Your credit scores are never more important than when you are about to buy a home. That pesky 3-digit number can lower or raise your interest payments by tens of thousands of dollars over the life of a mortgage. So it was no surprise when a reader named Kelly sent me the following email:

“I am looking to have my middle score at a certain number for a home purchase and would like to start monitoring before formally applying for the loan.”

Great topic and a great strategy when you’re planning to apply for a mortgage. By monitoring your credit scores in advance, you avoid negative surprises at application time and give yourself time to correct errors.

So what’s the best way to monitor your credit? We’ll look at some tools to help you do that. But first, let’s cover some general information as it relates to credit scores.

Listen to the Podcast on how to track all three credit scores:

Credit Scoring Basics

It’s important to understand that you don’t have one credit score, but three. Actually, you may have as many as fifty, but the three most common - and most used by mortgage lenders - are issued by the three major credit bureaus:

- Equifax

- Experian

- TransUnion

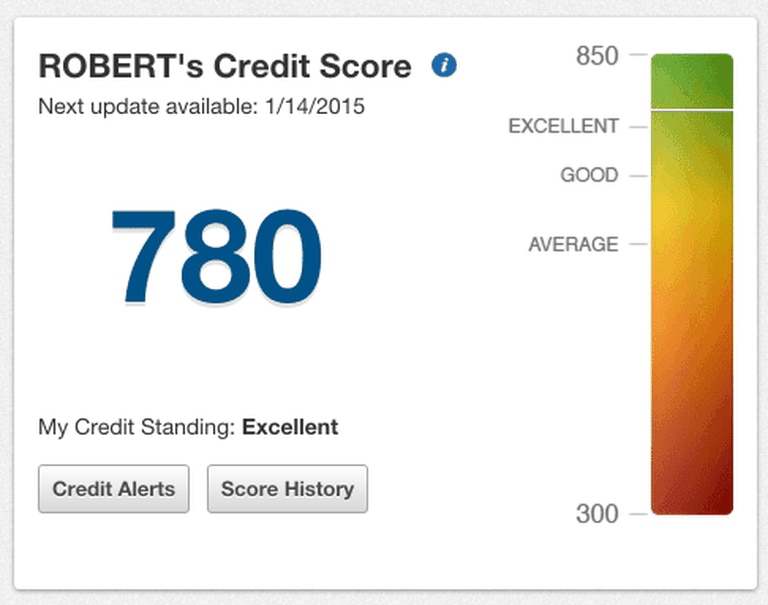

Mortgage lenders will pull the three scores from each of the reporting agencies. They do this because there typically are differences in the score from one agency to the next. These differences are the result of each of the credit bureaus having slightly different information on a consumer. Mortgage lenders use the middle score. So if my three scores are 770, 780, and 790, the lender will use 780 as my representative credit score for the purpose of the loan.

A difference of even 20 points can mean a higher or lower interest rate. Mortgage lenders base credit on credit tiers. A 20-point difference could drop you from the 720+ tier down to the 700 -719 tier, resulting in a 1/8 increase in the rate you will pay on a 30-year mortgage.

For example, a score of 730 might get you a rate of 4.00% in today’s market. A score of 710 may result in a rate uptick to 4.125. On a $200,000 mortgage, that will increase your monthly payment from $955 to $969 - a difference of $14 per month. While that may not seem like much, over 30 years that will add up to $5,040. That’s why it’s so important to monitor your credit scores before taking a major step, like applying for a home mortgage.

So what Kelly wants to do - correctly - is to track her middle score. How do you track all three?

There are different ways to do this. Some options will cost money, while others are free.

1. MyFICO

The easiest, most reliable - and most expensive - way is through myFICO, which is run by Fair Isaac Corporation, the creator of the FICO score. You can subscribe to the service and monitor your credit reports from all three bureaus and your three FICO credit scores. One place, all three scores.

The downside to this service is the cost. It’s $19.95 per month, and there’s a three-month minimum requirement. So even if you just want to see a snapshot of your scores, you’ll have to pay a minimum of $60.

If you’re going to buy a home, myFICO is an excellent way to monitor your credit and deal with problems before submitting a loan application, particularly as you get very close to applying for your mortgage.

2. Credit Cards

Several credit card companies now give you free access to your FICO Score. Discover, Capital One, and Barclaycard are three credit card companies that do offer free credit score access. However, they don’t all provide your official FICO score, nor do they provide scores from all three credit bureaus. Typically, they’ll offer just one score.

Capital One, for example, uses a non-FICO scoring model based on your TransUnion credit data. That said, the score is still a good barometer of where your credit stands and is an excellent tool to monitor your credit for the general credit score range.

Capital One’s scoring model is based on six categories:

- On-time payments

- Oldest credit line

- Credit Utilization

- Recent inquiries

- New accounts

- Available credit

In each category, your score is based on A, B, C, and D grades. You can also click on any category and run “what-if” scenarios. For example, you can look at what having no late payments for the next 12 months will do to your score. Or you can measure the impact of late payment.

When I did this, I found that one 30-day late payment on my credit drops my score from 780 to 739. A 60-day late drops it to 727, while a 90-day late drops it to 718.

Among large credit card issuers, Citi is slated to offer a similar tool in January 2015. But curiously, Amex and Bank of America don’t offer it.

3. Quizzle

Quizzle is similar to the others, and also free of charge, but it’s based on Equifax. My score here was 807, so you can see that despite using many different credit score sources, they’re all in the same ballpark on scores.

Summary

If you just want to monitor your credit scores on an ongoing basis, use the free options. Use the paid services only when you get close to getting a new mortgage.

You can see all the credit score links listed in this post on this page How to Get Your Free Credit Score (with no credit card).