When is the last time you went out to a restaurant with a group of friends or colleagues, and everyone at the table pulled out cash to settle their part of the bill? If you are like most people, you’d be hard-pressed to answer that question. (And if you’re under 30, the answer might be, Never.)

Splitting bills when you're paying via credit card or debit card can get hairy. It's often easier to have one person pay and everyone else pay that person back. But even that can get tough unless you want to start accepting checks.

Enter money-sending apps. These apps make for a convenient, painless way to transfer cash from yourself to friends and family, or vice versa. These make sharing expenses painless and quick. Plus, there’s no longer an excuse for that one friend to conveniently forget to pay you back for months on end.

Deal of the Day: Chase is now offering a $200 cash bonus when opening a Total Checking® Account. No minimum deposit and all deposits are FDIC insured up to the $250,000 per depositor maximum.

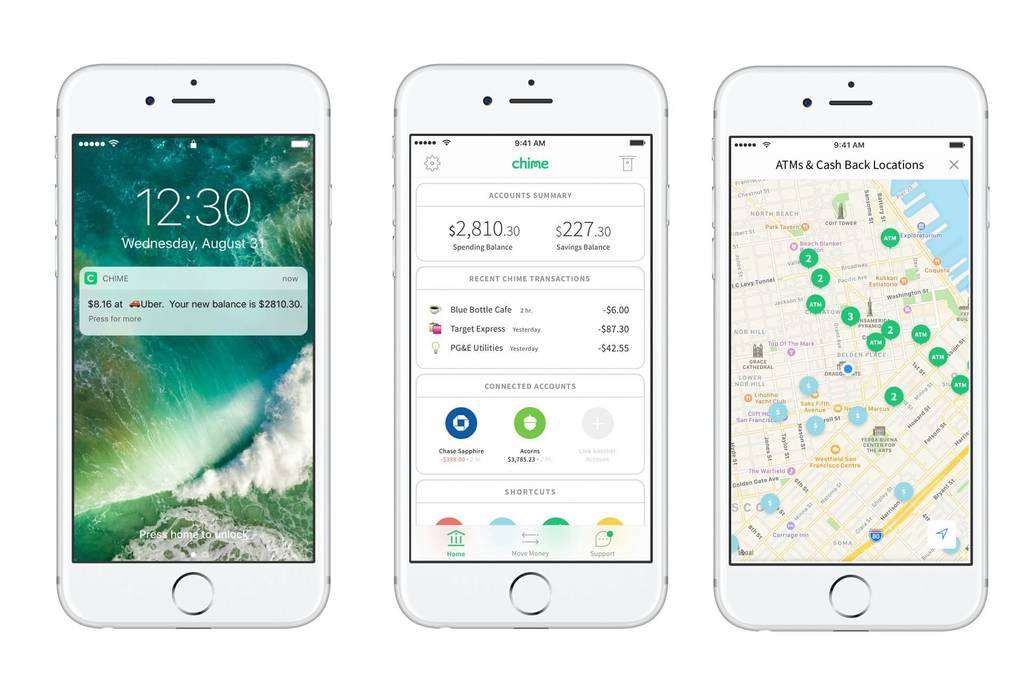

1. Chime®

Chime is an award-winning financial app and debit card with a lot of great features to make it easy to send money to your friends and family.

Chime has no minimum balance requirements and no monthly fees, which means anyone can benefit from its offerings. One useful service it offers is SpotMe® which safeguards you from expensive overdraft fees. SpotMe® can give you between $20 and $200 to cover expenses, even if your account is empty. You automatically repay the debt with your next direct deposit, fee-free.

Chimes Pay Friends feature lets you send money to your friends. All you need is their phone number. You can send up to $2,000 per month this way, with no fees.

Pros: There are no monthly fees to use Chime.

Cons: There are no physical locations.

Visit Chime or check out our full review.

Chime Disclosure - Chime is a financial technology company, not a bank. Banking services and debit card provided by The Bancorp Bank, N.A. or Stride Bank, N.A.; Members FDIC.

1Chime cannot guarantee when files are sent by the IRS and funds can be made available.

^Early access to direct deposit funds depends on the timing of the submission of the payment file from the payer. We generally make these funds available on the day the payment file is received, which may be up to 2 days earlier than the scheduled payment date.

2. Venmo

Venmo has been around since 2009 and is now one of the most popular money transfer apps around. In fact, it’s so popular that among millennials, in particular, it’s become a verb. It’s common to hear someone saying just Venmo me when discussing splitting a check or expense.

Venmo’s claim to fame is that it allows users to send money to friends easily. You can link a debit card or bank account to your Venmo account. You can also carry a balance in your Venmo account. Transfers from these options are free.

You can also use a credit card to send money, but this comes with a 3% fee. It's always free to receive money through Venmo.

Transfers to your Venmo account are available within Venmo immediately. You can then transfer that money elsewhere or save it until you need to pay someone through Venmo. You can also transfer the money to your linked debit card or bank account.

Pros: Venmo boasts an easy-to-use interface and a quick app. It also offers bank-level security, so you can be relatively certain your money is safe.

Venmo also has a Facebook-like feed where you can see who is paying whom for what. It's kind of a quirky aspect of the service, but it can be interesting. You can, of course, decide which payments to share on your feed.

You can also start a group account on Venmo to handle money for a group like a student organization or club. This can make managing this type of money pretty simple.

Finally, Venmo allows for a simple splitting of payments.

Cons: The social aspect of Venmo can also be a negative. For those who either don’t care to know about the payment activity of others, the feed can be a bit of an annoying distraction. For the privacy-minded, Venmo’s settings do allow you to turn off sharing. That way, no one else can see where or why you are sending money.

Payments are not made directly to your bank account, but rather get applied to your Venmo Balance. Users must then manually transfer funds from their Venmo balance to their bank account. So it often takes a few days for the cash from your Venmo balance to reach your bank account.

Another downside is that the app does not use your Venmo balance to cover transactions larger than your Venmo balance. For example, say you need to pay someone $60 and have $35 in your Venmo balance. There is no option for you to just pay the $25 difference from your linked debit or credit card. You must pay the whole payment from the debit or credit card, or make two separate transfers.

What Venmo says about its app:

Pay family and friends in the US with a phone number or email, whether or not they have Venmo all they need to do is create a Venmo account to claim their payment. Find friends automatically by syncing your Facebook or phone contacts.

