To help you find the right real estate crowdfunding platform for your portfolio, we’ve analyzed more than a dozen providers in the space and narrowed our list down to those that provide the best combination of high returns, low fees, professional property investment vetting and a reasonable minimum initial investment.

Based on that criteria, Streitwise is our top pick. Not only do they have a very low minimum initial investment, and a consistently high annual return, but they also offer the ability to exit your investment position and retain most of your original investment.

Real estate crowdfunding has been growing in popularity in recent years, as investors have sought diversification away from a portfolio comprised entirely of stocks. Adding real estate to your equity allocation is a way of adding more stable returns to your portfolio.

Much like high-dividend-paying stocks, real estate crowdfunding investments offer an opportunity to earn both annual dividends and long-term capital appreciation when the underlying properties are sold. And since commercial real estate is not as dependent on the financial markets as stocks, they can represent a diversification that will provide consistent returns even when the stock market is falling.

In fact, according to the National Association of Real Estate Investment Trusts (NAREIT), equity REITs (which are invested in commercial real estate) have outperformed the S&P 500 over the past 30 years, by 10.65% to 9.72%. Especially during times of turbulence in the financial markets, REITs are an excellent hedge against an all-stock equity portfolio.

Our Top Real Estate Crowdfunding Pick: Streitwise

Streitwise tops our list on a number of fronts. The minimum investment is $5,000 and you don’t need to be an accredited investor to participate on the platform. (That will only be required if you invest more than 10% of either your net worth or your income for the past two years on the platform.)

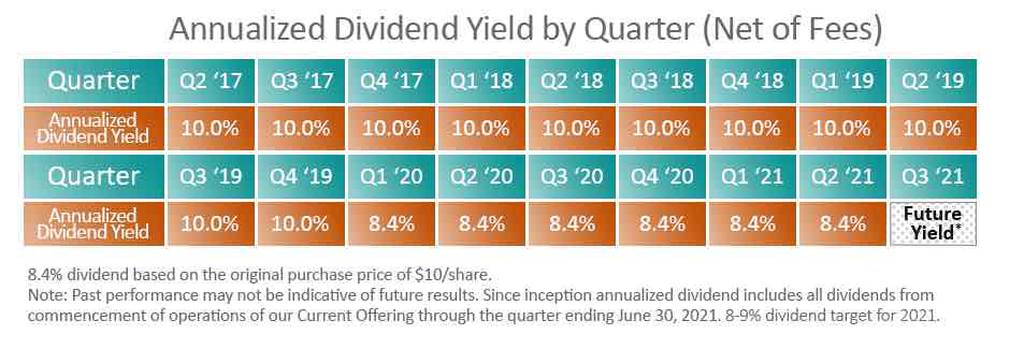

But we also like the consistent returns ranging between 8% and 10% per year. And they not only offer a combination of annual income distributions, but also capital appreciation when the underlying properties are sold.

But Streitwise has one advantage offered by no other real estate crowdfunding platform and that is some measure of liquidity.

Real estate crowdfunding platforms are notorious for a lack of liquidity. Because the investments are either in individual properties or non-publicly traded funds, you’ll generally be required to remain invested for several years until the underlying properties are sold. But with Streitwise you’ll have the opportunity to liquidate your investment for up to 90% of its value after holding your position for just one year. And if you are invested for at least five years, you can get your entire investment back.

Streitwise may not offer the most spectacular investment returns, but it has the most flexible investment parameters of any real estate crowdfunding platform. That will be especially important to new and small investors who may be getting into the sector for the first time.

Runner-up: Crowdstreet

We like Crowdstreet because of its very generous investment returns. They project annual returns ranging from 10% to as high as 22%. What’s more, you can choose from multiple investment properties. We also like that they put investments through a very stringent vetting process to make sure they represent only the best investments available to participating investors.

What kept Crowdstreet from the top spot was the combination of the accredited investor requirement and the uncertainty of the fees on each investment. Since each investment is customized, there is no single fee structure. Instead, there is a collection of several fees that can apply to any property investment. That makes the final level of fees uncertain at the time of investment.

