If you’ve been thinking about moving some of your money into alternative investments, perhaps to have a portion of your portfolio held in counter-cyclical assets, you should take a close look at gold and silver.

In this article, were going to focus on how to invest in gold and silver, since there are actually several different ways to go about it. Each comes with its own set of benefits and costs.

But before we get into the mechanics of how to invest in gold and silver, let’s start by considering a more fundamental question:

Why Invest in Gold and Silver?

There are several answers to this question.

Gold Has Been Money For Thousands of Years

Nations, kingdoms, and empires have come and gone over the past 5,000 years, and their currencies have disappeared with them. But gold has continued to function as a medium of exchange and a store of wealth through it all. Along the way, silver has functioned as a parallel precious metal, achieving the title of the poor man’s gold due to its much lower price.

Gold and Silver Have Intrinsic Value

Modern paper and electronic currencies are conventions. They’re declared to be money by governments, and accepted as such by citizens. But in and of themselves, they have no intrinsic value.

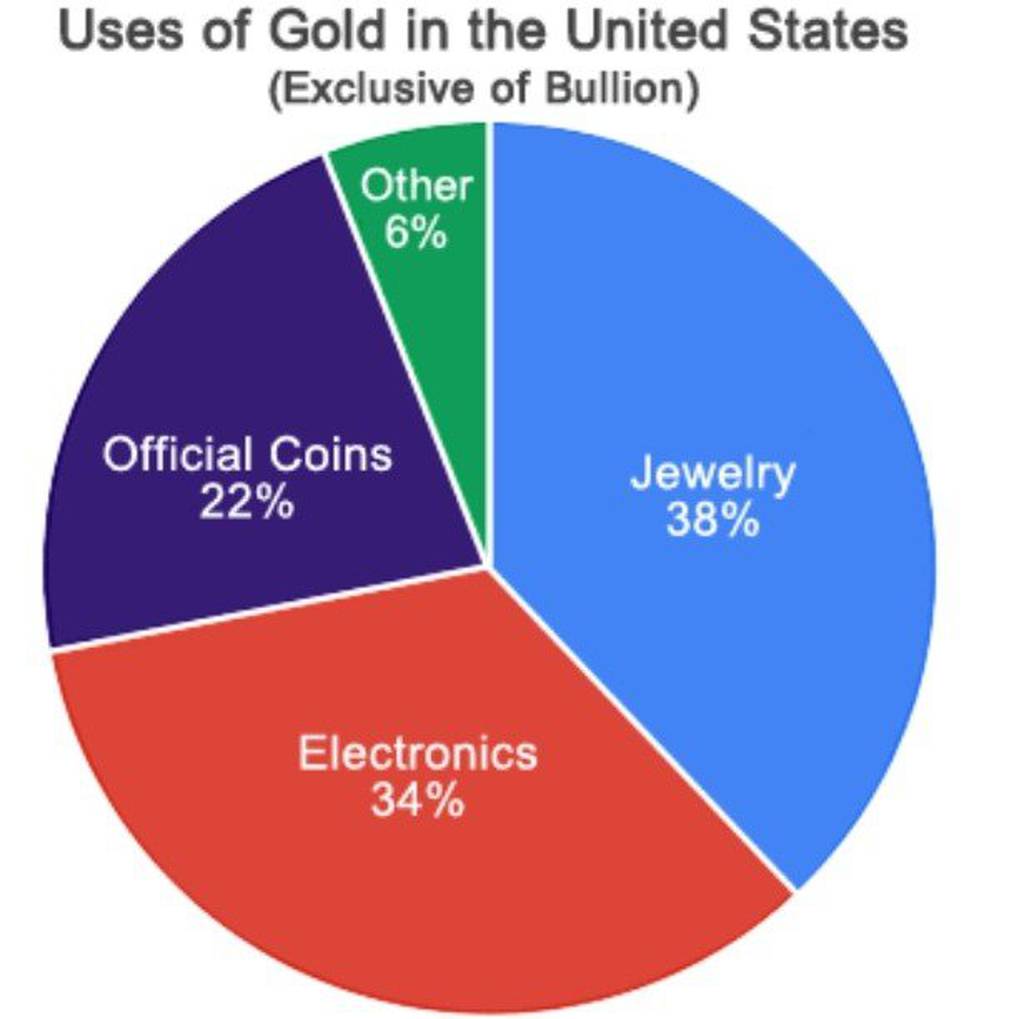

Gold and silver, on the other hand, represent physical commodities. Not only are they valued for their rarity, but they also have practical applications. For example, both are used in jewelry fabrication and for certain industrial uses.

The screenshot below shows the distribution of gold use in the United States. Note that 34% of gold is used in electronics.

Gold as a Counter-cyclical Investment

Were going to focus primarily on gold in this section because it’s the more documented of the two precious metals.

The main arguments against gold as an investment are that 1) it doesn’t pay interest or dividends, and 2) it’s not an all-weather investment (doesn’t perform consistently in all types of market environments).

Those are legitimate concerns, but they miss what might be the bigger point. Gold is, for the most part, an asset that performs best when the economy and the financial markets are at their worst. That makes gold a true counter-cyclical investment--it’s often the only asset that turns in a positive performance when paper assets are falling.

The U.S. experienced two periods of extreme crisis since World War II, and gold easily outperformed the financial markets in both.

The First Was the 1970s

During the decade, the U.S. economy, financial markets, and even the whole financial system seemed to be unraveling. From January 1970 to January 1980, the S&P 500 index rose from 90 to 110. That represented an increase of just 22% for the decade. But that’s poor performance--and a decline in real terms--during a decade in which general price levels more than doubled.

The story with gold was dramatically different. The price of gold averaged $36 per ounce in 1970. The average price in 1980 was $615. For the decade of the 1970s, the price of gold increased by just over 1,700%. Even if you account for the doubling of general price levels, gold still increased by 850% in real terms. Stocks, on the other hand, went decidedly negative for the entire decade.

The Second Was the Financial Meltdown (2007 to 2009)

The financial markets experienced a sudden and dramatic crash in a space of less than three years. Gold went in the opposite direction.

From January 1, 2007, through January 1, 2010, the S&P 500 index fell from 1424 to 1123, for a decline of about 21%. But even that didn’t capture the full extent of the decline, since the market was down well over 50% from peak to trough within that time frame.

But during the same timeframe, the price of gold increased from $640 on January 2, 2007, to $1,120 on January 4, 2010. That’s an increase of 75% during a time that was marked by severe declines in financial asset values.

Gold Has Kept Pace with Financial Assets

Much is made of how stocks have heavily outperformed gold in recent decades. And there is abundant evidence that’s been completely true during certain very specific time frames. But if we go back to 1970, and compare the price of gold and the level of the S&P 500 between then and now, we see a surprising development: Gold has at least matched the performance of the S&P 500 since 1970.

Collectively, the S&P 500 index has increased from 90 in January 1970, to a recent level of 3046. This represents a gain of nearly 3,400%. But the price of gold, rising from $36 in 1970 to its current level of $1,500 per ounce, has experienced a cumulative gain of 4,160%. Gold has had a slight performance advantage over the S&P 500 over a space of nearly 50 years.

Whether you’re looking at times of extreme crisis, the past 50 years, or the past 5,000 years, gold has maintained an exceptional performance. Not only does that substantiate its reputation as a long-term store of value, but it also shows its importance as one of the very few true counter-cyclical assets available to investors.

That makes a strong case for maintaining at least a small allocation in gold and silver in your portfolio, despite the chorus of naysayers.

What About Silver?

The case for silver is somewhat weaker than it is for gold. Though it has performed well during certain periods of crisis, the longer-term performance has been well below either gold or stocks. The metal has provided a cumulative return of about 1700% since 1970, rising from just over $1 per ounce then, to about $18 today. It’s a positive performance, but still less than half the returns on either stocks or gold.

The main advantage of investing in silver may be bullion coins. With the price of gold being as high as it is, buying a single one-ounce gold bullion coin can be out of reach for small investors. If you have a small amount of money to invest, it may be better held in silver bullion coins, which are currently available at only a little bit more than 1% of the cost of gold bullion coins.

How to Invest in Gold and Silver

Now that we’ve established why you should invest in gold and silver, let’s take a look at the specific ways you can do it.

Gold and Silver Bullion

Through the centuries, this has been the preferred way to own gold and silver. Even today, some investors favor bullion as a way to hold an asset that will retain or expand its value in the face of a potential collapse of the financial system.

The primary advantage of gold and silver bullion is that they’re cash and carry assets,” at least if you take physical possession of the metals.

You can buy bullion in either coin or bar form. The most popular gold bullion coins are the American Eagle, Canadian Maple Leaf, and the South African Krugerrand. Each coin contains one full ounce of gold, but they may also be available in half ounce, quarter ounce, and 1/10 ounce coins. There’s typically a markup of 5% to 10% above the bullion value of these coins if you buy through a coin dealer or online exchange.

Silver bullion coins are typically pre-1965 U.S. coins, including commonly minted silver dollars, half dollars, quarters, and dimes. However, availability has become increasingly difficult as many have been melted down.

You can purchase commemorative silver bullion coins, but they have a significant markup above the metal price. Silver coins are more typically available in numismatic varieties. These are coins minted in previous centuries, that carry prices well above the bullion value. This is due to the fact that the coins are popular with collectors and increasingly rare.

Numismatic coins can sell for several times more than the metal value of the coin, which means the primary value is numismatic, rather than based on the price of silver itself.

You can also purchase gold or silver bars. Amounts range from one- to 400-ounces. There’s a lower markup on bars, and they’re a better way to purchase a large amount of either metal.

Where to buy gold and silver bullion

You can buy gold and silver coins at local coin dealers. But they may have limited availability, and charge higher than normal markups. Local shops are also often more oriented toward numismatic coins than bullion. You also need to be concerned with the reputation of a local coin dealer. Check references with the Better Business Bureau, your local or state department of consumer affairs, or various online sources to determine if there have been any complaints.

