Do You Need Life Insurance?

If you died today, would someone suffer financially because of it?

For many of us, the answer is yes. At the very least, someone would have to pay for your funeral or memorial.

The National Funeral Directors Association says that nationally, the average cost for a funeral service in 2015 was about $7,200. The costs were more than $8,500 if mourners needed to buy a vault, which most cemeteries require.

Even if you leave no other end-of-life costs behind, someone has to pay for at least these costs. And none of us wants to leave those costs to mourning spouses, family members, or friends.

And what about other financial obligations you could leave behind? This might include debt, unpaid taxes, or caring for children or your spouse. If you don’t have enough money in the bank to cover these expenses plus end-of-life expenses, you need life insurance.

We’ll talk more about how much coverage you need in a minute. But for now, just know that you need it if anyone might suffer financially when you die. Here’s your complete guide to life insurance.

Some People Don’t Need Life Insurance

With that said, some people actually don’t need life insurance. It still comes back to this basic question: Will anyone suffer financially when you die? If not, you may not need it.

For instance, what if you’re single and have no children? You don’t carry any debt, and you have plenty of money in savings. In this case, you shouldn’t need life insurance.

If you’re single, have no children, a few debts, and enough savings to cover end-of-life costs, then you shouldn’t need life insurance. It’s similar if you’re retired with self-supporting grown children. Don’t pay for it if you have enough to cover any outstanding debt and end-of-life costs.

However, even if you don’t need life insurance right now, buying it early can make sense. Policies are much cheaper when you’re young and healthy. So if you’re single but might need the coverage in the future, purchasing insurance now can make sense. You can always add to your policy later. But, for now, you can lock in a very low premium for the coverage you may need for the next few decades.

In general, you don’t need life insurance if no one would suffer financially from your untimely demise.

Related:

- Do You Need a Million Dollar Life Insurance Policy?

- When Should Millennials Take Out a Life Insurance Policy?

- Best Life Insurance for Seniors: Our Top 7 Options

Types of Life Insurance

We’re still going to table the talk about how much life insurance you need for now. First, let’s look at the different types of life insurance. Which type you choose can actually inform how much coverage you opt for, after all.

All types of life insurance are one of its most confusing aspects. There are two main categories: term and permanent. But they’re further divided into subcategories.

First, let’s look at a basic breakdown of the two main life insurance categories, and then we’ll check out the pros and cons of each option.

Term Life Insurance

Term life insurance provides a set amount of coverage for a fixed term and usually comes with fixed monthly or annual payments.

For example, Joe could buy a $100,000, 20-year term life insurance policy for $30 a month (a completely fictional premium payment, by the way). So Joe would have that amount of coverage for 20 years, so long as he kept paying the premium.

Term life insurance is only a death benefit. (Though some policies have caveats, listed below.) If you die during the stated term with paid-up premiums, your beneficiaries get the face value of the death benefit. If you don’t die during the term, the insurance company keeps your premiums, and you get nada.

It may seem silly to pay monthly for insurance you may never use. But this is why term life insurance is so affordable. And the less likely you are to die during a term, the lower your premiums will be. So if you’re young and healthy, you could pay very little each month for a decent death benefit amount.

One potential problem with term insurance is that you have to prove your insurability each time your term runs out. You could get a great rate today. But when your term is up in 10 years, you might pay much more if you’ve developed health issues in the meantime. This is why choosing the correct term from the get-go is important. We’ll talk more about that in a bit.

Types of Term Life Insurance

Though term life insurance is simpler than whole life insurance, it still has many variations. The main types of term life insurance include:

Level Term Life Insurance

With this type of life insurance, the premium is guaranteed to remain level for the entire insurance term. So if you start off paying $20 a month, you’ll continue paying $20 a month until the end of the life insurance term.

Most level term life insurance policies have a renewable option, too. This will let you renew your policy for a maximum guaranteed rate if you need more coverage at the end of your term. As long as you meet insurability requirements, you could extend your policy without paying through the nose.

Return of Premium Term Insurance

As you might guess, this type of insurance gives you the option to get your premiums back, minus fees and expenses, if you outlive your policy. These policies tend to come with much higher premiums. But they can be a way to regain some money if you don’t end up using your death benefit.

Annual Renewable Term

This is a single-year term life insurance policy, which you must renew at the end of each year. Since your likelihood of dying in the next year are slim, you might save some money on premiums with an annual renewable term.