Our Selection Methodology

We used the following criteria in determining the real estate crowdfunding platforms on this list:

Accredited investor requirement To meet accredited investor status you must have a minimum net worth of $1 million--excluding equity in your home--or have earned at least $200,000 (or $300,000 if you’re married) in each of the past two years. We favored platforms that don’t have this requirement or that offer investments to both accredited and non-accredited investors.

Minimum required investment Those minimums range from a low of $500 to a high of $50,000. We naturally gave greater weight to the platforms with the lower minimums.

Average annual returns This is what investing is all about and we looked for a consistent pattern of higher earnings over the last several years. Those earnings can be a combination of regular income distributions or projected capital appreciation.

Types of investments offered Platforms can offer investments in non-publicly traded real estate investment trusts, or even in specific individual properties. We gave added weight to those that offer both. We also favored platforms that offer a variety of different commercial real estate investments, such as apartment complexes, office buildings, retail space, and other property types.

Investment term Commercial real estate is a long-term investment commitment, generally requiring several years. We favored companies that have shorter investment maturities or the ability to liquidate your investment early.

The Top Crowdfunding Sites for Real Estate

Streitwise

Streitwise is available for both accredited and unaccredited investors. You can begin investing with a minimum of $5,000. Streitwise is a bit different from other investments on this list because it’s actually a public, non-traded real estate investment trust, and not a real estate crowdfunding platform. It offers equity-based REITs comprised of commercial properties.

Streitwise REITs are open to all investors, however, you must be an accredited investor if your investment in the platform exceeds 10% of either your net worth or your income for the past two years.

The trusts are designed primarily to generate regular dividend income, though the potential for capital appreciation exists once properties held are sold and the gains are distributed.

Streitwise has an impressive performance on dividend distributions, with the range being between 8% and 10%. The annualized return was 8.4% as of the second quarter of 2021.

One of the big advantages Streitwise offers is liquidity. Typically, when you invest in a real estate crowdfunding platform or non-publicly traded REIT, you’re required to remain invested for several years. But Streitwise has a redemption policy that allows you to liquidate your investment for nearly all the original amount.

The liquidation is based on the following schedule:

- Less than one year: No redemption permitted

- One to two years: 90% of the Net Asset Value (NAV)

- Two to three years: 92.5% of NAV

- Three to four years: 95.0% of NAV

- Four to five years: 97.5% of NAV

- Five years or more: 100% of NAV

Streitwise may be the best choice if you want to invest in commercial real estate. You’ll at least have some options if you’re not sure you can commit to the typical seven-to-ten-year range these investments require.

