Overall Ranking

4.5/5

Overview

4/5

4.5/5

5/5

4.5/5

Discover if Webull is the right online brokerage for you to use as the markets stabilize and the nation heads towards recovery.

Editor's Note

You can trust the integrity of our balanced, independent financial advice. We may, however, receive compensation from the issuers of some products mentioned in this article. Opinions are the author's alone. This content has not been provided by, reviewed, approved or endorsed by any advertiser, unless otherwise noted below.

Finding a new investment platform can be stressful–especially if you don’t know what you’re looking for. Some brokers focus on simplicity, while others focus on advanced tools for research. And while those advanced tools may be tempting, they’re not for everyone.

In this Webull review, I’ll cover one of newer players to the online brokerage space – Webull – and show you how their use of technology and financial acumen combine to make a beautiful blend of investment tools for more seasoned investors.

What Is Webull?

Webull is an online brokerage that says they’re “a financial company with the customer at heart, the internet as our foundation, and technology as our lifeblood.” Webull’s leadership team has experience in both the financial and technology industries. Their big focus is combining finance with technology to provide “reliable, professional, intelligent, and efficient products and services.”

They focus A LOT on technology. It’s in pretty much everything they talk about. Webull says:

Technology is the investor’s best friend. It vastly expands the human’s trading capabilities in terms of time, scale, and technique. Technology is the future.

So what do they offer?

Webull has an all-encompassing investment platform that lets you make stock trades commission-free and access intelligent tools and services, all while having a great user experience. But we’ll dive more into this below.

Webull Features

Multiple Investment Options

Webull makes it easy to diversify your portfolio with several different types of securities. You can invest in stocks, options, ETFs, and even cryptocurrency (currently Bitcoin, Ethereum, Bitcoin Cash, and Litecoin).

Two Different Account Types

Whether you’re looking to invest for wealth, retirement, or some other reason, Webull has you covered. You can open up an IRA (Traditional, Roth, or Rollover) for your retirement needs and grow your balance in a tax-advantaged way. Alternatively, you can open up an individual, taxable brokerage account which allows you to buy and sell securities as you please.

Extended Hours Trading

You don’t see this very often with brokerages, but Webull offers extended-hours trading. This includes full pre-market (4:00 AM – 9:30 AM ET) and after hours (4:00 PM – 8:00 PM ET) sessions. Note that you should understand the pre- and post- markets before investing during after hours. For those who are comfortable with it, though, the option is there.

In-Depth Analysis Tools

With Webull, you’ll get a lot of tools to help make your investment decisions a lot easier. Things like technical indicators, real-time market data, and powerful advanced charts will allow you to do a deep-dive into the companies you want to invest in.

Webull Desktop

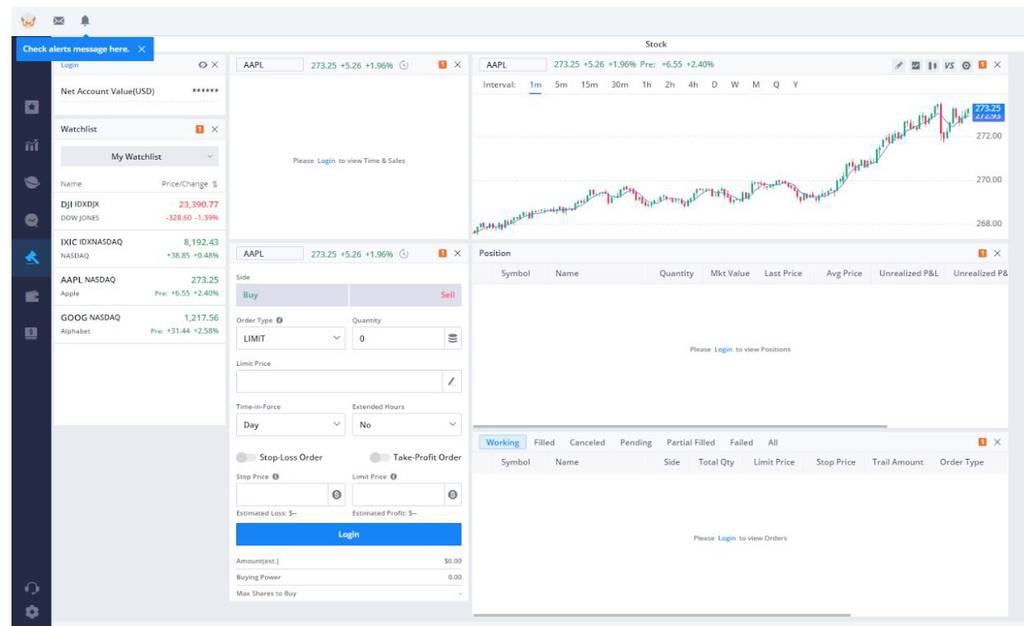

You’ll have access to Webull’s advanced desktop platform, which allows you to set a watch list, analyze stock charts, make trades, and get an overall view of your positions–either right from your desktop or on your mobile phone.

High-Level Market Trends

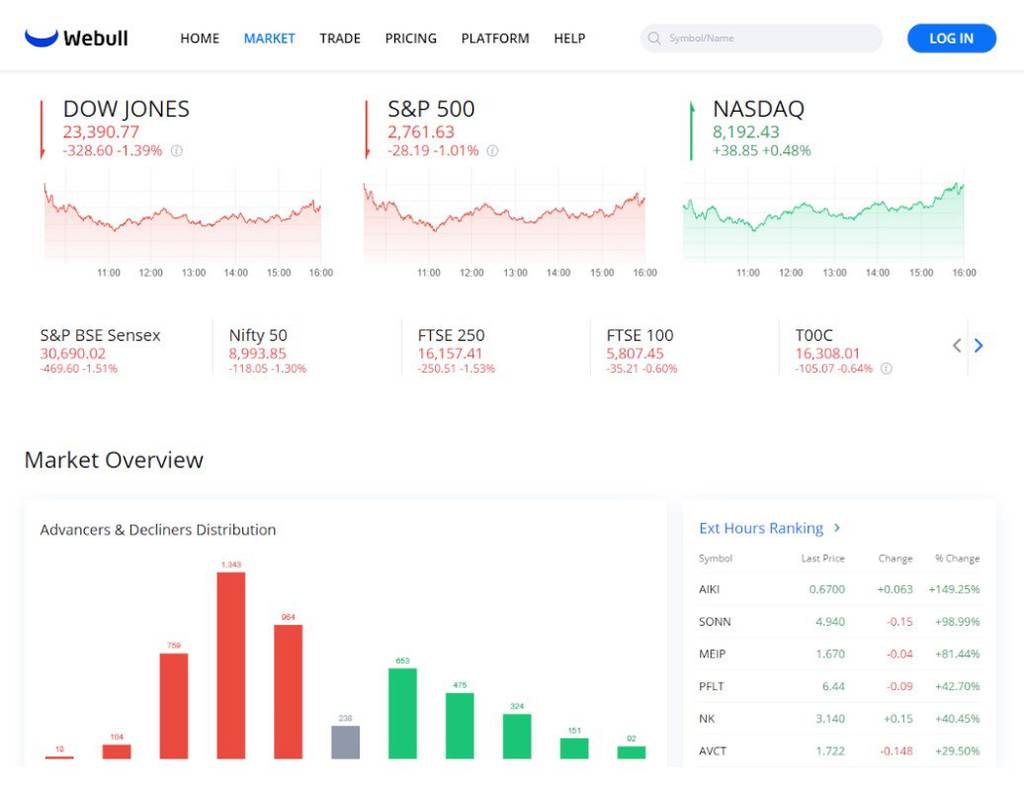

One of my favorite features is free to anyone and is a summary of market trends that are happening in real-time. You’re able to see how the major indexes are performing, IPOs happening, hot stocks, and several other pieces of data. In a time like this, it’s pertinent to keep a birds-eye view on everything happening across global markets.

