Overall Ranking

5/5

Overview

5/5

5/5

4/5

4.5/5

Have you ever tried searching for a financial advisor? The wealth of information on the internet means the search could take hours, days, even weeks to find the right one. Until now. Paladin Registry is a free service that matches users with vetted financial advisors. Why is it free and how does it work? We’ve got those answers and more below.

Editor's Note

You can trust the integrity of our balanced, independent financial advice. We may, however, receive compensation from the issuers of some products mentioned in this article. Opinions are the author's alone. This content has not been provided by, reviewed, approved or endorsed by any advertiser, unless otherwise noted below.

Finding a financial advisor can be a pain. In fact, so many of them focus on marketing to you that you don’t even know who’s good and who isn’t. Or, who has your best interests in mind and who has experience in doing the things you want to do when investing–not what makes them the most money.

In this article, I am going to do a deep dive into Paladin Registry–a unique company that vets financial professionals through an intensive background process, then approves them to be a part of their network. Paladin then matches advisors to you, based on your financial goals and situation.

Let’s first start with what Paladin is.

What is Paladin Registry?

In a nutshell, Paladin Registry is a platform that connects you with a financial advisor. But not just any financial advisor. Paladin Registry only focuses on highly rated financial advisors, planners, and money managers.

Related: Do You Need a Financial Advisor?

Each of these financial professionals pays a monthly fee to be a part of the Paladin Registry--but Paladin has to approve them first. What’s great about this is that there’s no cost to you, and Paladin Registry is able to match you to a financial professional that meets your needs.

Paladin Registry was founded in 2003 by Jack Waymire. Waymire is fairly well-known in the finance world and has written a couple of books. His whole philosophy, and why he created Paladin Registry, was to help people get honest financial advice.

He noticed that too many advisors and planners were making investment decisions that would earn them the most money, not necessarily what was best for the client. So he changed the game and curated a collection of professionals that his company will match you to so you’re in good hands.

They’re SEC-registered and they review a lot of details about the financial professionals that join their network (more on this below). Though they’re registered as a Registered Investment Advisory firm, they are not considered a financial services organization. Paladin Registry is really a glorified information provider. And a darn good one at that.

Paladin Registry Features

The main feature Paladin has is its matching process, which is incredibly in-depth. Here’s what they look at.

Minimum Qualifications for Advisors

Paladin Registry has a very unique matching system. But it all starts with the depth of research they do on the financial professionals that wish to join their network.

First, they have a strict set of minimum requirements. To even be considered as a financial professional in their network, you need to:

- Have at least five years of experience

- Be a Registered Investment Advisor or an Investment Advisor Representative

- Be a financial fiduciary when providing advice and services

- Be compensated with fees (all or in part)

- Provide one or more of the wealth management services

That’s pretty intense. But that’s not all. Paladin then does in-depth research on each of the financial professionals.

Rating Process

After the minimums are met, they get data from places like:

- Advisor websites

- FINRA

- The SEC

- State securities commissioners

Once they collect that information, they put each of their financial professionals through an in-depth questionnaire (42 questions, which is then checked for accuracy and consistency). They then use an algorithm to rate the quality of advisor responses and document the advisor information for use in their research reports (made available to you as a customer).

But they’re not done yet.

Rating Algorithm

Paladin has a proprietary algorithm that’s based on four different levels of information:

- Credentials. This captures the advisors education, experience, and certifications.

- Ethics. This looks at the advisors compliance record, fiduciary status, and licensing.

- Business Practices. This piece examines the advisors compensation, communication practices, and reporting standards.

- Services. This looks at the services the advisor offers, including planning, investments, insurance, tax, and legal services (if applicable).

According to Paladin, “advisors must score in the 90th percentile or higher to be profiled in the Registry.”

With all of this together, they are able to provide massive data sets about each and every financial professional before deciding whether to approve them. Their goal is to serve up the best possible financial advisors they can find, and they give you tons of research to back that up.

Pricing

You’re probably thinking that this must cost a fortune, right? As a matter of fact, it costs nothing. That’s right, nothing. Paladin doesn’t charge the people that use its services, they make their money from the dues the vetted and approved financial advisors pay monthly to be a part of the network.

So you pay nothing and you know you’re getting a committed and thoroughly-vetted financial advisor.

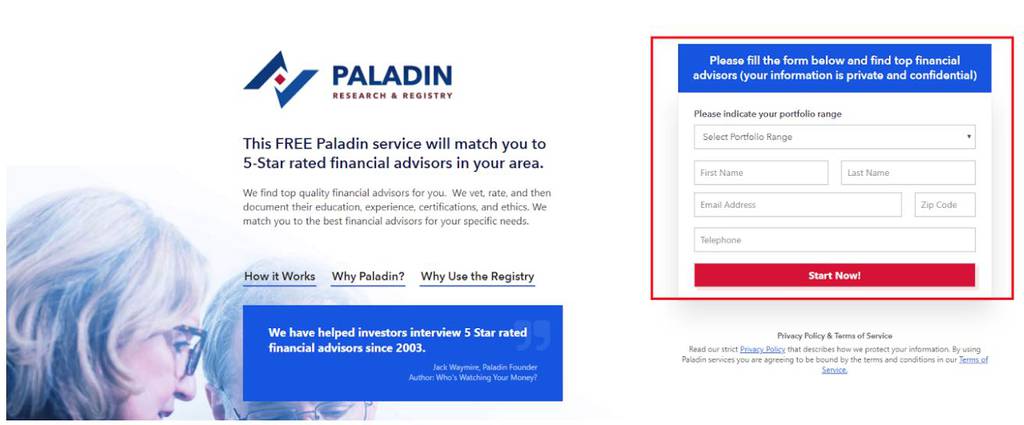

Signing Up

Signing up is incredibly simple. You just fill out a basic online form on the Paladin website and they’ll start the matching process. You will need to answer a few more questions so they can narrow down the scope for you, but it’s very simple.

Once you fill out the form, you’ll do a pre-interview According to Paladin:

“Advisors will use your information to contact you to conduct the pre-interview. You select advisors for in-depth interviews.”

The only downside here is it can take a little time for them to match you. Sometimes it can take a couple of business days to hear back and get a list of appropriate matches. So if you’re in a hurry, know that it might take a bit of time.

Security

Paladin is very meticulous about keeping your information safe and secure. According to their Privacy Policy, Paladin stores “information provided by Users on our secure servers and information provided to a third-party service provider for processing the payment of any applicable User service fees is encrypted using SSL technology.”

Mobile Support

Since Paladin is just a conduit for connecting you with financial advisors, there’s no mobile app needed. That said, you can access their site and register with your mobile phone.

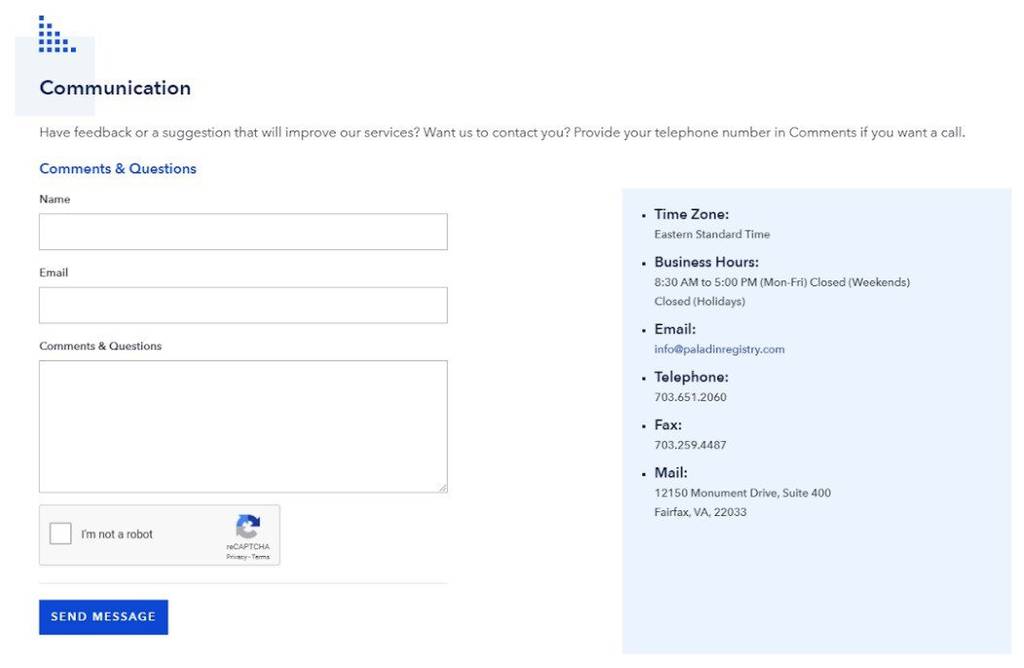

Customer Service

I love how proactive Paladin is with its customer support. You can email them directly through the contact page, but you can also contact them through phone (Monday through Friday during normal business hours), fax, or snail mail.

Paladin Registry Pros & Cons

Deeply-vetted financial professionals — Paladin goes through a rigorous process to vet the financial advisors they allow into their network. This way, you know you’re getting a top-notch advisor to be matched with.

Simple process — The process for getting matched is very easy. You just have to fill out some basic information and Paladin will match advisors to you, who will then do a brief phone pre-interview.

Cost — There is none, which is the best part. Now, you’ll have to pay fees to any financial advisor you choose (based on their rates), but Paladin does not charge you for their services.

It can take a while for matches — Sometimes you will have to wait a few days to get a call from a financial advisor to do a pre-interview. If you’re looking for a quick turnaround time, this may not be the service for you. I would argue, though, that if you’re waiting for a good financial advisor, it’s probably worth the time to find the right one.

Clunky and annoying matching process — There are some real estate apps that will match you to a realtor online first, before having to do a pre-interview. It can be a little clunky (and annoying) doing an interview over the phone with a financial advisor you don’t know. Thankfully Paladin provides a ton of resources to help you find the right one by asking the right questions.

Alternatives

There are three alternatives to Paladin: finding an advisor yourself, investing yourself, or using a robo advisor.

- Finding an advisor yourself - this can be frustrating if you don’t know where to start. It’s best if you know someone or have a referral for someone you can trust.

- Investing yourself - you can forego financial advice altogether and invest on your own. But you have to know what you’re doing, so I would start with index funds and ETFs (and read this article on how to start investing).

- Use a robo-advisor - a robo-advisor is a nice blend between doing it on your own and paying someone for advice. You should make sure to choose the right robo-advisor, though, and read this article to learn more about robo-advisors.

Outside of that, Paladin is really in a league of its own. There aren’t a lot of competitors, especially free ones. You could check out SmartAdvisor, a new service from SmartAsset, but they’re not as in-depth as Paladin. There’s also NAPFA, but again, not even close to the amount of vetting Paladin does.

Who Is It For?

Paladin is geared toward the person who is definitely interested in hiring a financial advisor but doesn’t know where to start. It’s easy to find an advisor, but finding the right one for YOU is where it gets difficult.

Because of the depth of vetting Paladin goes through, I would highly recommend anyone that wants to hire someone to manage their money to start with them. You’ll get pre-vetted advisors that will be excellent matches for you and your financial situation, and you can count on the fact that they will be focused on your success, not their own paychecks. That’s how Jack Waymire wanted it.

Bottom Line

Overall, if you’re looking for an advisor and you have a little bit of time to invest (which, if you’re looking for someone to manage your money, you should have a little bit of time–or at least make some) Paladin is totally worth it.

The service costs you nothing, and you’ll be matched up with advisors that have been through a heavy amount of scrutiny (plus they pay) to be a part of this network. So you know they’re good.