Large-cap vs. mid-cap vs. small-cap... what’s the difference? Furthermore, why does it matter to an asset allocation plan and a well-diversified portfolio?

These are important questions for every investor to answer. So first, let's talk about market capitalization. Then, we'll talk about why it matters.

Invest Your Dough: Get your first $5,000 managed for free from Wealthfront. Sign up today and start investing at low costs! Learn More

Market Capitalization

Market capitalization (or market cap, for short) is the value of all outstanding shares of a corporation.

For example, assume a company has 1 million shares outstanding. If each share trades at $100 per share, the company's market cap is $100 million.

To put this in some perspective, the company with the largest market cap as of today is Apple, which has a market cap of over $800 billion (yes, that’s a billion with a B). In contrast, the smallest companies on the S&P 500 have market caps of just a couple of billion. And there are many, many public companies with a market cap of less than $1 billion.

Related: What Will Apple Do With All That Cash?

Now, why does it matter? Well, history tells us that, on the whole, investing in smaller companies is riskier than investing in larger companies.

That seems sensible. Smaller companies don't have the financial resources of many larger companies to weather a financial storm. And the products or services of smaller companies are often still unproven.

As we saw with stocks versus bonds, the higher risk involved with investing in smaller companies has, historically, resulted in higher returns. From 1926 to 1998, for example, large-company stocks had an annualized return of 11.22%, while small company stocks enjoyed an annualized return of 12.18%.

Market Cap Size

So what is the large-cap? What is the small-cap?

All of this still leaves open an important question: How big (or small) must a company be to be considered a large-cap (or small cap) stock?

Well, there is no single answer to this.

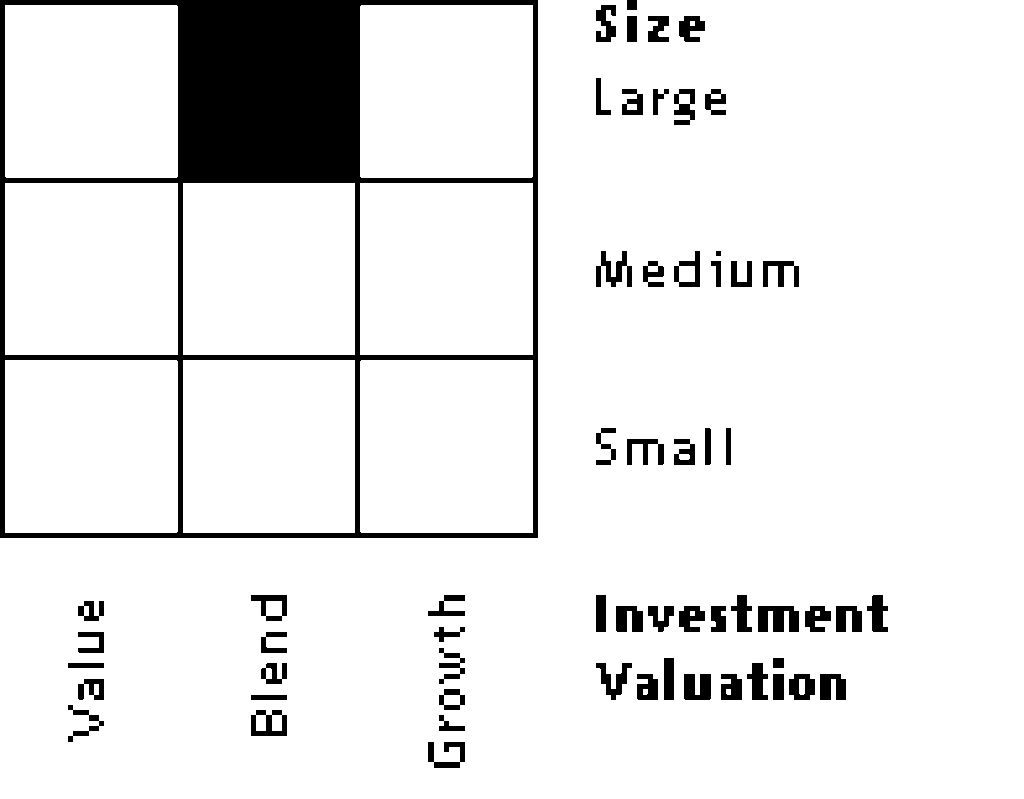

Morningstar considers the largest 5% of the stocks in its database as large-cap, the next 15% as a mid-cap, and the remaining 80% as a small cap. Morningstar uses the familiar and convenient Style Box to indicate the market cap of an individual stock or mutual fund.

Here is another commonly used division of market cap, which breaks the size of a company into six categories:

- Mega Cap: $200+ billion

- Big/Large Cap: $10 - 200 billion

- Mid Cap: $2 - $10 billion

- Small-Cap: $300 million - $2 billion

- Micro-Cap: $50 - $300 million

- Nano Cap: <$50 million

Small-Cap Performance

Now that we understand the market cap, the next question is how we should invest our money. Many investment professionals recommend that investors tilt their portfolio toward small-cap stocks.

Recently, I interviewed Paul Merriman. Paul has done great work on asset allocation, including his Ultimate Buy and Hold Portfolio. He recommends small-cap value.

Why? Small-cap value stocks historically have enjoyed higher returns than most other asset classes.

As an example, let’s compare a 100% S&P 500 index portfolio with one that moves 10% to a small-cap value index. Using Portfolio Visualizer, from 1972 to today, the portfolio with a 10% small-cap value outperformed an S&P 500 index portfolio by 50 basis points. Remarkably, the standard deviation of the two portfolios is almost identical.

Listen to my interview with Paul Merriman:

Of course, small caps are riskier if evaluated in isolation.

The standard deviation for Vanguard's S&P 500 Index is 7.35%, according to Morningstar, while Vanguard's Small Cap Index fund has a standard deviation of 12.21%.

As a refresher, standard deviation tells us that about two-thirds of an investment's yearly returns will fall somewhere between its average return minus its standard deviation on the one hand, and its average return plus its standard deviation on the other.

Using the numbers above, two-thirds of the S&P 500's returns will fall between 3.87% (11.22 - 7.35) and 18.57% (11.22 + 7.35). In contrast, two-thirds of the Small Cap index fund's returns will fall somewhere between -.03% (12.18 - 12.21) and 24.39% (12.18 + 12.21). Thus, the higher the standard deviation, the more volatility you can expect in the investment.

Standard deviation is not all that meaningful when applied to a specific asset class. Rather, we should consider standard deviation, if at all, on our portfolios as a whole. And here, adding a reasonable amount of small-cap value does not significantly increase the volatility of a portfolio.

My Small-Cap Investments

So, what does this mean for asset allocation?

My approach has been to invest about 10% of my portfolio in a small-cap value index fund. The idea here is to benefit from what I hope will be higher returns from small caps, while not going overboard and greatly increasing the risk of my overall portfolio.

At one point, I split my small caps into three funds:

Bridgeway Ultra-Small Company Market (BRSIX): This fund invests in ultra small-cap stocks, and its current holdings have an average market cap of $362 million.

Allianz NFJ Small Cap Value Instl (PSVIX): This fund invests in small-cap stocks, and its current holdings have an average market cap of $2.11 billion. This fund is really on the borderline between small-cap and mid-cap.

Vanguard Explorer Fund (VINEX): This fund invests in international small-cap and mid-cap stocks, and its average market cap is currently $1.863 billion.

Today, I’ve greatly simplified my portfolio. My exposure to small-cap stocks comes from Vanguard’s small-cap value fund (VSIAX).

The point here is not to recommend these funds or my asset allocation. Rather, the point is to show the choices I've made, which may or may not be appropriate for you.

You should note from the above information, however, that not all small caps are created equal. There is variance in the size of the companies these small-cap funds actually own. The Allianz fund market cap is several times larger than the average market cap for the Bridgeway fund.

The point is that you need to look at the average market cap of the fund. Don't rely on the name of the fund, as the name can be deceiving.

The risk, as measured by their standard deviation, also can vary significantly from fund to fund. The standard deviation for the Bridgeway fund is 13.52%, while the other two funds have standard deviations of about 10.50%. This is to be expected given that Bridgeway invests in significantly smaller companies.

Related: Small Cap Value vs. Growth: Which is Better?

How Does My Allocation Stack Up Against the Pros?

You'll see a lot of recommended asset allocations in books and published articles. Generally, for those with at least 10 or 20 years to go before retirement, the suggested allocations that I've seen range anywhere from about 10 to 25%.

For example, Bernstein in The Intelligent Asset Allocator: How to Build Your Portfolio to Maximize Returns and Minimize Risk suggests 15% for a long-term portfolio. The Bogleheads in The Bogleheads’ Guide to Investing recommend 25% allocated to mid-cap and small-cap for a young investor, and about 15% for us middle-aged folks.

One critical thing to keep in mind is that if you own a small-cap fund, be prepared to lose some money in the short term. As we've seen from the standard deviation, these funds are more volatile than large-cap and bond funds. So, know ahead of time if you can't stand the heat.

Track Your Asset Allocation for Free

My favorite investment tracking tool: The tool I use every day is Empower’s free financial dashboard. The financial dashboard enables you to link all of your investment accounts, including 401(k) accounts. This, in turn, allows you to see all of your investments in one place, track their performance, evaluate your asset allocation, and analyze the fees associated with your portfolio.

In the next article in this series, we’ll look at the difference between a value and a growth stock.

Go to Asset Allocation

(Personal Capital is now Empower)

Empower Personal Wealth, LLC (“EPW”) compensates Webpals Systems S. C LTD for new leads. Webpals Systems S. C LTD is not an investment client of Personal Capital Advisors Corporation or Empower Advisory Group, LLC