Visit Streitwise or Read our full Streitwise Review

CrowdStreet

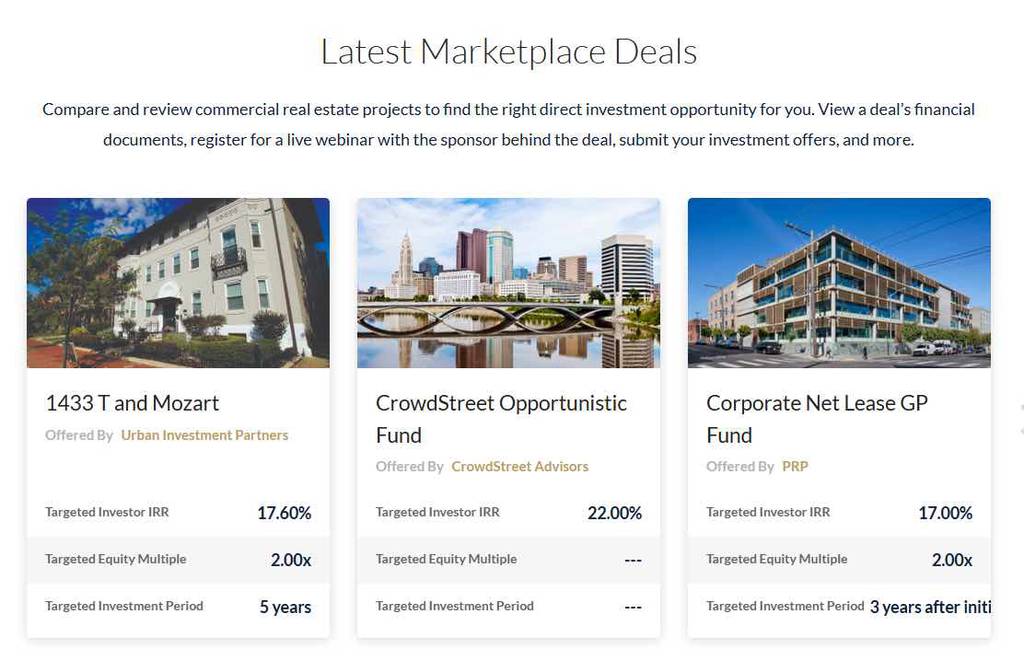

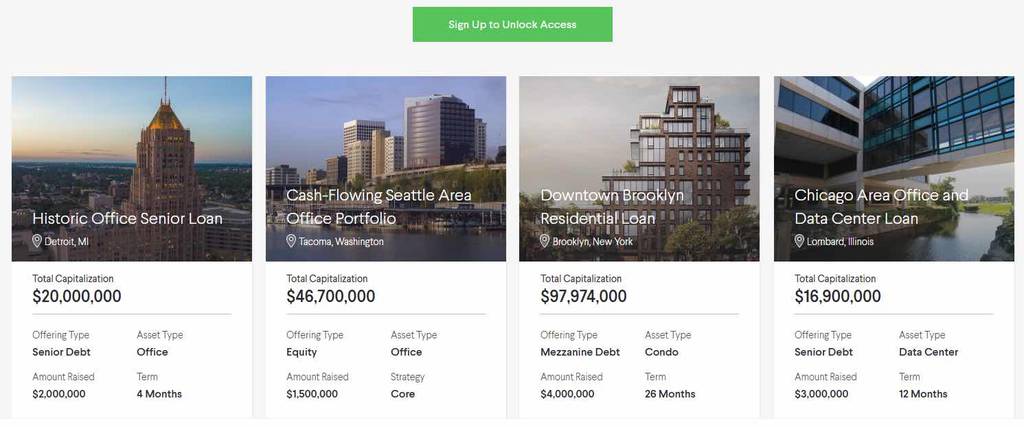

CrowdStreet invests in commercial properties, including office buildings, retail, large apartment complexes and similar properties. They offer returns on investment that are well above what is common for the industry. Published targeted returns can range anywhere from 10% to as much as 22% per year. Investment terms can be in a range of two years to 10 years.

CrowdStreet is a peer-to-peer marketplace, where investors come to invest money in projects being put together by real estate developers. You’ll be able to choose the specific properties you want to invest in.

One of the limitations with CrowdStreet is that you must be an accredited investor to participate. This makes sense, given the fact that the high projected rates of return typically come with a commensurate level of risk.

The properties you will invest in will be fully vetted to ensure the integrity of the project. The company puts each potential deal through a rigorous 26-point review process, accepting less than 3% of the deals reviewed for investment. Each investment is set up as either an individual property purchase or as part of a real estate investment trust.

Crowdstreet targets higher value properties, generally ranging in value from $5 million to $30 million. But to protect their investor’s interests, they typically limit total Crowdstreet participation in any project to no more than 10% to 12% of the project value.

The minimum required investment can be anywhere from $10,000 to $50,000. There are no fees charged by CrowdStreet, but investment sponsors do charge fees that are structured based on each individual property. Those fees can relate to acquisition and disposition of properties (generally up to 2% of the purchase or sale price), property management ranging from 3% to 4% of gross revenues, 1% to 2% for asset management, 5% for construction management, and 3% to 5% for development fees. Common equity investments have an expected annual return of 14% or higher. That will be comprised of both capital appreciation and income distributions, which will occur monthly or quarterly.

Visit CrowdStreet or check out our complete review of CrowdStreet for more information.

RealtyMogul

RealtyMogul requires you to be an accredited investor to participate in certain investments, but not for others.

RealtyMogul offers investments in individual properties. These are pre-vetted investment opportunities, referred to as private placements. They include commercial properties, such as office buildings, industrial and flex space, multi-family complexes, and mixed-use properties. The minimum investment in individual properties ranges between $15,000 and $50,000.

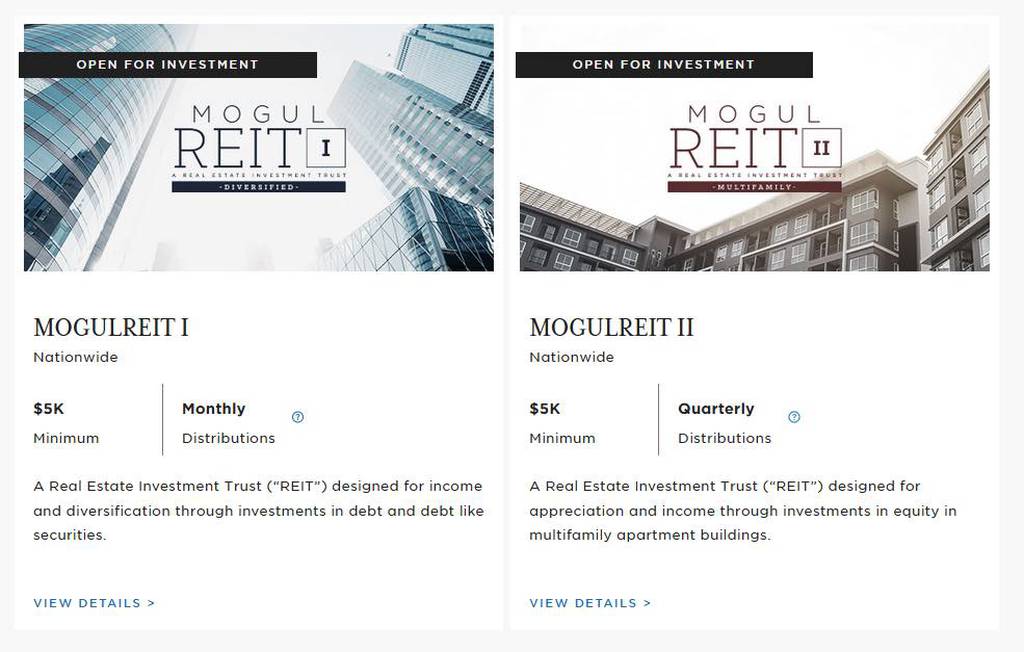

If you don’t meet the requirements for accredited investor status, you’ll be limited to investing in RealtyMoguls REITs, MOGULREIT1 and MOGULREIT2. These are real estate investment trusts that invest in multiple commercial properties.

MOGULREIT1 requires a minimum investment of $5,000 and is invested in various commercial property types. It has an annualized distribution rate of 6% with a monthly distribution frequency. It’s designed primarily to provide stable cash distributions while preserving and increasing the value of your investment over time.

MOGULREIT2 similarly requires a minimum investment of $5,000, but invests in multifamily properties, presumably large apartment complexes. The trust has an annualized distribution rate of 4.5%, with a quarterly distribution frequency. The trust emphasizes long-term capital appreciation while paying an attractive and stable cash distribution.

For MOGULREITs you can expect to pay annual fees of up to 1.6% of your investment. Private placements work on a completely different fee structure and will vary based on the individual investment arrangement.

Visit RealtyMogul or read the full RealtyMogul Review

Fundrise

Fundrise offers two account types, an eREIT (electronic real estate investment trust), and an eFund. In this way, they’re able to make real estate investing available even for small investors.

With the eREIT you can invest in a group of commercial real estate properties. REITs function as something like mutual funds for real estate. The fund holds several properties, and as an owner of the fund, you’ll participate in the earnings from each, without having the burden of participating in management. The eREIT includes commercial properties, like office buildings, shopping centers and large apartment complexes.

The eFund invests in residential real estate, primarily single-family homes. The fund is structured as a partnership rather than a trust.

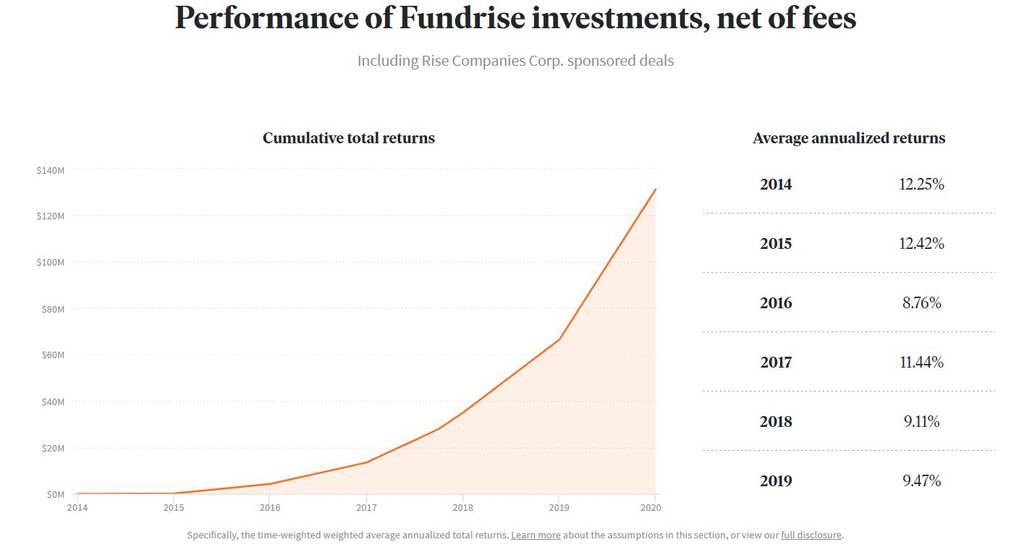

Collectively, both funds hold a total of 219 properties. Recent investment returns look like this:

Fundrise charges two fees, an asset management fee of 0.85%, and an investment advisor fee of 0.15%, for a combination annual fee of 1.00%. The returns listed above are net of those fees. However, depending on your investment, you may also be charged an asset origination or acquisition fee that can be as high as 2%. These are still among the lowest fees in the industry.

One of the big advantages of investing with Fundrise is that it doesn’t require you to be an accredited investor. They offer four different plan levels, each with its own minimum investment amount. That can range from $500 for the Starter plan and $1,000 for the Core plan, to $10,000 for the Advanced plan and $100,000 for the Premium plan. You can invest in both the eREIT and eFund with the Advanced and Premium plans, otherwise, you’re limited to only the eREIT.

Learn More: Fundrise vs. RealtyMogul

The plans give you an opportunity to choose between supplemental income, long-term growth, or balanced investing that includes a mix of the two.

Visit Fundrise or read the full Fundrise Review

This is a testimonial in partnership with Fundrise. We earn a commission from partner links on DoughRoller. All opinions are our own.

EquityMultiple

EquityMultiple is reputed to be the only online real estate investment platform to be developed by an existing real estate company, rather than by techies. The founders brought their real estate knowledge to the platform, along with a history of having closed more than $75 million in real estate transactions before launching the company.

Similar to other platforms on this list, EquityMultiple involves investing in commercial real estate. It does have an accredited investor requirement, so it will not be suitable for new and small investors.

They structure their deals a little bit differently than other platforms. Each investment is held by a unique limited liability company formed specifically for that property. When you invest in the LLC you’ll have direct ownership in the property. Unlike other real estate investment platforms, they don’t offer real estate investment trusts.

EquityMultiple fully vets each property available on the platform, approving only about 5% of the proposed projects. The minimum investment is $10,000, and terms can range from as little as one year to as many as 10.

The company claims average annual returns of more than 9%. The company has a unique fee structure, in which you pay an annual fee of just 0.50% of the amount invested. But when the property is sold, a fee of 10% of the profits will be assessed. In that way, EquityMultiple has a low annual fee, which is recovered only upon the sale of the property.

Visit EquityMultiple or read the full EquityMultiple Review

Origin Investments

Origin Investments offers best-in-class private commercial real estate funds to accredited investors interested in high returns, low fees, and an alternative to the stock market.

Origin Investments is a crowdfunding platform that provides you access to off-market deals at a fraction of the overall cost.

The company focuses the majority of its attention on properties in fast-growing markets, including but not limited to Atlanta, Dallas, Denver, Orlando, and Raleigh.

With access to two unique funds, Origin Investments can cater to a larger pool of investors.

Origin Investments requires a minimum investment of $50,000.

Visit Origin Investments or read the full Origin Investments Review

Best for

There’s no single real estate crowdfunding platform that’s the best for all investors. Instead, it’s better to consider each platform in regard to what it does best. We’ve broken down the five top crowdfunding sites for real estate as best for in each of the following categories:

- Best for liquidity (investment redemption): Streitwise

- Best for high returns: Crowdstreet

- Best for investing in individual properties: RealtyMogul

- Best for low fees: Fundrise

- Best for long-term capital appreciation: EquityMultiple

Factors to Consider when Investing in a Real Estate Crowdfunding

Commercial real estate is an unconventional investment, at least for typical individual investors. Historically, only wealthy individuals and investment funds have participated in commercial property investments.

If you’re going to invest in a real estate crowdfunding platform you should be aware of the following factors:

- Commercial real estate is a long-term investment To realize the full investment potential on any deal, you should expect to remain invested for several years.

- Commercial real estate is not liquid Unlike stocks and other financial assets, they cannot be readily bought and sold on public exchanges. Each deal is unique and will require a long-term commitment.

- The opportunities with the highest reward/risk potential are reserved for accredited investors Investments are limited to accredited investors anytime they involve a high degree of risk. This is because high income/net worth individuals have a greater capacity to absorb potential losses.

- Multiple investment structures Investments can be structured as debt, equity, or preferred equity. Debt investments will pay interest on a regular basis, while equity investments will be mainly about capital appreciation. However, preferred equity involves both regular income and capital appreciation.

- Hands-off investment Real crowdfunding involves investing in deals that are managed by professionals. You won’t be involved in the day-to-day management of individual properties.

- Real estate crowdfunding is not risk-free Despite the potential for high returns, the potential to lose part or all your investment is real. A major tenant can vacate an office building or retail space, causing both a cash flow shortage and a decline in property value. A general decline in commercial real estate will have a depressing effect on nearly all properties.

- No FDIC insurance If an investment goes sour, there’s no federal or industry agency that will compensate you for your losses.

Learn More: Real Estate Crowdfunding: Everything You Need to Know

Final Thoughts on the Best Crowdfunding Sites for Real Estate

Commercial real estate is undoubtedly one of the best diversifications for an equity allocation that’s comprised entirely of stocks. Not only has commercial real estate slightly outperformed the S&P 500 over the past 30 years, but it also has the potential to perform well when stocks are falling. That’s because typical crowdfunding investments are in well-priced, well-located properties with reliable tenants and strong cash flows.

The five real estate crowdfunding sites reviewed in this guide represent an excellent way to add a commercial real estate allocation to your portfolio.

But at the same time, it’s important to remember that commercial real estate is not a risk-free investment. As such, it should be a portion of a well-balanced portfolio. That portfolio should include stocks, bonds, and other conventional investments, and a commercial real estate position of perhaps between 10% and 20% of your overall portfolio.

Just remember a real estate crowdfunding investment is a long-term venture. Make the investment only after careful consideration of your investment objectives, your risk tolerance, and your financial needs.

Learn More: Beginners Guide to Real Estate Investing