With more investment platforms coming out every day, it’s helpful to take a comprehensive look at some of the newer ones to see what they offer, the pros and cons of each, how they differ, and which one might be best for you.

In this article, I will make a comparison between Robinhood, Webull, and M1 so you can get a holistic view of each platform and determine which is right for you.

First, let’s get started with a brief comparison table so you can get an overview of each brokerage.

| Robinhood | Webull | M1 Finance | |

|---|---|---|---|

| Category | Brokerage | Brokerage | Hybrid |

| Platform Fees | $0 commissions on stocks and ETFs | $0 commissions on stocks and ETFs | $0 commissions on stocks and ETFs; M1 Plus is $125/year |

| Minimum Balance | $0 | $0 | $100 |

| Types of Investments | Stocks, ETFs, options, ADRs, crypto | Stocks and ETFs | Stocks, ETFs, options |

| Account Types | Individual taxable investment | Taxable, IRAs | Taxable, IRAs, Trusts |

| Best For | Options and crypto trading | More advanced stock trading | Beginners who want to choose individual stocks |

About Each Brand

Robinhood

Let’s first start with Robinhood. Robinhood was founded in 2013, and it is one of the first no-fee investment apps, meaning it offers free trades on stocks and exchange-traded funds (ETFs).

Robinhood's app is geared toward investors who are newer to investing but want to get started picking individual stocks or funds in the stock market.

However, it has grown substantially over time and now appeals to a much wider audience.

Robinhood has some excellent features. You can trade options, and you can buy fractional shares. It has extended trading hours, and there's even a cash management bank account that comes with your Robinhood account.

When you sign up for a Robinhood account, you can get up to $225 in free stocks.

Robinhood's app is straightforward to navigate, and it has an excellent news section that serves up the best investment news in real-time, making it very easy to make trades on the go.

Advertiser DisclosureThis advertisement contains information and materials provided by Robinhood Financial LLC and its affiliates (Robinhood) and Doughroller, a third party not affiliated with Robinhood. All investments involve risk and the past performance of a security, or financial product does not guarantee future results or returns. Securities offered through Robinhood Financial LLC and Robinhood Securities LLC, which are members of FINRA and SIPC. Doughroller is not a member of FINRA or SIPC.

Webull

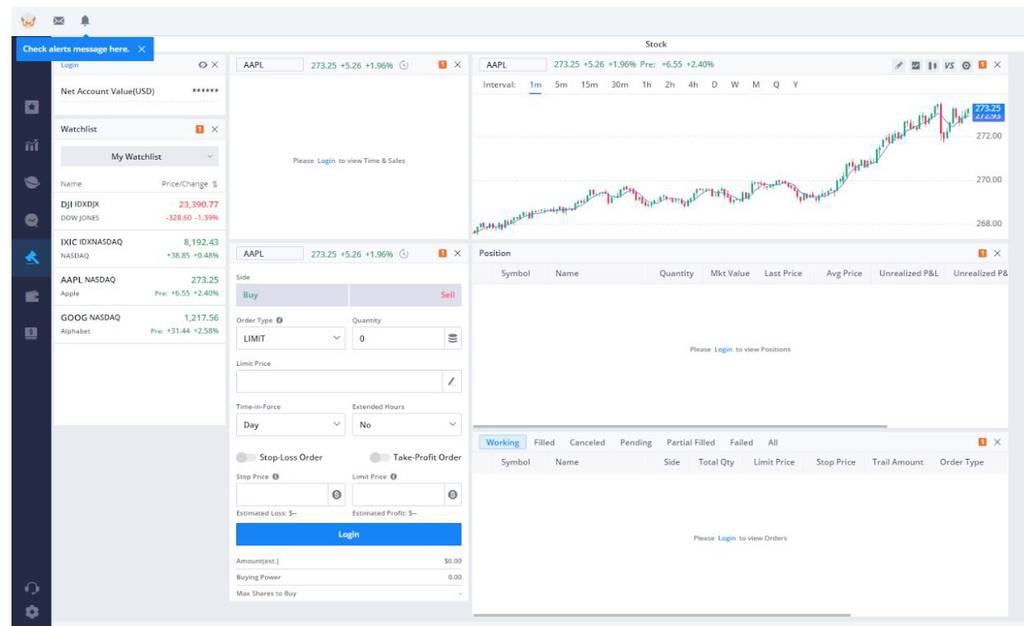

Webull was founded a few years after Robinhood in 2016, and it caters itself to more advanced traders. There are quite a few charting tools and technical indicators you can access when you sign up for a Webull account.

