Overall Ranking

4.5/5

Overview

5/5

5/5

4.5/5

2.5/5

5/5

Reali Loans (the new name for Lenda) is an online mortgage company. It promises an easy application process, low fees and great rates. Let’s see if it delivers in our Reali Loans review.

Editor's Note

You can trust the integrity of our balanced, independent financial advice. We may, however, receive compensation from the issuers of some products mentioned in this article. Opinions are the author's alone. This content has not been provided by, reviewed, approved or endorsed by any advertiser, unless otherwise noted below.

What if there was a way to speed up the mortgage application process, lower closing costs, and streamline documentation requirements? Well, there is, and you can do it through Reali Loans. It’s an all-online direct mortgage lender, that enables you to complete the entire mortgage application process from the comfort of your own home, doing it all online, and with the benefit of live customer support when needed. And because it’s all online, closing costs will be lower.

Who and What is Reali Loans?

Reali Loans is the former Lenda, an online mortgage lender launched in 2014. Lenda’s goal was to “reimagine” the process of getting a home loan through the use of technology. And by eliminating the traditional loan officer–to be replaced by a “digital loan officer”–the consumer saves on loan related costs. The company is now part of the Reali family, which is a natural marriage.

Reali is a full-service real estate broker that combines technology and the expertise of local real estate agents to create a streamlined, commission-free homebuying and selling process. Their goal is to make homebuying accessible to more people, giving home sellers a better return on their investment, and making homeownership a seamless and efficient experience.

With the former Lenda joining Reali, the combination is creating a one-stop homeownership experience, providing services to home buyers and sellers, as well as financing.

One of the major advantages of Reali Loans is that they are a direct lender. That means you’ll work with in-house staff, and your loan will be underwritten through the company. There’s none of the lost time and confusion that occurs when loans are brokered out to third-party lenders. And with the loan process being completely paperless, everything moves even more quickly.

Reali Loans is available in 12 states, including Arizona, California, Colorado, Florida, Georgia, Illinois, Michigan, Oregon, Pennsylvania, Texas, Virginia and Washington. But they do plan to add additional states going forward.

Reali Loans Features and Benefits

Mortgage loans provided by Reali Loans include:

- All loans are fixed rate mortgages–Reali Loans does not offer ARM loans.

- Loan terms are 15 years and 30 years.

- Reali Loans provides both purchase money mortgages and refinances (both rate and term and cash out refinances).

- Reali Loans does not provide HELOC’s or second mortgages.

- All loans are conventional/conforming through Fannie Mae and Freddie Mac–Reali Loans does not offer FHA or VA mortgages.

- Reali Loans can work with borrowers who own up to six properties.

- They do not provide loans for manufactured homes or mobile homes.

- Loans are for residential properties only, and not commercial.

- Reali Loans does provide mortgages for investment properties, consistent with Fannie Mae and Freddie Mac guidelines.

Related: 16 Types of Mortgages Explained

Reali Loans Security: The platform uses the following strategies to protect your information:

- A comprehensive security program based on industry standards and best practices to ensure your information is safe from unauthorized access or misuse

- Rigorous physical, administrative and technical safeguards

- Perimeter security, industry-standard encryption, and continuous monitoring

- SSL technology to create an encrypted connection for all communication between all web browsers and company servers

- The security safeguards are reviewed and adjusted periodically based on ongoing risk assessment

Customer Service: Contact is available by phone, live chat and email, Monday through Friday, 9:00 am to 5:00 pm Pacific time. But since the application process takes place entirely online, you will have 24/7 access to your application and related documentation and communication with the company through the Interactive Loan Dashboard.

Preliminary Services Provided: Reali Loans will provide both pre-qualification and pre-approval services. A pre-qualification is based on self-reported information, and does not in any way imply a pre-approval. A pre-approval is a comprehensive preliminary evaluation, based on third-party documentation. It’s the stronger of the two, and preferred by real estate agents and home sellers.