However, you are taking a risk by assuming that you’ll be insurable at the end of the one-year term. You could be up the proverbial creek if you contract an illness or become uninsurable.

Decreasing Term Insurance

This type of policy lets your premium remain the same throughout the term, but decreases the death benefit annually. Why might you choose this option? It’s best if you’re insuring something specific. For instance, say you’re purchasing life insurance to cover your mortgage. You can set up the death benefit to decrease as your mortgage amortizes. Then, you can pay less for the coverage you need.

Decreasing term premiums tend to be lower than level term premiums because the older you get, the less the insurance company would need to pay out upon your death.

Increasing Term Insurance

On the flip side, you can get a policy set to increase annually. With these policies, the premium often increases each year, too. But you don’t have to re-qualify medically to access the increased death benefit.

This can be a helpful option if you purchase life insurance when you’re just starting out, financially or career-wise. Then as your pay increases, your insurance coverage and premiums increase. But you don’t have to go through the hassle of applying for a new or larger policy to get the increase.

Convertible Term Insurance

Many term insurance policies (including the types listed above) come with the option to convert the policy to a whole life insurance policy within a specific number of years, sometimes without proving that you’re still insurable.

If, for instance, you have a 10-year renewable term insurance policy but end up with a medical issue that keeps you from renewing it, you could convert the policy to some type of whole life insurance policy within a certain time frame. This keeps you insured and doesn’t require you to prove a clean bill of health to keep that life insurance.

Did You Know: Even Singles with No Children May Need Life Insurance

Comparing Term Life Insurance

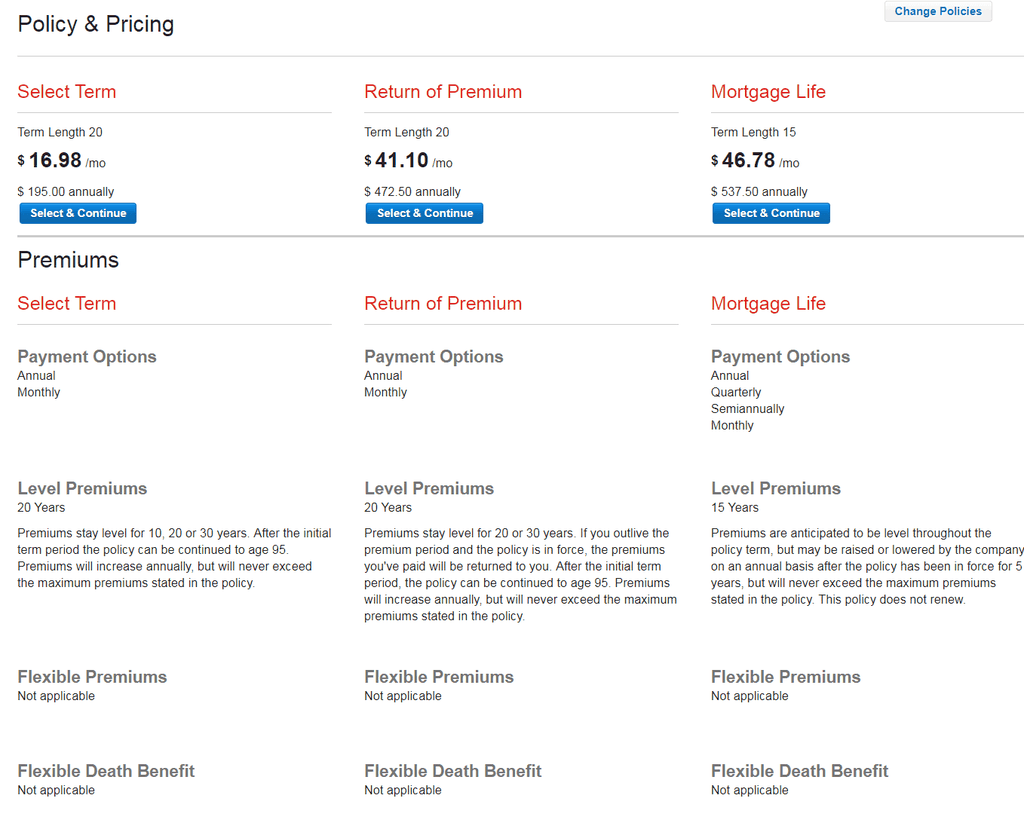

The following chart from State Farm compares three types of term life insurance. Premium amounts are based on a healthy 25-year-old female in Illinois, so your premiums would vary. However, this chart breaks down the differences in types of term life insurance and also shows the difference in premium amounts.

Permanent Life Insurance

Unlike term life insurance, permanent life insurance isn’t just a death benefit. It’s also a sort of savings or investing vehicle. Because of this, permanent life insurance is both more expensive and more complicated.

Permanent insurance comes with higher payouts for insurance companies and brokers. So insurance brokers often pressure consumers to buy this type of insurance. However, most third-party financial advisers often prefer term life insurance over permanent.

This is because permanent life insurance has much more expensive premiums. Part of the premium pays for the death benefit, and the rest goes into an investment account. This can seem tempting. After all, it’s a way to invest money, right? But you can often get much better returns by investing that money yourself. Here’s an article about the pros and cons of whole life insurance for you to learn more.

Also, the higher cost of permanent life insurance means that people are more likely to stop making payments during tough financial times. The policy then lapses. And if you need to renew or get a new policy later, you could face sky-high premiums.

Still, there are times when permanent life insurance is a good bet. For example, most parents need life insurance only until their children are old enough to support themselves, making term insurance a good bet. But what if your child will never be fully self-supporting? In this case, a permanent life insurance policy could be a good idea. You’ll be able to provide for your child after your death, even if you become uninsurable.

And again we’ll come back to estate planning. Some estate planners will recommend a hefty permanent life insurance policy to protect your estate from taxes. Talk with your estate planning professional about whether or not this is a good approach for your needs.

Related: Haven Life Review

Types of Permanent Life Insurance

As with term insurance, permanent life insurance comes in several flavors. Because this is a complex product, be sure you understand what you’re getting into before choosing your insurance policy.

Whole Life

This is the most basic type of permanent life insurance. In fact, you might often see term compared with whole life insurance. But remember that whole life insurance is actually a subcategory of permanent life insurance.

This option comes with a death benefit and a savings component, which is called the cash value.

With a whole life policy, part of your premium payment goes to ensure that you have a death benefit, as with term insurance. The rest goes into a savings account. The insurance company pays dividends on this account. The dividends typically have a minimum guaranteed amount per year. The investments and dividends make up your policy’s cash value.

With most whole life policies, you can withdraw a limited amount of money from the policy’s cash value. You could also choose to surrender the policy. This gives you the cash value, minus (often hefty) surrender fees, rather than leaving your death benefit to the beneficiaries of your policy.

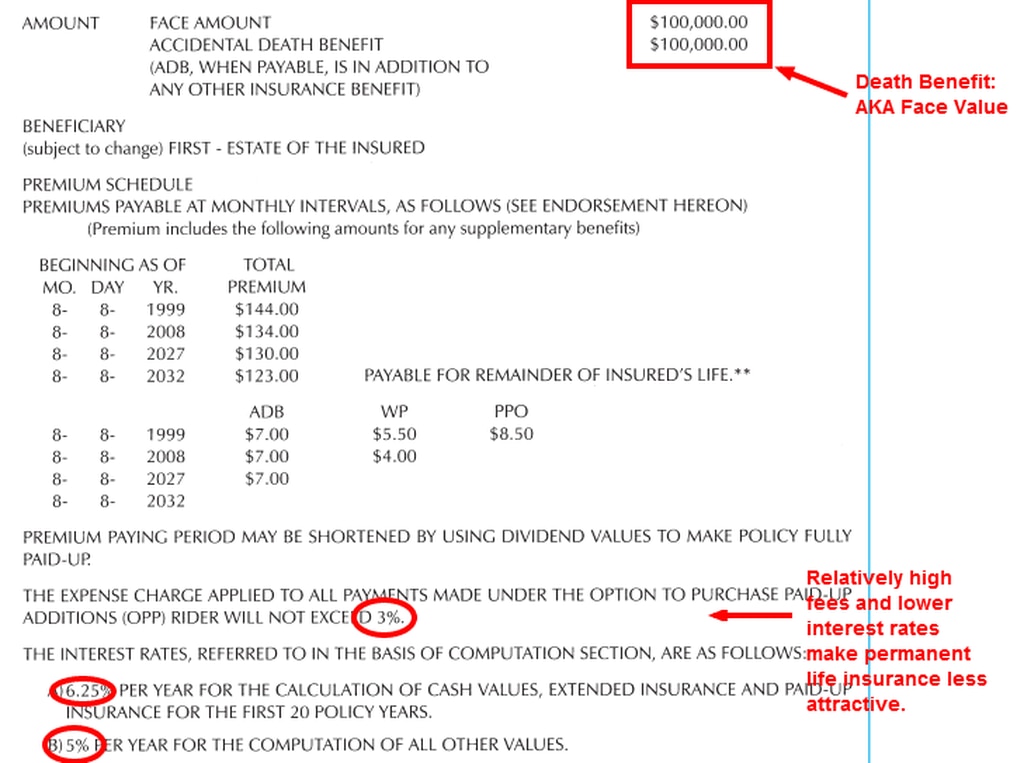

The following images give you an example of what the paperwork for a whole life insurance policy might look like. Note that the premiums are high compared with term life insurance premiums, even though this policy has a relatively low $100,000 death benefit.

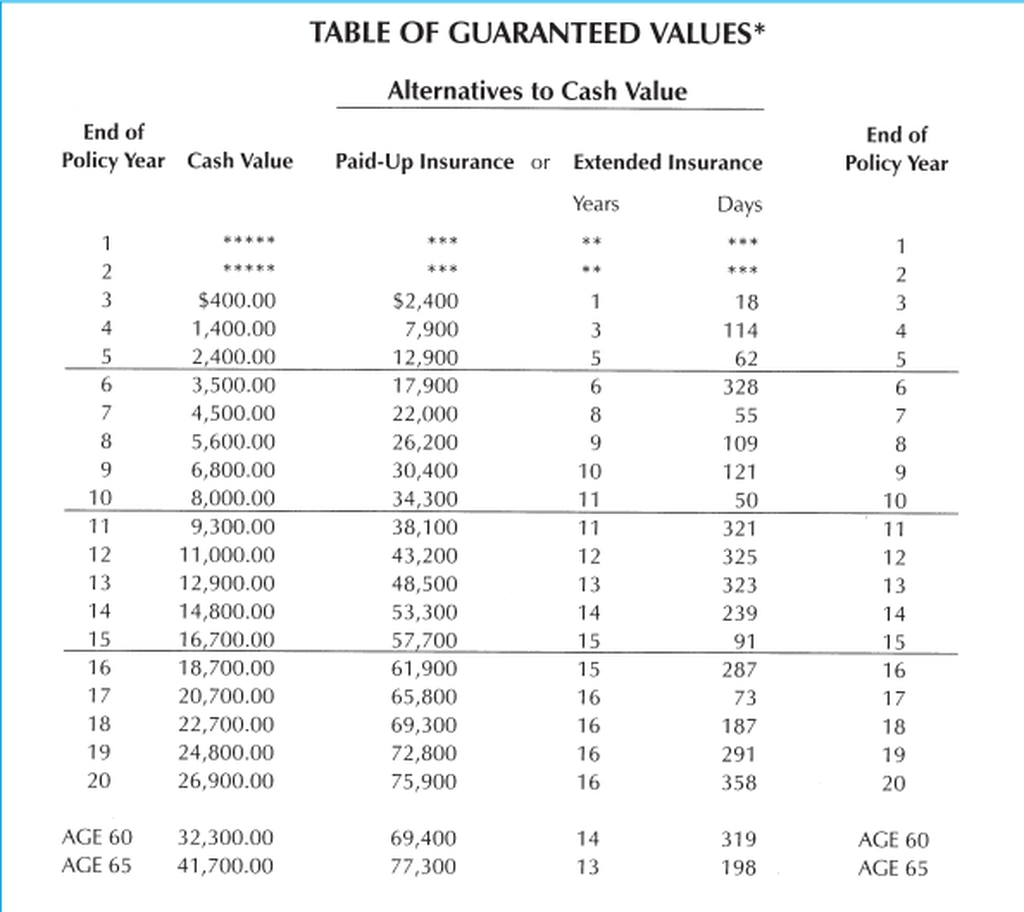

The second image shows you what the cash value of the policy would be, depending on how long you’ve paid into it. Again, these are only samples and don’t have much bearing on what you’d pay for a similar whole life policy.

Universal Life Insurance

Universal insurance is a little more complicated than whole life. And it has a more aggressive investment component. Often, the cash value for this type of insurance policy is tied to an interest rate that adjusts each year.

