Overall Ranking

4/5

Overview

4/5

4.5/5

4.5/5

3.5/5

The robust Empower app is a great way to start budgeting while also building savings in an account with no overdraft fees and no minimums.

Editor's Note

You can trust the integrity of our balanced, independent financial advice. We may, however, receive compensation from the issuers of some products mentioned in this article. Opinions are the author's alone. This content has not been provided by, reviewed, approved or endorsed by any advertiser, unless otherwise noted below.

Did you know 69% of Americans have less than $1,000 in savings, including 45% with no savings at all? If that describes your situation, it doesn’t have to any longer. Empower will not only help you implement a workable budget, but it will also passively build up your savings. You simply need to set a weekly savings target and the Empower app will make that happen. (Empower is a financial technology company, not a bank. Banking services provided by nbkc bank, Member FDIC.)

About Empower

Based in San Francisco, and launched in 2017, Empower is an app that helps you master your money. Over 3 million have downloaded the Empower app. It works as a financial aggregator that enables you to connect all your financial accounts on your smartphone. In that way, you’ll not only see all your accounts on the app, but also track your spending and even find ways to save money.

The app is designed to provide four primary functions:

- $25 to $250 Cash Advance¹ with no interest and no late fees.

- Get paid up to 2 days faster.*

- Lower your expenses by tracking spending.

- Take advantage of the intelligent AutoSave feature that will automatically direct excess cash into a savings account*.

Cash Advance

They also have a cash advance feature. It allows eligible members to get up a Cash Advance of $25 – $250 directly to your bank account.¹ Even better, there are no interest charges, no late fees, and no need for a credit check. The feature is designed to provide a “bridge” until your next paycheck. Best of all, since the Cash Advance is not a loan, it won’t affect your credit score.

iOS users rate Empower 4.8 stars out of five on the App Store, based on nearly 35,000 reviews, while Android users rate it 4.6 out of five stars, based on more than 22,000 reviews.

Related: Best Payday Loan Alternatives

How Empower Works

Empower users can get Cash Advances of $25 to $250 with no interest or late fees. Users can also sign up for the Empower Card*, a debit card that comes with a number of valuable features. For example, people who set up paycheck deposit can use the card to access their paychecks up to two days early.*

You can use the card to make purchases at retailers and fee-free withdrawals at more than 37,000 MoneyPass ATMs nationwide. Cardholders can also earn up to 10% cashback* on purchases at select retailers, making the card very rewarding to use.

Additionally, you can earn interest on the money in the Empower Card, with no minimum balance required. There’s also no overdraft fees and no insufficient funds fees. Interest on the account compounds daily. Empower deposits are FDIC insured up to $250,000.*

You’ll be provided with monthly bank statements directly from the app. Statements will be available around the fourth business day of each month.

Automatic Savings (AutoSave). You can set weekly savings goals and the Empower app will create a strategy to make it happen. It’ll do that by monitoring your checking account activity every day, including the source and frequency of cash inflows and outflows. They’ll be able to determine when you have extra cash and when you’re running low. Extra money will be set aside in your AutoSave when the funds are available. The AutoSave feature can be set up directly from the app.

Empower will make anywhere from one to four smaller transfers each week to hit your weekly goal. They’ll transfer money at most once a day, up to four transfers per week if they’re supported by your spending activity and the balances in your external accounts. Transfers can be one per day, Monday through Thursday. You can pause or restart the AutoSave feature at any time.

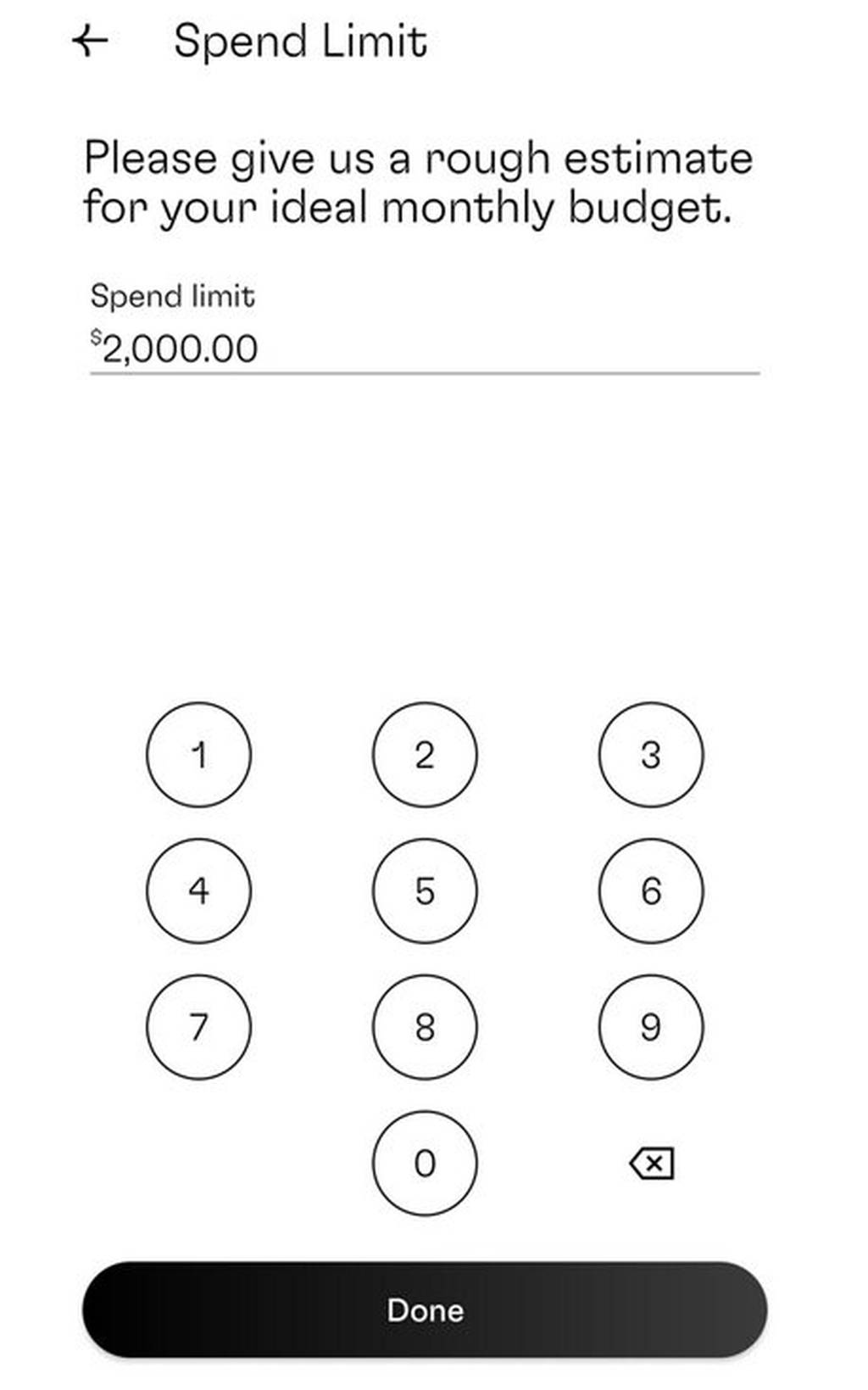

Effortless Budgeting. You can use this feature to customize your budget categories and track your spending on a 24/7 basis. You can create budgets for every category of spending, and get real-time alerts on bills and purchases. The app will give you the ability to set limits on how much you can spend in any category, as well as the frequency with which those expenses are incurred. And to help you better manage your finances at the bigger-picture level, you can also set overall monthly spending limits.

Your income and expenses will be recapped at the end of each month, and you’ll be provided with a monthly report.

Smart Recommendations. Empower will provide proactive recommendations helping you find extra savings in your budget. The app will monitor your financial activity and send you updates. You’ll be notified of bill increases, bills, bank fees, credit utilization, and other important financial information. Knowing exactly what’s going on will help you to better react to what’s happening with your money.

Other Empower Features and Benefits

Mobile app. Empower can be downloaded on the App Store for iOS devices, 9.0 or later, and is compatible with iPhone, iPad and iPod touch. It’s also available at Google Play for Android devices, 5.1 and up.

Customer contact. Empower can be contacted by email or chat in the app and users with an Empower Card will have access to a phone number. Empower is available via phone from Monday – Friday 6am – 6pm PT.

Fees. The app is free to use for the first 14 days for first-time customers, then a $8 per month fee applies for access to the full suite of money management features. There is also a foreign exchange fee on international transactions of 1%.**

Account security. Empower protects your information using bank-level security. That includes 256-bit Secure Socket Layer (SSL) and encryption, multi-factor authentication, Touch ID, and strict access controls.

Related: Best Online Banks

How to Sign Up with Empower

As mentioned above, you can download the Empower app on the App Store for iOS devices, or on Google Play for Android devices. Alternatively, you can download it on the website by entering your mobile phone number.

To be eligible to open an account, you need to meet the following requirements:

- Be 18 years old or older.

- Hold a bank account at a U.S. financial institution.

- Have a mobile phone number that can operate in the U.S. and can receive SMS messages.

If you want to sign up for an Empower Card you’ll also need a valid Social Security Number and a valid U.S. physical residential address.

You’ll need to furnish two forms of identification, with the first being one of the following:

- U.S. state-issued driver’s license

- A valid U.S. state-issued ID

- An unexpired passport

- An Armed Forces ID with a photo

The second form can be any one of the following:

- A recent pay stub

- Utility bill – water, gas, electric, or cable

- Lease agreement

- Auto registration

- Official bank statement

You can fund your Empower Card account using direct deposit from your paycheck, by bank transfer from a linked financial account, or by using mobile payment service apps, like PayPal, Square Cash, Cash App and Venmo. Empower does not currently support cash or check deposits, but they are working on a mobile check deposit feature.

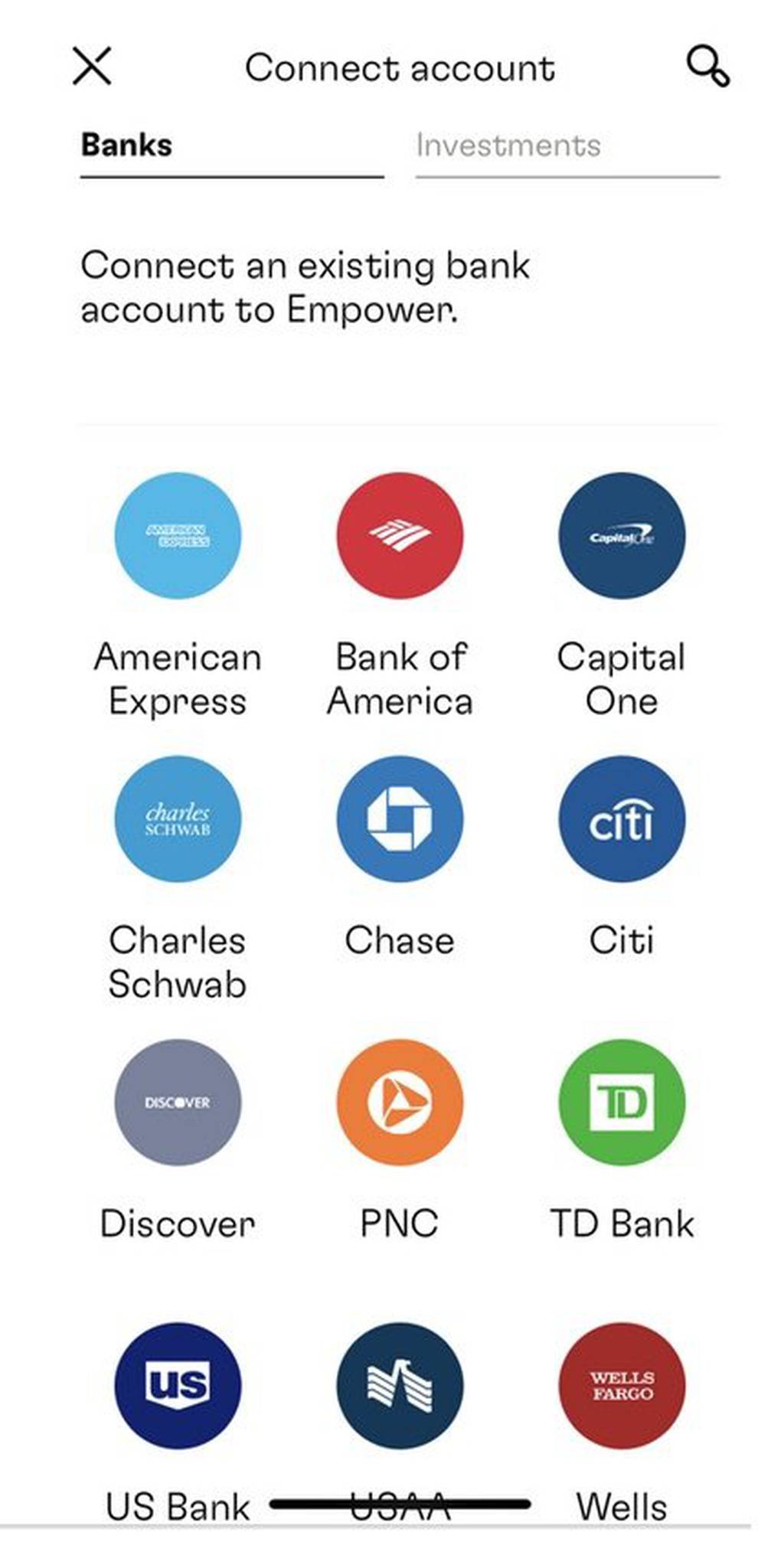

Connecting your accounts to Empower

You can connect your spending accounts so they can be tracked. It can take up to three business days to perform a manual review of the accounts added. The more accounts you can link to the app, the more comprehensive your financial management will be.

You can connect an account by tapping “Connect Account” when you sign up. Your accounts will be connected using the data provider Plaid.

To connect the app to your external accounts, you can use one of two methods:

- Use your Empower account and routing numbers

- Connect your Empower account using your phone number and passcode (this option is only available if your external account uses plaid)

As you might expect, the app has a number of pre-loaded financial institutions for you to choose from. In fact, you can connect to over 10,000 U.S. banks, credit card accounts, lenders, investment accounts, cryptocurrency and even 401(k) accounts.

Empower Pros and Cons

Get fast cash direct to your bank account — Get access to up to $250 Cash Advance^ with no interest, no late fees, no risk to your credit, no questions asked.

Link your financial accounts and monitor them on a single app — Empower allows you to link your financial accounts and monitor them on a single app.

Customizable budget that limits how much you can spend — You can create a customized budget that limits how much you can spend in a week or month, or even in a specific expense category.

Passive savings accumulation — Empower works to allocate additional funds into savings. The process is completely passive, eliminating the need for you to expend any effort building up your savings.

Earn interest — Once in your Empower Card, Empower deposits are FDIC insured up to $250,000.*

Charges a fee of $8 per month in a field with many free apps — Empower does charge a fee of $8 per month, but there are similar apps available free of charge.

Web-based version — Empower does not have a web-based version – it’s a mobile app only.

Can't deposit cash or checks — No ability to deposit cash or checks into your Empower bank account.

Alternatives to Empower

The number of financial apps to help you get better control over your spending and increase your savings has increased in recent years. Empower is joined by other apps that have their own unique features, some you may prefer.

Empower is a free financial aggregator that links all your financial accounts on one platform. That will enable you to get a high-altitude view of your complete financial picture and make changes as necessary. But a big advantage of Empower is its orientation toward investing. If you have any investment accounts, or you’re working to build one, the app can provide investing tools to help you improve your portfolio performance. And if you have at least $100,000, they can also provide a direct investment management service.

If you’re primarily looking for a budgeting app, take a close look at Mint. Like Empower, Mint is a financial aggregator and is completely free to use. The app is designed specifically for budgeting and even enables you to pay bills.

If your main goal in budgeting is to find money to save, a more passive alternative is Acorns. Rather than focusing on budgeting, it connects with your primary spending account and rounds up your purchases to transfer the overage into savings. For example, if you make a purchase for $6.25, your account will be charged $7, with $.75 going into savings. Once you reach $5 in savings, the funds are transferred into an Acorns investment account, where the Acorns robo-advisor will create and manage a diversified portfolio for you.

(Personal Capital is now Empower)

Also read: Best Micro Savings Apps

Empower FAQs

Does Empower have a desktop version?

No, and there are no plans to offer one at the moment.

Do I have any ability to change the settings on the AutoSave feature?

Yes. You can select your AutoSave account from the “View More” tab or you can tap on “Edit”. There, you can make changes, as well as pause the feature entirely.

Is Empower the Right Choice for You?

If you’ve never been able to successfully budget in the past, you’re going to need help. That can all be done for you through the Empower app. Not only will it track and budget your cash flow but it will also look for ways to save money. That will include canceling unused subscriptions.

But the most exciting feature of Empower is undoubtedly its ability to help you to accumulate savings without any additional effort on your part. The app constantly monitors your financial situation and allocates funds to savings as they become available. That’s the perfect solution for you if you’ve been struggling to save money up to this point in your life.

If you’d like more information, or if you’d like to sign up for the app, visit the Empower website.

¹ Eligibility requirements apply.

* Empower is a financial technology company, not a bank. Banking services provided by nbkc bank, Member FDIC. Early access to paycheck deposit funds depends on the timing of the employer’s submission of deposits. We generally post such deposits on the day they are received which may be up to 2 days earlier than the employer’s scheduled payment date. Cashback deals on Empower Card purchases, including categories, merchants, and percentages, will vary and must be selected in the app. Cashback will be applied automatically when the final transaction posts, which may be up to a week after the qualifying purchase.

** Empower does not charge foreign transaction fees for the use of the Empower Visa Debit Card outside of the US. However, Visa charges a foreign transaction fee of 1%. Empower does not reimburse this 1% transaction fee on foreign ATM transactions or on any other foreign transactions or purchases.