Related: Best Payment Apps

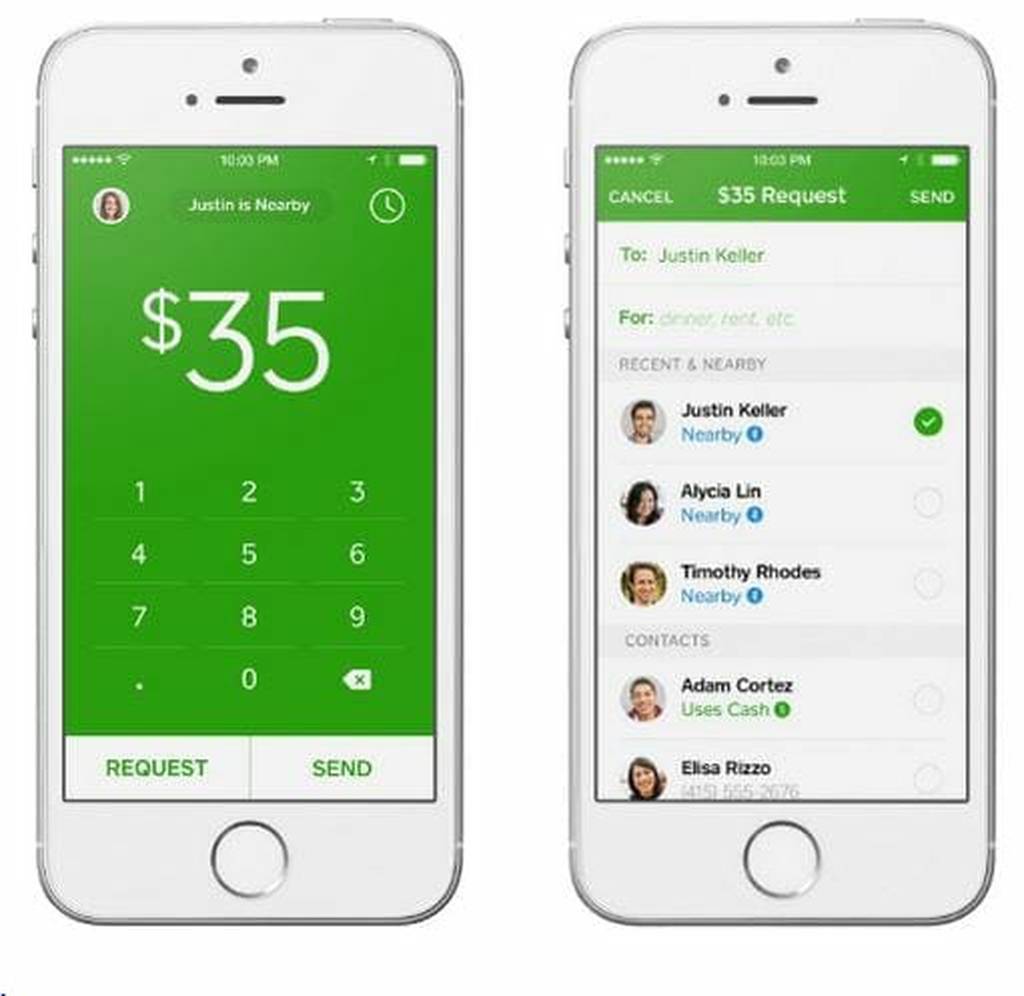

3. Square Cash

Square has been around for a while as a payment processor for small businesses. It also offers options to transfer money personally. As with the other apps featured here, Square Cash is an app that allows users to transfer money through email, or by way of the app directly. In order to transfer money for free, you must link a debit card.

There is no charge to send, request, or receive money through the app, if you choose Personal Use at setup. If you send funds via a credit card, however, there is a 3% processing fee (paid by the sender).

You can also refer new users to Square Cash through the Invite feature of the app. When they make their first $50 transfer, you’ll both receive a $5 bonus in your account!

Another interesting perk of Square Cash is that it comes with its own Visa Debit card. The card is linked to your Square Cash balance, and makes it safe to make actual purchases with that balance.

Pros: This service is easy to use, and you have the option to handle money directly in your Square Cash account or send it to your bank account. For a 1% fee, you can use an Instant Deposit to get money in your bank account right away. Or if you need money to spend, you can just use the attached debit card to spend directly from your Square Cash account.

Cons: Square requires a bit more security if you’re sending larger amounts of cash. If you send more than $250 in one week, the app will ask for personally-identifying information like the last four digits of your Social Security number. Once you’ve given this information, though, your limit will be raised to $2,500 for that week in most states.

What Square Cash says about its app:

Whether splitting a dinner bill with friends or paying your landlord for the month’s rent, Square Cash is the easiest way to send money. Cash is available for both personal and business use.

$Cashtags: Square markets this unique feature as a “virtual tip jar.” You can use these to receive payments from outside of the Square app. You’ll create your own personal $Cashtag that links to a Square URL. Then you can give out the URL to people who want to send you cash. You can use it to split payments or even to receive tips from your website, artwork, or whatever other endeavor you have going on.

The $Cashtags aspect of Square Cash is also beneficial for those accepting donations or funding for specific causes/goals. A graduate could set up a $cashtag page for contributions to his mission trip in Kenya. A restaurant could raise money to support someone in their community. Or a bride and groom could set up a honeymoon $cashtag in lieu of a wedding registry. The possibilities are endless.

The biggest downside for the person accepting funds, however, is that any money accepted through $Cashtags is subject to a 1.5% fee. Payments are transferred directly to your bank account.

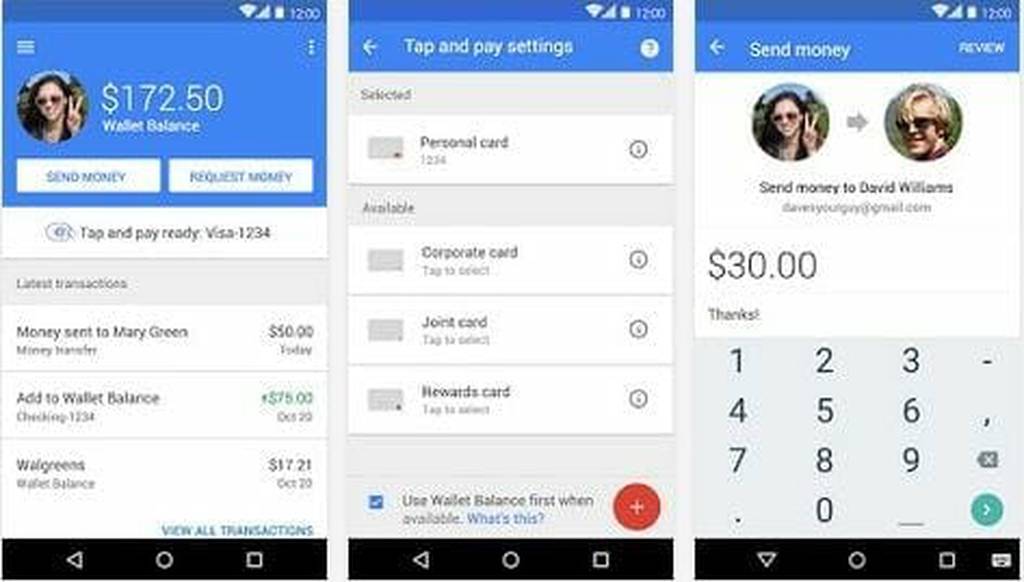

4. Google Wallet

You can send and receive money via Google Wallet using a convenient app or your desktop computer. Make payments by linking a debit card to your Google Wallet account, and Google then transfers the money fee-free. Google Wallet is available for Android devices.

Security: Google uses a Payments PIN for accessing your Wallet. If you ever lose your phone (or it gets stolen), you can log in to your Google account and remove access to your Google wallet account on that device.

Google even goes so far as to provide 24/7 fraud monitoring, and Google covers 100% of all verified unauthorized transactions.

Pros: The Google brand is well known and trusted. It’s also quite easy to send money from the app. Just use the recipient’s email address or phone number, or send directly from Gmail. You can also use the Google Wallet site and app to do more than send money to friends and family members. You can use it for online spending quite easily, as well.

Another pro of Google Wallet is the ease of sending money. You only need to provide your phone number or email address to get money from others.

Cons: You can’t send or receive money between two countries through Google Wallet. Luckily, this should not present a problem to the majority of users.

What Google says about its app:

Send money to anyone in the US using an email address or phone number. It’s fast, easy, and free to send directly from your debit card, bank account, or Wallet Balance. You can do all this in the Google Wallet app, or, if you’re on a desktop, you can also send and request money in Gmail. When you receive money, you can quickly cash out to your bank account using your debit card, and get access to your money within minutes.

5. Paypal

Paypal has long been the go-to method for making payments and sending money online. Utilized by individuals and businesses alike, the company has become a household name. Since it introduced its web store plug-in, you’d have a tough time finding someone who hasn’t used or at least seen, Paypal.

Beyond online purchases, you can also use Paypal to send and receive money to friends and family, free of charge. As long as you use a bank account or Paypal balance, and choose the Send money to friends or family option, there is no fee for the transfer. For a fee, you can also choose to transfer money to friends or family from a credit card.

As with some of the other apps here, you can carry a balance within PayPal. Or you can transfer the balance to your bank account. It has a more recent option that allows you to transfer money through a debit card to your checking account. It has a $.25 fee, but it gets the money into your bank account within an hour, most of the time.

PayPal also offers the option of a Money Pool. You can join with friends and family members to collect money for a particular cause. And then it stays in your pool's balance until you need the money.

Pros: Well-known and trusted, the relatively easy-to-use site allows for storage of your shipping information, credit and debit cards, and the email addresses of others with whom you exchange money. Many companies also allow for direct linking to your Paypal account. This allows for even faster checkout (or payment acceptance) on sites like Etsy and eBay.

Cons: PayPal is notorious for shutting down or freezing accounts if they see any activity they consider fraudulent.

What PayPal says about its service:

Your cash and cards can rest easy. PayPal lets you send money to anyone’s email address or mobile number--whether it’s a friend, school, or family member. They can set up a PayPal account for free, and the money goes right into it. Send money across the street or internationally as fast as you can enter your secure PIN.

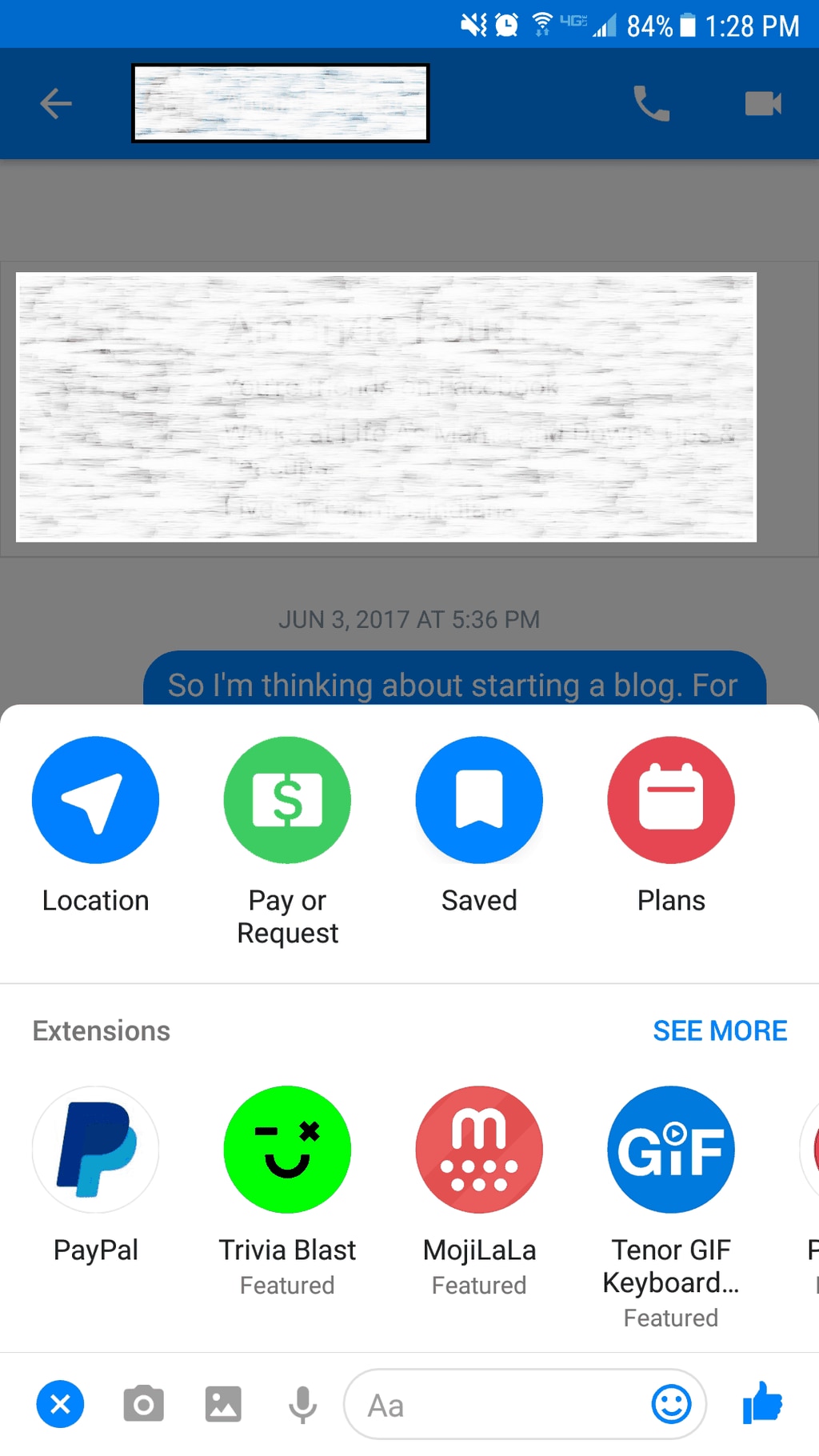

6. Facebook Messenger

A relative newcomer to the money-transfer market, Facebook Messenger now lets you send or collect money through the popular messaging app. To make it happen, you just have to link a debit card to your Facebook Messenger account. When you're in a message, click the dollar sign, enter the amount of money you want to send, and get it done. You can receive money the same way, as long as you've added a debit card to the account.

Pros: This service is easy to incorporate into social apps you’re only using, and it’s free.

Cons: It can take between one and three days to get money deposited into your account, and it only supports debit cards.

Conclusion

While it’s clear that each of these apps is trying to present their forms as unique, the functions are essentially the same. The user interfaces, fees, and security features vary somewhat. Overall, there does not seem to be a clear winner among them that stands out above the rest.

At the end of the day, which app you choose to use for your digital cash transfers is likely to be determined by which app the majority of the people in your cash transferring circle are using. You may very well end up using some combination of them. If all else fails, you could always hunt down some actual dollar bills and settle up the old-fashioned way.

Do you use any of the apps named here? What did you think?