You can also purchase gold and silver coins and bars from various large online sources. These are companies that have physical facilities, but market bullion worldwide.

Some of the more recognized names among online bullion dealers include the following:

Selling Gold and Silver Bullion

If you decide to sell your gold or silver bullion, you can sell it back to the coin shop or online dealer where you bought it, or even one where you didn’t. They act as bullion exchanges, that both buy and sell the metals. But you may also be able to sell your bullion online, using platforms such as eBay and Craigslist. Just make sure you receive payment before shipping the metals.

Where to Store Gold and Silver Bullion

There are three primary choices:

- Take physical possession. This is where you take personal custody of the bullion. You’ll need to store it in a safe place, somewhere it’s unlikely to be destroyed by fire or some other disaster. But you may also want to add a rider to your homeowners insurance policy to provide coverage in the event of loss.

- Storage with the exchange you bought the bullion from. Most online exchanges will also provide storage for your bullion. However, there will be a cost to do so. Others that don’t provide storage facilities may recommend other reputable providers.

- IRA accounts. Certain self-directed IRAs will allow you to hold bullion coins in the account. American Gold Eagles are an example. It’s a specialized process, and you’ll need to find an IRA custodian specializing in the practice. Also, be aware that you cannot hold numismatic coins in an IRA account.

Unifimoney to Invest in Gold and Silver

There used to be a time when investing in gold and silver was only for the ultra-wealthy. Fortunately, this is no longer the case, as services such as Unifimoney allow anyone to get involved.

Just the same as other investments, you can trade gold and silver from the Unifimoney app, available on IOS. Here are some of the many features:

- Buy any quantity

- Instant liquidity (24/7 access)

- 100 percent physical metal backing

- Third party verification & audit

When you buy and trade gold and silver via Unifimoney, you can rest assured that you’re in good hands.

Visit Unifimoney

*Editorial Note: This offer is no longer available. Please visit the Unifimoney website for current terms.

Gold Exchange Traded Funds (ETFs)

If you want to own gold bullion, but don’t want to buy individual coins or bars, you can invest in a gold ETF. That’s an ETF that holds the bullion at a central facility and allows you to buy shares in the fund. Not only will that avoid the need to buy, store, and ultimately sell your bullion, but you can also purchase shares just as you would any other financial assets.

Examples of gold ETFs include SPDR Gold Shares (GLD) and iShares Gold Trust (IAU). Since they are ETFs, they can be bought and sold through popular investment brokers.

Gold Mining Stocks

Some gold investors prefer investing through gold mining stocks. That’s because gold mining stocks offer more leverage than the bullion itself. For example, if the price of bullion increases by 20%, the value of gold mining stocks may increase by 50% or more. That’s due to the increased profit potential that comes with greater demand for bullion.

But there are a few problems with gold mining stocks. First, they’re stocks, not bullion. That is, investing in gold mining stocks is not the same thing as investing in the metal itself. As gold mining companies, they’re subject to all the economic forces affecting all other companies. That includes government regulation, credit liquidity, interest rates, availability of labor, and even trade issues.

Second, the mining industry, in general, is highly speculative. Capital costs are high, and it can take years to convert proven deposits into productive mines. In the meantime, bullion prices could fall, leaving mining companies in an impaired situation.

Third, much of the gold mining activity in the world takes place in unstable regions. A gold mining company can see its mines shut down or nationalized by the local government. Or there may be invasions or civil wars.

Gold stocks are extremely speculative, not recommended for the average investor, and not a suitable replacement for bullion in your portfolio.

Gold Funds

If you like the profit potential of gold mining stocks, but don’t want to buy individual companies, you can invest in gold funds instead. A fund will allow you to invest in the shares of many different gold mining companies, which will reduce the risk of holding just one or two companies, or the cost of holding many.

Examples of funds include the VanEck Vectors Gold Miners ETF (GDX) and Fidelity Select Gold Portfolio (FSAGX).

Just like gold ETFs, gold funds can be purchased, held, and sold through major investment brokers.

But whether you plan to invest in gold mining stocks directly, or through gold funds, it’s best to hold no more than a small, single-digit percentage of your portfolio in these investments. That’ll give you just enough exposure to the sector if it takes off, but very little risk in the more-likely event it turns down.

Final Thoughts on How to Buy Gold and Silver

Now that you understand the benefits of investing in gold and silver, as well as how to buy it, give serious thought to adding a small position in these metals to your portfolio. No, they won’t provide the steady returns that interest-bearing assets and stocks do. But they have real potential to perform well when those other investments arent.

Just a small allocation--5% to 10%--could add a significant amount of protection to your portfolio if things get ugly in the financial markets.

Recommended Investing Partner

If you are really eager to start investing, one of our recommended choices is Wealthfront. They have an easily attainable minimum balance, low fees, and a simple, convenient interface. They're a great choice to start investing easily and quickly.