Overall Ranking

4.75/5

Overview

5/5

4.5/5

5/5

4.5/5

You may love Progressive’s commercials. But does it offer reasonably priced insurance and friendly customer service? We have the answers in our Progressive Insurance review.

Editor's Note

You can trust the integrity of our balanced, independent financial advice. We may, however, receive compensation from the issuers of some products mentioned in this article. Opinions are the author's alone. This content has not been provided by, reviewed, approved or endorsed by any advertiser, unless otherwise noted below.

Known for its aggressive, and often funny, TV advertising, Progressive has become one of the largest and best-known auto insurance providers in the country. They are also consistently one of the lowest-cost providers in a fiercely competitive industry.

While it may seem Progressive is a newcomer to the market, they actually first offered auto insurance back in 1937. But today, Progressive is an online provider of auto insurance. It has gained much of its current popularity with the rise of the Internet.

Progressive is a publicly-traded company, headed by CEO and President Tricia Griffin. The company is headquartered in Mayfield Village, Ohio. It holds more than $23 billion in written auto insurance premiums.

What Progressive is Best Known For

Apart from aggressive pricing, Progressive has made its mark on the industry with innovative product offerings, two in particular.

Name Your Price Tool. You enter the amount that you want (hope) to pay, answer a few questions, and the tool provides you with a range of car insurance coverage options. This will avoid the need to crunch numbers and investigate discounts. The tool will jump straight to the rate that you hope to find.

Progressive Snapshot. This is a plug-in device that uses your onboard diagnostics (OBD) port to monitor your actual driving experience. If you are an extra safe driver, this can result in a reduction in your premium. Progressive claims the program has resulted in over $600 million in discounts. That’s an average savings of $130 per year per participant. It’s a six-month program. The good news is that it may save you money, but it won’t work against you.

Now in the interest of full disclosure, I have to report that I did try the Snapshot device. Progressive is keen to promote it. The device emits a series of beeps whenever you’re displaying less than optimal driving patterns. What I found is that I got dinged every time I hit the brakes, or drove much faster than 25 mph. It beeped so much that I yanked it out before the 30-day trial was over.

For the record, I haven’t had it at-fault accident or a moving violation in 10 years. By all objective standards, I’m considered to be a safe driver. The Snapshot device didn’t agree, so I terminated our relationship early.

Progressive Special Features

Loan/Lease Payoff. This is commonly known as “gap insurance.” It’s the kind of coverage that will pay off the balance of your auto loan or lease if your car is totaled. It will pay off up to 125% of the value of your vehicle. That’s an excellent offer for anyone who is “upside-down” on their car loan (you owe more on the loan than your car is worth). That’s where the word “gap” comes into the picture.

Pet Medical Bills. This is coverage that will pay medical costs if your dog or cat is injured in a car accident. It’s part of your collision coverage.

Custom Parts & Equipment Value. If you add amenities like a sound system, TV equipment, navigation systems, phones, custom paint, and custom grills and spoilers to your car, Progressive will cover those items if your car is damaged. This is an optional add-on feature that will cost more.

Roadside Assistance. This may not be a dealmaker, since it’s often available through car insurance companies and AAA. But it’s a nice feature to have, nonetheless. If your car breaks down due to mechanical or electrical issues, a flat tire, or a lockout, Progressive will pay for towing or roadside assistance. You could even call them if you have a flat tire.

Ridesharing Coverage – Maybe. In 2016, Progressive announced that it would begin providing coverage for drivers working with ridesharing services. The coverage is only available in Texas. There’s also no information about the coverage on the Progressive website. It’s described as “a personal policy endorsement that fills most of the coverage gap between a personal auto policy and the commercial coverage held by a TNC like Uber or Lyft.”

(NOTE: Some sources report that Progressive offers accident forgiveness. I was unable to find any official sources confirming it.)

Progressive Discounts (Why is Progressive so Cheap)

Progressive offers at least 10 other potential discounts, in addition to Name Your Price and Snapshot:

Start your quote online. The average discount is seven percent if you start your process online. Even if you ultimately buy by phone, if you start online, you’re eligible for the discount.

Safe driver. The average discount is 31 percent, which is a good bit higher than the typical 25 percent offered by most other auto insurance companies. A safe driver is defined as having no moving violations or at-fault accidents within the last three years.

Multi-car. The discount averages 10 percent if there are at least two cars on your policy.

Homeowner. If you own a home, condominium, or mobile home, you are eligible for this discount, even if Progressive doesn’t insure the property.

Continuous insurance. If you maintain car insurance for at least five years, with no gaps or cancellations, you’re eligible for this discount. In fact, you’re eligible even if you didn’t hold the previous insurance with Progressive.

Signed documents online. If you complete the shopping and purchase process of your policy entirely online, you’ll be eligible for this discount. The average discount is seven percent.

Pay in full. You can reduce the overall cost of your premium by paying upfront (six months total), rather than in monthly installments.

Automatic bill pay. You can get a discount just for setting your premium payment up with an automatic draft.

Good student. There are two discounts here. The first is if you’re a student who maintains a grade point average of B or better. The second is if you’re attending college at least 100 miles from home and you only drive your car when you are home.

Minor child driver. A new driver on a family policy is eligible for this discount up to the age of 18.

Progressive Car Insurance Estimator

Progressive offers its Car Insurance Estimator tool. It enables you to get an obligation-free quote from the website. But you do have to provide your name, address, and email address. (Translation: expect follow-up solicitations!)

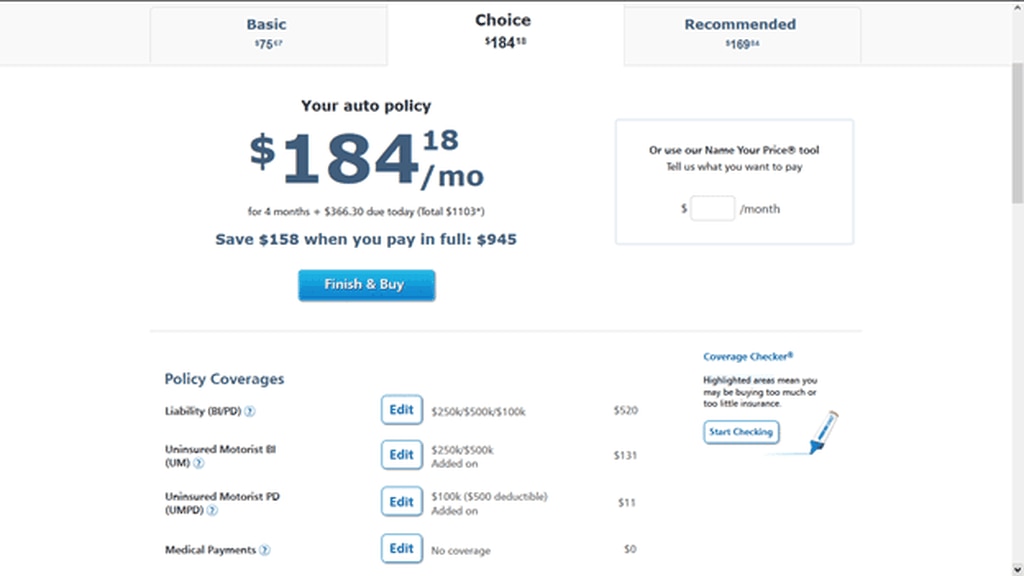

I used a fictitious profile of a 40-year-old married couple residing in Alpharetta Georgia. They have no chargeable at-fault accidents or moving violations. The insurance policy is for a 2013 Hyundai Sonata, with financing.

Coverages requested were as follows:

- Liability: $250k/$500k/$100k (basically, the highest coverage commonly available)

- Uninsured Motorist (Bodily Injury):$250k/$500k

- Uninsured Motorist Property Damage:$100k, with a $500 deductible

- Collision: with a $500 deductible

- Comprehensive: with a $500 deductible

Here’s what the Car Insurance Estimator returned:

$184 per month works out to be $92 per month per person. That works out to be $1,104 per year per person.

For comparison’s sake, the average car insurance premium in Georgia is $1,440 per year, making it the 12th most expensive state in the country. (The US national average is $1,318 per year, in case you’re wondering.)

Please understand that auto insurance rates vary by state and even by ZIP Code. The same insurance company can have wildly different premiums in other states. It’s even more influenced by your personal driving profile. Insurance companies take into consideration your age, occupation, credit history, and driving history, including at-fault accidents and moving violations. It’s almost impossible for two people to get identical quotes.

It’s the nature of the beast when it comes to car insurance.

Related Coverages Provided by Progressive

Though they aren’t car insurance, strictly speaking, Progressive offers coverage for a large number of related needs:

- Commercial auto insurance

- Boat insurance

- All-terrain vehicle (ATV) insurance

- Golf cart insurance

- Recreational vehicle insurance

- Personal watercraft insurance

- Motorcycle insurance

- Snowmobile insurance

- Travel trailer insurance

- Segway insurance

- Business insurance

- Umbrella insurance

- Classic car insurance

Any of these additional coverage types could be important to you if you own recreational vehicles or if you use your car or other vehicles for business purposes.

Customer Service Ranking

According to the J.D. Power 2017 U.S. Auto Claims Satisfaction Study, Progressive ranked at just about the middle of the pack on customer service. They placed 14th among 26 auto insurance companies. That put them behind well-known competitors, such as Amica ( #1 overall), GEICO, State Farm, Allstate, Nationwide, and 21st Century. But they came out ahead of Travelers, MetLife, Farmers, Liberty Mutual, and USAA.

In the study, auto insurance companies are judged based on seven categories, including:

- Overall satisfaction

- First Notice of Loss (FNOL)

- Claim Servicing

- Estimation Process

- Repair Process

- Rental Experience

- Settlement

Progressive received three stars out of five in each category, except rental experience, where they garnered four out of five stars. Their overall rating was three stars out of five, which is considered “About Average”.

Personal experience. My son had a claim with Progressive in 2015. He hit a deer on the highway, and his car was “totaled” (the cost of the repairs exceeded the replacement value of the car). The entire process was handled quickly and with no hiccups. The subsequent car rental situation was equally pleasant. Progressive provided him with a paid rental for several days to give him time to purchase a new vehicle.

I don’t want to give that experience too much weight. You could, after all, infer that hitting a deer is close to the simplest type of auto insurance claim.

Progressive Insurance Pros and Cons

Snapshot Tool Allows for Discounted Rates

Personal Experience - Used them for 15 years

Competitive Low Rates

Easy Claims Service Cons

Home Ownership Bundle can be Pricey (even with discount)

Should You Get Your Auto Insurance with Progressive?

Progressive certainly rates investigation if you’re looking for car insurance. Though they get only average ratings on customer service, they do consistently come up as one of the lowest-cost providers. That’s probably the single dominant factor in selecting auto insurance for most people.

The website AutoInsurance.com states that “Statistically, GEICO and Progressive have the cheapest auto insurance options.” (They add the disclaimer that it’s statistical, and doesn’t apply in all cases.)

I can however back that up by saying that in my own search for car insurance, GEICO and Progressive did come up as consistently less expensive. But again, that doesn’t mean that they will have the lowest rate in your state, for your specific driver profile.

I currently have Progressive for myself and my family. But when it comes to car insurance, it always pays to shop. If you have been with your current provider for several years, you owe it to yourself to check out the competition. Insurance companies raise and lower their premium rates based on experience in a given market, as well as other factors. In periodic searches for less expensive coverage, you may very well come across a lower-cost provider.

But in my experience, Progressive provides solid coverage for the premium paid.

If you’d like to get more information, or get a quote, check out the Progressive website.