In the recent podcast on How to Track All 3 of Your Credit Scores, I mentioned that I would have a follow-up article that tracked all the cards that offer free credit scores – whether it’s an official FICO score or not – and the credit bureau the data are drawn from.

Here is the promised article, and I’m including the list of credit cards offering credit scores and additional information about each offer.

Related: Already know your credit score? Check out the best rewards cards for Excellent, Good, Fair, Poor, or No credit.

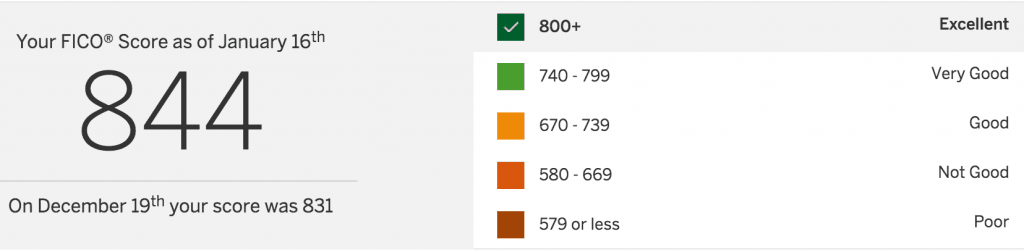

American Express gives you free access to your FICO score based on the FICO 8 formula. I’ve carried an Amex card for decades and recently pulled my FICO score from the Amex website. Here are some of the details:

Here is one of my favorite cards from American Express:

Blue Cash Preferred® Card From American Express

The Blue Cash Preferred® Card From American Express is another top-rated credit card. The list of benefits is rather long, so here goes –

- Get a statement credit after meeting a minimum spending threshold

- Earn high cash back percentages at U.S. supermarkets, streaming services (like Netflix, Hulu, and others)

- Earn medium cash back at U.S. gas stations and ground transportation

- Earn 1% cash back on other purchases

- Terms Apply.

Capital One

Capital One provides a non-FICO score, called CreditWise. The score is calculated based on the TransUnion VantageScore 3.0 model. Customers can, of course, access their scores through this system. But now, so can non-Capital One customers.

CreditWise is available online and through a mobile phone app. You can sign up for the app even if you aren’t a customer, and the score will remain free.

The service offers the following features:

- Credit Simulator – This tool estimates how future credit behavior could impact your Credit Tracker score. For example, you can determine how a 30-day late payment on a mortgage might affect your score – or going 12 months without one. It can also help you find the best way to improve your credit score by estimating the impact of positive behaviors like making payments on time or paying off credit card debt. Unlike some other credit simulators, this tool will actually let you account for multiple behaviors at once, including taking out a mortgage, paying down debt, letting an account go delinquent, or even paying child support.

- Credit Alerts – You can receive alerts for factors that affect your score, including a new inquiry, recently opened account, delinquent account, improved account, or bankrupt account. The alerts go out when your Trans Union credit report changes.

- Grade Overview – This feature enables you to see the major factors that are affecting your credit score.

Capital One offers several great card options. Here are three of the best, in my opinion (I carry the first one).

Capital One Venture Rewards Credit Card

The Capital One Venture Rewards Credit Card pays out 2 miles for every dollar in purchases. Use these miles for travel, and the card is a 2x travel rewards card. I’ve found it very easy to redeem miles for travel purchases charged to the card. And there are no blackout dates or other restrictions.

Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel. Earn 5X miles on hotels and car rentals when booked through Capital One Travel. The Capital One Venture Rewards Credit Card comes with no foreign transaction fees, and the annual fee is $95.

Capital One Quicksilver Cash Rewards Credit Card

The Capital One Quicksilver Cash Rewards Credit Card is an excellent cash back rewards option. You earn 1.5% cash back on every purchase, every day. Earn a one-time $200 cash bonus after you spend $500 on purchases within 3 months from account opening.. There’s also a 0% intro APR on purchases and balance transfers for 15 months (and an everyday APR of 19.74% - 29.74% (Variable); 3% fee on the amounts transferred within the first 15 months.

The Capital One Quicksilver Cash Rewards Credit Card has $0 annual fee and charges no foreign transaction fees.

Capital One Platinum Credit Card

Finally, the Capital One Platinum Credit Card is ideal for those trying to build their credit. While there are no rewards with this card, it’s easier to qualify if you have limited credit. And it gives you access to your credit score and tools to help you improve that score.

Capital One is best for: Improving or building your credit score using Credit Wise tools.

Credit One Bank® Visa® with Free Credit Score Access

Credit One Bank® Visa® with Free Credit Score Access gives you the ability to view your Experian credit score and credit report summary online, and at no additional cost to you. What’s more, the card is available for those with poor credit. That’s mostly people who are either looking to rebuild their current credit or building from the ground up.

Apart from access to your Experian credit score, the card also comes with the following list of benefits:

- Earn cash back rewards on eligible purchases

- Automatically earn more cash back rewards using the card at participating merchants

- Zero fraud liability for unauthorized charges

- Regular account reviews for credit line increases

- You can make purchases securely using Apple Pay

The annual fee is based on your creditworthiness. The first-year fee will be immediately charged against your credit limit. For example, if you receive the minimum credit line of $300, the $99 annual fee will be charged immediately, lowering your remaining credit limit to $201.

In subsequent years, the annual fee will change once again depending on your creditworthiness. If you qualify, the annual fee for subsequent years will be prorated and billed on a monthly basis. That will leave your credit limit largely intact.

Since the card is designed for those with fair or no credit, you’ll start out with a low credit limit. But as you make your payments on time, you’ll be eligible for periodic reviews to increase that limit.

Lower rates and fees will apply if you are covered under the Military Lending Act.

Credit One Bank® Visa® with Free Credit Score Access is best for: Anyone looking to have access to their credit score on a regular basis, who might be either rebuilding their credit or building it from the ground up. It’s the perfect choice for anyone who has fair or even no credit and wants an unsecured credit card.

Barclaycard

Barclaycard provides FICO scores to its cardholder customers on its website. The score is based on your TransUnion file.

It also provides email alerts, letting you know when your score changes. The alerts list the two main factors that have caused the score change. The service also provides a historical chart that tracks the movements in your score, once you have a three-month history in the program. There is no charge for this service and no attempts at up-selling you into other programs.

The email alerts, historical tracking, and the fact that Barclaycard provides you with your actual FICO score are major advantages with this program. Many other free credit score sources, whether they are provided by credit card issuers or other sources, give you a parallel score rather than the actual FICO that is used by most banks for lending and mortgage purposes.

Barclays is best for: Accessing your FICO score on Barclay’s website, monitoring your score via email alerts, and tracking movement in your score.

Commerce Bank

Commerce Bank customers can now access their FICO scores on their monthly credit card statements. The score is automatically reported on each statement and includes a list of score factors and options for improving your score. Plus, you can see how your current score might impact interest rates and other credit terms.

Commerce Bank is best for Receiving your FICO score on your monthly credit card statement plus a list of factors that affect it and tips for improving your score.

First Bankcard

First Bankcard through First National Bank offers FICO scores to its cardholders and you can view it online. They use the FICO 8 Bankcard Score, which is the score the bank purchases monthly to keep track of customers’ creditworthiness. Like other credit card credit score providers on this list, First Bankcard also provides you with the main factors that determine your score.

First Bankcard is best for: Checking your FICO score online and learning the main factors that affect it.

USAA Bank

As of late 2015, USAA started offering members, not just credit cardholders, access to their free credit score. The CreditCheck & ID Monitor solution from USAA comes in several different levels.

The basic level, CreditCheck 1, offers daily credit monitoring through Experian, updates, and alerts about changes in your credit score, and access to your credit score and historical scores. The credit score provided at this level is the Experian VantageScore 3.

At the paid levels, customers can access additional benefits like twice-monthly credit score checks, reports from the other credit reporting bureaus, and identity protection alerts.

USAA Bank is best for Daily credit monitoring through Experian plus updates and alerts for your VantageScore 3.

US Bank

US Bank provides its cardholders with their credit score as provided by Experian directly from the Experian website. Its service is called CreditManager Plus. The scores are available for free to US Bank cardholders, and you simply need to log into your US Bank account and click on a link on the right side of your statement that says, “Know your credit score? Check it free.”

US Bank is best for: Checking your Experian score online.

Credit Cards That Offer Free Credit Scores

| Credit Card | Score Type | Details |

|---|---|---|

| Barclaycard | FICO | 1. Email Alerts. 2. Two main credit score factors 3. Historical Tracking Charts |

| Capital One | Credit Tracker (based on Transunion New Account Model) | 1. Online and Mobile App 2. Credit Simulator Tool (measure future behavior) 3. Credit Alerts, including specific reasons for the alert. 4. Grade Overview, telling you the top reasons for your score. |

| Discover | TransUnion FICO | Available on the monthly statements and online. Score, plus top two factors. |

| First Bankcard | FICO 8 Bankcard Score | Available online. Reports top two factors in determining your scores. |

| US Bank | Experian, presumably FICO | Service is provided directly by Experian, which is one of the three major credit repositories. |

Bonus: Ally Bank

Ally Bank offers free FICO scores to its auto loan customers.

Bottom Line

These are the 12 major credit card issuers (plus an auto lender!) currently offering free credit scores to their customers. I wouldn’t be surprised if more credit card companies jump on board, as this is now becoming a “standard issue” benefit in the credit card world.

At any rate, many of these companies offer great credit cards that are worth having, anyway. So if you need to keep better track of your FICO score, consider doing it for free using a card from one of these companies.

Know of another credit card company or lender offering access to free credit cards? Let us know in the comments.