Picking the right insurance policy for you (and your family) can be tricky. There are so many options out there, and it’s difficult to decide which product best suits your needs.

Should you buy term or whole life? How much insurance do you actually need? When should you buy your first policy? Which company should I go with?

While term life is an ideal option for most people, whole life certainly has its benefits. If you’ve decided that a whole, or permanent, life insurance policy is the right choice for you, you’ll want to spend some time shopping around to find the best policy offered. Luckily, we have sifted through them and found some of our favorites, to save you time.

Let’s take a look at the companies that offer the most beneficial whole life insurance policies, and what you need to know about each.

Why Choose Whole Life?

Really quickly, let’s talk about whole life insurance and why you’d choose it.

Lifelong Coverage

Whole life is different from term life in that it’s considered a permanent policy. This means that it doesn’t have a set period of time that it covers (or term). The policy continues indefinitely. If you wanted, you could have the same life insurance policy from ages 20 to 100, without ever having to change companies or reapply.

You won’t have to worry about finding an insurance policy after a serious illness or injury. You won’t go into a 10-year term at age 40, knowing full well that when it’s time to renew, you’ll be 50 and your premiums will probably jump.

Predictable Premiums

Another benefit to whole life insurance is that the amount paid each month is level, or consistent. You don’t have to worry about premium hikes as you age or as your health declines.

If you want payments that stay the same throughout your entire life, without the worry of terms and varying premiums, whole life is where you need to look.

Cash Value

With whole life policies, you also don’t lose the money paid into premiums. You do lose this money with a term policy (assuming, of course, that you don’t pass away during the term). Whole life policies will build up a cash value. A portion of your monthly premium will go toward the cost of coverage, and the remainder will go into a savings account of sorts.

This money will then earn dividends and grow over time, potentially building into a significant nest egg. That’s why some people choose to use whole life policies as a combination life insurance and retirement account.

If you ever need to draw from your policy or cash it out, the option is there. This makes whole life insurance an asset, rather than simply a safety net expense. Of course, the price reflects such--whole life premiums usually dwarf those of their term counterparts.

Before choosing a whole life product, be sure to consult a fee-only financial advisor. Since they won’t make a commission off of your financial decisions, they can offer you objective advice on what you truly need.

Our Rating Methodology

What We Looked At

All of these companies were checked against A.M. Best--which is a major rating agency of insurance providers. Each company came out with high marks. This is the primary reason they made the list. They’ve gotten top grades for being reliable and having good customer service.

Each of the companies here are available nationwide. We avoided obscure companies and those that had membership requirements (like USAA) or strict eligibility guidelines.

We also only looked at companies that sell their own policies. Middlemen add a level of confusion and frustration when the time comes to file a claim or access your cash. Only considering companies that underwrite their own whole life policies can help eliminate some of that frustration.

We also picked companies that offered a wide range of life insurance coverage. Whether you want $25,000 to cover funeral expenses or $1 million to take care of your family for years, you can find what you need.

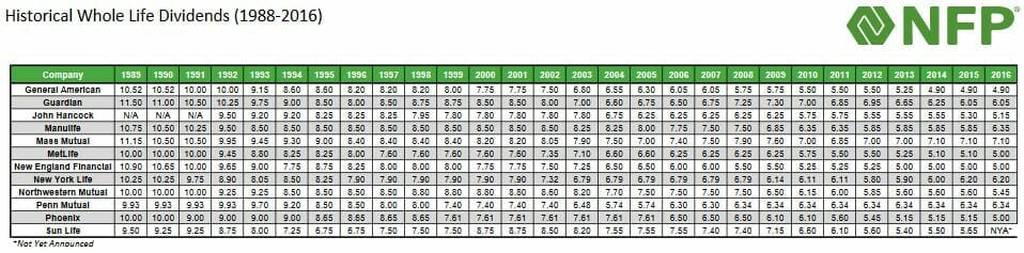

We also looked at the history of each company from an investment perspective. Specifically, we considered their dividend rates. Not all insurance companies will pay out dividends or, if they do, they aren’t guaranteed. When they are paid out, though, they’re a nice addition to your financial situation and can even offset your premium payments.

Of course, dividends in the past don’t play a role in the future trajectory of a company. However, you can use them as a good gauge of how a company is managing their expenses and investment strategy. It’s a solid indicator of how a company will react moving forward and how things are being managed internally.

What We Didn’t Look At

There’s really only one factor that we didn’t consider when writing this article, even though it’s probably a very important one to you--the price.

Life insurance policies are very personal products. Depending on your preferred coverage, benefits, added riders, and selected options, your cost will change. Throw in the fact that your initial approval for whole life insurance will also be determined by your health, age, and other factors, and it would actually be impossible to fairly compare these companies by price.

Your best bet is to determine which companies better suit your needs as far as offered options and coverage. Then, compare prices, sifting through the companies you chose. This may be a fairly involved process, though, as whole life policies often require you to get quotes from agents. There aren’t online quote aggregators available, like there are for term life policies.

Best Whole Life Insurance Companies

Find the Cheapest Insurance Quotes in Your Area

There are a number of companies on the market offering whole life insurance policies. But which company is the best?

Let’s take an in-depth look at some of the better-known and better-rated sellers out there. This way, you can see exactly what they offer. Today, we’re going to talk about State Farm, MassMutual, Guardian Life, and Northwestern Mutual. These aren’t the only companies you have to choose from, but they are the ones that we deemed to be at the top of their class.

Northwestern Mutual

Making the top of our list for a number of reasons, Northwestern Mutual is definitely the front-runner overall.

Remember those agency ratings we talked about? Well, Northwestern Mutual tops out on all of them. In fact, A.M. Best ranked the company A++ (or Superior) in their Financial Strength Rating and aaa in their Long-Term Issuer Credit Rating. This means that the company is reliable and has the financial backing necessary to elicit confidence from their clients.

Northwestern Mutual also has longevity and a proven track record on their side. They were founded in 1857 and today, they’re the biggest writer of life insurance in the country. The company also ranked third in customer satisfaction, according to last year’s survey by J.D. Power and Associates.

- Pros: They boast a great company history, excellent customer service rankings, and high dividend payouts.

- Cons: Their website is, well, pretty slim. This means that if you want more information (especially on pricing), you’ll need to call and speak to an agent. Also, they only offer three different cash-accumulation models, so you’re somewhat limited in your policy options.

Guardian Life

Ranked Harris Polls 2017 Life Insurance Brand of the Year, Guardian Life is a trusted name in the world of whole life companies. In fact, it’s almost just as old as Northwestern Mutual, having been founded in 1860.

It’s no surprise, either, since they scored just as well as Northwestern Mutual--A++ in Financial Strength Rating and aa- in Long-Term Issuer Credit Ratings--according to A.M. Best. This puts them in the top-tier for reliability and financial security.

Where Guardian Life really shines, though, is in its premium customization options. No matter your financial situation or what you consider to be the ideal whole life insurance product, Guardian Life has a structure to suit you.

For example, if you are primarily concerned with lower premiums and aren’t as concerned about the accumulating cash value, the Guardian Whole Life Paid-Up at Age 121 (L121) policy is right up your alley.

If paying off your premiums quickly and accelerating your cash value is of utmost importance (and you have the room in your budget for a higher monthly premium), you may want to opt for the Ten Pay Whole Life plan. This allows you pay for your policy’s full coverage over the course of 10 annual premium payments. After that, any funds contributed go straight to your wealth-building cash value.

- Pros: This is another company with excellent customer service and ratings, as well as the ability to really customize the life insurance policy (and premium schedule) that best suits you. Their website is also very informative, with plenty of life insurance-related resources.

- Cons: Their dividend rate has been slowly declining over the past few years, holding steady for the last two. While this is fairly standard across the industry at the moment, it’s not the best dividend history around. They also have a smaller network than some of the other companies, so finding a local agent to work with might be a challenge.

MassMutual

If you want a top-ranked whole life insurance company that has a history of paying out the highest dividends around, look no further than MassMutual.

The oldest of the three companies, MassMutual has been around since 1851. They top out the A.M. Best rankings(A++ and aa+, respectively), but ranked a bit below average in customer satisfaction, according to J.D. Power.

Where they stand out is in their dividend payouts. Most insurance companies have been steadily decreasing their dividends, with most holding steady for the last few years. MassMutual, however, has steadily been increasing their rates. Last year, in fact, they offered 17% more than Guardian and 30% more than Northwestern Mutual.

- Pros: This company is on par with their competitors as far as quality rankings, but holds strong above them all on dividend rates. They also offer five different cash-accumulation models to choose from.

- Cons: Their customer satisfaction ratings are lower than the other companies mentioned.

Additional Riders

All three of the companies listed above also offer different riders that may be of interest to you when picking a whole life insurance product. These include:

Waiver of Premium

This rider is important to have, in case you were to ever become disabled before age 60. (Considering that somewhere around one in four of today’s 20 year-olds will be disabled before retirement, this has a significant risk.)

The waiver of premium allows the policyholder to have their premiums forgiven if they were to become disabled. This protects them from the likely financial strain and loss of income that disability would bring. It also potentially saves them from a policy surrender, due to nonpayment.

Living Benefits

The living benefits rider allows you to access a portion of your death benefits prior to passing, in the case of a terminal illness or debilitating injury. Requirements vary, but typically, you’ll need to have a prognosis of 24 months or less in order to access these funds.

However, they can be incredibly useful. If you are ill or injured, your family could probably use the financial stability that a lump sum payout would bring. It could help take some of the strain off of your family’s bank account, could be used to pay for home care or assisted living, or (in some cases) could even be used to take that trip of a lifetime that you always dreamt about.

Taking out a portion of your death benefits in the form of a living benefits payout allows you to use what you need before your passing, while still leaving a portion for your loved ones to receive after you die.

Long-Term Care

LTC, or long-term care, riders are built into many plans as a way of paying for lengthy periods of care toward the end of a policyholder’s life. This could include nursing home care that isn’t covered by medical insurance, in-home assistance, etc.

Even if you use the long-term care coverage offered, your beneficiaries will still receive the remaining benefit. This amount varies, depending on your insurance provider.

Healthy Living

If you take your health seriously, you should consider checking out Sproutt. After taking Sproutts proprietary Guided Artificial Intelligence Assessment (GAIA), you’ll be assigned a Quality of Life Index (QL index) score. Sproutt’s software will recommend ways to raise your score to potentially unlock lower insurance rates. And you can get quotes from multiple whole life (and term) insurers in a matter of minutes.

Deciding on a Whole Life Policy

When picking life insurance, it can be tough to decide on the perfect policy. Picking between term and whole life, deciding on which riders to add, and even determining how much life insurance you need its a lot of questions.

If you’ve decided that whole life is right for you, though, then these three companies are great places to start looking. You’ll want a company that offers you flexible premiums, pays out dividends, and has a history of reliability. Finding the perfect policy will allow you to rest easy, knowing that you have secured your family’s livelihood.