Play Portfolio

You can also access a free “test portfolio” so you can look around the trading platform before you decide to sign up. This is also helpful once you do sign up to practice making trades, reviewing charts, and analyzing stocks before you put your money on the line.

Webull Pricing

Webull has no-fee commission trades and no deposit minimums. According to Webull, they can still make money through things like “stock loans, interest on free credit balances, margin interest, and payment for order flow.”

Here’s a look at some of their other pricing and fees:

Tiered Margin Interest Rates

You can get up to 4x day-trade buying power and 2x overnight buying power with a margin account–and you need $2,000 to qualify. The interest you pay on margin trading “is calculated on a daily basis and paid on a monthly basis,” and the “margin rate is variable and is determined by the size of the margin loan.”

Short Selling

With short selling, you have to borrow shares of a stock before you can sell them–and there’s a fee to borrow those shares. This loan rate will vary based on the current market conditions, and like margin trading, it is calculated daily and charged monthly. Webull’s formula for this is:

Daily Margin Interest (Short Position) = The Daily Market Value of the Borrowed Stocks when Market Closes* Stock Loan Rate for That Stock/360

Fees Charged By Regulatory Agencies and Exchanges

While Webull doesn’t charge you a commission for trading, legally, you still have to pay some fees to regulatory agencies and exchanges. Here’s a breakdown of those fees:

| Trading Privileges | Chared By | Types | Fees | Rule |

|---|---|---|---|---|

| Stock/ETF | The U.S. Securities and Exchange Commission (SEC) | Transaction Fee | $0.0000221*Total $ Trade Amount (Min $0.01) | Sells Only |

| Financial Industry Regulatory Authority (FINRA) | Regulatory Fee | 0.000119*Total Trade Volume Min $0.01 per - Max $5.95 per | Sells Only | |

| Options | The U.S. Securities and Exchange Commission (SEC) | Transaction Fee | $0.0000221*Total $ Trade Amount (Min $0.01) | Sells Only |

| Financial Industry Regulatory Authority (FINRA) | Trading Activity Fee | $0.002 * No. of Contracts (Min $0.01) | Sells Only | |

| Options Exchanges | Options Regulatory Fee | $0.0388 * No. of Contracts | Buys & Sells | |

| Options Clearing Corp (OCC) | Clearing Fee | $0.055 * No. of Contracts (Max $55 per Trade) | Buys & Sells |

Signing Up for Webull

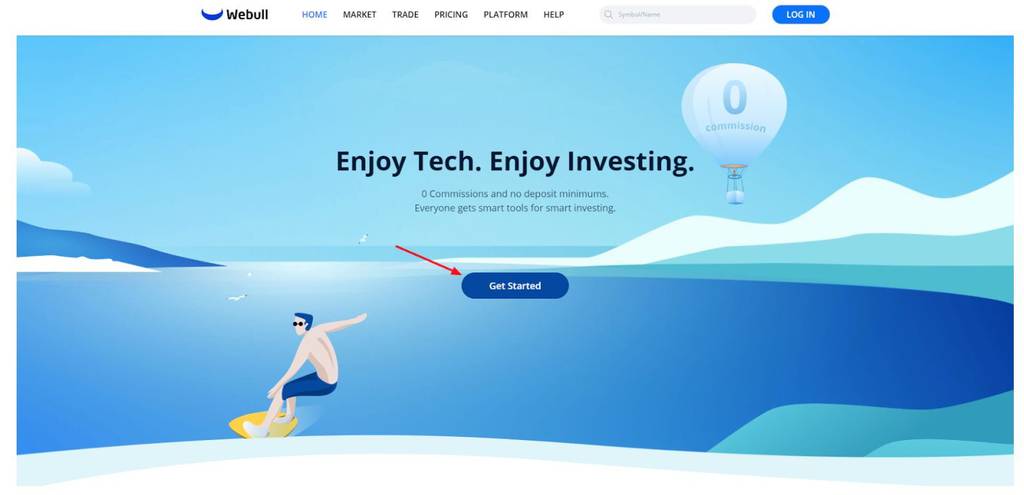

Signing up for Webull is incredibly easy. First, just click “Get Started” from their homepage:

