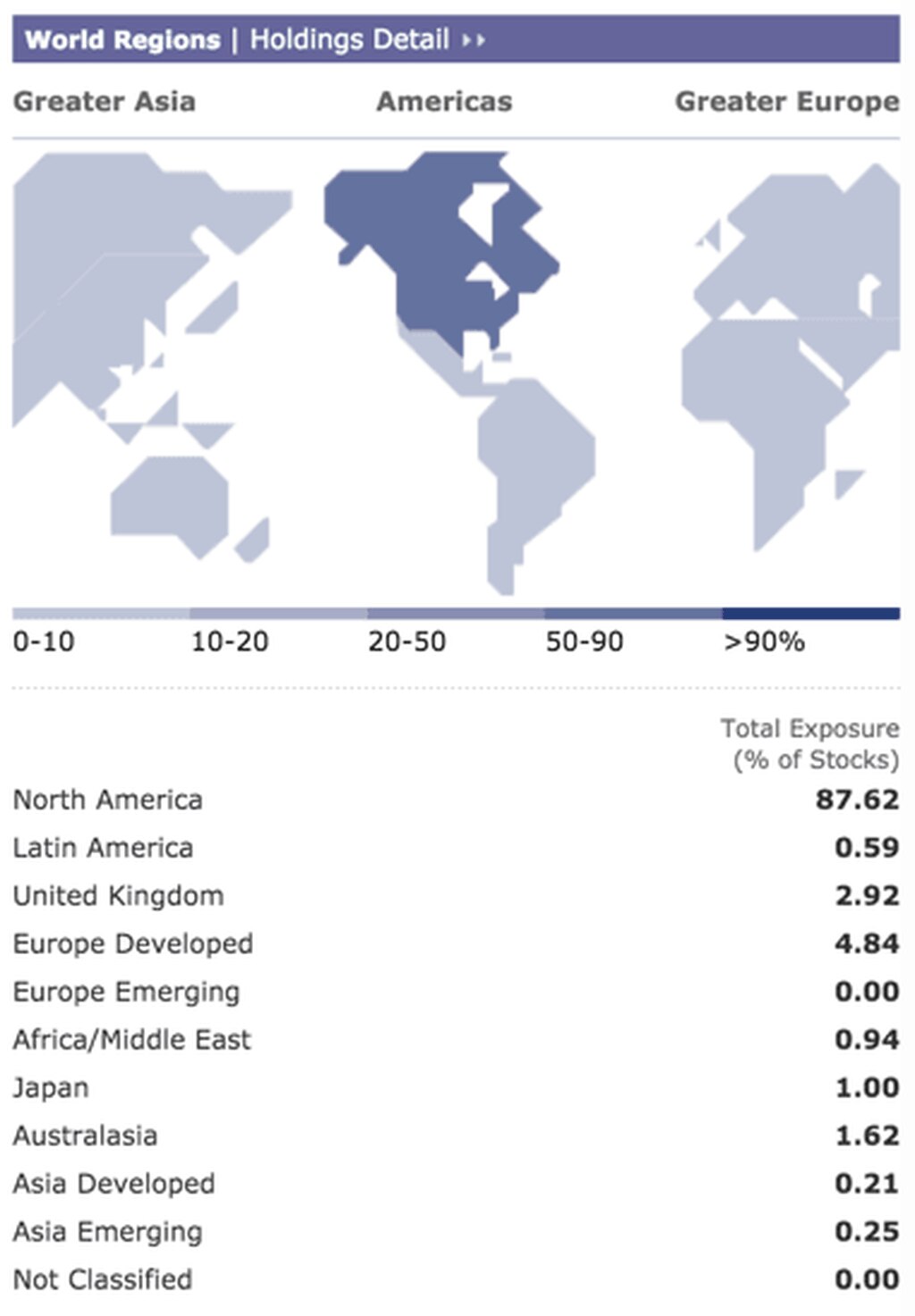

- Why is his international exposure limited almost exclusively to North America? While this may not be obvious at first, it becomes clear when viewing his portfolio in Morningstar–

- Why such a heavy emphasis on small and mid-cap companies? According to Morningstar, Dave has nearly 35% of his equities in small caps and nearly 30% in mid-caps.

- Why individual stocks? His portfolio includes Shares of American Express, Caterpillar, and Boeing. While I take no issue with owning these companies, what’s the point? He’s exposing his portfolio to the risk these companies will significantly underperform the market. At the same time, he doesn’t own enough of these shares compared to his overall portfolio to see much of an upside.

- Why is nearly 10% of his portfolio in gold? There’s really no point to invest in gold at all. It’s not a productive asset, its long-term performance is dismal, and its protection against inflation has a dubious record at best.

Step 4: Evaluate Bond Allocation

Bonds are designed to give stability to a portfolio. A simple allocation to a Vanguard total bond fund or even a fund limited to U.S. government bonds will do the trick. In Dave’s case, however, his advisor has him in a high yield fund. In fact, his advisor has placed 20% of his portfolio in a high yield fund.

Also known as junk bonds, high yield funds invest in corporate bonds issued by companies whose credit rating has fallen below investment grade. These funds can be a perfectly fine investment in some circumstances. In my opinion, however, they have no place in a retiree’s portfolio where stability is critical. Certainly allocating 20% of a retiree’s portfolio to junk bonds is indefensible.

Dave also has over 20% in cash. Given that he’s not retiring for at least 5 years, it’s difficult to understand why his advisor has made this choice. While cash is a must for an emergency fund, it’s not a productive asset for purposes of long-term investing.

In fact, John Bogle has specifically identified “cash drag” as an “expense” often incurred with actively managed funds. Here he’s referring to the fact that many managed funds will keep a significant portion of assets in cash. A typically index fund does not. In Dave’s case, he has more than 20% in cash, most of it of his own doing (or that of his advisor).

Step 5: Evaluate Specific Funds

Now we turn to the specific funds. Here we are looking at two things. First, are the funds actively managed or index funds? For actively managed funds, we want to understand the purpose of choosing such a fund over an index fund. Second, we look at costs.

Here, in my view, Dave’s portfolio raises numerous questions:

- Why does Dave have 14 funds plus 3 individual stocks. Three to six funds should be more than enough. Keep in mind that the goals are diversification at a low cost. Add more and more funds doesn’t increase diversification necessarily. It just adds to the maintenance of the portfolio.

- Why are most of his funds actively managed, high cost funds. His weighted average expense ratio is 72 basis points. It’s higher if you exclude the three individual stocks. Is there well thought out reason for this choice.

- Why does he own a long-short fund (QLENX). Does a fund that shorts certain equities help achieve his investment goals and is it worth the cost (1.53% expense ratio)?

Step 6: Evaluate Advisor Fees

As noted above, the weighted average cost of this portfolio is 72 basis points. Add to that the 1.2% investment advisor fee, and Dave is shelling out nearly 2% of his wealth each and every year. On top of that, 20% of the portfolio is in cash. Why pay an advisor 1.2% to hold funds in cash. A high yield savings account is a better option if such a large cash position is necessary.

Related: 7 Ways to Improve Your Investment Returns

But Isn’t This a Ton of Work?

The short answer is yes–evaluating an investment portfolio is time-consuming and you have to know what you’re doing. If you want to save time, headaches, and possibly money, I would highly recommend utilizing a new service from SmartAsset called SmartAdvisor.

SmartAdvisor can help you out by discovering, vetting, and providing you financial advisors who will get in contact with you. SmartAsset has developed a process that allows them to fit you with exceptionally high-quality advisors.

First, you’ll take a survey–between 20 and 25 questions. After you’re done, an in-house concierge team from SmartAdvisor will review your results further to discover the best match possible.

After that, up to three different financial advisors will contact you directly so you can start a conversation. We’ve found that this really narrows down the pool of advisors to find only those who are a fit for you and your financial situation.

Final Thoughts

Investing and asset allocation are not difficult. It can be intimidating if you are just starting out. One way to begin is to look at some standard, easy to implement asset allocation plans. You’ll find some excellent portfolios on the Bogleheads Forum (named after Vanguard founder, John Bogle).

(Personal Capital is now Empower)

Empower Personal Wealth, LLC (“EPW”) compensates Webpals Systems S. C LTD for new leads. Webpals Systems S. C LTD is not an investment client of Personal Capital Advisors Corporation or Empower Advisory Group, LLC