According to CNN Money, about 15% of bank account applicants are denied regular savings and checking accounts because of their banking history. Banks usually get information about this history from a company called ChexSystems, which maintains a file of information on your checking account history similar to your credit report.

ChexSystems, which is governed by the Fair Credit Reporting Act just like larger credit reporting bureaus, simply record negative banking account information. Items like non-sufficient funds overdrafts and unpaid bank account liens will stay on your report for up to five years.

So if you’ve made checking account mistakes in the past – especially issues like frequent overdrafts or unpaid obligations – you may be denied when you apply for a new savings or checking account. In addition, some banks pull your credit report and will deny your application if your credit score doesn’t meet their requirements.

If you do get denied, don’t worry, though; you’ve got plenty of alternative options.

Find Out Why You’ve Been Denied

The first step you should take when you’re denied a checking account is to figure out why you’ve been denied. Under the Fair Credit Reporting Act, banks are required to tell you why you’ve been denied a bank account.

The most likely reason to be denied an account is that you’ve got an outstanding debt with a bank – often because of unpaid bank fees. But you may also be denied because of a history of frequent overdrafts. Just ask the bank that has denied you exactly what the issue is.

Your next step is likely to check out your ChexSystems report, which you can access at ConsumerDebit.com. Like your credit reports, you can get one free copy of your ChexSystems report every twelve months. The report will show which bank or banks have reported you and why.

If you owe a bank money according to your ChexSystems report, you’ll need to either negotiate with the bank you owe to pay off the debt, or dispute the report as inaccurate.

If you pay off your debt with a bank, they’ll have to report the account as paid to ChexSystems, which may help your case next time you apply for an account. If the report is wrong, you can talk to the reporting bank first. If they refuse to deal with the matter, dispute the information with ChexSystems, who is required by law to investigate the claim.

The fact of the matter is that it can take months – or even years – to clean up your ChexSystems report. In the meantime, you may need to take advantage of other bank account options so that you can pay your mortgage on time and avoid hefty transfer or cashier’s check fees.

Consider Alternatives

1. Alternative checking accounts

As companies seek to reach out to unbanked or underbanked Americans, more are coming up with tempting checking account alternatives. These alternatives often come with lots of features and low fees, though you’ll want to do your research so you know exactly what you’re getting into.

Chime® is an award-winning financial app and debit card that offers a terrific online savings and checking account geared toward savers. Using the Chime checkbook feature, you can send checks to anyone you wish; fee-free.

There are no account opening fees, no monthly maintenance fees and the only fee you’re likely to incur is ATM fees for using a network, not in the Chime network.

Another great benefit of Chime is that you can get paid 2 days earlier with direct deposit. Your money doesn’t get stuck in “electronic limbo” as Chime puts it. Early access to direct deposit funds depends on the payer.

To open a Chime account, there is no credit check. When approved, you’ll have access to a Chime Visa® Credit Card, a Spending Account, and an optional savings account should you need one.

Chime Disclosure - Chime is a financial technology company, not a bank. Banking services and debit card provided by The Bancorp Bank or Stride Bank, N.A.; Members FDIC.

1Save When I Get Paid automatically transfers 10% of your direct deposits of $500 or more from your Checking Account into your savings account.

^Round Ups automatically round up debit card purchases to the nearest dollar and transfer the round up from your Chime Checking Account to your savings account.

Read More: Chime Review – Fee-Free Account

Aspiration is an online “neobank” that offers access to high-interest spend and save accounts without fees. It’s completely free to set up an account with Aspiration and, once you do so, you can unlock their cashback features. This includes up to 3-5% cash back in your favorite stores, including Warby Parker, Target, and Walmart.

If you’re looking for a company that makes a difference, Aspiration is a great choice. It supports users that want to invest in environmentally sustainable businesses and pledges to give a portion of fees to a collection of global charities.

With Aspiration, you can do everything you would do at a regular bank: send and receive cash, carry out mobile check deposits, make free withdrawals from one of 55,000 ATMs around the world, and manage your money from one place.

Read More: Aspiration Review

Revolut – If you can’t get a traditional bank account, working with a fintech company can help you get the financial services that you need.

One fintech company that is popular in Europe, but new to the American market, is Revolut. Revolut offers a debit account and debit card. You can use the app to store your money and use your card to make purchases in-store or online or withdraw cash at more than 55,000 fee-free ATMs across the country.

Revolut makes it easy to send and receive dozens of major world currencies and cryptocurrencies, making it a one-stop-shop for all your financial needs. It also offers valuable features like budgeting tools and single-use virtual card numbers that can keep your information safe.

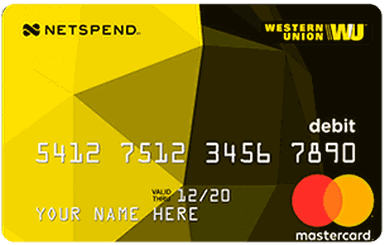

2. Prepaid cards

Prepaid cards were once known for their outrageous fees, but they’re becoming much more reasonable in recent years. Many prepaid cards function very similarly to checking accounts – even allowing for automatic paycheck deposits.

Be sure you research prepaid card options to ensure that you’re getting the best possible deal – especially when it comes to fees. And be sure you choose a card with the basic functions you need most, whether that’s paying bills online or getting gas at the pump.

The Netspend® Visa® Prepaid Card offers cardmembers a variety of feature that makes it one of our favorites. You can use Netspend Direct Deposit to get paid 2 days faster than other direct deposits and there are never any late fees or interest charged because this isn’t a credit card.

During tax season, you can get your refund deposited directly onto your Netspend® Visa® Prepaid Card. And, there’s a mobile app that will help you manage your account and receive text messages and alerts.

3. Secured credit cards

A secured credit card is a good way to build your credit, which may help you get a checking account in the future. With these cards, you pay a deposit upfront. The deposit is held by the card issuer in case of default. Sometimes these deposits also earn interest like a checking account.

Secured credit cards generally have a very low credit limit and a high-interest rate. But if you use a secured card to pay your bills each month, paying it off at the end of the month, you won’t have to worry about interest. One thing to note: you’ll need to be sure you have a way to actually pay off your secured credit card if you don’t have a bank account!

4. “Second chance” checking accounts

One final alternative to a traditional checking account is a second chance checking account. These accounts include most of the same features as regular checking accounts – checks, ATM access, online bill pay, debit cards, money transfers, and direct deposit.

The main difference is that these accounts often come with higher annual/monthly maintenance fees or require a larger opening deposit. Basically, these accounts are set up to give consumers a “second chance” while protecting the bank from losing too much money.

Some banks that offer second chance checking accounts don’t even check your ChexSystems file. Others will require that any outstanding balances from old banks (reported in your ChexSystems file) be paid off before you can get a second chance account.

A second chance checking account can be a good way to establish a better bank account history, and can often lead you into a lower-fee, traditional checking account within a few months to a year.

5. Repair any negative information on your ChexSystems report then apply for a regular checking account

Earlier, under “Find Out Why You’ve Been Denied”, I recommended obtaining a copy of your ChexSystems report, and either disputing any negative information it contains or settling any outstanding balances due with a previous bank (or banks). You’ll need to do this if you ever hope to open a traditional bank account in the future. The best strategy is to deal with ChexSystems right now to keep it from being a problem going forward.

While it’s true that it can take weeks or months to dispute negative information or settle accounts if you have outstanding balances with several banks. But if your ChexSystems report is showing only one bank with an outstanding balance, you may be able to clear up the situation by settling that account as soon as possible.

It may be that a single outstanding bank balance is preventing you from getting a traditional bank account. But when you consider the benefits available with many traditional bank accounts you should have all the incentives you need to repair your previous bank history as soon as possible.

BBVA Online Checking

For example, BBVA Online Checking is a free checking account you can open with a minimum deposit of just $25. And once opened, there is no monthly service fee, and no minimum balance required. They also offer no ATM fees at more than 64,000 ATMs and participating 7-Eleven stores nationwide. You’ll also receive a Visa Debit Card, as well as access to Online Banking, Mobile Banking, and Bill pay – all free of charge.

But the free account is just the beginning. BBVA offers its Simple Cash Back program with the account. It comes with a Visa debit card, and you must either download the mobile banking app or participate in online banking to be eligible. But once you are, you’ll receive cash back offers at participating merchants.

The cash back earned will be deposited into your account the month after eligible purchases are made. And since it’s cash into your account, it’s a true cashback arrangement.

BBVA Online Checking is just one example of the many traditional bank accounts offering benefits and rewards that will help you improve your financial situation. They’ll be available once you’ve repaired any negative information appearing on your ChexSystems report, so start working on that today.

Related: Have a business? Check out the Best Business Checking Accounts