If you’re looking for a free way to check your credit score, look no further than three websites. Quizzle.com, CreditKarma.com, and CreditSesame.com each offer free scores. Although they offer similar services, each site has its own nuances and unique perks.

But before we get into an analysis of each service, it’s important to understand one thing. The credit score you receive from free credit score services is not based on the official FICO scoring model.

Instead, you’ll receive a credit score based on models developed by the credit reporting agencies. So the score you see may differ somewhat from what lenders will actually see. However, in my experience, these scores are very similar to your FICO score. The benefit of these services, as you’ll see, is that they can help you improve your score at no cost.

With that information in mind, let’s take a look at all three free credit monitoring services.

Credit Karma

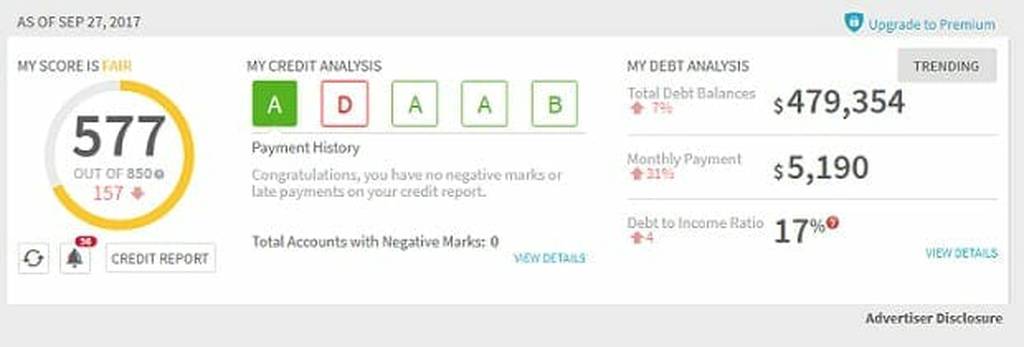

Credit Karma offers a free credit monitoring service that makes it easy to access your scores and credit reports at any time. In addition to a free estimated credit score, you can also sign up for free automatic credit alerts, email alerts when important changes occur, and identity theft tracking and protection.

One of the benefits of Credit Karma is that it tracks your estimated score based on two different credit reports--the one from TransUnion and the one from Equifax. They don't say the exact scoring model they use, but some suggest they use either TransUnion's New Account score or the VantageScore model.

One of the best parts of Credit Karma is its free credit simulator. It takes into account all of your current credit information, and then lets you visualize what effect different moves will have on that score. You can see what would happen if you racked up more credit card debt or paid some off. What if you made a late payment, or made zero late payments for the next six months?

With the simulator, you can easily figure out which financial choices are likely to have the biggest impact on your credit score. This is an excellent tool if you're seeking to improve your credit score over time.

Credit Karma also offers several good calculators, including a home affordability calculator, a debt repayment calculator, and an amortization calculator.

Credit Sesame

Credit Sesame provides you with free credit monitoring. And it’s not a limited-time free offer that requires you to put a credit card on file, either!

Like the other two services listed here, Credit Sesame will only pull your information from a single credit bureau. In this case, the score is based on your TransUnion credit file, and it's based on the VantageScore 3.0.

Credit Sesame features a slick interface. It gives you your current score, as well as some information about why your score is what it is. You can also sign up for credit monitoring alerts. The feature alerts you to changes in your credit score or TransUnion credit report.

Here are some of the other benefits offered for free through Credit Sesame:

- Free Identity Theft Protection--When you sign up for the site, you get $50,000 in identity theft insurance and fraud resolution assistance.

- Mobile Apps--Credit Sesame offers a mobile app that allows you to access the same information and tools that are available on the website using your iPhone or Android mobile device.

- The Best Rates Available--Credit Sesame will help you find the best rates available on personal loans, investment accounts, and auto insurance policies.

- Credit Card Suggestions--Using the information provided in your credit profile, Credit Sesame is able to suggest balance transfer and rewards offers that might benefit you.

Quizzle

Quizzle gives you a free credit report every three months, and they don't require you to put a credit card on file. Along with your free credit report, Quizzle also provides you with a free credit score.

Like Credit Sesame, Quizzle uses the VantageScore model and your TransUnion credit report. The VantageScore model is still not used as often as the FICO model, but it's gaining steam with lenders.

The VantageScore tends to be better for people with little credit history. It also assigns a hierarchy to late payments, whereas FICO treats most of them equally. For instance, with a VantageScore, a late mortgage payment will have a larger impact than a late credit card payment.

Experian

Another option is Experian. You get your Experian credit report and FICO score when you sign up for Experian’s Score Tracker. You get a 7-day free trial.

Related: Credit Karma vs. Experian

Credit Builder Tools

In addition to the free credit report and credit score, Quizzle also provides the following Credit Builder tools:

- Credit Comparison--This feature lets you compare two of your last four credit reports for a line-by-line analysis of why your score went up or down.

- Score Analysis--This feature analyzes your credit score and suggests ways to improve it.

- Credit Timeline--This feature uses charts and graphs to illustrate how your credit score fluctuates over time.

- Credit Trending--This tool tracks the direction of your credit; that can include the direction of your credit score, credit utilization, and your available credit.

If you want to pay for their services, Quizzle also offers packages with wider benefits. The Quizzle Pro Plan, for example, provides you with a monthly credit report, credit score update, and 24/7 monitoring for $8 per month.

Meanwhile, Quizzle Pro+ offers everything that the Pro version has in addition to public records monitoring, sex offender monitoring, lost wallet protection, and tri-bureau dispute resolution for $15 per month.

Under ordinary circumstances, the free version will probably meet your needs quite well. However, if you are trying to build your credit or want to monitor changes to your credit more closely, you may want to consider one of their paid services.

Looking for Identity Theft Service? Check out LifeLock

Which Credit Monitoring Service is Best?

If you're trying to decide which site to use for your free credit score, you should know that you don't have to pick just one. If you want all of the perks that these services offer, you can easily sign up for all three.

The most important thing to remember is that your credit score matters. Whether you use just one site or all three, it’s crucial that you stay on top of your score. Since all three of these sites offer this important information for free, you have no excuse not to sign up for at least one of them.

What’s your opinion? Have you used any of these three free credit monitoring services? If so, which would you recommend?

Listen to our show on how to track all three of your credit scores