Overall Ranking

4.8/5

Overview

4/5

4.5/5

4.5/5

4/5

Lemonade is shaking up the insurance market with its innovative model. Find out its pricing, features, and why it’s getting so much attention.

Editor's Note

You can trust the integrity of our balanced, independent financial advice. We may, however, receive compensation from the issuers of some products mentioned in this article. Opinions are the author's alone. This content has not been provided by, reviewed, approved or endorsed by any advertiser, unless otherwise noted below.

Lemonade is a new face on the homeowners and renters insurance scene, but it’s already receiving tremendous feedback from consumers. Reinsured by huge names including Lloyd’s of London, Lemonade breaks the traditional insurance mold with low rates, a mutual insurance model, high-tech solutions, and transparency that is a welcome change from the norm.

Lemonade is stirring up a lot of commotion “reversing the traditional insurance model.” Its homeowners’ insurance model really does something revolutionary with its services. Shifting the focus from revenue to benefits, it’s a combination of innovative technology, flexible policies, and modern thinking. Not sure what that all means? Let me show you what Lemonade is all about.

How Does Lemonade Insurance Work?

Lemonade operates on a model similar to peer-to-peer insurance providers. That means people pay their premiums into a communal pot, and claims are covered by the money that’s in the jar.

This model has recently expanded to several areas throughout the industry, with companies like Prosper and LendingClub offering specialized social loans. This P2P model is certainly a refreshing twist to the gray and outdated insurance industry.

That’s already vastly different than the standard every-man-for-himself model, but Lemonade goes further. Traditionally, insurance companies tried to lure you to pay the highest premiums possible because that meant more money in their pockets. Then, they’d use red tape and hidden terms to deny your claims because the less money paid out in claims, the more revenue the company gets to keep.

The most amazing feature of Lemonade’s business model is this: After covering expenses, updating technology, and paying employees, Lemonade will donate leftover money to charity.

This is a really unique, innovative way to make sure that you and your insurer are not on opposite ends of a battlefield.

If you have a claim, a traditional insurer is incentivized to fight you, because if it doesn’t pay that claim, it will pocket that money as profit. Lemonade won’t get that money in any case because it will be earmarked for charity. We’ll dig deeper into this Giveback Program later in the article.

A Millennial Approach

Lemonade embraces technology, unlike other insurers. Whereas traditional insurance companies offer plans that I might liken to a dial-up modem, Lemonade services are more like high-speed mobile internet. You can sign up for everything via the mobile app or online, make claims, and receive reimbursements without ever leaving the couch.

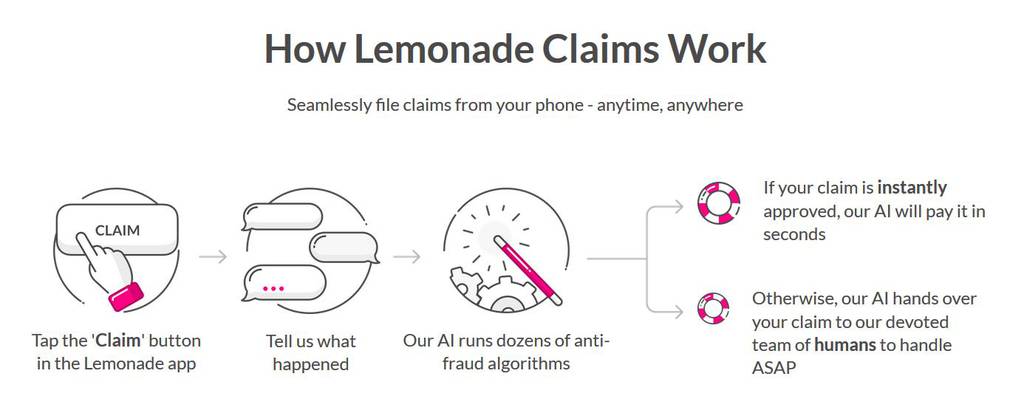

Claims are also automated for faster turnaround. You just upload a video of the damage, and Lemonade reviews the claim instantly. After approval, you’ll have the money transferred to your account so you can replace the item or have the property damage repaired.

What Does Lemonade Cover?