You can configure your trading panel on their website to discover trends and potential opportunities to develop your investment strategy. Webull also has $0 commissions, so no trading fees, and you can trade a wide variety of ETFs and stocks.

Webull is still suitable for beginners, but if you're a little bit more advanced than a beginner and you want to use more charting tools and pick individual stocks with cutting-edge research, Webull might be a better option than Robinhood.

M1

M1 was founded in 2015, and I would consider it more of a hybrid brokerage because it’s half robo-advisor, half online brokerage account.

When you sign up for an M1 account, you get to pick a set number of stocks, funds or ETFs, to have as part of your core portfolio, which M1 calls the “pie.” Each “slice” of the pie is an individual stock or ETF that serves as your portfolio’s foundation.

Whenever you add money to your M1 account, the robo-advisor feature kicks in, and it can automatically rebalance and reallocate those dollars as necessary.

Whatever targets you set in your portfolio with the original stocks and funds you chose, M1 will maintain that consistently, according to your strategy.

If you don't want to pick individual funds, you can also select from 80 expertly curated portfolios, which gives you a leg up, a much easier start and acts far more like a robo-advisor.

Like the other two platforms on this list, M1 costs nothing, and trades are free. However, you can upgrade to an M1 Plus account, which gives you several more features and costs $125 per month.

Key Features

Robinhood

Easy to Use

Robinhood is simple to use. All you have to do is download the app, sign up for a free account, and you can get started trading right away. After you fund your account, you can pick stocks and funds to purchase, and you'll be building a portfolio quickly. How the app is designed makes it easy for you to get started promptly.

App Interface

The app interface, building off of my previous point, is one of the best features of Robinhood, especially if you're someone who likes to trade on the go or from your mobile phone. The app is intuitive. It's effortless to navigate. The news feature is easy to scroll through to find news articles you want to read. But most of all, making a trade is as simple as it gets.

All you have to do is punch in the ticker number of the stock you want to buy, take a look at some of the historical trends, and scroll down and click buy. And within minutes, you'll be an owner of that stock. Funding the account is easy, too. It just takes a couple of days to get funds in your Robinhood account.

Robinhood Crypto

Suppose you're in one of 46 states where you can invest in crypto. In that case, Robinhood Crypto is available for you to invest in seven types of cryptocurrency, including Bitcoin, Bitcoin Cash, Ethereum Classic, and Litecoin.

Robinhood Gold

For an additional $5 per month, you can get access to Robinhood Gold, which gives you NASDAQ Level 2 market data and Morningstar research reports. This is helpful if you want to do more research on the stocks that you’re considering.

Robinhood Snacks

Recently, Robinhood acquired MarketSnacks, which was a financial news podcast and newsletter. It was renamed Robinhood Snacks, and it gives you digestible and easy-to-understand financial news.

Too often, when we’re trying to read through financial information, it isn’t very easy to follow or it’s loaded with data we don’t understand. Still, Robinhood Snacks does a great job at breaking down complex topics into easy-to-understand and actionable items, so you can leverage that news to make better trades.

Learn more about Robinhood or read our full review.

Related: How to Invest with Robinhood?

Webull

Extended Hours Trading

One of the unique features of Webull is its offering of extended-hours trading. This gives you full pre-market and after-hours sessions. Pre-market is 4 to 9:30 a.m. Eastern and after-hours trading is 4 to 8 p.m. Eastern.

You need to make sure you understand both of these market types before you invest in after-hours because it does drive or require a little bit of a different strategy. However, those who are familiar with extended-hours trading will find this option helpful.

Different Investment Options

You could invest in stocks and ETFs as with most other platforms. Still, Webull gives you the ability to invest in options and cryptocurrency, including Bitcoin, Ethereum, Bitcoin Cash, and Litecoin. This is a nice feature for people who want to play around with different investment types or expand their portfolios.

In-Depth Research Tools

Webull gives you access to high-level market trends so you can see what's happening, IPOs coming out, hot stocks, and other bits of data.

You'll also get access to in-depth analysis tools including technical indicators, powerful advanced charts, and real-time market data so you can do a deep dive into any company you want to invest in. For someone really into researching and picking their stocks, this is a great feature.

Related: How to Read a Stock Quote

Play Portfolio

Webull gives you the ability to have a free test portfolio. That way, you can find out how it works before you sign up; you can even practice trading stocks. I love this feature because it gives you the ability to get a look and feel of the platform before committing to signing up for an account.

Learn more about WeBull or read our full review.

Related: Best Paper Trading Apps

M1

Hybrid Approach

M1 acts as a hybrid between a full-scale online brokerage and a robo-advisor. You get some benefits of a robo-advisor like automatically rebalancing your portfolio or expert crafted pre-made portfolios, but you also can choose individual stocks and funds.

Your options are somewhat limited because there are only about 6,000 stocks and funds to choose from, which might seem like a lot. Still, in the grand scheme of things, it's limited, but you can have 100 different "slices" in your "pie," which makes it an excellent foundation for establishing a portfolio that's more catered to the things you want.

Related: Best Robo Advisors

Recurring Investments

You can set up auto-deposits with M1 to occur whenever you want, whether that’s weekly, biweekly, monthly, quarterly, whatever works for you. When the money goes into your M1 account, it automatically gets invested for you based on the allocation you’ve set in your pie.

So if you have 10% of your pie allocated to Apple stock and deposit $100, $10 will automatically go to Apple stock. This is a great feature because you don't have to worry about allocating a certain amount of money to each investment in your portfolio.

Tax Efficiency

This is one feature that you tend to get with robo-advisors, but M1 uses tax minimization on all of their accounts using what it calls a lot allocation strategy. This prioritizes the sale of a security to be most beneficial for you from a tax perspective.

It also reduces the amount you pay in taxes. You can learn more about this by reading about the tax efficiency feature with M1.

M1 Borrow

M1 Borrow allows you to borrow up to 40% of your existing portfolio’s value at a low-interest rate. The rates are fairly cheap (6.25% – 7.75%). If you sign up for an M1 Plus account, which is $125 per year, your M1 Borrow rate will be on the lower range.

You’re using your portfolio of investments as collateral, so M1 won’t do a credit check or involve any application or loan officers. You have access to that amount of money if you need it. This is a great feature if you’re someone who may need a short-term loan at a low-interest rate.

Learn more about M1 or read our full review.

Promotions

Robinhood

Robinhood's promotion has been around for quite some time, but it's still a great promotion. When you open an account, you get free stock. And after two days, you're able to either keep it or sell it.

Robinhood says there is a 98% chance of getting stock with a value of $2.50 to $10 per share. However, you may receive stock with a value per share of up to $225. This is all random, and it happens once you open your account. You can also get additional shares by referring friends.

Webull

Webull does something similar to Robinhood because it gives you free stocks when you open your account. Once you open a Webull brokerage account, you get two free stocks, and each stock is valued between $2.50 and $250 per share.

If you fund your account with $100 or more, you get two additional free stocks. Each stock would be valued at between $8 per share or $1,600 per share. So if you open an account with at least a hundred dollars, you're getting at least four free stocks from Webull, which is a great offer.

M1

M1 offers a promotion when you transfer an existing account to M1. You can earn up to $3,500, although the promotion is a little bit misleading. It has tiers and you can get a promotional bonus offer depending on how much you deposit.

For example, to get $3,500 plus what it calls M1 Swag, you have to deposit at least $2 million into an M1 portfolio. Here are the other tiers and corresponding bonuses:

- $10,000 to $19,999.99 $40 bonus

- $20,000 to $49,999.99 $75 bonus

- $50,000 to $99,999.99 $150 bonus

- $100,000 to $249,999.99 $250 bonus plus M1 Swag

- $250,000 to $499,999.99 $500 bonus plus M1 Swag

- $500,000 to $999,999.99 $1,000 in bonus plus M1 Swag

- $1 million to $1,999,999.99 $2,500 bonus plus M1 Swag

- $2 million+ $3,500 bonus plus M1 Swag

Pros and Cons

Robinhood Pros and Cons

Easy-to-use app. As I mentioned before, the Robinhood app is easy to use. It’s intuitive, the buttons are large, and it’s easy to purchase a stock or find relevant news.

No minimum balance requirement. Robinhood requires no minimum deposit to get started. You’re going to need money to buy stocks or other funds, but opening an account and getting a free stock costs nothing.

Free trading. One of the best things about Robinhood is the fact that it doesn’t charge commissions on trades. So you can trade as many stocks as you want, both buying and selling, and you will pay no fees to do so.

Investment options. Robinhood has a lot of options for you to trade, especially considering its overall simplicity. So obviously, you get 100% commission-free stock trading, but you can trade ETFs, options, and cryptocurrency on the Robinhood platform.

No retirement accounts. This is one of the biggest downsides of Robinhood. You can’t open a retirement account. The only option available is an individual taxable investment account. This is still nice if you want to pick individual stocks and invest, but you don’t get the tax advantages you would with something like a Roth or a traditional IRA.

You can’t balance with more stable funds. Robinhood does not offer the ability to buy bonds. You might find an ETF heavy in bonds, but in terms of just buying bonds to balance out an otherwise aggressive portfolio of stocks, you will be out of luck.

No contact number. This is frustrating. You can’t contact Robinhood, or at least it’s not easy to do so, because it doesn’t publish their number. So you need to contact Robinhood through email support, and where this will get frustrating is if you need to act on your investment account quickly and need some fast direction or advice.

Webull Pros and Cons

Extended hours trading. I mentioned this earlier, but for those who understand pre-market and after-market trading, this allows you to trade after the market closes or before it opens.

Play account. I like the ability to go in and test out what Webull looks and feels like before signing up for an account. So if you’re undecided, this might be a deciding factor for you because you get to experience what it’s like.

You can trade crypto. Webull gives you the option to trade cryptocurrency if that’s something you’re interested in. You can also trade options on the platform.

No commissions. Like other platforms now, Webull is offering commission-free trading, so it won’t cost you to buy or sell any stocks or ETFs.

Maybe too advanced for newbies. Webull offers more advanced features, but it kind of markets itself as being beginner-friendly. You’ll have access to many different research tools and charting tools and pre and post-market trading options, which is all great if you know how to leverage them. But if you’re a brand new investor just looking to pick a couple of stocks or ETFs, this can be overwhelming. So while a beginner could quickly get used to Webull, if you’re a brand new investor, this might be overly cumbersome.

No contact phone number. Webull, like Robinhood, does not have a number it publishes for you to call into them. Instead, you have to email them at customerservices@webull.us. This can be frustrating, especially with the Webull system’s complexity and advanced features. If you have questions on one of the platform’s features, you must email them directly.

No crypto investing. As of this writing, Webull does not offer cryptocurrency investing. It says that the feature is coming soon, but it’s been a while since this has been up, and we still don’t have cryptocurrency investing. If you’re someone who wants to invest in crypto, Webull will not be a good option for you.

M1 Pros and Cons

Automatic investments. M1 Finance offers a nice feature for you to deposit and invest your money with a hands-free approach automatically. Once you establish your “pie,” all you need to do is make additional deposits, and M1 Finance will allocate your deposits appropriately based on the fractional shares you have in your account.