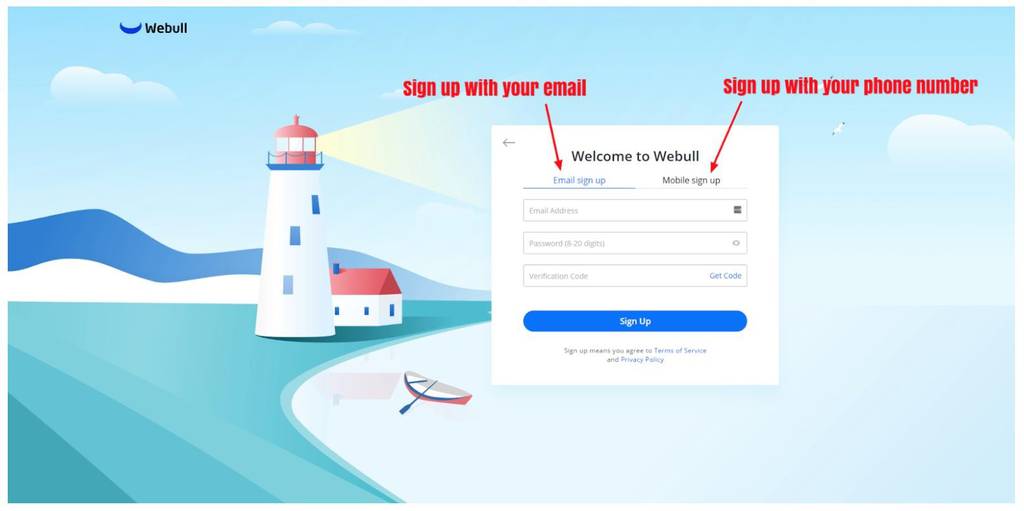

From there, you’re taken to a screen where you can either sign up with your email address or your phone number:

Note that you’ll have to click “Get Code” before proceeding. Once you do that, you’ll get a verification code sent to either your email or mobile phone via text.

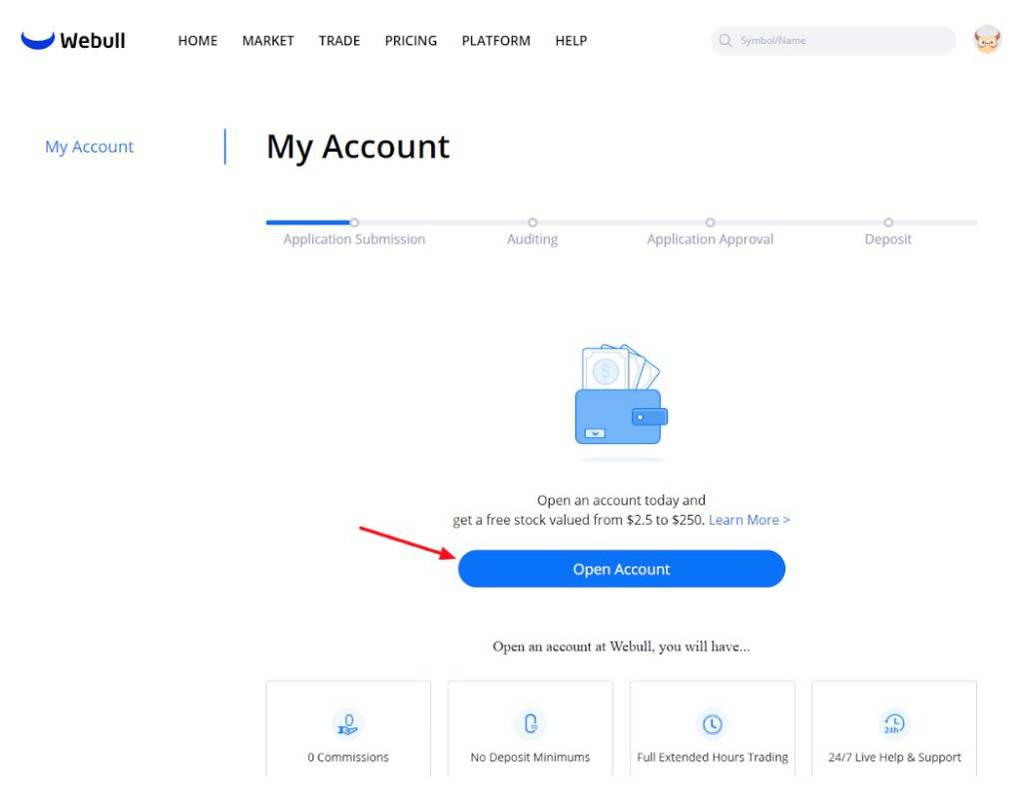

You’ll then be taken to your account screen, where you’ll click “Open Account”:

Here, you’ll enter all of your personal information:

After that, you’ll select what type of account you want to open, sign risk disclosures, and get started. Note that it may take a couple of days to get your account fully approved and open.

Webull Security

Webull has a valid SSL certificate and is a secure website. Beyond that, here’s how they use and safeguard your information, according to their privacy policy (note: I am not an attorney, this is just my interpretation of their privacy policy):

Collection of Customer Information

We may collect non-public personal information about our customers from the following sources:

Account application and other forms, which may include a customer’s name, address, social security number, driver’s license and information about a customer’s income, net worth, investment goals and risk tolerance;

Account History, including information about transactions and positions in a customer’s accounts; and

Correspondence, written, telephonic or electronic between a customer and Webull or service providers to Webull.

This means that they’ll collect non-public information about you.

Disclosure of Customer Information

We do not disclose non-public personal information about our customers or former customers to anyone, except permitted by law. We may disclose non-public personal information about our customers or former customers to non-affiliated third parties of Webull under one or more of these circumstances.

As Authorized – if you request or authorize the disclosure of the information.

As Permitted by Law – for example, to effect, administer, or enforce a transaction that a consumer requests, or authorizes, or in connection with processing or servicing a financial product or service that a customer requests or authorizes.

And this means that they won’t share that information unless they have to by law.

Security of Customer Information

We maintain physical, electronic and procedural safeguards that comply with federal standards to protect non-public personal information of customers of Webull, including policies and procedures designated to assure only appropriate access to, and use of information about customers of Webull.

We will adhere to the policies and practices described in this notice regardless of whether you are a current or former customer of Webull. If you have any questions about our Privacy Policy, please do not hesitate to contact us at 917-725-2448.

This means that Webull has strict guidelines to protect your information, and if you have questions about it, you can call them directly.

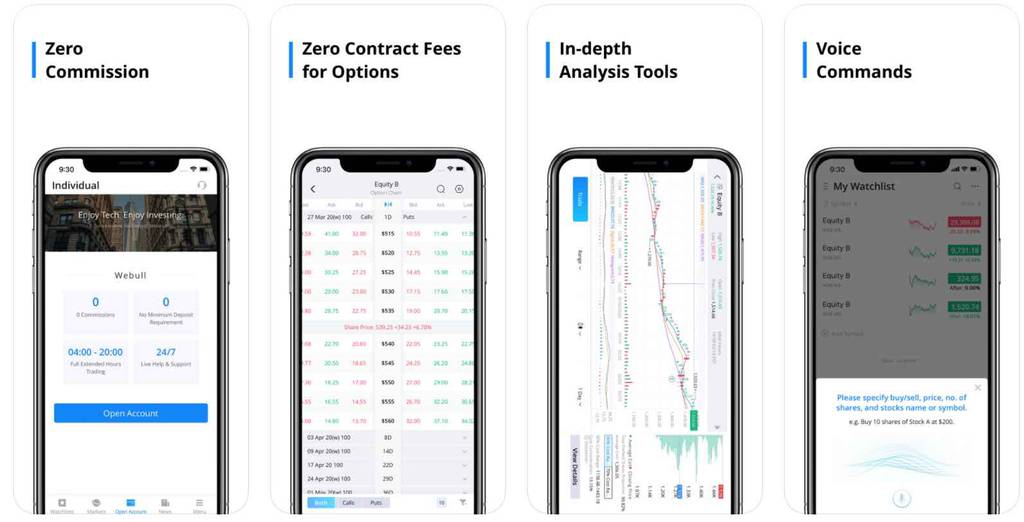

Webull Mobile Support

Webull has a slick mobile app available for both iOS and Android. It has all the features you need and allows you to analyze stocks, make trades, and a lot more right from your mobile phone. Also, Webull now offers an AWESOME-looking app for iPad.

Here are some screenshots from the iOS version:

Customer Service

Webull’s customer service is available 24 hours a day, seven days a week to help you with any questions you have about anything related to their platform. You can contact them in a variety of ways, too:

- Phone – +1 (888) 828-0618

- Email – customerservices@webull.us or marketing@webull.com

- Facebook – https://www.facebook.com/WeBullGlobal/

- Twitter – https://twitter.com/WebullGlobal

- Reddit – https://www.reddit.com/r/Webull/

Pros and Cons

Commission-free trading — You won’t pay any commission for trading stocks with Webull, which allows you to build a diverse portfolio (and not invest a TON) at little to no cost.

Ability to trade options and crypto — Webull didn’t use to offer options or cryptocurrency trading, but now they do. This is a great addition for those who are comfortable investing in these types of securities and will help to diversify even further.

Extended hours trading — Again, for people who need additional trading options, the ability to trade outside of normal trading hours is awesome. This gives you additional angles to trade stocks and find opportunities for scooping up equities at more desirable prices.

Stock simulator — I love the ability to play around in a trading simulator platform to make sure you’re comfortable making trades, analyzing stocks, and getting comfortable with the trading platform overall.

No fractional shares — While there are no account minimums, you aren’t able to purchase fractional shares of stocks--meaning you can invest a lot less--so you’ll need enough cash to buy at least one full share.

Not for beginners — While it’s easy to get started, I don’t like Webull for beginners. There are no prebuilt portfolios, no robo-advisor option, and there is a heavy lean toward investing in options and buying on margin--which are advanced techniques. Also, the amount of data and insights you can get access to, while great, are a bit much for a newer investor.

Alternatives

The closest alternative is Robinhood. I wrote a review on Robinhood so you can read more there, but where I see Robinhood edging out Webull is when it comes to beginners. Robinhood has a lot of the same features (including $0 commissions), but it’s much more geared toward someone who is a newer investor.

The app is clean, the site provides tons of resources, but they don’t urge you to invest in options or crypto as much (at least that’s what I have found). Their customer service isn’t as good (or quite as available) as Webull’s, but since things are a bit more straightforward, that might not be an issue for you.

Related:

Is Webull For You?

Webull is an excellent option if you’re a more seasoned investor, and you want to take advantage of things like options trading, crypto, and after-hours trading. It’ll also benefit you if you’re someone who likes to do in-depth technical analysis on stocks before you buy them since there is so much information available. And since there is no cost to get started and make trades, I don’t see any risk in trying it out.

Bottom Line

I really like what Webull is doing. They’re taking the best pieces of several types of online brokerages and putting them together.

For an investment nerd like me, I see them taking the advanced data and charts from the likes of TD Ameritrade and E*TRADE, folding in the slick and intuitive app that Robinhood produces, and finally the pricing structure that Ally Invest has (no commissions). The only piece it’s missing is a robo – like Wealthfront or Betterment.

My advice is to check it out–it won’t cost you anything, and it might be one of the best investment apps you’ve tried yet.