Lemonade coverage is pretty exhaustive, especially for the price. Generally, Lemonade can cover everyone in your home (all relatives included for no additional cost) excluding roommates who are not related to you, and all of your belongings even if they’re not in the house at the time of damage. Here’s what you can expect to be covered with a Lemonade homeowners/renters insurance policy:

Reconstruction Costs

If damage is done to your home, insurance covers the cost to repair those covered damages.

Personal Property Damage

Lemonade also covers damage or destruction of any personal items.

Personal Property Theft

You’ll be reimbursed if your personal property is stolen, and what’s even more impressive is that items are covered regardless of where the item is (in your home, outdoors, in France!).

Other Person Liability

Lemonade covers medical expenses and legal fees when another person is injured and you are held responsible. This also refers to injuries sustained on your property for which you are held liable.

Loss of Use

Finally, Lemonade will cover any living expenses you incur if forced to leave your home for covered reasons.

Is Lemonade Worth the Cost?

Easily one of its most prominent features is the low cost of having Lemonade insurance. When compared to the competition, Lemonade wins hands down in the rates department. No matter which policy and competitor I compared it to, Lemonade was at least $10 cheaper, and more often than not it was $200, $300 or even $400 less.

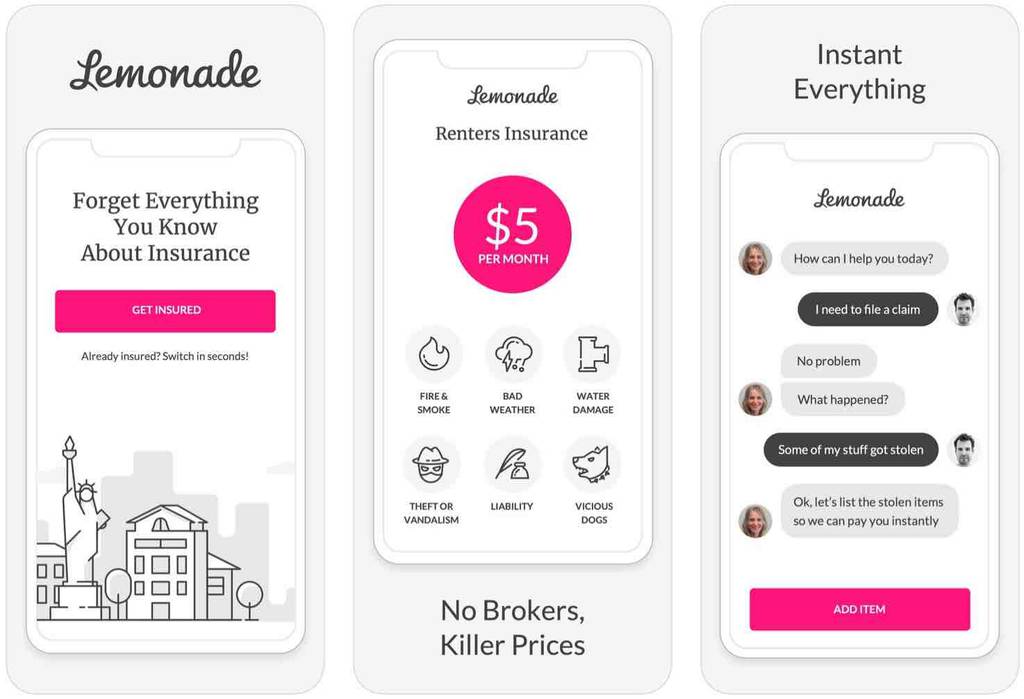

In short, Lemonade offers tremendous value for your money. If you aren’t looking for a bundled insurance policy, this is easily your cheapest bet. Where you live, what you want to be insured, and deductibles will factor into your premium cost, but a lot of people can get Lemonade renters insurance starting at $5/month. What’s more, Lemonade offers some of the highest coverage limits in the industry. That means you’ll get more money for your losses than you would from competitors.

Not only does it boast the lowest rates, but you can adjust your deductible at any time to increase or decrease your premiums. They’re inversely proportional, so if you pay more of a deductible, you’ll pay less premium.

Lemonade also offers discounts for good credit or owning an alarm system, smoke detectors, or home monitoring system. Don’t have a fire alarm or security system? Lemonade will give you a discount on your premiums even if you live within close proximity to major defense departments like a fire station or police department.

Coolest Lemonade Features

Zero Everything

Lemonade’s Zero Everything policy is great for people who have a lot of smaller items they want insuring. This policy waives the deductible for claims made in exchange for a slightly higher premium. Let’s say your $350 tablet breaks. With a $100 deductible, you’ll get $250 to have it replaced. With Zero Everything, you’ll get the full $350 (after paying a higher premium). And unlike many insurers, Lemonade won’t increase your rate if you make two claims or less annually.

Extra Coverage and Add-Ons

Lemonade allows you to increase your coverage limit for more valuable items. For example, the standard coverage limit for jewelry insurance is $1,500. However, you can expand your coverage, so the limit for that same item rises to an impressive $50,000. Such high limits for expanded coverage is a unique feature that you won’t easily find with Lemonade’s competitors. Coverage also applies to belongings stored in an outdoor unit. Items eligible for additional coverage include artwork, jewelry, bikes, musical instruments, and more.

Mobile App

With the sleek Lemonade app, you can request a quote, sign up and even file claims on the mobile app, making the entire process streamlined and so much faster than anything I’ve ever seen in the insurance industry (not to mention convenience you won’t find anywhere else). You can also tailor your coverage options and immediately apply changes via the app.

Transparency

Lemonade is straightforward and easy to work with. It tells you everything you’ll need to know, doesn’t hide behind complicated jargon, and explains policy rules and caveats.

What’s This About Charity?

Anyone who likes the idea of big corporations giving back will appreciate Lemonade’s Giveback Program. This initiative lets Lemonade customers pick charities to donate their premiums to. Here’s how it works:

Lemonade takes a flat rate percentage (20% to be exact) to cover salaries, costs, etc.

Another percentage goes back to purchasing reinsurance coverage

The rest goes towards claims

Now, here is where the charitable donations come in. If there is money left over in the claims pool, that remainder will go to charity. In the first year of the program, Lemonade gave away an unbelievable 10.2% of its annual revenue to charity through the Giveback Program.

Signing Up

Signing up for Lemonade is easy. If you visit the Lemonade website and click the “check our prices” button, it will bring you to a questionnaire that asks about your insurance needs.

Answering the questions takes about five minutes. After providing your contact information, Lemonade will use the information you provided to produce a quote. You can also customize the exact protections that you need. For example, if the default renter’s insurance policy offers $40,000 of personal property protection, you can adjust it upward or downward to see how that impacts your monthly cost.

Once you’re happy with the proposed policy you can choose the effective date of the policy and sign up.

Best of all, if you already have coverage from another company, Lemonade can help you cancel your old insurance policy.

Mobile Support

Lemonade’s website is fully functional on mobile devices. You can easily get a quote, purchase a policy, or submit claims through your account when using your phone.

You can also download the Lemonade app, which includes all of the features available on the Lemonade website.

If you have to make an insurance claim, you’re probably already in a difficult, stressful situation. Being able to easily submit a claim and get help from your phone means you can avoid the stress of having to find a computer to get help from your insurer.

Support/Customer Service

Lemonade offers 24/7 customer support, which is essential for an insurer. If something happens, you can contact Lemonade any time of day or night for assistance.

The company offers immediate assistance during claim emergencies, which include anything that “requires immediate assistance or temporary housing as a result of fire, ongoing water damage, or any other structural damage that leaves your home exposed.”

Once you reach out about an emergency, Lemonade will refer you to assistance, such as water or fire damage cleanup or temporary housing as quickly as possible.

If your issue is pet-related, Lemonade understands that caring for your pet comes first. Its policies say that customers should “contact your pet care provider as soon as possible, and file a claim on the Lemonade app when you’re ready.”

This high level of customer support means that you can feel comfortable that you’ll get help in an emergency if you have Lemonade insurance.

Drawbacks

Sounds too good to be true? Well, you can stop pinching yourself because Lemonade is the real deal. So, what’s the downside to this up-and-coming insurance model? For one thing, Lemonade isn’t available everywhere yet. Coverage is an option only if you live in the following states:

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- District of Columbia

- Georgia

- Illinois

- Indiana

- Iowa

- Maryland

- Massachusetts

- Michigan

- Missouri

- Nevada

- New Jersey

- New Mexico

- New York

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- Tennessee

- Texas

- Virginia

- Wisconsin

Europe

- Germany

Lemonade Insurance is soon coming to:

Alaska, Alabama, Delaware, Florida, Hawaii, Idaho, Indiana, Kansas, Kentucky, Louisiana, Maine, Minnesota, Montana, North Carolina, North Dakota, Nebraska, New Hampshire, South Carolina, South Dakota, Utah, Vermont, West Virginia

Honest Recommendation

Lemonade is a solid choice of insurer for the types of coverage it offers. Its primary drawback is that its offerings are limited to renters’ and homeowners’ and pet insurance policies. Most people need more types of coverage, with auto insurance being very common.

Because other companies often offer bundling discounts, it can be hard to choose Lemonade for just one or two policies when buying all your coverage from others leads to discounts.

However, Lemonade’s 24/7 availability, good customer service, and easy-to-use website and app make it a good choice for people who have limited insurance needs.

Related: Lemonade Pet Insurance Review

Pros and Cons

Affordable homeowners and renters insurance — Depending on your needs and where you live, you might only pay as little as $5 per month.

Transparent policies — Easy to understand and just as straight-forward as it sounds.

Fast, easy claims processing — File a claim via app or online; Lemonade reviews claims instantly with a quarter of claims paid out in less than 3 seconds.

Only available in certain states — Lemonade is currently available in about 27 states including Washington, D. C. but may soon be available in all states.

No bundled insurance options — Lemonade only offers homeowners and renters insurance, no auto insurance. Learn more about Home and Auto Insurance Bundle

Alternatives

Young Alfred

Young Alfred is an insurance policy comparison site. Tell it the type of insurance that you’re looking for and provide some basic information. The site’s search engine automatically collects quotes for you. You can compare rates from multiple different insurers, including Progressive, Travelers, and Lemonade.

Young Alfred works no matter where you live, and you might be able to find a great deal, so there’s no reason not to give it a try.

FAQs

These are some of the most commonly asked questions about Lemonade Insurance.

What makes Lemonade insurance different?

Lemonade operates on a peer-to-peer insurance model. The company takes customer premiums and places them in a central pot, then uses that pot of money to pay out claims to other customers. Because Lemonade isn’t pocketing excess premiums as revenue, it lets the company offer coverage at a lower cost than other insurers.

Does Lemonade cover accidental damage?

Yes, Lemonade’s personal property coverage will cover accidental damage to your possessions. It also covers theft and other perils named in the policy.

How do I extend a Lemonade policy?

Lemonade’s insurance policies have a one-year term. They automatically renew at the end of the term, so you don’t have to do anything to extend your policy. You can cancel your policy at any time to get a prorated refund of your premiums.

Scoring the Product

To test Lemonade I went through the process of requesting a quote through the company’s website and iPhone app. I also reached out to the company’s support line to ask a few questions.

All in all, Lemonade is easy to use and its support is friendly and easy to talk to. The company’s policies are reasonably priced and getting emergency help when you need it is an important feature of insurance.

Who is it For?

Lemonade offers three types of insurance: renters homeowners and pet insurance. If you don’t have many different insurance needs, Lemonade is a great choice. Because many companies give you discounts to bundle different policies, like renter’s insurance and auto insurance, you may want to consider a different company if you have lots of policies you need to purchase.

Bottom Line

Lemonade peer-to-peer insurance is a refreshing take on the more stagnant insurance model. The company has found a really unique way to make sure it’s not incentivized to cheat you (the money it has leftover goes to charity instead of to its own pocket). It offers a quality service that makes homeowners insurance affordable to everyone. Strong financial health and outstanding customer feedback give new customers all the encouragement they need to trust this company.

Lemonade’s Giveback Program, smart mobile app, and easy claims process are just more reasons to support this service. What’s more, with excellent rates, a wide range of coverage, and useful add-ons, the company has definitely turned lemons into lemonade. Check out how easy it is to sign up for Lemonade now.

Learn More: