Is there a formula for creating a perfect portfolio? In this podcast episode, we answer a few listener questions and discuss what’s important for building a sound asset allocation plan.

Year end is a perfect time to give your retirement and other investments an annual tune-up. Each year at this time I evaluate my 401(k), rollover IRA and taxable investment accounts to see if I should make any changes to my asset allocation plan for the next year. Generally, I look at five things:

1. Whether my asset allocation plan should be adjusted

2. Whether my investments are tracking to my planned asset allocation or need rebalancing

3. Whether my investments are distributed between my retirement and non-retirement accounts in the most tax efficient manner (known as asset location)

4. Whether any changes to the mutual funds I own have been made that might cause me to reconsider my investment

5. How my investments have performed over the past year. From this information, I decide what changes, if any, need to be made to my current investments and contribution choices for next year.

This annual checkup takes a couple of hours, but is time well spent.

Today, we will look at how to build an asset allocation plan, using my asset allocation plan as a guide.

6 Steps to Building an Asset Allocation Plan

Building a sound asset allocation plan can be as simple or complex as you want. On the extremely simple side, one can choose to invest in a single lifestyle fund. For example, Vanguard offers Target Retirement funds. Simply pick the year you want to retire (e.g., Target Retirement 2035), and put your money in the corresponding fund. Vanguard’s 2035 fund (VTTHX), for example, invests in five Vanguard funds, one U.S. stock fund, one bond fund, and three international funds. On the opposite extreme are those who slice and dice asset classes into dozens of pieces and invest in dozens of mutual funds and ETFs to implement their investing strategy. I take a middle of the road approach, which I describe below.

Building my asset allocation plan takes 6 steps:

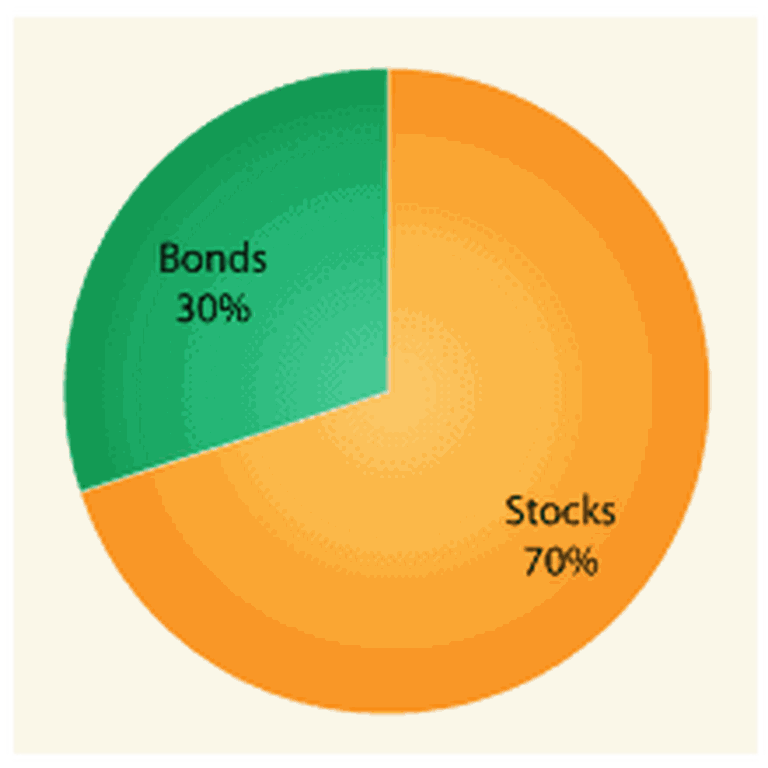

Step 1: Choose how much to invest in stocks and bonds

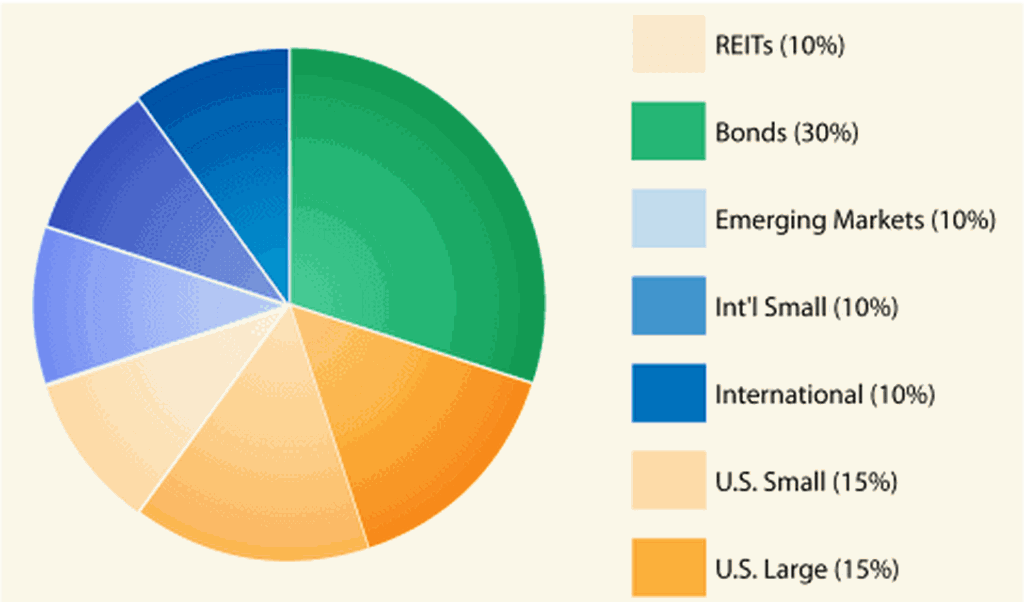

This is one of the most important asset allocation decisions you’ll ever make. I’ve written before about Stock v. Bond Funds and Allocating Between Stock and Bond funds. There are two commonly used rules of thumb when it comes to allocating between stocks and bonds. The more conservative approach says to invest your age in bonds. At 40, for example, you’d invest 40% in bonds and the rest in stocks. The more aggressive approach says to invest your age minus 20 (sometimes you’ll see this approach described as investing 120 minus your age in stocks) in bonds. So at 40, you’d invest 20% in bonds and the rest in stocks. I follow a middle of the road approach. The pie chart to the right is an example of my allocation in my 40s. Included in the 30% bonds, however, is about 10% in cash that I use as an emergency fund.

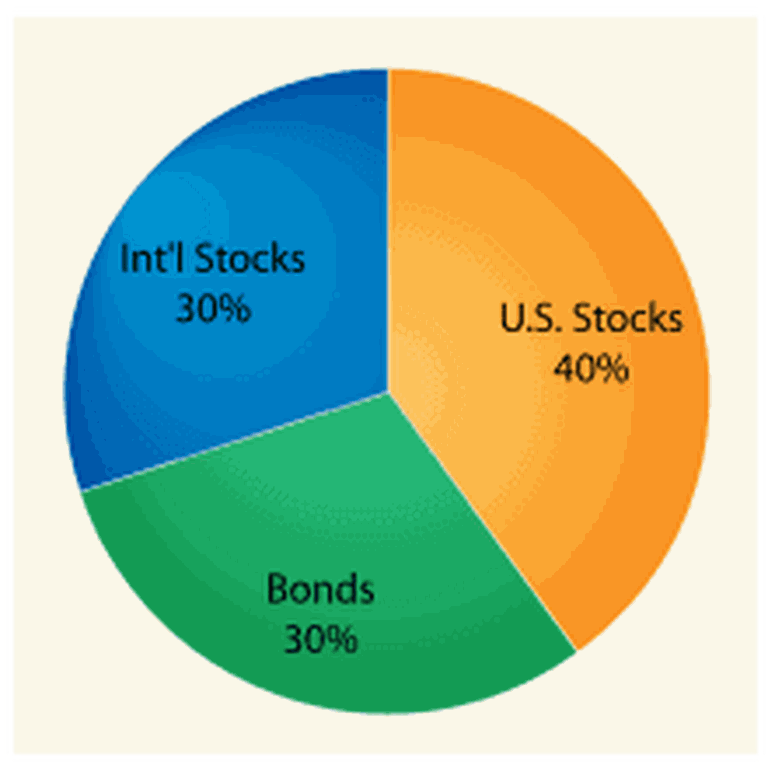

Step 2: Choose how much to invest in U.S. and International stocks

I view this as the second most important asset allocation decision. Particularly with the effects of globalization and the financial struggles the U.S. has and will continue to experience, the proper allocation between U.S. and non-U.S. stocks is critical in my opinion. I’ve chosen to allocate 40% of my investments to non-U.S. funds. This would be viewed as high by many. The pie chart to the right reflects 30%. The reason is that the other 10% comes from having about 5% international bonds and 5% international REITs (which we’ll come to in a minute). There is no one right answer for all investors.