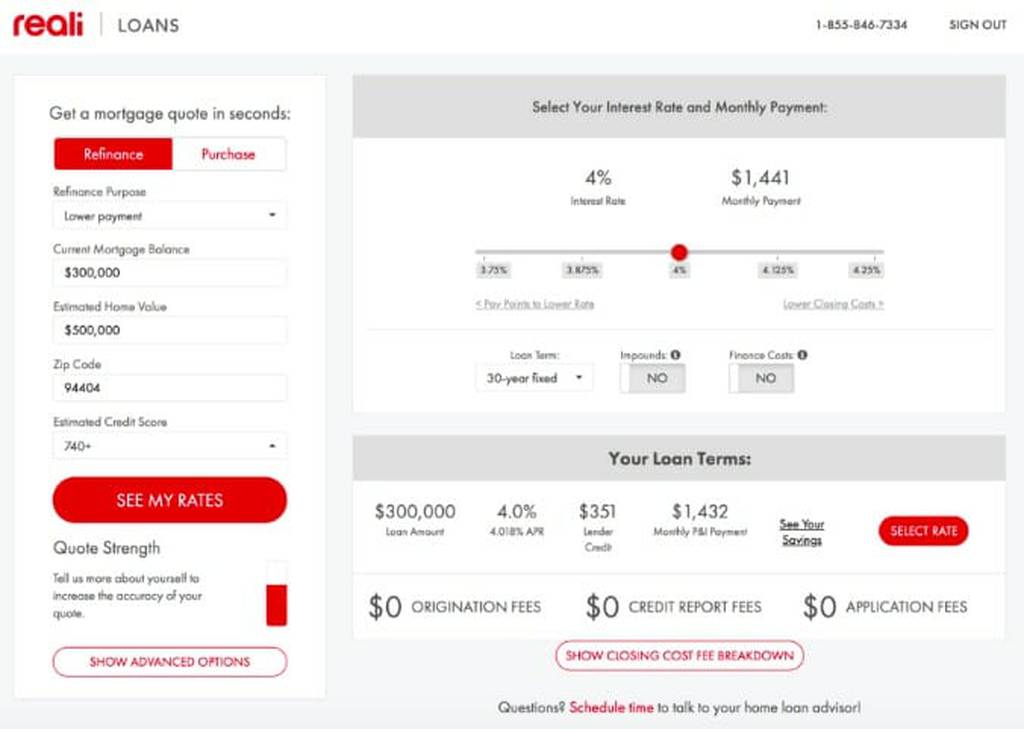

Reali Loans Fees: The company does not charge origination fees, broker fees, or even an application fee. The closing costs you will incur will be the normal third-party fees associated with any mortgage loan closing. These will generally include attorney fees, title search, title insurance, recording fees, mortgage related taxes and fees, appraisal fees, survey (if required) and a home inspection, should you choose to get one. Specific fees will depend upon the state where you are closing your loan.

Reali Loans does allow you to pay discount points, to lower the interest rate on your loan. For example, you might pay 1% of the loan amount in order to lower the interest rate by 1/8 point (or 0.125%).

Appraisal Deposit: If a property appraisal is required, Reali Loans will collect a $500 appraisal deposit at about halfway through the application process. The actual cost of the appraisal can range between $400 and $750, depending upon property location, type, and size. The appraisal fee is part of your closing costs, and not an additional fee charged by Reali Loans. It must be collected before closing because the appraisal is provided by an independent third-party. The appraisal deposit will be refunded if the appraisal has not been ordered.

Related: 11 Little-Known Facts About Home Appraisals

Loan Servicing: Reali Loans originates and closes mortgage loan applications. However, once your loan closes, it will be transferred to another company for servicing. This is typical in the mortgage industry, especially among mortgage brokers. Reali Loans, like all mortgage brokers, doesn’t service mortgage loans.

Reali Loans Educational Guides

With the understanding that each borrower has a different level of knowledge and experience when it comes to the mortgage process, Reali Loans offers six guides to help you better understand the process:

- Home Mortgage Guide

- Refinance Guide

- How to Refinance a Home with Bad Credit

- The 5 Best Ways to Save Money When You Refinance Your Home Loan

- 3 Easy Ways to Improve Your Credit Score with Credit Cards

- How to Choose A Mortgage – 5 Things to Consider

Home Mortgage Guide

This guide will teach you everything you need to know about the mortgage application process. It provides instructions on getting pre-approved, applying for the loan, the importance of a home inspection, the purpose of an appraisal and home insurance, the closing process, and move-in instructions. It even gives you a loose four-week timetable to let you know what you should be doing and when. It’s an easy-to-follow guide that will be especially beneficial for first-time homebuyers.

Related: How to Buy Your First Home

For example, it can show you how much you can qualify for, and how it will affect your budget:

Refinance Guide

You want to refinance your current home, but how do you know if it’s the right thing to do, and which type of loan you should consider? The Refinance Guide will help you answer those questions and more.

Related: 5 Reasons When You Should Refinance a Mortgage

For example, it covers the benefits of refinancing, 15- versus 30-year mortgages, cash-out refinance considerations, and instructions on the refinance process, including the costs involved.

What I like about this guide is that it doesn’t just show you the mechanics of a refinance, which of course is important by itself. But it also gives you the tools to evaluate whether doing the refinance is even in your best interests.

How to Refinance a Home with Bad Credit

It’s not uncommon for homeowners to experience a decline in their credit profiles since purchasing their homes. This guide gives you six practical steps to help you do a refinance if you have credit problems.

The 5 Best Ways to Save Money When You Refinance Your Home Loan

This guide goes into the specific details of refinancing your loan. It discusses five factors–loan term, options and programs, costs, shopping for services, and switching from an adjustable rate to a fixed rate mortgage.

3 Easy Ways to Improve Your Credit Score with Credit Cards

It’s no secret that credit scores are one of the major factors in determining the rate you will pay on your mortgage–or even whether or not you will be approved at all. This guide goes into strategies to improve your credit score through the use of credit cards. They’re simple steps, and they’ll require some time to implement. But they will get you the better credit score you’ll need to improve your mortgage prospects.

How to Choose A Mortgage – 5 Things to Consider

This guide covers the basics of considerations in applying for a mortgage. For example, it instructs you to look at what you can afford, to know where your credit stands, understand the difference between conventional and government loans, fixed versus adjustable rates, and comparing lenders and estimates. You’ll need to know all of these to make an informed decision on your mortgage.

Related: Best Mortgage Rates Today

The Reali Loans Pre-Qualification Process

You can use this tool to determine how much mortgage you can qualify for. You’ll be asked to indicate purchase or refinance, your home purchase goals (pre-approval, apply now, or check rates), estimated purchase price, estimated down payment, ZIP Code, and your estimated credit score. You can complete the process in less than a minute, and get your loan results.

Unfortunately, your results are not provided directly. To get your results, you must enter your email address and create a password.

Limitation on lower loan amounts: One disadvantage to be aware of is that Reali Loans are not available for loan amounts of less than $150,000.

Rate Quote page: On this page, not only will you be provided with the rate on your loan, but also an estimated breakdown of fees and closing costs. If you’re ready to move forward with the application process, you’ll be given the option to lock your rate. Rate locks are usually good for 45 days.

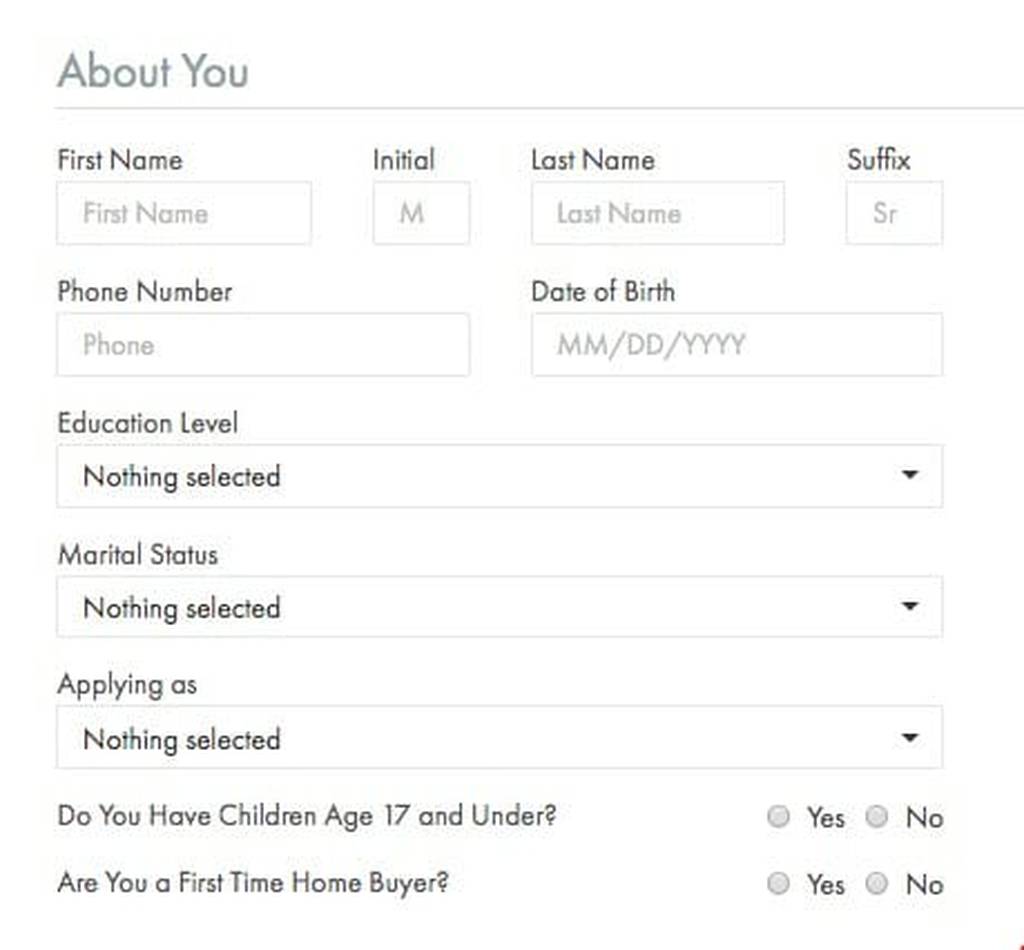

The Reali Loans Online Application Process

The entire Reali Loans application process takes place online. You can even begin the process directly from the rate quote screen.

They will guide you through the mortgage application process, which they claim will take six minutes. Any application documents that will require your signature can simply be reviewed and signed electronically.

Once you complete the application, they will generally get back with you within one day to update you on the process, and request any documentation that may be required. In addition, once you submit your application, you will get a free credit check to let you know exactly what your credit standing is.

Document Submission: If you’re familiar with the mortgage application process, then you know that lenders typically request a virtual laundry list of supplemental documents. This includes recent pay stubs, W-2s, income tax returns, bank statements, credit explanations, and other documents.

To expedite the process–and to save you a small fortune on postage–you can upload your documents to the Reali Loans platform, and submit them digitally. They even offer a drag-and-drop feature if you already have your documents stored on your computer. That can enable you to take a process that might take several hours manually, and complete it in a matter of minutes.

Dedicated Home Loan Advisor: In case you’re concerned that the whole online loan application process will leave you dealing with bots, rest assured Reali Loans will assign a human dedicated home loan advisor to work with you through the whole process. You’ll be able to maintain contact with that person by phone, email, chat or text.

Closing Process: Reali Loans claims that it can move the mortgage process from application to closing in about 30 days. However, they claim they have the ability to fund loans in as few as 13 days. This will of course depend on your ability and willingness to supply all necessary documents as quickly as possible.

Reali Loans Pros and Cons

Lower closing costs: Reali Loans charges no origination fee, application fee, or credit report fee, saving you money on closing costs.

No face-to-face meetings required: The entire loan process takes place online, eliminating the need for a potentially uncomfortable face-to-face meeting or series of meetings.

Easy document upload: Loan documentation can be uploaded digitally, avoiding the need to assemble, copy and either mail or hand-deliver large amounts of paperwork.

Track your loan: You can track the entire loan process from the Interactive Loan Dashboard.

Access to a live home loan advisor: Reali sets you up with a dedicated home loan advisor, providing human contact to walk you through the entire loan process.

Not available everywhere: Reali Loans operates in just 12 states, though they do plan to add more in the future.

Reali does not service loans: This means your loan will be transferred to another company immediately after closing.

Limitations on lower loans: Reali Loans does not make loans for less than $150,000.

No secondary financing: This includes home equity loans or home equity lines of credit.

Conventional loans only: Reali Loans does not offer FHA or VA loans.

Should You Apply for a Mortgage With Reali Loans?

Reali Loans offers several advantages if you are applying for a mortgage:

- The loan application process itself will be much quicker, due to the fact that it is completed online, rather than having to actually meet with a mortgage loan officer.

- The process will be incredibly easy if you already have your supporting documentation saved on your computer. All you need to do is drag and drop the files, and you’re done.

- Being able to go online and check the status of your application is a much simpler process than playing telephone tag with a loan officer or processor.

- Reali Loans has no direct fees, like origination fees and application fees. That can save you several thousand dollars alone.

The major negatives with Reali Loans are that it operates in only 12 states, and that it has a limited mortgage loan selection. For example, they don’t offer FHA or VA loans, nor do they offer adjustable-rate mortgages. Their loan selection is limited to conforming conventional fixed rate mortgages.

But if you’re located in one of the 12 states where Reali Loans operates, you’re looking for a faster loan application process, and you want to save a bunch of money on closing costs, it’s well worth checking out.

If you’d like more information, or you’d like to apply for a mortgage, visit the Reali Loans website.