As a 22-year old who was way too excited about investing, I vividly remember creating my first retirement tracking Google Sheet. The sheet was intended to show me how much I could expect to have saved for retirement based on certain monthly contribution amounts and a specific annual rate of return.

I still look back on that Google Sheet with fondness every once in a while. But the reality is that I haven’t used it in years. It didn’t take long for me to realize that to properly analyze my portfolio, I needed to consider a host of factors such as the historical performance of my investments, fees, my retirement income needs, and more.

This is why I began to turn to retirement planning and tracking apps that can offer advanced calculations and simulations. Plus, many of the retirement trackers available today make it easy to track all of your investment accounts in one place. Below, we take a closer look at how retirement tracking apps work and provide a list of the best ones available today.

What Is a Retirement Tracking App?

A retirement tracking app allows you to manage and analyze all of your investments in one place. Some investors have multiple 401k and/or IRA accounts. Others may have some of their retirement savings placed in taxable accounts.

The more investment accounts you have, the more difficult it becomes to track your progress and evaluate your portfolio performance. But by using a third-party retirement planner, you can see all of your investments in one place.

Most retirement tracking apps can estimate your retirement savings balance based on your current savings amount and asset allocation. Others will run Monte Carlo simulations to analyze the probability of different portfolio outcomes. Some will also evaluate the performance and fees of your underlying holdings (i.e. mutual funds, ETFs, stocks, etc.)

Related: Should You Buy Mutual Funds or ETFs?

What to Look For in Retirement Tracking Apps

First and foremost, it’s important to look for retirement planning apps that are low-cost. How low? Preferably free. Typically, you shouldn’t have to pay for a retirement tracking app unless it offers additional services such as robo-advisor, wealth management, or CFP access.

Next, you’ll want to look for retirement calculator apps that offer syncing with your external accounts. Remember, the idea is that these apps are meant to offer more convenience than old-school manual-entry tools (i.e. Google Sheets). So if a retirement tracking app you’re considering cant connect with your bank or broker, you may want to keep looking for a better option.

Finally, the best retirement tracking apps visually display their results in aesthetically pleasing ways. In other words, they’re able to condense the complicated math into colorful graphs and charts that are easy to understand.

Best Retirement Tracking Apps Overview

| Name | Best For |

|---|---|

| Empower | Analyzing your investing fees |

| Betterment | Analyzing your tax strategy |

| Wealthfront | Analyzing your financial goals |

| Stash | Analyzing your retirement income needs |

| Vanguard | Analyzing the cost of a 401k loan |

| Financial Planner | Analyzing complicated financial situations |

6 Best Retirement Tracking Apps

Ready to start taking your retirement planning more seriously? The retirement tracking apps we cover below can help you take things to the next level.

Empower

(Personal Capital is now Empower)

Empower tops our list of best retirement tracking apps by offering several advanced tools that are all completely free to use. In addition to its savings planner, Empower offers four investment-focused tools. These are its:

- Retirement Planner

- Net Worth Calculator

- Investment Checkup tool

- Fee Analyzer

Empower makes it easy to link your brokerage and bank accounts to its Net Worth Calculator. And its Investment Checkup tool can help you assess your portfolio’s risk and compare its performance to your target.

Its marquee Retirement Planner will run 5,000 Monte Carlo simulations on your portfolio and give it a low, medium, or high probability of success. Here are a few more of the features built into the Retirement Planner:

- Recession simulator: This shows you how your portfolio would have been affected by a major negative event like the Dotcom Crash or the financial crisis of 2008.

- Scenarios: See how changing your asset allocation, monthly investment amounts, or retirement date could impact your net worth at retirement.

- Income and expense planning: Add your income and anticipated expenses to create a data-driven spending plan that can help you reach your financial goals.

Finally, Empowers Fee Analyzer can help you find hidden fees in your mutual funds or 401k accounts. After linking your 401k, Empower can show you how much you’d pay in fees over your lifetime with your current portfolio. And, when possible, it will recommend lower-cost ETF or index fund alternatives.

Empower offers a lot of the tools listed above for free as a way to promote its Wealth Management services. For accounts below $1 million, Empowers Wealth Management fee is 0.89%.

Visit Empower or learn more in our Empower review.

Betterment

Betterment is a low-cost robo-advisor investment platform. But it makes our list of best retirement tracking apps because of the free Retirement Savings Calculator it offers. The calculator will ask you four questions:

- How old are you? This is used to calculate how long you’ll have to contribute before you reach retirement.

- What is your household annual pre-tax income? This is used to estimate your Social Security benefits.

- How much has your household already saved for retirement? You’ll want to include the balance of any 401(k)s, IRAs, or other accounts that are earmarked for your retirement.

- How much is your household saving for retirement each year? This is used to calculate the income that your investments may provide in retirement.

Once you’ve finished this quick questionnaire, Betterment can instantly generate a graph that projects your annual spending in retirement.

On the left, you’ll see the amount of income that your investments are likely to generate in retirement. And, on the right, you’ll see how much income your investments would mostly generate in retirement even if they performed poorly.

For more accurate estimates, you can also open a free Betterment account, after which you’ll be able to sync your external accounts. Once your accounts have been linked, you can log back in at any time to track your progress. Betterments No Fee tier also offers a no-fee checking account and a high-yield savings account.

Betterments expert tax advice is one of its biggest strengths. In addition to tax-loss harvesting strategies, it can help you find tax-efficient rebalancing and asset location options. In fact, Betterments simulations show that following its recommendations over a 30-year span could lead to an estimated 38.8% more of after-tax money in retirement.

Of course, you can always choose to upgrade to one of Betterment’s investing tiers if you’d like more retirement advice. The annual fee is 0.25% for Betterment’s Digital Investing tier and 0.40% for its Premium tier (which includes unlimited CFP access).

Visit Betterment or Check out our full review of Betterment.

Wealthfront

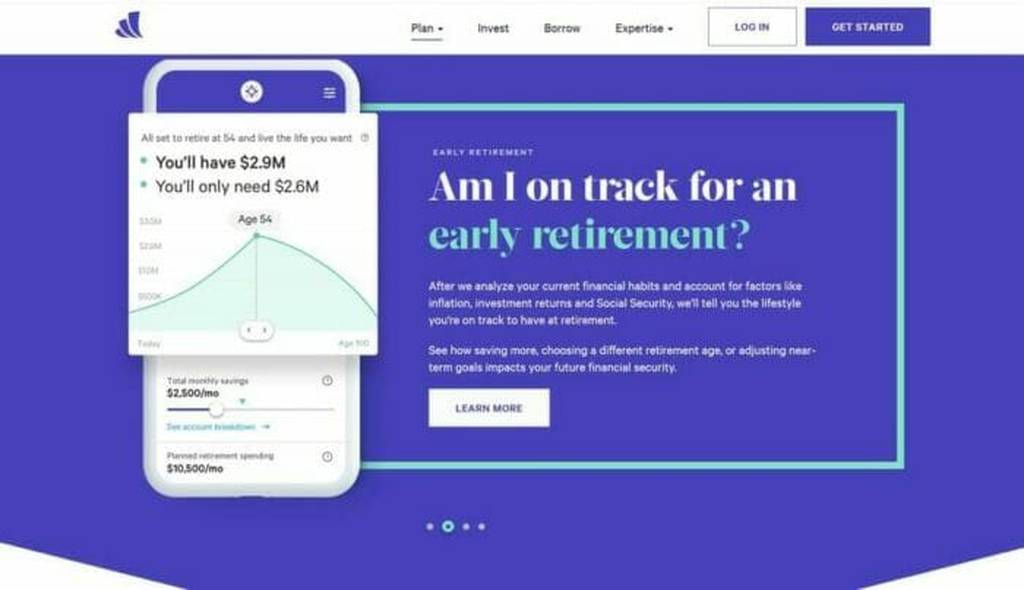

Wealthfront is another company that is primarily known for its robo-advisor platform. At the end of 2018, however, it made big waves by announcing that it was launching FREE financial planning services inside its mobile app.

Wealthfronts free app allows users to map out their financial future and achieve their goals by running scenarios and receiving world-class, data-driven advice. In fact, Wealthfront says that its app includes answers to 10,000 investment questions!

One major reason that Wealthfront is one of the best retirement tracking apps available today is that doesn’t require any manual input. Simply link your bank, brokerage, and loan accounts, and Wealthfront can automatically calculate your retirement savings and projected net worth.

Wealthfronts financial planning tools revolve around your financial goals. Whether you want to buy a house or pay for your child’s college education, Wealthfront will show you how much (and in which type of account) you should be saving each month to reach your goals on time. You can also easily see how your retirement savings would be impacted if your goals were modified or delayed.

In addition to its free financial planning, Wealthfront also offers a high-yield cash account that charges no fees and offers early direct deposit. And it only charges a 0.25% annual advisory fee on its robo-advisor investment accounts.

Visit Wealthfront or See our full review of Wealthfront.

Stash

Next on our list of best retirement tracking apps is Stash. Stash is a fintech company known for its automatic savings tools and fractional investing options. But it also offers a solid retirement calculator that is worth checking out.

Similar to Betterment’s calculator, Stash will ask you a few questions about your age, income, and existing retirement savings. For more detailed calculations, you can also modify its default Assumptions which are:

- I will need 70% of my pre-retirement income for spending in retirement.

- My investment rate of return (pre-retirement) will be 6.0%.

- My investment rate of return (post-retirement) will be 5.0%.

- My rate of increase in annual salary will be 2%.

- I expect to live 90 years.

- The average inflation rate throughout my life will be 3%.

After plugging in your information, the Stash retirement calculator can show you how your projected net worth at retirement compares to what you’ll most likely need to have saved.

Next, Stash can give several recommendations. For example, it may recommend that you delay retirement a few years longer. In my case, it asked me to consider whether I would really need 70% of my pre-retirement income in retirement and directed me to some resources to help me decide.

All of the tools listed above are free to use. But if you’d like access to Stash’s full suite of banking and automatic investing tools, plans start at $1/month.

Visit Stash or Learn more about Stash in our full review.

Related: How Much Should You Have Saved for Retirement?

Vanguard

Vanguard is a stockbroker known for offering low-cost index funds. The company also offers three retirement planning tools:

- Retirement Income calculator

- Retirement Nest Egg calculator (using Monte Carlo simulations)

- Retirement Plan Loan calculator

The first two calculators listed above are similar to many of the others on this list. But the last one is a bit unique in that it’s meant to help you weigh the true cost of a 401k loan. The Retirement Plan Loan calculator considers several variables including:

- Loan amount

- Term of the loan

- Plan loan interest rate

- Alternative lender interest rate

- Expected annual return on savings

Finally, the calculator can compare what your loan would cost in terms of foregone investment return by borrowing from your retirement plan to the interest that you’d pay if you borrowed from a bank or online lender instead.

In addition to the retirement tracking tools listed above, Vanguard also offers college savings, 401k plan savings, and power of compounding calculators.

To learn more about Vanguards tools and investment services, read our full review.

Financial Planner

While retirement calculators can be very helpful, they won’t be sufficient for everyone. If you have a complicated financial situation, a high net worth, or are about to experience a big life change, a human financial planner may still be your best retirement planning choice.

But how can you find a reputable financial planner? Apps like SmartAsset, and Paladin Registry can help.

Paladin Registry offers a free advisor match tool that is very similar to the one offered by SmartAsset. Or if you’d prefer to do your own scouting, you can browse through its directory to find advisors located near your zip code. You can also use its Check a Credential to verify an advisor’s certifications and licenses.

SmartAsset can help you find a local fiduciary advisor near you through its SmartAdvisor program. After answering a few simple questions, you’ll get up to three financial planner matches. And if you’d like, you can immediately book an appointment for an introductory interview.

Related: Best Online Financial Advisors

How Did We Come Up with This List?

First, each of the retirement trackers on this list is free to use. While many of the companies discussed above also offer paid services, their core retirement calculators and planners are made available at no charge.

Second, all of the companies covered above also offer professional brokerage services (with the exception of the ones that offer advisor-matching services). In other words, these are companies that have a deep understanding of how investing works and the ins and outs of financial planning.

Finally, in the case of the advisor-matching apps, we only choose matching services that work with fiduciary financial advisors. Further, each app carefully vets their advisors to confirm that they possess the required licenses and certifications.

FAQs

How do I find all my retirement accounts?

Think that you may have unclaimed 401(k) money from an old job and you’re not sure where to find it? You may be able to find your retirement accounts by using online databases like the National Registry of Unclaimed Retirement Benefits, MissingMoney.com, or Unclaimed.org.

What is a Monte Carlo simulation?

A Monte Carlo simulation is a computer algorithm that is used to show the probability of an event occurring. These simulations are applied to a variety of fields including finance where they can help to predict the impact of risk and volatility on a portfolio.

How can I check my retirement money?

Most brokers and 401(k) plans now offer online account access. Contact your plan administrator or broker customer service line if you need login assistance. You can also use the Social Security Quick calculator on SSA.gov to estimate your future Social Security benefits.

How do I find a good retirement planner?

You can use apps like Facet Wealth, SmartAsset, and Paladin Registry to find credentialed retirement planners. You can also use the “Verify a CFP® Professional” tool on the CFP Board website to find retirement planners who hold the CFP® certification.

Final Thoughts

Finding the right retirement planning tool for you will depend on your needs. If you have a simple financial situation, one of the retirement tracking apps above could provide all the direction and advice you need. But if your situation is a bit more complex, sitting down with a qualified financial planner may be the best way to verify that your retirement savings are on the right track.

DoughRoller receives cash compensation from Wealthfront Advisers LLC (“Wealthfront Advisers”) for each new client that applies for a Wealthfront Automated Investing Account through our links. This creates an incentive that results in a material conflict of interest. DoughRoller is not a Wealthfront Advisers client, and this is a paid endorsement. More information is available via our links to Wealthfront Advisers.

Empower Personal Wealth, LLC (“EPW”) compensates Webpals Systems S. C LTD for new leads. Webpals Systems S. C LTD is not an investment client of Personal Capital Advisors Corporation or Empower Advisory Group, LLC

Related: