Overall Ranking

4.25/5

Overview

4.5/5

4/5

4.5/5

4/5

NewRetirement is a planning tool that can help you figure out if you’re on track for retirement and help you set goals if you’re not.

Editor's Note

You can trust the integrity of our balanced, independent financial advice. We may, however, receive compensation from the issuers of some products mentioned in this article. Opinions are the author's alone. This content has not been provided by, reviewed, approved or endorsed by any advertiser, unless otherwise noted below.

If you’re saving for retirement but not sure you’re on track to meet your goals, a tool called NewRetirement can help you figure out what to do.

NewRetirement offers tools, advice, an overview of your savings, and a financial checkup for free.

While there are many retirement planning websites, NewRetirement stands out because it allows you to get a more detailed view of the future.

You can also pay a fee to talk to an independent financial planner who can offer additional guidance.

What Is NewRetirement?

NewRetirement is a ground-up solution that helps users plan for retirement and check if they are on track. The San Francisco company was founded in 2015 by Stephen Chen and his brother, Tim, to help users navigate retirement planning.

The idea for NewRetirement evolved when Stephen was helping his mother transition into retirement. He was surprised at the lack of useful retirement planning resources, and the idea for a DIY retirement planning solution was born.

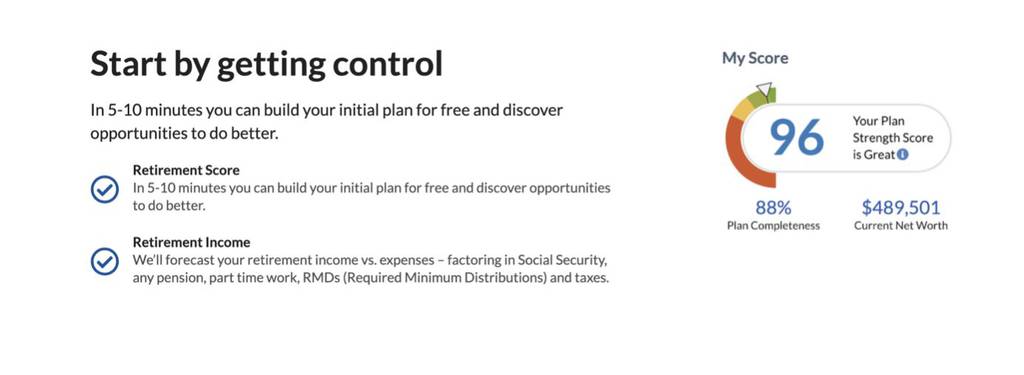

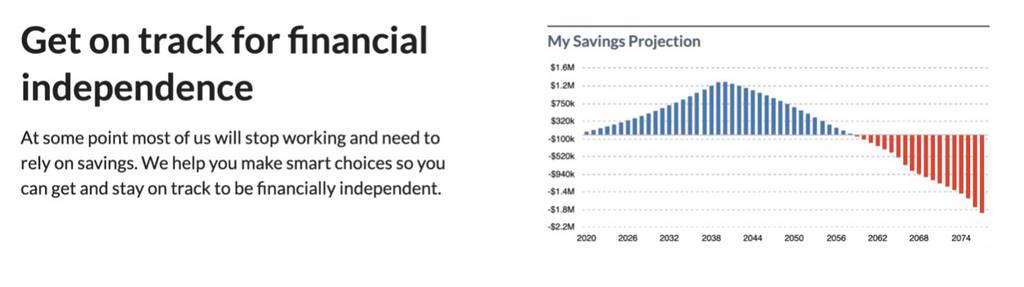

NewRetirement starts by asking you to input some data to help you build your initial plan. This part of the planning tool is free and provides you with a retirement score, a forecast of your retirement income vs. expenses, and helps you find opportunities to improve your finances. The calculator also offers tools to help you get on track for financial independence.

While NewRetirement can help you create a financial plan for retirement and check your current course, it does not manage your investments.

Even if you elect for the paid tier that gives you access to a financial planner, you will still need to work with a broker or a robo-advisor to execute your retirement plan.

Related: Best Robo Advisors

NewRetirement Features

Quick Overview Option

When you get started, you have the option to do a quick check of your retirement finances or a comprehensive look. Both are free, but the quick option estimates income, savings, and expenses and gives you a less detailed overview.

NewRetirement estimates it will take you a couple of minutes to complete the quick version. In less time than it takes you to brew a cup of coffee, you can have insight into how you’re doing with retirement planning.

If you go the quick route, you can always add and update your information later.

Detailed Financial Plan

The comprehensive version of NewRetirement allows you to include more information about your finances, although you can still use estimates for some inputs. The plan you receive will be more accurate and result in a higher likelihood of success.

NewRetirement estimates it should take you eight minutes to complete all the information for the comprehensive path. Since you will be required to include income, expenses, retirement, savings, pensions, and home value, this may take longer unless you already have a spreadsheet handy with this information.

The great thing is that you can use an estimate and go back and change the number when you have time. Even guessing your mortgage, retirement, or home value can still give you a good overview of your retirement situation.

Once you finish the questionnaire, you will have a baseline plan that gives you a potential peek into the future, including your estimated monthly income and the average age when your savings will run out.

You will also get a plan strength score, which comes with suggestions and opportunities to improve your finances.

The retirement income forecast will consider Social Security, pensions, required minimum distributions (RMDs), part-time work, and taxes. If you use estimates for any of these inputs, you can get a more accurate forecast by going back in and updating the data with actual numbers.

Suggestions and Articles

Once you complete your profile, you can access additional features, including what-if modeling and coach suggestions.

NewRetirement reviews your finances and identifies opportunities to improve your savings, investing, taxes, and more.

The what-if feature can include running through scenarios such as taking a part-time job, delaying retirement by a few years, or reducing expenses to see how they affect your retirement plan.

Coach suggestions offer recommendations for how to improve your financial plan.

Some suggestions will direct you to take action, such as reviewing the plan with your spouse or considering how your expenses may change over time. Other recommendations may lead you to informational articles or tools that can help you learn more and refine your retirement plan.

You can also sign up for daily emails that can guide you on your road to retirement.

Get Started for Free With New Retirement

NewRetirement Pricing and Fees

NewRetirement offers one free and one paid option to subscribers. In addition, it has two add-on options to customize your retirement planning.

Free Planner

The free plan is where everyone starts. It helps you get organized and figure out where you stand regarding your retirement.

Many people will find enough recommendations and analysis just using the free version. You will also get access to coach recommendations, what-if scenarios, and informative articles to help you refine your plan.

It can give you a good overview of where you are on your road to retirement and if you need to make any changes to be successful. The free planner uses estimates for some calculations and doesn’t offer much customization, which can skew your retirement plan.

However, if your primary goal is to double-check your retirement is on track without needing exact calculations, the free planner offers plenty of features and tools. If you want a more precise plan, upgrading to PlannerPlus may be a good option for you.

PlannerPlus - $96 Annually

The next level after the free plan option is the PlannerPlus. For $96 per year, you can take your retirement planning up a notch and unlock several tools, and NewRetirement even offers a free 14-day trial. This way, you can try out all the extra tools before deciding if it’s worth the cost.

Going to a paid level allows you to link your accounts to NewRetirement for a more accurate picture. You can also add a wider variety of assumptions for each planning category to broaden your potential outcomes and make a more solid plan, including variables such as salary raises, investment returns, inflation, Roth IRA conversions, and more.

A budgeting tool helps you review your budget, plan for tax liabilities, and review your assets and income to improve your projections.

If you’re planning to retire early, using the tax modeling tool for Roth conversions can help you stay below marginal tax rates. NewRetirement also offers a Monte Carlo simulation along with an article on it works.

In addition, you’ll get access to downloadable charts and reports to help you work on your retirement plan offline. If you want to maximize certain parts of your retirement plan, NewRetirement offers suggestions to get you on the right track.

Add-ons: Product Expert and Financial Advisor

Customize your NewRetirement plan with the following add-ons:

Product Expert - $150+/Session

Add one-on-one Zoom sessions with an expert to either of the plans above for $150 per session. Talking with a planner can help you stress test your retirement plan and ensure you’re on the right track.

Financial Advisor - $999+ Annually

For those who want additional support beyond what’s provided by the one-on-one Zoom sessions, NewRetirement has an advisor option. While it’s pricey at $999 per year, it gives you access to a Certified Financial Planner, which can help you deal with complex financial situations and help you customize your plan further.

It’s important to note that NewRetirement does not manage your investments. The fee-only financial advisor can help guide you on the best ways to optimize your investments, but you will have to do the legwork.

Get on Track With New Retirement

NewRetirement Security

NewRetirement uses bank-level security to keep your data safe. All data is encrypted using industry-standard 128-bit encryption. In addition, the company has internal access controls preventing NewRetirement employees from having access to your credentials.

If you opt for the PlannerPlus, you can link your brokerage and bank accounts using Plaid. Plaid uses industry-leading security practices to keep your data safe, and NewRetirement does not store any of your credentials.

NewRetirement Customer Service and Support

If you need help, you can get technical support by phone, email, or by using the live chat feature. To access the chat feature, you will need to log into your planner account.

NewRetirement also offers video tutorials to help you troubleshoot specific common problems and save you from contacting customer service.

Pros and Cons

Robust free planner — The free planner level offers plenty of functionality to help you get an overall feel for your retirement plan. If you gather all the necessary data and make a few assumptions, this may only take eight to ten minutes.

Great resources — Many of the resources and calculators are available with the free version. This includes the coach suggestions and a bank of free advice articles to help you refine your plan.

Additional help options — If you need additional help, NewRetirement offers one-on-one Zoom sessions as part of the PlannerPlus level or as an add-on option.

Need to upgrade for exact inputs — Many of the calculators in the free plan only allow you to use broad assumptions. If you want to be more specific, you will have to upgrade.

Account linking only for paid levels — If you want to link your brokerage and bank accounts, you will need to upgrade to the paid level.

Some simulators and calculators only available at paid level — Certain tools such as the Monte Carlo simulation can only be accessed at the paid level.

NewRetirement Alternatives

Retirement planning calculators and planners have been around for a while. There are plenty of competitors, but most offer only a fraction of the functionality and tools of NewRetirement. Below are some alternatives to consider.

Empower

Empower offers financial planning tools to help you meet your retirement goals. Using the retirement planning feature, you can enter your age, savings behavior, and other variables and get a checkup on your retirement plan. Additional features include a savings planner that tells you if you’re saving enough for retirement, how much progress you’ve made toward paying off debts, and if you prepared properly for emergencies.

Another helpful feature is the retirement fee analyzer, which shows if your fees are above average. Other tools, such as an asset allocation checkup, tell you if your portfolio is too aggressive or conservative. It also offers target allocation recommendations based on your goals.

All of these tools are available at the free level. You can also link all of your accounts for free, unlike NewRetirement. However, for access to a financial planner, you will need to sign up for Wealth Management which requires a minimum of $100,000 in investment assets.

(Personal Capital is now Empower)

Visit Empower or read our full Empower Review

OnTrajectory

OnTrajectory is similar to NewRetirement and helps you determine if you’re on track for retirement. It’s not free, but it offers a free trial period.

You’ll need to enter various information such as your income, Social Security, pensions, expenses, and current account balances to get started. Unlike NewRetirement, OnTrajectory does not offer the option to link your accounts, and you’ll have to enter the information manually.

From there, you can change the various inputs to create future projections to help you refine your retirement plan and figure out how different income streams, such as a part-time job in retirement, will affect your plan.

Who Is NewRetirement For?

NewRetirement is a great option for anyone looking to make a retirement plan. The free plan level offers plenty of functionality to help you figure out if you’re on track for retirement. Just keep in mind that some calculators will only let you use broad assumptions unless you’re willing to move to a paid tier.

Bottom Line

If you’re looking for a comprehensive retirement planning tool that won’t break the bank, you can’t get much better than NewRetirement.

The free version helps you factor in retirement variables such as Social Security, pensions, 401(k) plans, and RMD requirements. You can sign up for the free version at NewRetirement and see if you’re meeting your goals.

There’s no pressure to join the paid plan, and you can always pay a one-time fee to talk to a planner via Zoom. However, remember that you will have to implement investing advice since NewRetirement does not offer wealth management. If you prefer someone else do the heavy lifting, you may be better off with a robo-advisor.

Sign up for Free With NewRetirement

Empower Personal Wealth, LLC (“EPW”) compensates Webpals Systems S. C LTD for new leads. Webpals Systems S. C LTD is not an investment client of Personal Capital Advisors Corporation or Empower Advisory Group, LLC