In May, I wrote about how I decided to install Progressive Snapshot, a device that tracks the performance of my car while I drive. This device can tell you at what time you’ve driven, how fast you drive and at what speed. Progressive offers this service to all policyholders who drive a vehicle launched in 1996 or later as a way to gather data on drivers, while potentially saving them money on car insurance payments.

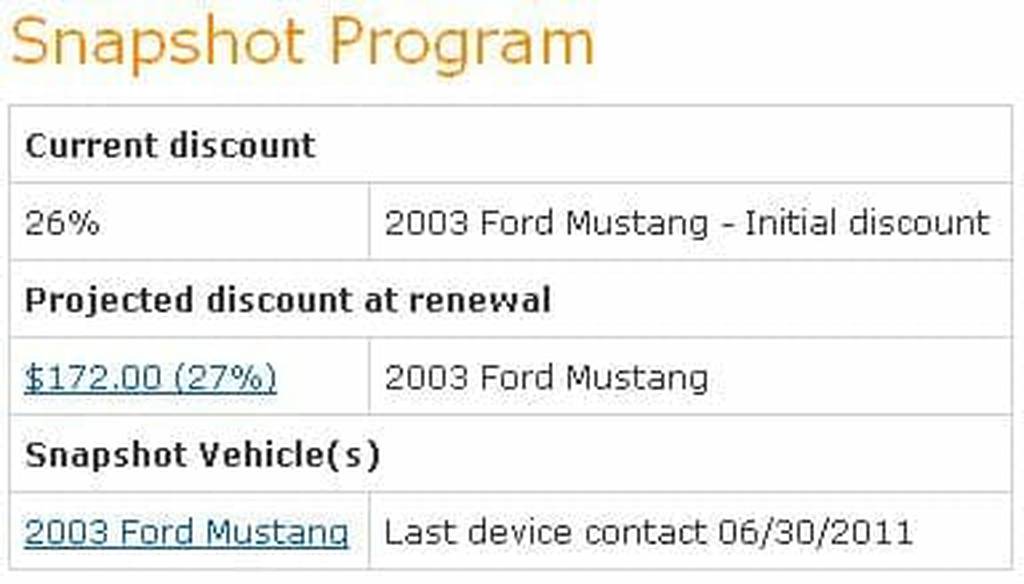

After driving with the Snapshot device for one month, the verdict is in. Progress has decided to cut my auto insurance payments by 27%! This means that my normal $110 a month auto insurance payments will now be $81 a month, and that's a pretty nice savings of $350 a year.

The discount I received however is only temporary until Progressive decides to take back the Snapshot device. This is done to ensure that my driving habits for one month are similar to my driving habits forever, and while there is no immediate timetable that I must leave the Snapshot device installed in my Mustang, the longest time period is six months. Progressive also states that during this period, I could stand to gain yet another discount, however smaller than the one already received. Since I only use this car to run errands and take the occasional trip once a blue moon, I’m confident this discount will stick and I might even be able to reduce my car insurance even further!

Perhaps the nicest part of this whole experience was just how simple this entire process was. After signing up online for Snapshot (which took all of 60 seconds), I received the Snapshot device, installed it and just watched as my data was compiled. Progressive allows you to check your driving performance every day, informing you of high-risk driving times, rate of speed, distance traveled and hard brakes. All of these factors led to my 27% initial discount and once 30 days were up, Progressive immediately revised my auto insurance rates and sent out my new contract. I had to do absolutely nothing after installing the device and only when I return it (Progressive provides a box with prepaid shipping) will I have to do anything else.

Related: 15 Auto Insurance Discounts You May Be Missing

So long as my rates remain reasonable with Progressive, I predict I’ll be a lifelong customer of theirs. My discount remains intact as long as I have this car insured with Progressive, and should I decide to insure any other car, I can request another Snapshot device and start the process over. Progressive makes it very clear that there is no risk on the consumer’s end to try this program, and policyholders can only receive a discount from this program, not a surcharge. If you have Progressive auto insurance and are looking to lower your rates, Snapshot is a must.