This is the twenty-second day in our 31-Day Money Challenge. Over 31 days we’ll publish 31 podcasts, each designed to help you move closer to financial freedom. Yesterday we discussed the importance of keeping mutual fund fees as low as possible. In today’s podcast, I share my own asset allocation plan and the investments I’ve selected to implement that plan.

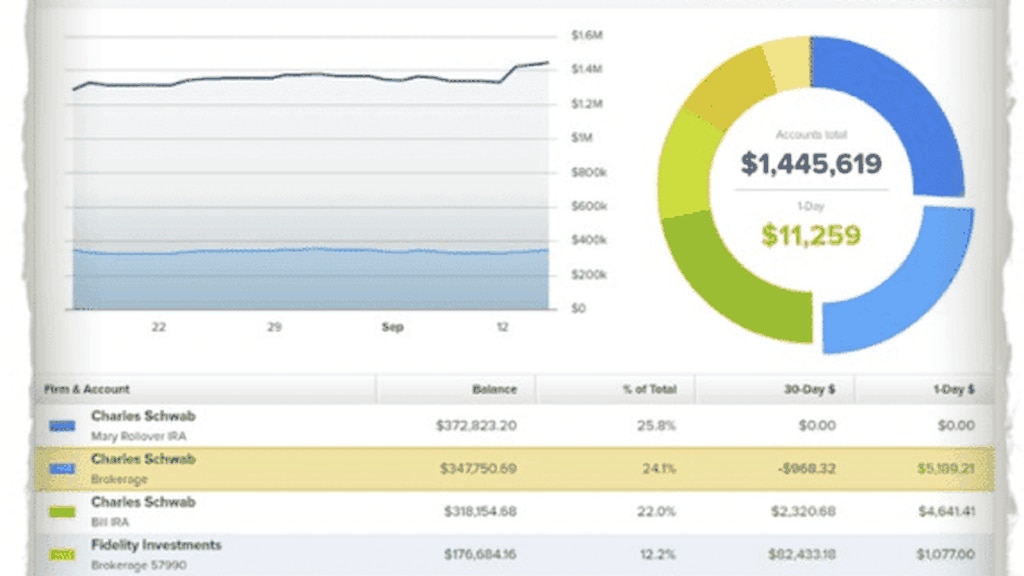

Sponsors: The 31-Day Money Podcast is sponsored by Betterment and Empower. Betterment and Empower are two tools you can use to make investing easier, less expensive, and more effective.

Topics Covered

Here’s my asset allocation, which I discuss in depth in today’s podcast:

Stocks: 80%

U.S. Equites: 40% Foreign Equities: 25% REITs: 10% Commodities: 5%

Bonds: 20%

U.S. Total Bond Market: 10% Tax-Exempt Muni Fund: 10%

(Personal Capital is now Empower)

Empower Personal Wealth, LLC (“EPW”) compensates Webpals Systems S. C LTD for new leads. Webpals Systems S. C LTD is not an investment client of Personal Capital Advisors Corporation or Empower Advisory Group, LLC

Resources

- Vanguard Total Stock Market Index Fund Admiral Shares (VTSAX)

- Fidelity Spartan 500 Index Fund (FXSIX)

- Vanguard Small-Cap Value Index Fund Admiral (VSIAX)

- Vanguard Mid-Cap Index Fund Admiral Shares (VIMAX)

- Vanguard Total International Stock Index Fund Admiral Shares (VTIAX)

- Dodge and Cox International Stock Fund (DODFX)

- Vanguard Developed Markets Index Fund (FDMAX)

- Vanguard Emerging Markets Stock Index Fund Admiral Shares (VEMAX)

- Vanguard REIT Index Fund Admiral Shares (VGSLX)

- Vanguard Global ex-U.S. Real Estate Index Fund Admiral Shares (VGRLX)

- PowerShares DB Commodity Index Tracking (DBC)

- Vanguard Total Bond Market Index Fund Admiral Shares (VBTLX)

- Vanguard Intermediate-Term Tax-Exempt Fund Admiral Shares (VWIUX)