Up until the ripe old age of 30, I had never considered a life insurance policy. Married without children or a mortgage, I really didn’t find the need to insure myself… especially if it gave my wife extra incentive to get rid of me (she’ll tell you, of course, that no extra incentive is needed). Now, however, with both a mortgage and two very young children, I very much understand the importance of taking care of my family if I’m no longer around.

Today, with the help of the Haven Life Insurance Agency, I purchased a 10-year term life insurance policy. This review is based on my experience buying this policy.

Haven Life is a relatively new life insurance agency, circa May 2015. It offers term life insurance policies for as long as 30 years and coverage for as much as $3 million. (Applicants aged 60-64 can apply for $1 million in coverage) Haven Life also offers policies nationwide. Unlike other websites that are simply comparison engines, which then direct you to a proper policy, you are actually purchasing your insurance policy through Haven Life’s website. The insurance is issued by C.M. Life, a subsidiary of MassMutual, a leading life insurance company with over 160+ years. Haven Life offers a quick and painless term life insurance purchasing experience.

Related: Ethos Life Insurance Review – Quick and Easy Way to Find Affordable Term Life Insurance

My Quote

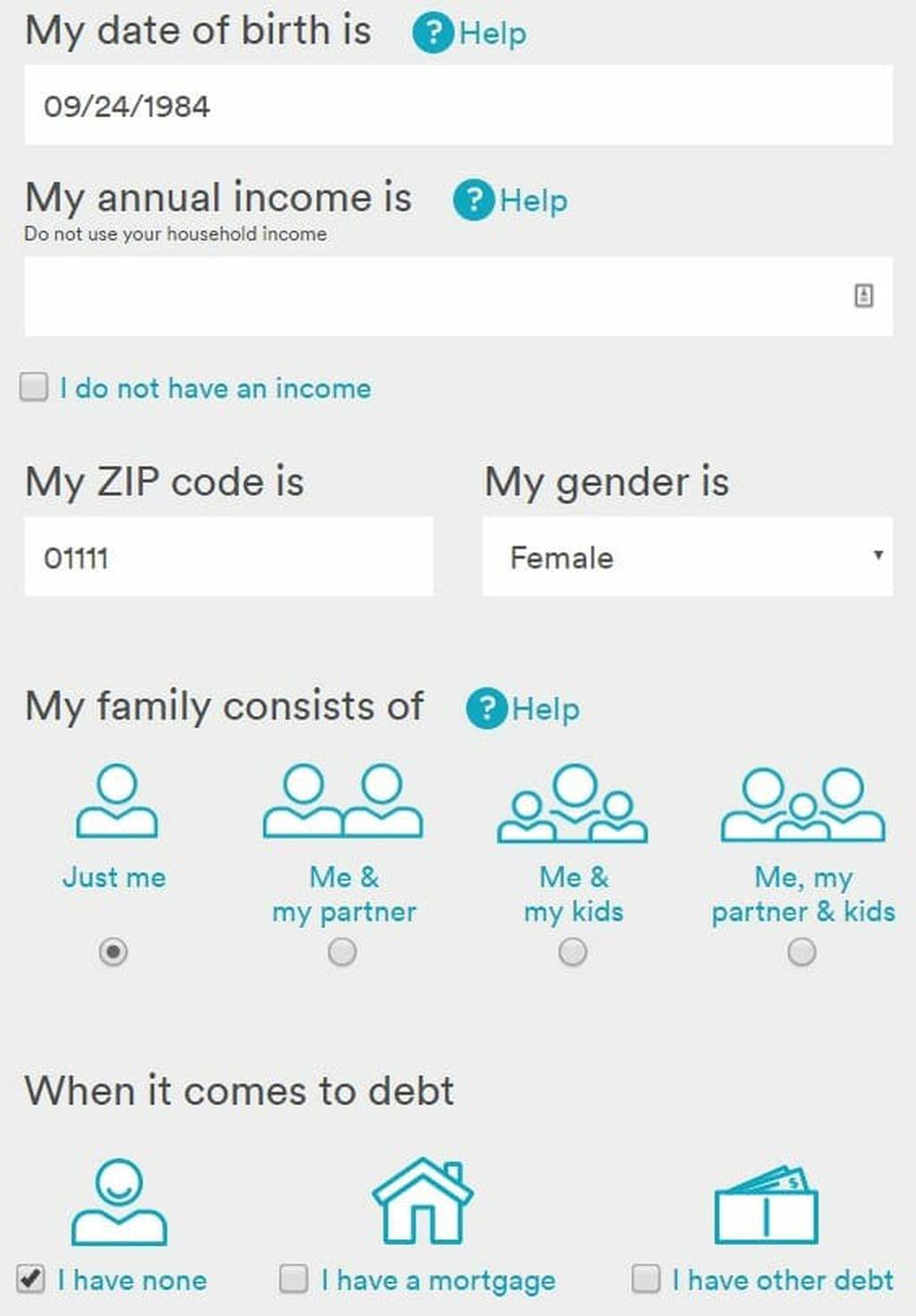

Getting started in the life insurance process was a snap. I visited the Haven Life website and answered a handful of easy questions to get a quote in a minute’s time. From there, I got an idea of how much the policy was going to cost.

Learn More: How Much Life Insurance Do You Need?

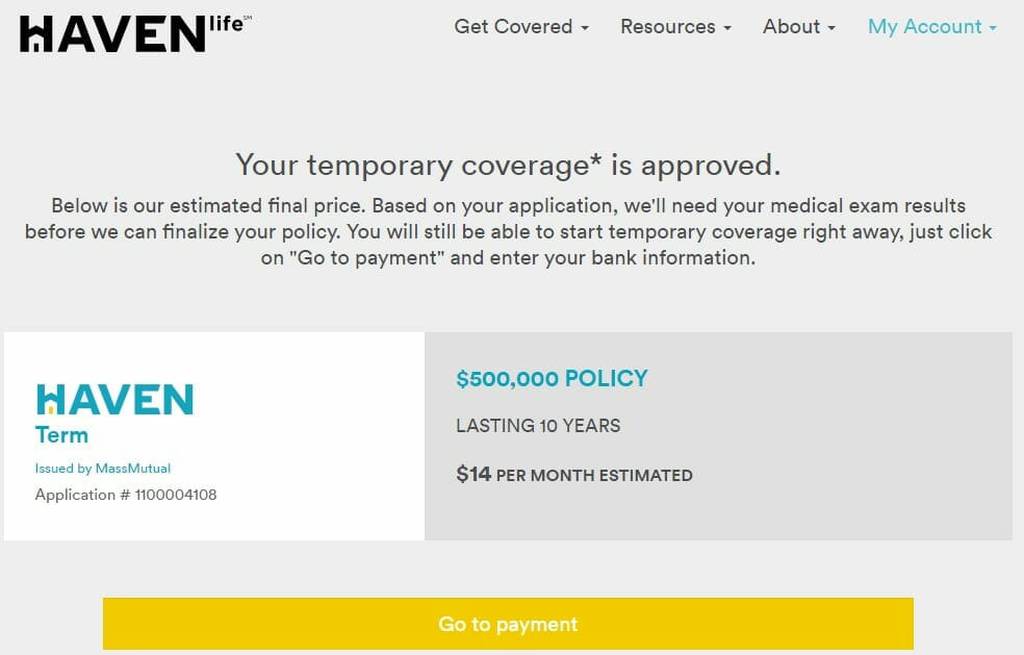

I was quoted $14 a month for the $500,000, 10-year term policy I selected. Immediately following my quote, I was asked to complete a full application. From start to finish, the application took roughly 15 minutes. Once that was complete, I was asked to sign it, and provide my banking information.

Although I had to meet with my doctor to complete a physical to finalize my policy, I was given temporary coverage that would protect me until my policy was issued.

After creating an account with Haven Life, I can now log in and see my application status. Right now, I still have temporary coverage; I have until 4/19/2017 to complete my medical coverage. Also inside my account is the ability to cancel my application (if I so desire), review my application, or browse some general FAQs.

Key Haven Life Details

- When you sign up, apply, and are approved, you will receive a total of five emails from them. They come in the form of (1) Complete your Application, (2) Verify your Email Address, (3) Sign your Application, (4) Completed Signature of the Application, (5) Received your Signed Application. Today, I received a 6th email about how it’s almost my half birthday, which is still two months away (they’re reaching).

- Even though I’ve visited a hospital once in my lifetime(bounce houses are tough places for 31-year-olds) and consider myself an extremely healthy person, I was required to complete an exam. No biggie, I was due for an annual physical all the same, so it was not a concern.

- Haven Life provides a Life Insurance Calculator that asks you to answer a few personal questions about yourself, your future, and your finances. They use this to provide you with a few different term life insurance recommendations. From there, you can choose to view what the estimated plan costs would be for some of Haven Life’s competitors. I didn’t bother running the calculator, yet found Haven Life to be one of the most affordable options.

Resource: The Complete Guide to Life Insurance

Haven Life Pros and Cons

Medical exam may not be required for some eligible applicants up to age 45

Online application process was a snap

Cost was reasonable

Parent Company, C.M. Life, a subsidiary of MassMutual, is rate A++ by A.M. best

Instant decision on coverage eligibility

A medical exam will be required for many applicants

Financial Stability of C.M. Life, a subsidiary of MassMutual, Haven Life’s Parent Company

It’s important to know the financial strength of the insurance companies you use. A company called A.M. Best rates insurance companies based on their financial strength. It gave MassMutual and its subsidiaries its highest rating of A++ (Superior). Note, that the product will be issued by C.M. Life, a subsidiary of MassMutual in all states with the exception of CA and NY (which will still be issued by MassMutual).

Life insurance can be an odd topic to discuss with your family because the only way to reap its benefits is when somebody you love passes away. Setting the awkwardness aside, one of the most important decisions a family can make is ensuring that they’re taken care of should the worst happen.

This review of Haven Life shows just how affordable a 10-year term life insurance policy can be. If you need more than $500,000 in coverage, the increased costs are very reasonable.