There’s no minimum deposit. You can open an M1 Finance account with nothing, but you need at least a hundred dollars to invest or $500 for a retirement account. What I like about this, though, is you can go in and test the system before you commit to depositing a bunch of money into the account.

Fractional shares. This is nice because you don’t have to have the full amount of money to buy a single share. So to buy a share of Apple or Tesla, which can be very expensive per share, it doesn’t matter because whatever amount of money you deposit will go toward that stock, and you’ll own a fractional share. It’s also nice once you own at least one share; you don’t have to buy another whole share. It’ll just be another fractional share, so you don’t have to bother yourself with having enough money to afford full individual shares as you would with a full-scale online brokerage.

Limited trading windows. If you have a basic M1 Finance account, your stock trades will be placed only at one time during the day. If you’re a buy-and-hold investor, this may not be a terrible problem. However, you might also miss out on big upswings or downswings in prices because there’s only one window that stocks are traded during the day. If you pay the $125 per year upgrade to M1 Plus, you’ll get two trading windows per day, which gives you a little bit more flexibility but not much more.

No tax-loss harvesting. While M1 Finance says it makes trades in a tax-efficient way, it doesn’t offer tax-loss harvesting as many other robo-advisors do. Tax-loss harvesting is a tax strategy to reduce the taxes you’ll pay by buying and selling investments at the exact right time. You’ll still have to manage any tax-loss harvesting on your own with M1 Finance.

You can’t pull in other investment accounts. I like many robo-advisors or investment accounts because they will link to your other investment accounts. You have a holistic view of all of your investments, not just the ones with that brokerage. M1 Finance does not allow you to link other brokerages, so the only view you’ll have is of your balance with M1 Finance.

Learn More: The Best Investment Apps for 2021

FAQs

Is Robinhood free?

Yes. Investing with Robinhood is free. There are no commissions now or ever. There are also no fees to open an account, maintain your account, or transfer funds to your account.

Is Robinhood good for beginners?

Robinhood is a great platform for beginners because there are no account minimums, and trades are free. Plus, the app is easy to navigate, and it's not overly cumbersome, so you'll be able to find stocks to buy and sell fairly simply, and you'll also have access to digestible bits of investment news information.

Is Webull free?

Webull is 100% a free trading platform. There are no commissions for trading stocks, options, or ETFs. You will find no hidden fees and no strings attached, and, best of all, there's no minimum balance for you to open an account with Webull.

How do you cash-out on Webull?

Withdrawing funds from your Webull account is easy. Within the app, all you need to do is tap more from the homepage. Then you'll tap "withdraw" from the "banking" section. From there, you need to enter an amount equal to or below the balance you have in your Webull account and move forward with the withdrawal. From there, it'll take a couple of days to show up in your bank account.

Is M1 Finance good for beginners?

M1 Finance is a great platform for beginners. It allows you to choose individual stocks and ETFs to start, but after that, it's very hands-off, and you can even choose an expertly crafted portfolio if you don't want to pick individual investments. Asset allocation comes automatically, and so does rebalancing.

How does M1 Finance make money?

M1 Finance makes money by earning interest on cash in different forms. It earns interest in lending securities and interest on margin loans from M1 Borrow, but it still doesn't charge you commission or management fees. And the cost to you is free, that is, unless you borrow money through M1 Borrow, at which it's still a low-interest rate.

Final Thoughts

There you have it. A comparison of Robinhood, Webull, and M1, three platforms with some similarities and many differences. Each one caters to a different group.

If you’re brand new to investing and you want to pick a couple of stocks, plus you like using your mobile phone, Robinhood might be a perfect option for you.

If you’re someone used to picking individual stocks but still want some luxuries of a robo-advisor, M1 makes a great hybrid.

Finally, if you're someone who wants access to more advanced tools and still doesn't want to pay commissions, Webull would be a great option to look at.

Either way, check out our complete reviews of each platform I've linked above and do your due diligence before deciding.

Learn More: