Overall Ranking

4/5

Overview

4/5

4/5

5/5

3/5

5/5

Policygenius promises to offer insurance for life and everything in it with an easy application process. In this Policygenius review, we put it to the test.

Editor's Note

You can trust the integrity of our balanced, independent financial advice. We may, however, receive compensation from the issuers of some products mentioned in this article. Opinions are the author's alone. This content has not been provided by, reviewed, approved or endorsed by any advertiser, unless otherwise noted below.

One of the keys to finding the right insurance policy is shopping around. The internet has made that simpler, but Policygenius makes it an absolute breeze. This aggregate website is an online marketplace that acts as your one-stop shop for all sorts of insurance policies, including life insurance, disability insurance, health insurance, and even pet insurance.

Here, we’ll tell you what Policygenius is and why you may want to use it next time you’re shopping for insurance.

What is Policygenius?

Policygenius is a tool that allows you to compare quotes from various insurance companies all in one place. But it’s also more than that. Most other aggregator sites will give your information to all the insurance companies you work with. Apply for a quote, and you’ll queue endless calls and emails from insurance companies.

At Policygenius, though, it’s not like that. Instead, they act more like a traditional insurance broker with a slick online twist. They walk with you through the insurance purchasing process rather than passing you off directly onto the insurance company. So you can get the ease of an online insurance quote aggregator with the personalized advice of a broker.

Besides its insurance services, Policygenius also offers a robust database of articles on various insurance products. If you have questions about life insurance, renters insurance, health insurance, and more, Policygenius’s online magazine is a great place to go for answers.

Who Created It and Why?

Policygenius founders Jennifer Fitzgerald and Francois de Lame used to be consultants to insurance companies. But they saw some big gaps in the way the insurance world spoke to consumers. Concerned about the gaps this left–like the more than half of consumers with no life insurance–they decided to make things easier.

So they launched Policygenius in 2014. Since then, the company has found new and better ways to help consumers find the insurance coverage they need. As they note on their website, buying insurance will probably never be fun. But at least Policygenius makes it less of a headache.

Policygenius Features

First, know that Policygenius isn’t licensed to sell all types of insurance in every state. So the offerings may depend on your state. But they specialize in several types of insurance, including:

- Life insurance

- Disability insurance

- Health insurance

- Renters insurance

- Pet insurance

If you haven’t shopped around for health insurance options recently, you might check out Policygenius just to see if you can get a better deal than your current coverage.

Depending on where you live and what type of insurance you’re looking for, though, Policygenius could have a list of policies for you to choose from. They work with some of the leading insurance providers in the nation to get you a comparison of various quotes so that you can choose the best insurance policy for your needs.

Policygenius also offers a huge database of articles on insurance, so you can get advice on the type of insurance you’re shopping for. This is a nice added perk that can help you make better decisions about the insurance you need to buy.

Policygenius Pricing and Fees

You don’t have to pay anything directly to get an insurance policy through Policygenius. They work with a select group of insurance companies, all of which are rated highly for their financial stability. The insurance companies pay Policygenius if you purchase a policy through Policygenius. And that fee is written directly into the insurance quote.

In short: What you see is what you get. When you get quotes for various insurance policies, the price that you see from Policygenius is what you’ll pay for insurance, provided that you’re approved by the actual insurance company.

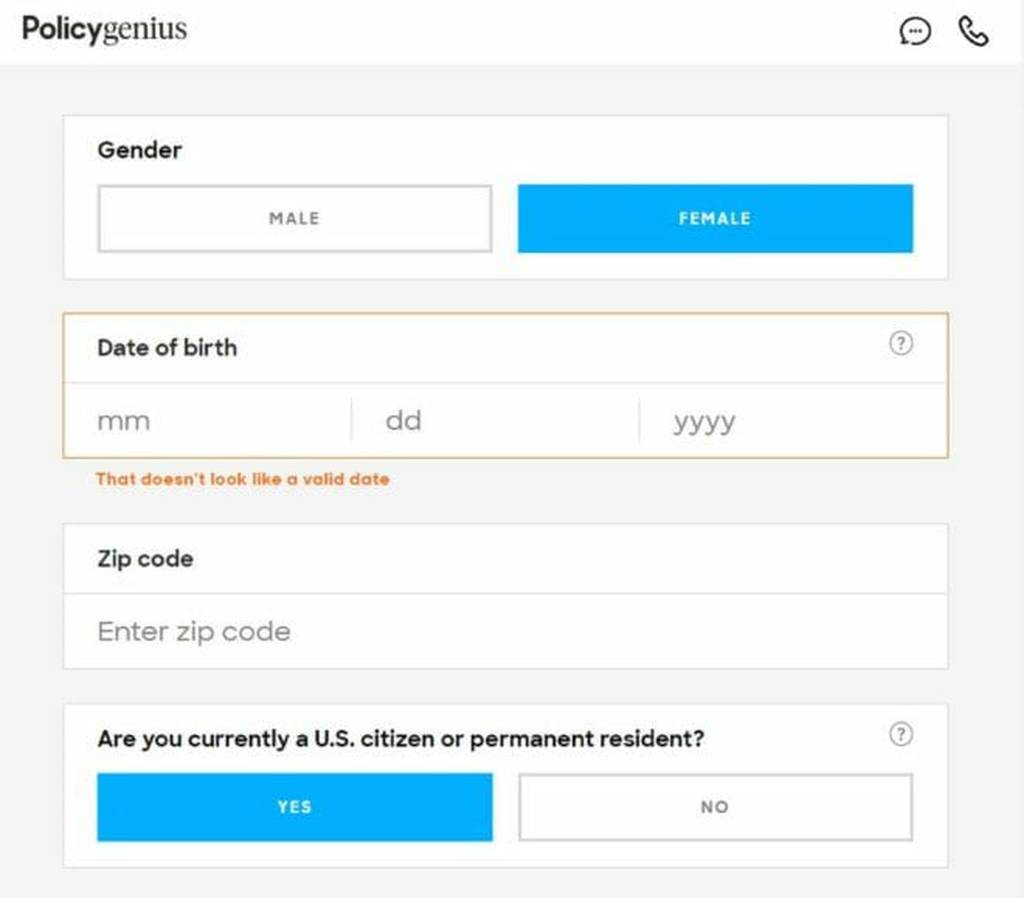

Getting Started

You don’t have to create an account with Policygenius to begin to get a quote. You’ll fill out your gender, date of birth, ZIP Code, citizenship status, marital status, and additional personal information. Once you get through these first two screens, you’ll be asked to enter your email address to save your progress. This lets you move forward, but you don’t have to create a full account with a password at this point.

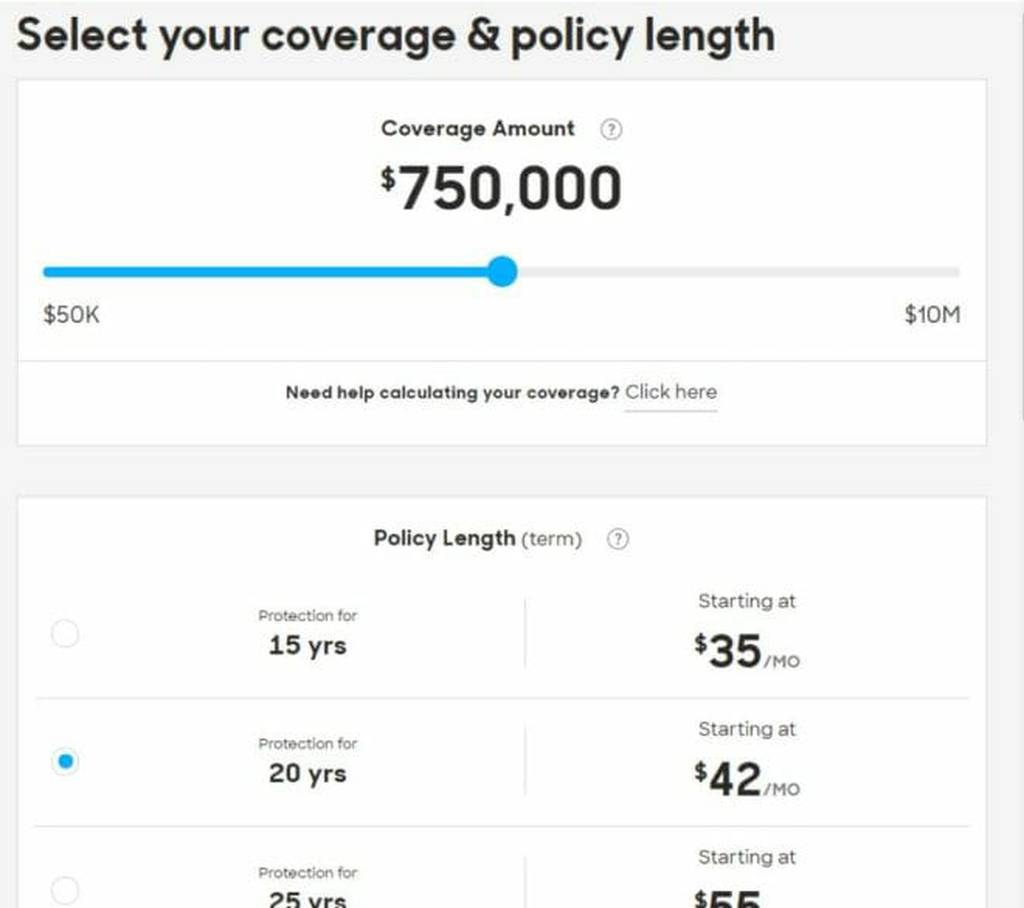

Once you get this information into the form you’ll get to choose the amount and type of term life insurance you want. When you’re choosing, you can see the starting monthly premium for each term of insurance.

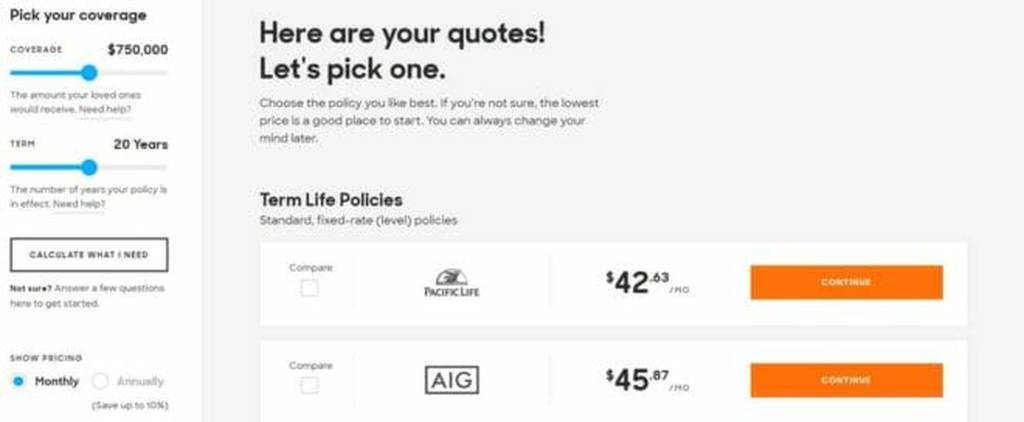

After this, you’ll get a screen with multiple insurance providers and the costs for the policies that match your circumstances. You can choose the insurer and policy you prefer. Here, you can also change the coverage amount and term length you want to look for:

Finally, you’ll need to fill out the rest of your personal information, including your name and phone number. Then Policygenius will call you to ensure that you’re a good fit for the insurance company before they fully process your application.

How Do I Choose a Policy?

Choosing a policy depends largely on your needs. Luckily, Policygenius has some great tools to help you figure out what you need.

One is their Insurance Checkup tool. It takes your basic information and then assesses things like your general level of worry, your ability to handle financial risks, and your family and financial situation. The checkup is pretty comprehensive and even asks for balances on your debts and information on your current insurance coverage.

Then the tool gives you a list of insurance to-dos. When I ran the checkup for myself, the tool suggested accident and critical illness policies to supplement my health insurance coverage. It also suggested pet insurance for my cat.

The Insurance Checkup tool can be a good place to begin if you’re looking for potential gaps in your insurance coverage. But if you have questions on specific types of insurance policies, check out Policygenius’s large base of informational articles for some in-depth information.

One thing to note, though, is that once you know how much insurance coverage you need, Policygenius suggests just choosing the cheapest quote you get. That’s because they only work with insurers that are financially sound. Since your policy will be taken care of either way, it’s a good idea to save as much on premiums as you can.

Security

Before giving your personal information to Policygenius, you might want to check out their security policy. They follow the best practices for encrypting data, including your health data. They are also regularly audited by HIPAA experts since they are dealing with personal health information.

Mobile Accessibility

Policygenius does not have an app, but it does have a mobile-accessible site so that you can apply and manage your applications from your phone.

Customer Service

Policygenius offers customer service via email seven days a week, 24 hours per day. They also have a live chat feature and a customer service phone line with extended hours throughout the week. Their customer service gets good reviews, generally. And, indeed, the service does depend a lot on customer service. Since Policygenius has to talk to you about your application during the process, you’ll have to interact with a customer service representative at some point.

Policygenius Pros and Cons

As with all insurance policy aggregators, Policygenius has its pros and cons, including:

It works with several insurance companies, all of which are vetted for their financial stability.

It seems to be fairly impartial. As a broker, Policygenius would of course prefer that you buy an insurance policy through their interface rather than somewhere else. But they do seem to generally give you a good set of impartial options.

They offer plenty of resources for choosing an insurance policy. The Insurance Checkup tool is excellent, and you can use it to find the amount of life insurance that you need.

Their customer service is great. They are known for helping people find the right insurance policy for their particular needs.

The process of finding and applying for insurance is easy. It’s nice to have a trusted source to get multiple insurance policies in one place.

Policygenius doesn’t work with all insurance companies, and not even with all good ones. So you may not get the absolute rock-bottom policy price from Policygenius. If you have other insurance companies you want to vet, you may need to apply to them separately.

They may need additional information. Policygenius’s online application is thorough. But it may not be all you need to provide to the insurance company you eventually choose. Applying directly with an insurer ensures that you fill out the full application on the first round.

Alternatives to Policygenius

There are definitely some alternatives to Policygenius online. However, there aren’t many companies that offer access to quotes for so many different types of insurance. So you might have to go one place for life insurance quotes, another place for health insurance quotes, and still another for property insurance quotes.

Some alternatives to consider include:

- CoverHound for personal and business property and liability insurance.

- Insurify for auto insurance.

- Impact Health for health insurance.

- Haven Life for life insurance, though only from one company.

Ultimately, Policygenius is one of the most flexible and comprehensive tools on the web. But you may also want to check out quotes with multiple individual insurers and even other aggregators to ensure you’re getting the best possible quotes for your needs.

Or, Check Out Bestow

While PolicyGenius will give you options to consider, Bestow will hook you up with a life insurance policy for cheap–and make it incredibly easy for you to do. Bestow offers their own insurance, but they’ve completely changed the way you shop for life insurance.

With Bestow, you don’t have to set up frustrating doctor’s appointments to get a physical, you don’t need to have blood draws or urine tests, and you don’t have to deal with a pile of complicated paperwork (that you’ll inevitably have to send back through snail mail).

You simply take about 10 minutes to do a questionnaire on your phone and within that time you’ll be able to get a life insurance policy that fits your personal situation. It’s as easy as that–and policies start at just $5 a month. See our full review of Bestow for more details.

Who is Policygenius For?

If you’re in the market for any of the above types of insurance coverage, Policygenius could be a great place to begin. It gives you the information you need to make an informed choice about insurance coverage. Then it lets you choose the coverage that best meets your needs.

However, there are a few potential caveats to consider, including:

- You may not get quotes from all available sources. Policygenius works with a pretty big list of insurance companies. But that doesn’t mean they work with all of them.

- Policygenius offers a variety of insurance options. But if they don’t have the type of insurance you’re looking for, you may need to go elsewhere.

Knowing that Policygenius isn’t going to sell your information to people who are then going to call you a million times is definitely a bonus. Plus, Policygenius can walk you through your options in a low-pressure environment. And they have some pretty great informational content to get you started, too.

Summary

In short, Policygenius is a great tool to use if you’re shopping for insurance. It makes the shopping process simple and will get you the quotes you need to make your decision. And if you aren’t sure what you actually need for your insurance coverage, you can use their handy tools to find out.