Universal life insurance is a little bit riskier than whole life because it doesn’t guarantee a certain cash value. Because of the risk, universal life insurance is typically cheaper than whole life insurance.

One potential benefit of universal life is that the premium is somewhat flexible. Pay more, and more goes into the investment account. Pay less, and less goes into the investment account. Also, you can use the money in your savings account to pay your premiums, if necessary. This makes it easier to maintain the policy when finances get tight.

If you are interested in whole life insurance, check out our guide to the best whole life insurance.

Variable Life Insurance

Variable life insurance policies are similar to universal policies, but they offer more choices in investments. The value of your policy can rise or fall with the value of the underlying investments, which can include equities.

Variable life insurance policies can be a little scary in a down-turning market because you could end up losing serious cash. And many individuals eventually let their premium payments come out of a variable life insurance plan’s cash value. So this can lower your cash value over time. If it gets too low, your policy could lapse. Then you’ll be without cash value or death benefit.

Comparing Whole Life Insurance

The three options above aren’t the only options insurance companies offer. But they’re the main options within the permanent life insurance category. However, different life insurance companies will offer plans with more specific differences and details.

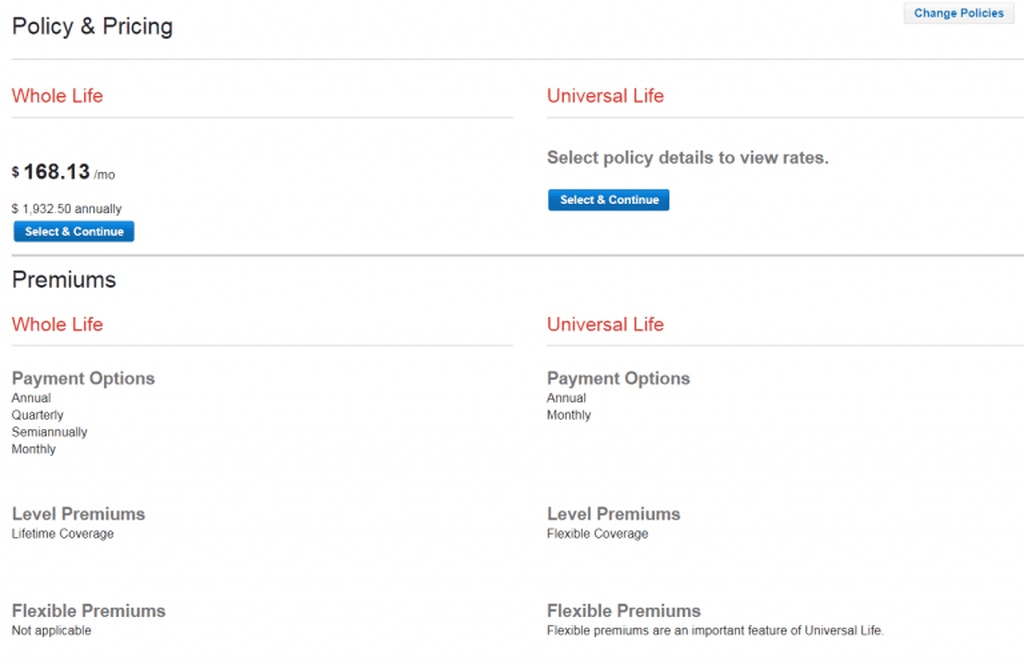

Here’s a comparison of two permanent life insurance policy options from State Farm. Again, these policies are based on a healthy, 25-year-old female from Illinois.

Term vs. Permanent: Which is Best?

For some people, deciding between term and permanent life insurance is simple. For your average consumer, term life insurance is the best bet.

The more-affordable term life insurance premiums free up money for other important financial matters, like saving for emergencies or paying for a child’s education. And most of the time, if you invest extra money on your own, you’ll get better returns than if you let an insurance company invest it on your behalf. And you’ll generally pay much less in investing fees.

Still, there are times when permanent life insurance makes sense. If you know you’ll need to financially provide for a child or spouse for a lifetime. Permanent life insurance can give you more peace of mind. Or, if your estate planner recommends permanent life insurance as a way to rescue your large estate from taxes, it can be a good option.

The bottom line is that, for most of us, life insurance should be just that – insurance. Just like car or home insurance, you hope you’ll never have to use your life insurance. But having it’s important, just in case.

How Much Coverage Do You Need?

One of the biggest pieces of shopping for life insurance is deciding how much coverage you need. You can get as little as a few thousand dollars or as much as millions.

There’s a lot to consider when deciding how much life insurance you need. And how much insurance you need will depend on your life situation. Plus, your life insurance needs will change throughout your life.

The main goal of life insurance is to cover the cost of dying, pay off debts, and replace your income if you have dependents. You’ll probably need to have life insurance worth several times your annual income, especially if you’re the family’s primary earner.

The rule of thumb for life insurance varies dramatically, depending on whom you’re talking to. Some financial planners advise getting five to seven times your income in life insurance coverage. Others advocate having 10 times your income or more. We have written in more detail about the various rules of thumb concerning how much life insurance to buy.

What factors matter when it comes to your life insurance amount? Here are a few:

- Marital status

- Parental status

- Earned income

- Potential future earned income

- Outstanding debts

- Rate of paying off those debts

- Estimated end-of-life costs

- Additional financial goals

Let’s look at some of the goals you might have for life insurance. Then, we’ll look at specific (fictional) situations from different consumers shopping for life insurance. This can give you a feel for how these factors play off of one another.

Life Insurance Goals

Depending on where you are in your life and who you’re responsible for, you could have any number of goals for your life insurance policy.

If you’re in your early 20s and don’t have a spouse or kids yet, you may just need enough to cover funeral costs. But as you age and become responsible for other people, your life insurance goals are likely to become more complex.

Here are some of the most common goals for life insurance, which would all have a bearing on how large a policy you might want:

- Covering end-of-life and funeral expenses

- Paying off debts, including a mortgage

- Allowing your family to maintain its lifestyle after you’re gone

- Funding your child(ren)’s college education

- Allowing your business to continue operating without you

- Paying off the taxes and transfer expenses on your estate

- Leaving money behind for heirs or charities

Obviously, the more you want to do with your life insurance, the more insurance you’ll need. For instance, if you just need to cover a few debts and your end-of-life expenses, you could get away with a small policy. But if you want to replace your income for 10+ years and fund your child’s college account, you’ll need more insurance.

When you have young children, you may need enough insurance to replace your income for 20 years and to fund college accounts. But as your children age, you’ll need less and less insurance coverage because they’ll grow ever closer to independence.

Let’s run life insurance calculations for a few different situations so you can get a feel for what your life insurance needs might include.

Estimate #1: Julie, a working mom with two kids and a husband

Julie is her family’s primary breadwinner. She’d like to be able to fund her family’s lifestyle until the kids are grown. And she also wants to fund their college accounts, should she pass away early. Here’s what her calculation looks like:

- End-of-life costs: $15,000

- Outstanding debts, including mortgage: $127,000

- College funds for kids: $100,000

- 10X annual salary: $800,000

Total Needs: $1,042,000

That sounds like a big number, but with Julie’s salary, she may find the premium fairly affordable. If not, Julie might consider lowering the salary calculation, especially if her husband would work after her death. She could also consider a decreasing term policy. This would let her lower her coverage as she paid off outstanding debts and her kids aged. This type of coverage could net her a lower premium throughout her term.

Example #2: Matt, a single dad with two older kids

Matt recently started his own business. He needs to shop for term life insurance because he no longer has it provided through his employer. Long ago, Matt designated a good family friend to be his children’s guardian if something should happen to him. But he wants to be sure his policy would cover his children’s needs and future college education if he passed away.

Here’s what his calculation looks like:

- End-of-life costs: $10,000

- Outstanding debts: $5,000

- College funds: $150,000

- 10X annual salary: $500,000

Total: $665,000

Matt is in excellent health and finds that he qualifies for really low-cost term life insurance. So he actually opts for a $700,000 policy, just for some additional padding.

Example #3: Jackie, a married woman with no children

Jackie and her husband, Ben, recently decided to get life insurance, even though they don’t have children. Their life insurance goal is to pay off their debts and to replace income for a couple of years to give the surviving spouse time to grieve.

We didn’t count Ben’s income in this life insurance calculation because the point is to replace Jackie’s income for a limited period to give Ben some breathing room in case she died. Here’s what her calculation looks like:

- End-of-life expenses: $12,000

- Outstanding debts: $65,000

- 2X annual salary: $100,000

Total needed: $178,000

Jackie and Ben are planning to have kids in a few years. So they choose a policy that will increase their coverage by ten percent a year, up to a cap of $250,000. They’ll probably need more if they have multiple children. But Jackie decides that she’ll just add an additional policy when the time comes. For now, she pays a low monthly premium just to protect her spouse.

Example #5: Alicia, a stay-at-home mom to three kids

Alicia’s husband makes an excellent income and has a large life insurance policy of his own. But the couple recently decided to get life insurance on Alicia because she does so much for her family. As a stay-at-home mom, she provides cleaning, child care, meal preparation, and a host of other essentials that her husband would have to pay for if she died.

The goal isn’t to replace Alicia’s nonexistent income. Instead, she and her husband want to be sure that he’d have enough money to pay for the services Alicia provides for the family while using his income to maintain their lifestyle.

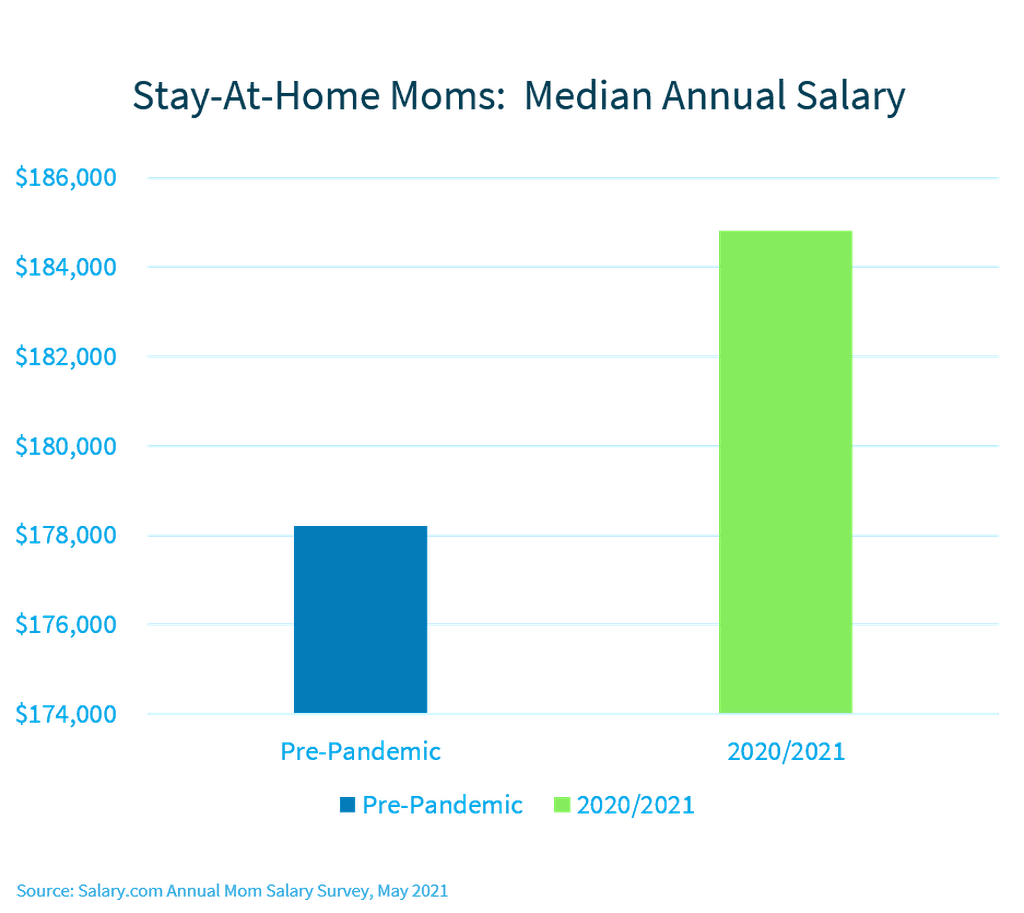

This infographic from Salary.com’s 2020/2021 Mom Salary Survey shows how much Alicia’s services would be equivalent to in terms of a median annual salary (based on a national average). We’ve used 75% of this average figure in Alicia’s life insurance calculation. If she wanted a closer estimation of how much it would cost her family to replace her, she could price out various services in her actual hometown.

The assumption here is that Alicia’s husband would outsource most things that she does for her family. Here’s the life insurance estimate they came up with:

- End-of-life expenses: $10,000

- Replacing essential services (10 years): $1,095,000

Of course, this figure could be wildly variable. But this much insurance would allow Alicia’s husband to take some flexible time at work and to outsource many of the tasks she does around the home. The bottom line here is that most stay-at-home parents need life insurance, too!

Note: Something is Better than Nothing

The goal of the above examples is to show you what life insurance estimates look like based on various scenarios. It’s surprising how much money you’d need to replace your income for even a decade.

The point here is that something is better than nothing. If you can’t afford the premiums on a hefty life insurance policy, opt for a smaller policy rather than none at all. You’ll be able to cover some of your family’s expenses if something should happen to you. And you won’t have to worry about your policy lapsing because you can’t cover the high payments. You can always increase your coverage or layer on an additional policy later.

Related:

Process of Getting Life Insurance

Shopping for and getting life insurance isn’t difficult. You can shop around online to get an idea of premium options, or you can call insurance agents or brokers to do some of the shopping for you.

The Internet is flush with insurance shopping options. They can help you compare apples to apples and get life insurance quotes. However, if you give these sites your telephone number and/or email address, expect to be contacted by salespeople for life insurance companies for months.

When you get a life insurance quote, remember that it will be based on your estimated health class. The higher your health class, the lower your premiums. A higher health class means you’re less likely to die during your insurance term. So this makes you less risky to insurers and, thus, cheaper to insure.

Health Class Qualifiers

If you’re generally very healthy, not a smoker, have no previous or underlying conditions, and maintain a healthy body mass index, you may qualify for the highest health class. But if you have any health problems, have a family history of cancer, have high blood pressure or high cholesterol, or have a high BMI, you’ll be bumped to a lower health class.

It’s possible to estimate your health class when you sign up for insurance quotes. But you should know that most life insurance companies will verify this. When my husband and I bought our life insurance policies five years ago, we had to meet with a home health nurse to be weighed and to have your blood pressure taken. The older you are and/or the larger the insurance policy for which you’re applying, the more tests you may need to undergo to verify your health class.

One thing to note as you shop around for insurance: different companies have different health class criteria. One company might knock you into a lower health class for slightly high cholesterol, even if you’re otherwise healthy. And a second company might have tighter blood pressure or family history restrictions.

It’s all how individual companies assess risk. If you know that you have one or two health issues that might bump you to a lower health class, consider working with an independent insurance agent. They’ll often be familiar with the health class rules for different companies. A good agent may be able to direct you to a company that will give you the best premium considering your health status.

5 Tips To Save on Life Insurance Premiums

As you’re shopping around for life insurance, there are things you can do to reduce your life insurance premiums. Here are five:

1. Apply Earlier

Age is one of the largest determining factors for premiums. The younger you are when you apply, the less you’ll pay for life insurance. So if you’re on the fence about applying now or later, go ahead and apply now. You can always add a second policy later or increase your coverage if you need more coverage as you age.

2. Opt for a Shorter Term

The longer your life insurance term, the more expensive your policy will be. Remember, level term life insurance looks at how old you are now and how old you’ll be when the policy expires. So a longer policy means higher premium payments. If you know your kids will be out of the house in 10 years, don’t get a 20-year policy.

3. Get Less Insurance

Depending on your situation, you may not need to replace all your income–or even half–for a decade or more. You could provide for your family’s needs with less life insurance. If you’re unable to pay a high life insurance premium, opt for a lower face value. Your family will still have some protection, but you won’t have to pay so much each month or year. Again, it’s better to go for a lower premium that you can actually afford each month than it is to let your policy lapse.

4. Improve Your Health Rating

The cost difference between health classes can be as much as 50 percent. That’s a lot of money. If you don’t need insurance coverage right now, work on getting healthier before you apply. Lowering your cholesterol and blood pressure, and losing weight if your BMI is too high can help reduce your premiums by quite a bit.

5. Shop Around

As with other insurance products, life insurance premiums can vary dramatically from one insurer to the next. So be sure you shop around for rates online or talk with an independent insurance agent to find the best price for you.

Where You Can Shop for Life Insurance

Policygenius

If you’re still not clear on life insurance policies and terms, Policygenius can help you out. The site aggregates life insurance and provides you with the best possible quote available.

Rather than sharing your information with all the insurance companies it works with, like other aggregators, it guides you through the insurance purchase procedure rather than immediately handing you off.

Policygenius doesn’t charge you anything if you purchase a policy. It works with a select group of insurance carriers that are widely recognized. When you buy a policy, the insurance company pays Policygenius. The amount is explicitly mentioned in the insurance quote.

Related: