Overall Ranking

4.6/5

Overview

4.75/5

5/5

4.4/5

4.75/5

4/5

If you’re finding yourself short money at the end of each month, you may need help with budgeting. Here’s one that fits neatly in your pocket–it’s called PocketGuard. Here’s everything you need to know about this app from cost to customer service.

Editor's Note

You can trust the integrity of our balanced, independent financial advice. We may, however, receive compensation from the issuers of some products mentioned in this article. Opinions are the author's alone. This content has not been provided by, reviewed, approved or endorsed by any advertiser, unless otherwise noted below.

There are plenty of budgeting services and apps to choose from. One well worth taking a close look at is PocketGuard. It’s a free app that tracks your spending, helps you to budget for expenses, and begin allocating money for savings.

It doesn’t promise to make you rich, but it can give you greater control over your finances. And that’s the first step forward with all things financial.

What is PocketGuard?

PocketGuard is a personal finance information management service, designed to help you track your spending, create a budget and lower expenses. It also has the capability to monitor for potentially unwanted and unauthorized charges. This can include hidden fees, billing errors, forgotten subscriptions, scams, and fraud.

PocketGuard is an app that is available for download at the App Store and Google Play. It is currently available only in the U.S. and Canada, though they plan to expand internationally in the future. A web app is being beta tested, and does not yet match the services and features available on the mobile app.

PocketGuard works in five steps:

- See the big picture. You link your bank accounts, credit cards, investments and loan accounts, so your entire financial life is assembled on the app.

- Be aware of your spending. Transactions are updated and characterized in real-time, giving you an opportunity to see where your money goes and how you can save.

- Know what’s safe to spend. This is the “pocket” part of PocketGuard. It lets you know how much money is left over after you’ve paid all your bills, and set some aside for savings.

- Put your budget on autopilot. The app automatically builds a personalized budget based on your income, expenses, and the goals you create.

- Discover simple ways to save. The app works to save you money through steps like negotiating lower bills and finding high-interest savings accounts.

PocketGuard is available in two versions–PocketGuard Basic, which is a free service, and PocketGuard Plus, which is the paid premium version.

PocketGuard Basic

Know what you’re spending and where you can save money with PocketGuard. It will also remind you when credit card bills are due.

Transactions are entered into the appropriate spending category. This allows you to know exactly where your money’s going.

You’ll need to provide income information during signup. PocketGuard focuses on recurring income. This includes income from your regular pay, rental income, pensions, alimony, or any other income source you receive on a regular basis.

Setting up goals

You’ll establish a monthly saving goal. They recommend you start with a very small amount, one that you can do very easily. You’ll need to add a savings account or money market (but not a checking account) as a destination for funds going into your goal allocation.

Bills

These are payments made from either your credit cards or your checking account. It includes recurring bills, like cell phones, utilities, loan payments, memberships and subscriptions, and insurance premiums.

A bit of an intentional quirk is that credit card payments are labeled as transfers." This is because credit cards are used to pay for expenses. So a payment to your credit card represents a simple "transfer" of money from one account to another.

PocketGuard Plus

PocketGuard Plus provides advanced services. Examples include:

Track cash that you spend and receive. Here you track money paid for tips at restaurants, or receive from friends for payment of a meal. You’ll enter the amounts on the app manually. The purpose is to give you the full picture on your budget, which includes transactions that don’t necessarily run through your linked accounts.

Plan for cash bills. You can set up a recurring cash bill that will enable you to track cash paid expenses on a regular basis. This is designed specifically for people who pay some or all of their bills in cash.

Know how much cash is in your pocket. As long as all cash income and expenses have been entered correctly, the app will calculate your cash balance on a continuous basis.

ATM withdrawals. Records the cash you withdraw from ATMs as cash transactions. This allows for more accurate tracking of all cash flows.

Add more pockets. PocketGuard Plus allows you to add more specific pockets. For example, you can set up pockets for fast food, public transportation, or furnishings. It will allow you to see where your money is going in even greater detail. It will appear on a spending pie chart, or you can even set up specific spending limits.

Unique PocketGuard Features

PocketGuard offers several features that make it stand out from the many other budgeting apps on the market.

In My Pocket

Once you’ve entered your recurring expenses and income items, and set your savings goal, this feature uses an algorithm to make calculations based on all three inputs. It will then let you know what you have leftover each day for spending. In other words, it first commits funds to your necessary expenses and savings, then gives you free access to what’s leftover.

In My Pocket uses the following formula to calculate your free cash:

Income – Bills – Savings Goal – Ongoing Spending = In My Pocket

Find Savings

You’ll answer a few questions about yourself in the Profile section, then you’ll receive offers based on that information. PocketGuard uses financial services that can help you lower your bills, pay off loans, improve your credit score, and even get rebates on shopping. It will help you to stretch your budget farther than you otherwise could.

Spending Limits

You can establish these to keep you from going over budget in any category. When you set a spending limit on any expense category, the app will alert you that you’re going over budget. The purpose is to get you to think more about how and where you spend your money. The app will even alert you when you’re getting close to a spending limit, to keep you from going over it.

Easy to use mobile app. See all your finances in one place.

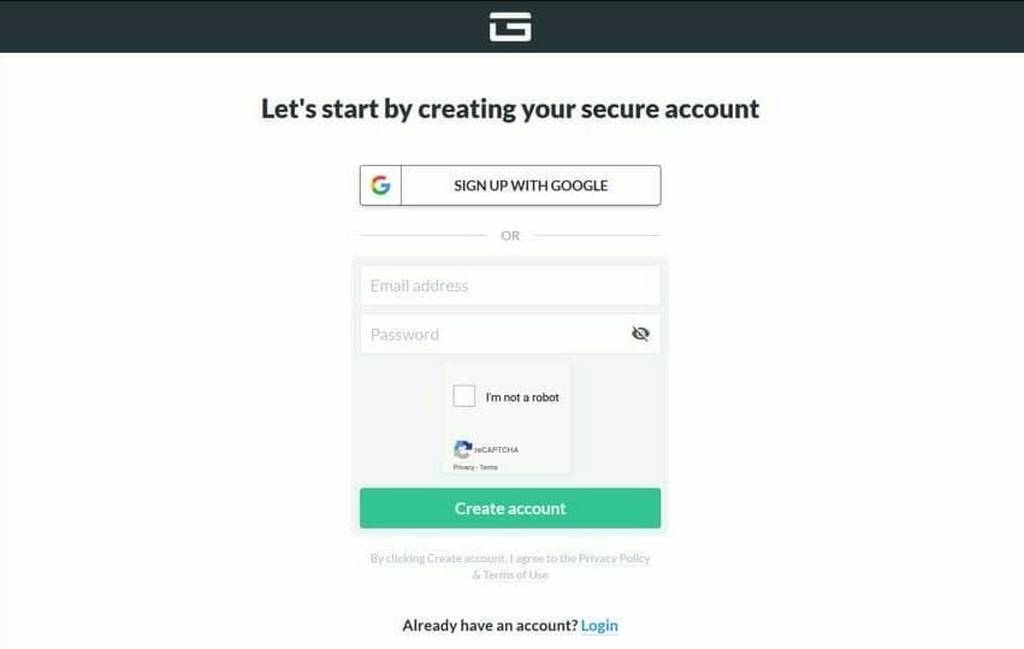

Signing Up for PocketGuard

You can sign up for PocketGuard on the website. You’ll first be asked for your email address, and then to create a personalized password.

Once you’ve opened your account, you’ll begin by connecting your bank accounts, credit cards and other loan and investment accounts. You will have to provide your login credentials for each account you add to the app. This is typical with third-party financial management platforms and apps.

PocketGuard Pricing

The PocketGuard app is available for free to users. Like other free financial apps, PocketGuard does use your financial information to generate offers for financial products and services from marketing partners. Should you sign up for any product or service, PocketGuard will receive compensation from the marketing partner. This is how the service is paid for, and why it’s free to use.

PocketGuard Plus is the paid version and is available at either a monthly subscription of $3.99, or an annual subscription of $34.99.

PocketGuard Referral Program

The referral program provides you with an opportunity to get PocketGuard Plus premium service for free. It works on a point system. You receive 10 points for each of the first three friends you refer who sign up for the service. Additional friends referred will earn five points.

Each friend will also receive 10 points for signing up.

You can get one free month of PocketGuard Plus for every 30 points you accumulate. Put in other words, three referrals are worth 30 points, which translates into $3.99.

Customer Support

Customer contact is available either directly through the app, or by email at support@pocketguard.com. Unfortunately, phone support is not an option.

Security

PocketGuard uses a 256-bit secure sockets layer to ensure all information and data transferred remains encrypted. Your login credentials are not stored on PocketGuards servers, and they never have access to make any changes to your accounts.

If you’re finding yourself short money at the end of each month, you may need help with budgeting. Here’s one that fits neatly in your pocket--it’s called PocketGuard. Here’s everything you need to know about this app from cost to customer service.

PocketGuard Pros & Cons

PocketGuard is free to use, though there is a premium version if you want or need additional services.

The In My Pocket feature focuses on what you have available for free spending. Knowing that you have at least some free cash makes going on a budget easier to accomplish.

The Spending Limits tool will help you to stay within budget, alerting you when you’re close to going over.

PocketGuard Plus allows you to track cash transactions. This is unique in the budgeting universe, where most competing apps track only what runs through financial institutions.

No phone support.

PocketGuard uses your financial information to generate offers for financial services and products. That means ads and email solicitations.

The referral program is weak, earning you just $3.99 toward one month of PocketGuard Plus for the first three friends you refer. After that, you’ll need six friends referred to get an additional month free.

Currently available only in the mobile app version (the web version is still being worked out).

PocketGuard Alternatives

If you want to get serious about managing your money, we recommend Empower. This tool isn’t focused as much on budgeting as it is on building your wealth. With Empower you can track your money, your investments and your net worth all in one place. Be sure to review our list of Top Money Management Apps to find the one that best fits your needs.

Some people prefer to keep track of their finances the same way they keep track of their schedule--with a calendar. If this sounds appealing to you, check out our list of Best Calendar-based Personal Finance Apps.

(Personal Capital is now Empower)

Should You Sign Up for the PocketGuard App?

PocketGuard is a solid budgeting app. And you can’t beat the price--free! If you’ve been finding yourself short each month, and unable to save money, PocketGuard can help you reverse that trend. Remember, before you can hope to attain financial independence, you first need to master financial control. PocketGuard is a step in that direction.

PocketGuard Plus is inexpensive as premium budgeting services go, at just $34.99 per year. It adds valuable services, particularly the ability to track cash income and expenses. Though most people do work through financial institutions and debit and credit cards, some still prefer to make use of cash. If you’re one of them, and you want a budgeting app to help you manage it, PocketGuard Plus is virtually alone in the budgeting software space.

For most people, the free version will work just fine. It’s designed to convert you from a debtor to a saver in the shortest time possible. If you haven’t been budgeting your money effectively up to this point, give PocketGuard a try. It’s free, so you have nothing to lose!

If you’d like more information, or you’d like to sign up for the app, visit the PocketGuard website.

Empower Personal Wealth, LLC (“EPW”) compensates Webpals Systems S. C LTD for new leads. Webpals Systems S. C LTD is not an investment client of Personal Capital Advisors Corporation or Empower Advisory Group, LLC