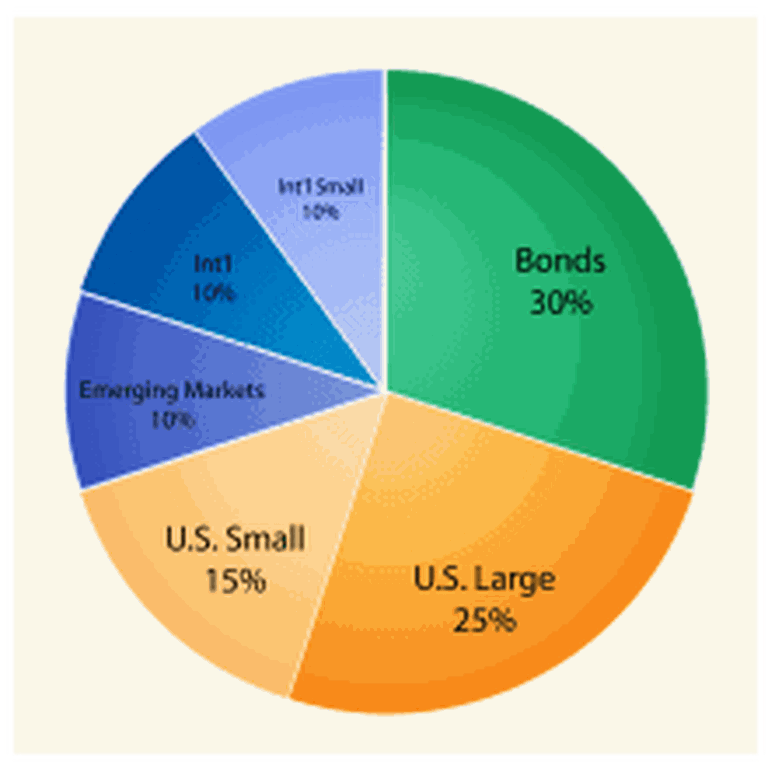

Step 3: Choose how much to invest in small and large companies

As a general rule, small companies tend to be riskier investments but, over the long haul, return a higher performance than large companies. I've written in the past about Large Cap v. Mid Cap v. Small Cap Funds and Allocating Between Large and Small Cap funds. One thing to keep in mind is that this allocation decision applies to both U.S. and foreign investments. I put about 15% toward U.S. small companies and 10% toward international small companies.

Related: Small Cap Value vs. Growth: Which is Better?

Step 4: Choose how much to invest in developed and emerging markets

In addition to the market cap, for international investments, it’s important to consider whether the investment is in a developed country or emerging market. Like small cap companies, companies located in emerging markets tend to be riskier but offer the potential for greater returns. I’ve written about Emerging Market funds. I generally divided the 30% allocated to international investments between developed countries, emerging markets and small cap companies in equal amounts.

Step 5: Choose whether to invest in other asset classes such as REITs and commodities

I invest 10% in REITs, 5% to U.S. REITs and 5% to International REITs. At this point, I don't invest in commodity funds. Over the long term, commodities tend to return 0% after inflation. While some view them as a good hedge against inflation, the amount I'd be willing to put into commodities would have minimal impact on my portfolio.

Step 6: Choose how to invest in bonds

Generally, I allocate 10% to cash and divide the rest among TIPS, high-yield corporate bonds (i.e., junk bonds) and international bonds. This is one area I know I need to focus on this year. I suspect I'll transfer my high-yield corporate bond investments to either TIPS or a total bond fund. In making bond investments, two of the significant factors to consider are credit risk (i.e., the risk of default) and interest rate risk (i.e., the risk that interest rates will go up while you are holding a long term bond that's earning a lower interest rate). Thus, long term bonds are generally riskier than short term bonds, and debt held by struggling companies or countries are generally riskier than debt held by financially secure companies or countries.

Here's what my final asset allocation plan looks like in this example:

As part of my investment portfolio’s annual tune-up, I look at whether I should make any changes to this asset allocation. Last year I increased the amount allocated toward bonds/cash from 20 to 30%. This year, I think I need to make further changes to my bond/cash allocation. Currently, I’ve invested a small percentage in high-yield corporate bond funds. These are bonds with companies that have low credit ratings. I’ve concluded that I simply don’t need to look for risky investments within my bond allocation. For that reason, I’ll be moving the high-yield bond fund over to either TIPS or a total bond market fund. I am also keeping an eye on frontier markets. Beyond that, no further changes are necessary to my plan this year.

Final Thoughts

Be sure to take some time at least once a year to go over your goals and check your allocation plan to see if it’s on track to meet those goals. If you’re looking for an easy way to do this, Empower offers a free Investment Checkup tool that analyzes your portfolio for you. Once you have all your accounts connected in Empower, it’s easy to login anytime to check your allocation, your net worth and get portfolio recommendations.

(Personal Capital is now Empower)

Empower Personal Wealth, LLC (“EPW”) compensates Webpals Systems S. C LTD for new leads. Webpals Systems S. C LTD is not an investment client of Personal Capital Advisors Corporation or Empower Advisory Group, LLC