In a Nutshell:

Crowdstreet is for larger investors looking for higher returns on their investments, as well as those interested in individual property deals.

Fundrise is for investors of all portfolio sizes, including non-accredited investors, looking to make a small investment in commercial real estate.

Streitwise is for investors looking for steady income with capital appreciation from their commercial real estate investments, along with a strong measure of liquidity.

Investing in real estate is one of the primary growth asset diversions away from a portfolio comprised entirely of stocks. And, one of the very best ways to participate in real estate as an asset class is through commercial real estate. That was impossible just a few years ago, but the growth in real estate crowdfunding in recent years is opening commercial real estate investing to millions of small investors. You can now hold commercial real estate in your portfolio alongside stocks, bonds, and other traditional investments.

Three of the top real estate crowdfunding platforms in the industry are CrowdStreet, Fundrise, and Streitwise. While each approaches commercial real estate investing from a different angle, you should be able to find one among the three that will be a comfortable fit for you and your investment portfolio.

Depending on which you choose, you’ll be able to either invest money in diversified funds composed of multiple commercial properties or even make direct investments in individual properties you select.

Which is the best real estate crowdfunding platform among the three: CrowdStreet, Fundrise, and Streitwise? It all depends on your personal financial situation, your investment goals, and your personal preferences.

Related: 8 Best Cities to Buy a Rental Property for Investment in the US

CrowdStreet vs Fundrise vs Streitwise The Overview

Virtually all three platforms CrowdStreet, Fundrise, and Streitwise offer you an opportunity to invest in commercial real estate with a relatively small amount of capital. This is a major advantage because historically, commercial real estate investing has been limited only to the wealthy. This is due largely to the fact that commercial real estate is capital-intensive, and is typically funded by private placements.

But, the three platforms, along with other real estate crowdfunding platforms, have democratized commercial real estate investing, making it possible now to invest in this sophisticated asset class with just a few thousand dollars.

The advantage of having three popular platforms to invest with is you’ll have greater control over the types of investments you want to participate in. For example, if you prefer investing in funds similar to mutual funds and exchange-traded funds (ETFs) you can do that using non-publicly traded real estate investment trusts (REIT) and eFunds available through Fundrise and Streitwise.

But, if you want to invest in individual commercial deals, including single-family properties, you can do that, as well, through CrowdStreet. CrowdStreet also gives you the ability to select the specific real estate deals you want to participate in. You can even spread your investment among several different properties.

In this way, real estate crowdfunding has come to a place very similar to stock market investing, where you have a choice to either invest passively through funds or to participate in self-directed investing by participating in the ownership of individual properties.

You should be aware that investments with Fundrise and Streitwise tend to be lower risk because you are investing in a portfolio of properties. Investing in single properties through CrowdStreet does carry higher risk, but also potentially higher rewards.

The table below shows the basic features of all three popular real estate investment platforms side-by-side:

| Features | CrowdStreet | Fundrise | Streitwise |

|---|---|---|---|

| Initial Investment | $25,000 to $100,000 | $500 to $100,000 | $5,000 |

| Management fee | None | 0.85% to 3% per year | 3% upfront, plus a 2% annual management fee |

| Stated return on investment | 23.1% | 8.76% to 12.42% | Targets 10% annual dividend yield, plus potential capital appreciation |

| Investment methodology | Individual properties, real estate investment trusts, and tailored portfolios | eREITs & eFunds | A single REIT |

| Specific types of real estate investments | Retail, office, industrial, mixed-use, apartment houses, hospitality, senior housing, and storage facilities | eREIT: Apartment buildings, shopping centers, office buildings; eFunds: individual residential properties or small groups of residential properties | The REIT holds office space, retail space, warehouse space and apartment complexes |

| IRA availability | Yes, through self-directed IRAs | Yes, through self-directed IRAs | Yes, through self-directed IRAs |

| Mobile accessibility | N/A | iOS devices, available on The App Store | iOS devices, available on The App Store |

| Accredited investor requirement | Yes | No | No, unless your investment exceeds 10% of either your net worth or your income for the past two years |

| Availability | All 50 states | All 50 states | All 50 states |

Learn More:

CrowdStreet vs Fundrise vs Streitwise Investment Methodologies

At the core, CrowdStreet, Fundrise, and Streitwise use many similar investment methodologies. For example, all three invest in commercial real estate. They also offer a variety of investment types as well as plans to best suit your own personal investment preferences. And, if you would like to hold a position in any of the three in a retirement account, you can do so through a self-directed IRA account. (Be aware that these are not the type of self-directed IRAs offered by major brokerage firms, but rather specialized IRA trustees that hold unique assets, like commercial real estate.)

Each of the three has its own minimum initial investment, which can certainly be a factor in choosing which platform you will invest in. For example, Fundrise requires a minimum initial investment of just $500, while CrowdStreet typically requires a minimum of $25,000 to invest in individual properties.

One thing they all have in common is a track record of paying above-average returns on your investment. In fact, the returns typically match or exceed the long-term return on stocks as measured by the S&P 500. That return is about 10% per year going all the way back to the 1920s. But, real estate crowdfunding platforms can match or exceed that annual return.

Be aware before you invest that real estate crowdfunding does involve a significant amount of risk. It’s inherent in commercial real estate since each investment is unique and subject to its own set of variables. This is why at least one of the three crowdfunding platforms, CrowdStreet, requires you to be an accredited investor to participate (Fundrise and Streitwise do not).

Let’s take a closer look at all three real estate crowdfunding platforms to give you a glimpse of the unique investment offerings each provides.

CrowdStreet Investments

CrowdStreet was founded in 2014 and brings together real estate sponsors the people who put the real estate deals together and participating investors to fund those properties.

CrowdStreet puts each property sponsor through a three-step vetting process. First, by evaluating the developer’s background and track record, looking for demonstrated capability in providing both returns and professionalism. Second, by evaluating the asset in a deal-screening process to make sure it’s consistent with the sponsor’s background and with investor preferences. And third, they review the terms of the proposed offering compared to their standard investor deal terms criteria matrix to make sure it matches CrowdStreet criteria.

Taken from Crowdstreet.com on April 13, 2021

Distributions occur either on a regular schedule or when the underlying property is sold. Most deals pay distributions on a quarterly basis, and a few even pay monthly. However, the distribution schedule or if there even is a distribution on investment will vary by the particular property investment.

And, though CrowdStreet deals are typically available to U.S. residents only, some investments will accommodate participation by international investors.

However, there are two limitations with CrowdStreet you need to be aware of:

- You must qualify as an accredited investor to participate on the platform.

- The minimum investment ranges between $25,000 and $100,000.

Put another way, CrowdStreet is designed primarily for larger investors.

Individual Property Investments

For this category, you’ll have an opportunity to invest directly in individual real estate deals through the CrowdStreet Marketplace. This will give you an opportunity to choose specific properties to invest in. However, you’ll be a passive investor in any properties you choose. The property itself will be managed by the sponsor of the project.

What’s more, rather than having 100% ownership of a single property, instead you’ll be one of typically dozens of other investors in the same property. That will allow you to write your portfolio across several individual properties at the same time, building your own commercial real estate portfolio.

You’ll be able to choose your individual property investments by property type (retail, office, apartment complexes, etc.) and even by location, which will allow you to diversify geographically. You’ll be able to shop among the various property offerings available on the marketplace, submitting offers and funding your investments.

Real Estate Investment Trusts (REITs)

A REIT is much like a mutual fund, except that it invests in commercial real estate. A single REIT will hold several commercial properties. Often these are similar properties in different geographic locations, or they can be a mix of commercial property types.

CrowdStreet offers two types of REITs:

- Single-sponsor funds. These are REITs led by one real estate firm, which will specialize in either a specific property type (like apartment complexes) or even a specific geographic location. This is a way to take advantage of the fund sponsor’s specific area of expertise.

- CrowdStreet funds. These are REITs constructed and managed by CrowdStreet itself. They attempt to diversify across a broad set of individual properties, with participation from multiple sponsors.

In either case, CrowdStreet REITs enable you to quickly invest in a ready-made portfolio of diversified commercial properties.

Tailored Portfolios

Also known as Private Managed Accounts, these are managed by CrowdStreet Advisors, LLC. They use proprietary systems to build customized investment strategies based on your personal financial goals. Once those goals are established, you’ll review the strategy before agreeing to proceed.

As you invest, you’ll receive tailored, electronically-delivered recommendations based on your investment goals and profile. You’ll also have access to a dedicated representative acting as your point person in your investing activities. In addition, you’ll be able to track your portfolio regularly through the CrowdStreet Portfolio Center.

You can think of Tailored Portfolios as being something like a robo-advisor for commercial real estate. You’ll fund your account, and all investment management will be handled for you.

Read our full CrowdStreet Review.

Fundrise Investments

Fundrise works much the same as CrowdStreet in that it allows you to invest in commercial property. However, it has two major advantages over CrowdStreet: Fundrise does not require you to be an accredited investor, and you can begin investing with as little as $500. That means Fundrise is available to offer commercial real estate investing to a much larger number of investors, particularly smaller ones.

Fundrise fees vary by the type of investment you make; they can range from a low of 0.85% to as much as 3.00%.

Fundrise investments have provided net returns ranging from a low of 8.76% in 2016, to a high of 12.42% in 2015. For 2019, Fundrise produced a net average annualized return of 9.47%.

Fundrise offers a wide variety of real estate investments, ranging from single-family rental homes to commercial developments. They’re currently offering 216 projects, of which most involve equity participation, while a smaller number are debt offerings. An equity offering allows you to participate in capital appreciation upon the disposition of the underlying property. Debt investments are strictly interest-bearing.

When you invest with Fundrise, you’ll be diversified across a series of investment funds customized to your selected investment strategy. Each fund you participate in will hold several properties. They do make clear that, as is the case with most real estate crowdfunding investments, you’ll be making a long-term investment-- typically 5 years or longer.

The funds you invest in are referred to as eREITs and eFunds. Each is a limited liability company that holds multiple real estate products, giving you an opportunity to diversify your holdings across several properties. eREITs are non-publicly traded REITs that hold commercial properties. However, since they are not publicly traded, you won’t be able to liquidate them before the end of your contract period without paying a fee for early withdrawal.

eFunds invest only in residential real estate. Typically, these are single-family homes. The funds are structured as partnerships, and unlike eREITs, they don’t pay dividends. The funds focus on the long-term capital appreciation and give you the ability to hold positions in several properties.

Fundrise offers four different portfolio levels:

Fundrise Starter Portfolio

This is the portfolio for real estate crowdfunding beginners. It’s the perfect choice for new investors because it requires a minimum investment of just $500. Also, you can upgrade to the Core Portfolio free of charge.

Your portfolio will be invested in a 50-50 mix of the Fundrise Income eREIT II and the Fundrise Growth eREIT II, giving you an equal balance between income and growth.

Fundrise Core Portfolio

Core plans are considered the foundation of your investment activities. They involve investing in a diversified real estate portfolio that’s consistent with your investment objectives. You’ll have a choice of focusing your investment on generating a consistent cash flow (Supplemental Income), maximizing long-term growth (Long-Term Growth), or a combination of the two (Balanced Investing). All three plans include a mix of dividends and appreciation, but the Supplemental Income plan emphasizes dividends, while Long-Term Growth favors appreciation. The Balanced Investing plan includes a combination of both.

Core plans require a minimum investment of $1,000.

Fundrise Advanced Portfolio

This plan provides access to more advanced investment strategies that also offer higher potential returns. You’ll have access to a Fundrise Plus plan, which is an optional add-on for each Core plan in your portfolio. The plan will allocate a portion of your portfolio to more sophisticated real estate strategies, taking advantage of new market opportunities.

The minimum investment for the Advanced plan is $10,000, and you’ll be able to invest directly in most of the investment funds offered by Fundrise.

Fundrise Premium Portfolio

Under this plan, you'll have access to one-of-a-kind investments including private funds that become available periodically. Offerings are highly specialized and, as private equity funds, they are illiquid and have even longer time horizons. However, they are expected to turn higher profits over the long run.

Fundrise Premium will give you access to all the benefits available under Fundrise Advanced, and it does require a minimum investment of $100,000.

Read our full Fundrise Review.

This is a testimonial in partnership with Fundrise. We earn a commission from partner links on DoughRoller. All opinions are our own.

Streitwise Investments

Streitwise is one of the newer real estate crowdfunding platforms, having only been launched in 2017. It’s different from most real estate crowdfunding platforms, just because it’s actually a public, non-traded real estate investment trust, combining both dividends and long-term capital appreciation. The REIT is an equity-based fund, giving you the benefit of ownership in the properties in the trust.

The REIT invests in commercial properties, including office buildings, retail space, warehouses, and large apartment buildings. The fund will be diversified across dozens of real estate markets nationwide. And, while its set up primarily to generate ongoing dividend income, capital appreciation is possible when properties held in the trust are sold at higher prices.

There are a few things to love about Streitwise:

Streitwise vetting process: Streitwise accepts only high-quality properties in their REIT. First, properties have to be located in non-gateway markets. This means they avoid the high price coastal markets, favoring lower price markets with higher dividend yields. Second, they limit leverage to no more than 60% of any property to lower risk. Third, investments are selected based on a strategic location, with nearby amenities, established employment, sustainable occupancy, and quality construction. And finally, Streitwise favors the most creditworthy tenants, particularly large, well-known organizations.

The Streitwise redemption policy: One of the inherent limitations of real estate crowdfunding investments is they are highly illiquid. Once you make an investment, youre expected to hold onto it until it’s completed. However, Streitwise has a redemption policy allowing you to recover 90% of your investments if you hold your position for at least one year. And, after 5 years, they’ll redeem 100% of your investment.

The Streitwise Dividend Reinvestment Plan (DRIP): Similar to DRIPs offered by publicly traded corporations on the stock exchange, Streitwise enables you to enroll in the plan and use your dividends to increase your investment in the REIT. If so, your investment will automatically increase the longer you hold your position.

On the negative side, Streitwise is admittedly high on fees. You’ll pay a 3% fee upfront, just to make an investment. After that, you’ll pay an annual management fee of 2%.

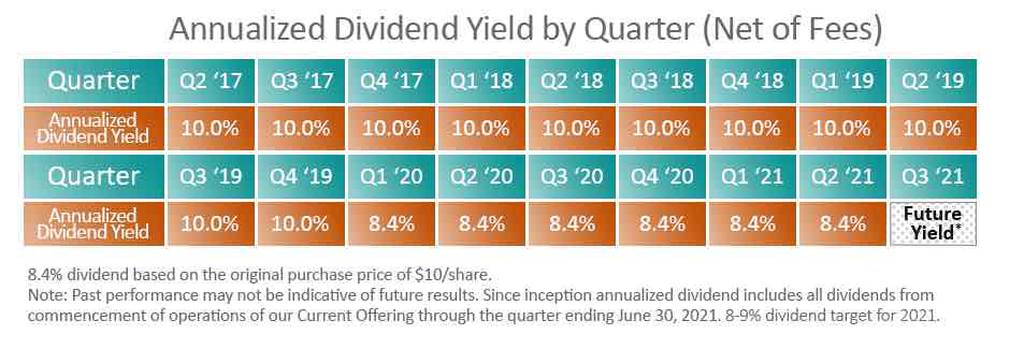

However, the company works to achieve a 10% annual dividend yield, after accounting for the 2% annual fee. That means the real return is 12%, but is reduced by the fee.

In addition, you’ll be able to participate in capital appreciation on the sale of properties within the REIT if they are sold for more than the original purchase price.

Streitwise also offers the advantage that you do not need to be an accredited investor, and the minimum investment is $5,000. It’s an excellent opportunity to earn high, regular dividends, with the possibility of capital appreciation. That makes returns on your Streitwise REIT comparable to the long-term returns on stocks, based on the S&P 500.

Read our full Streitwise Review.

Why Choose Crowdstreet?

Who wouldn’t be interested in real estate investments with returns well north of 20%? These are of course higher-risk investments, but if you’re a larger investor looking for high reward/high-risk opportunities, Crowstreet is an excellent choice.

What's more, you can either choose to invest in real estate investment trusts or individual property deals. Best of all, you don't have to take on individual properties all by yourself. Because of the crowdfunding factor, you'll only get a piece of the investment with dozens of other investors. You'll participate in the profits, but without the heavy time investment that typically comes with owning individual properties.

Why Choose Fundrise?

If you're a smaller investor, particularly one who is not an accredited investor, and you want to participate in commercial real estate investments, Fundrise will be the crowdfunding source for you. Not only does it require a smaller investment, but you'll be invested in multiple investments at any given time, lowering the dependence on the outcome of just one or two properties.

Another way in which Fundrise is a good choice for new and small investors is that it’s set up to allow you to grow as a commercial real estate investor. You can begin investing with the Starter Portfolio, then gradually work your way up to the higher rewards (and risks) of the Advanced Portfolio. Or, maybe you’ll be content with the performance of the Starter or Core portfolios, and see no need to try one of the higher risk portfolios. Fundrise will give you that choice, and with a smaller upfront investment than what’s required by other real estate crowdfunding platforms.

Why Choose Streitwise?

Streitwise is an excellent choice if you are a smaller investor interested in commercial real estate investing that combines income and capital appreciation. Streitwise has a pattern of a high dividend yield - in the 8% to 10% range - which will make it an excellent source of steady income. But if you want to grow your investment, you can participate in the DRIP plan to reinvest your dividends instead of taking them as income.

Streitwise is also an excellent choice if you want to invest in commercial real estate, but you're concerned about the lack of investment liquidity. Streitwise has what is probably the most generous redemption policy in the industry, allowing you to recover up to 90% of your initial investment after just one year. If you have any sense real estate crowdfunding may not be a long-term investment for you, this is the one you can choose.

CrowdStreet vs Fundrise vs Streitwise Which is the Best Real Estate Crowdfunding Platform?

Is there one real estate crowdfunding platform that stands out among CrowdStreet, Fundrise, and Streitwise? In truth, each is good in its own specialized niche. More than anything else, it will come down to a) making the decision that you want to invest a portion of your portfolio in commercial real estate, then b) selecting the real estate crowdfunding platform that will work best for you.

If youre a small investor, and new to commercial real estate investing, you’ll want to favor the small investment requirements and funds offered by either Fundrise or Streitwise. But, if youre a larger investor with a healthy appetite for risk, the potentially greater investment returns provided by CrowdStreet will be the better choice for you.

Whatever decision you make, understand that investing in commercial real estate is riskier than most other types of traditional investing. Commercial real estate should be held as a small percentage of an otherwise balanced portfolio that includes generous allocations in stocks, bonds, and cash.

Learn More: