If you’ve been looking to expand your portfolio to include a true alternative investment–like commercial real estate–Streitwise will offer you an opportunity to earn both high annual dividends and long-term capital appreciation with a minimum investment of $5,000.

Streitwise is a private real estate investment trust, and not a real estate crowdfunding platform. It’s a relatively new investment platform, but it’s been providing 8%+ dividend returns for at least the past two years, and offers an opportunity for long-term capital appreciation. With a small amount of money, you can participate in commercial property investments that are carefully selected for both current and long-term performance.

What is Streitwise?

While closely linked to real estate crowdfunding platforms, Streitwise is actually a public, non-traded real estate investment trust (REIT) that offers an opportunity for investors to get the benefit of both above-average dividends and long-term capital appreciation. The platform was launched in 2017 and is based in Los Angeles, California. The trust has more than $76 million in assets under management. The sponsors of the REIT (Tryperion Partners) have collectively done over $5.4 billion in transactions.

This is unlike traditional real estate crowdfunding platforms, which typically appeal to investors who are looking for specific real estate investments and can involve either debt or equity positions. Instead, Streitwise is an equity-based REIT, which is something like a mutual fund that invests in multiple properties.

Read More: Real Estate Crowdfunding

A REIT can invest in any one of several types of commercial properties. This includes large apartment complexes, office buildings, retail space, and warehouses, just to name a few. And since they hold multiple properties, they can diversify holdings across dozens of different real estate markets across the country. And while the investments are designed primarily to generate regular dividend income, they can also provide generous capital appreciation when properties held in the trust are sold and the gains distributed to investors.

REITs have another major advantage over real estate crowdfunding platforms in the area of tax treatment. By law, REITs must distribute a minimum of 90% of their taxable income as dividends to their shareholders. Since those dividends include depreciation expenses, taxable income is reduced. And when properties held in the trust are sold, the gains are taxed at lower long-term capital gains tax rates.

In addition, unlike stocks, REITs are not subject to double taxation at both the corporate and individual levels. REIT income is only taxable to the individual upon receipt of dividends or capital appreciation. And as a pass-through entity, it gets the benefit of a 20% exemption.

Streitwise has a Better Business Bureau rating of “A+”, the highest rating on a scale of A+ to F.

Streitwise Product Features

Minimum initial investment: $5,000

Accredited investor requirement: No, unless your investment in the REIT exceeds 10% of either your net worth or income for the past two years.

Available investment types: Can be held by individuals, corporations, limited liability companies, trust, and either self-directed IRAs or 401(k) plans.

Redemption policy: You will be unable to redeem your REIT shares for the first full year of ownership. But after the first year, you can redeem 90%. That figure gradually rises to 100% after five years of ownership.

The redemption schedule is as follows:

- Less than one year: No redemption permitted.

- One to two years: 90% of the Net Asset Value (NAV)

- Two to three years: 92.5% of NAV

- Three to four years: 95.0% of NAV

- Four to five years: 97.5% of NAV

- Five years or more: 100% of NAV

100% redemption is also available on the death or complete disability of the stockholder. However, you should be aware that as a non-publicly traded REIT, your investment can not be sold on popular exchanges.

Streitwise Dividend Re-Investment Plan (DRIP): Streitwise allows you to have your dividends used to purchase more shares in the REIT, increasing your investment. This is an optional feature.

How Streitwise Works

You can start using Streitwise with a minimum initial investment of $5,000. With the investment priced at roughly $10 per share, that will give you 500 shares.

Unlike many real estate crowdfunding platforms, there is no requirement for you to be an accredited investor. That opens the platform to investors of all net worth and experience levels. However, the company does require that your investment in the REIT does not exceed 10% of either your net worth or your income for the most recent two years. (The income or net worth can be either individual or joint.)

You can invest more than 10% of either your income or your net worth but you will be required to be an accredited investor if you do.

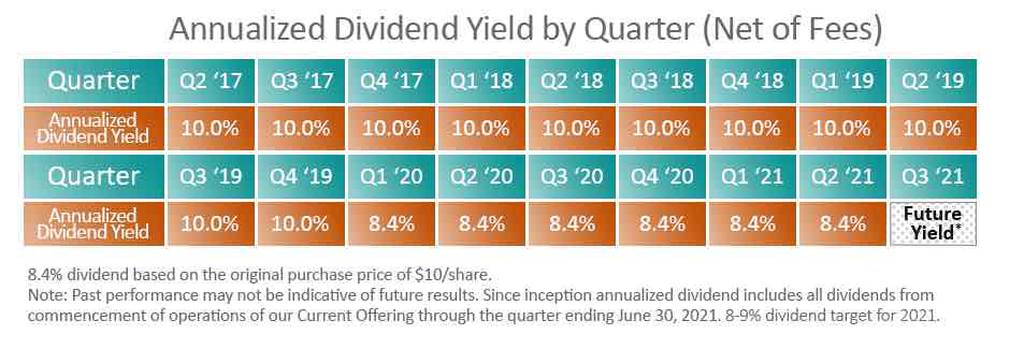

Since Streitwise pays dividends–averaging around 10% per year from 2017 through 2019–you’ll receive payments on a quarterly basis, net of investment fees. The dividend history is as follows:

One of the big advantages to investing with Streitwise is that the three founders who manage the REIT have over $5 million of their own funds invested in the trust. That means they have a direct vested interest in the successful management of the fund.

Streitwise invests in commercial properties, which they generally expect to hold for 10 years or until property values reach a desirable level, upon which it will be sold. At that point, the proceeds of sale will either be distributed to investors or invested in a new property.

The REIT currently holds two commercial properties. One, the Panera Bread Headquarters, is 290,000 square feet in three buildings located in St. Louis, Missouri. The second is the Allied Solutions Building, a 142,000 square foot, mixed-use commercial building in Carmel, Indiana.

Streitwise concentrates on properties that meet the following criteria:

- Value-oriented investments. This takes into account strategic location, with nearby amenities, established employment, quality construction, and sustainable occupancy.

- Creditworthy tenants. They aim for better established commercial tenants, like IBM, Verizon, and Edward Jones.

- Non-gateway markets. This is accomplished by avoiding the high-priced coastal markets, in favor of more moderately priced markets offering higher dividend returns.

- Modest leverage. To minimize the risk that comes with real estate leverage, the company looks to limit debt levels to no more than 60% of the value of any property held.

The use of these four investment strategies is intended to reduce risk while increasing both dividend income and long-term capital appreciation.

Streitwise Pricing and Fees

Streitwise charges two fees. First, you’ll pay a 3% upfront fee when you make your initial investment. Each year thereafter, you’ll pay a 2% annual management fee, which will be deducted from your dividend income (the dividends in the screenshot above are net of this annual fee).

If dividends for the year will be 12%, your net return will be 10% after the 2% annual management fee has been deducted.

How to Sign Up with Streitwise

To open an account with Streitwise you must either have a U.S.-based bank account or be able to complete a wire payment. The platform is available to both U.S. citizens and foreign nationals. Anyone outside of the U.S. can invest if they can complete a wire payment.

To open an account, you must provide the following information:

- Your full name

- Your email address

- Confirm your investor status (individual, corporation, LLC, etc.)

- Indicate individual or joint investment

- The amount of your investment

- Your physical address

- Your telephone number

- Social Security number

- Date of birth

You’ll then be asked to indicate if you are either an accredited investor or a nonaccredited investor and you’ll need to provide both your income and your net worth.

Read More: Best Investments for Non-Accredited Investors

To begin investing, you’ll need to complete an ACH authorization form connecting your bank account with the Streitwise investment platform. That will require providing the name on your account, the type of account, and both the routing number and personal account number connected to it.

The actual purchase of Streitwise shares will be done through the Computershare Investor Center. There, you’ll also be able to log in to track your portfolio and get account statements. It’s there you can also enroll in the Streitwise DRIP program, if you choose to do so.

Streitwise Security

Investment documents are handled electronically through stock transfer agent services provided by FundAmerica and Computershare. Both companies provide secure, SEC compliant platforms.

Streitwise Mobile Accessibility

Streitwise is now available for iOS devices.

Streitwise Customer Support

Customer support is available by phone, live chat and email, Monday through Friday from 9:00 am to 5:00 pm Pacific time.

Streitwise Pros and Cons

Invest with $5,000 — At around $10 per share, a $5,000 investment will get you 500 shares.

Open to unaccredited investors — Accredited investor status not required.

Managers invest in the REIT — Investment managers have their own funds invested in the REIT.

Above average dividends — The current dividend yield is well above what’s commonly being paid on both stocks and fixed income investments, like certificates of deposit and U.S. Treasury securities.

Earn annual dividends and capital appreciation — You can earn both annual dividend income and, eventually, capital appreciation when properties are sold.

Limited liquidity — Your investment cannot be redeemed during the first year, after which 90% will be redeemable, up to 100% after five years.

Non-public REIT — As a non-public REIT your investment cannot be sold on popular exchanges.

3% fee upfront — Though the 3% upfront fee is lower than what you will pay with most real estate crowdfunding platforms, it will reduce your upfront investment.

Only two properties — The REIT currently holds just two properties in the trust, limiting diversification.

Need special account — Retirement accounts must be special self-directed accounts set up specifically for investments in commercial real estate. These are not the same as regular self-directed retirement accounts that are simply designed to allow you to choose and manage your own investments.

Streitwise Alternatives

Streitwise could be compared to other REITs but since Streitwise is not publicly traded, it’s much more comparable to real estate crowdfunding platforms than to other REITs. Examples include:

RealtyMogul is a popular real estate crowdfunding platform that’s available to both accredited and non-accredited investors. The minimum initial investment ranges between $1,000 and $5,000, and is invested in either real estate loans or equity investments. RealtyMogul similarly invests in commercial real estate, with total annual fees of around 1.5% to 1.6%.

EquityMultiple is a real estate crowdfunding platform that claims average returns in excess of 90% per year. Like Streitwise it invests in commercial real estate. The minimum investment ranges between $1,000 and $10,000, and you are required to be an accredited investor. But the fees are lower than Streitwise, with no upfront fee and an annual fee of 0.5% for management. There is also a 10% fee charged for all profits from the sale of properties in the fund.

Related: Crowdstreet vs Fundrise vs Streitwise

Who is Streitwise For?

Streitwise is an excellent choice for investors large and small who are looking to diversify into high-quality commercial real estate. Since they limit your investment to no more than 10% of your net worth, it can be an excellent choice as an alternative investment in a well-diversified portfolio.

Since you can invest with $5,000, it’s available even to small investors. And it’s the perfect choice for investors who are not only looking to diversify into commercial real estate, but also to get the benefit of both regular dividends and the potential for capital appreciation.

With dividend rates of 10% annually, Streitwise can increase the income portion of your portfolio. In that way, it acts partially as an income generating bond equivalent, but also as an equity component due to capital appreciation.

The combination of the platform managers having their own money invested in the trust, as well as their four criteria for minimizing risk and increasing cash flow and long-term capital appreciation, this is one of the more safely managed commercial real estate options available.

One limitation to be aware of however is limited liquidity, which is something that applies to many commercial real estate investments. Once you make your initial investment, you will be unable to recover it within the first year. After the first year, you’ll be able to redeem up to 90%, and eventually up to 100% after five years of ownership.

Simply put, Streitwise is not a platform for you if you may have a short-term need for the funds within the first year. You should also be aware that commercial real estate carries certain unique risks. For example, a major tenant can pull out of an office building, lowering both the rent income and the market value of the project. This is why your investment should be limited to no more than 10%.

Bottom Line

If you’ve been looking to diversify some of your portfolio into an alternative investment, like commercial real estate, Streitwise is definitely worth a close look. Not only will it offer an opportunity for long-term, tax-favored capital appreciation, but it will also provide steady, high dividend income to supplement the interest income from lower-paying bonds and other fixed-income investments.