Buying a car can be an exciting time. Unfortunately, this excitement can be somewhat deflated by the prospect of choosing an insurance policy and the appropriate amount and type of coverage.

In order to actually choose the best policy for your driving needs, it’s important to be educated on the different types of insurance - including liability, comprehensive, and collision.

When would it be acceptable to be covered only by liability insurance?

State Insurance Requirements

Automobile insurance is regulated at the state level. Accordingly, each state has a minimum amount of car insurance coverage that is acceptable for drivers to carry.

Certain states require that motorists carry liability insurance coverage to ensure that their drivers can cover the cost of damages to people or property in the event of an automobile accident whereas other states, such as Wisconsin, have more flexible "proof of financial responsibility" requirements.

Traditionally, in the United States, liability insurance covers claims against the policyholder and generally, any other operator of the insured vehicle, provided they do not live at the same address as the policyholder and are not specifically excluded from the policy.

All states have laws regarding the minimum amount of liability coverage you must have in order to legally drive your vehicle.

State minimums are expressed in three parts. For example, a state’s legal minimum could be 20/40/18. In this example, the first number means that the insurance company will pay a maximum of $20,000 for a single individual injured, per accident. The number ‘40′ signifies the amount, $40,000, your insurer pays as a whole for all injuries in a single accident while the third number signifies the maximum amount the insurer will pay for property damage coverage per accident.

Consumers are always encouraged to purchase more than the minimum coverage!

Compare Car Insurance Plans

Other Types of Coverage

The two types of coverage insurance on top of liability car insurance are collision coverage and comprehensive coverage. Comprehensive coverage does come without collision car insurance, but collision does not come without comprehensive.

An insurance policy that has liability coverage and comprehensive coverage does not constitute full coverage but is more than the minimum legal coverage. Another term to refer to comprehensive coverage is OTC or “other than collision” coverage which covers damages that arise from something other than a collision such as theft, fire, weather damage, etc.

Comprehensive coverage is intended to cover events that are less likely to be your fault. Collision coverage is designed to help pay for damage to your own automobile such as auto repairs. In your auto insurance policy, collision coverage helps pay for auto repair or replacement.

As long as you have a lien against your car (i.e., you have taken out a car loan) lenders require car owners to carry collision and comprehensive insurance. After the vehicle is paid off, it is usually up to the insured whether to maintain coverage or drop it.

When is it smart to own only liability insurance? One good rule of thumb often cited in the industry is to recommend cancellation when the collision and comprehensive portion of your annual insurance premiums are greater than 10% of the car's book value.

For example, if you have a car that is worth $30,000, and the premium for collision and comprehensive is $3,700 a year, it might be wise to cancel the insurance. Then again, how much are you willing or able to pay out of pocket if you are at fault for an accident?

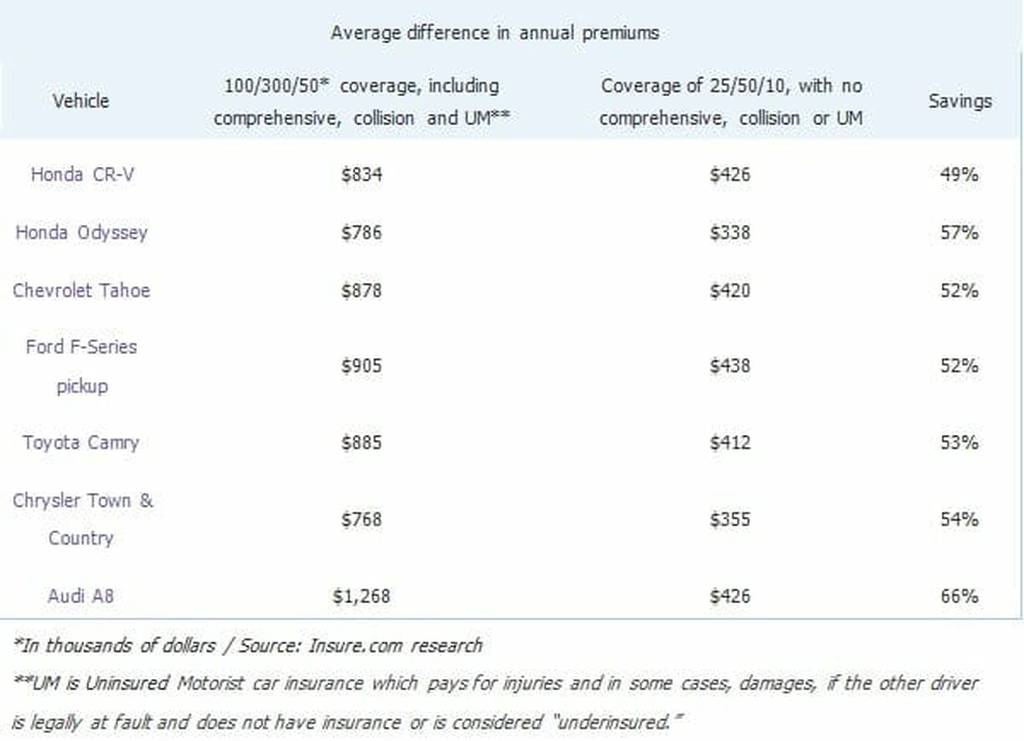

A study conducted by Insure.com looked at how coverage would change for seven cars, calculating average national premiums for a 40-year-old single male driver. Liability policy limits of 100/300/50 assume a $500 deductible. A 2004 year model was used because drivers often drop collision and comprehensive insurance on older cars.

Dropping your car insurance to minimum state liability levels could be risky. Although you would save money in premium payments by dropping comprehensive/collision coverage, it might not be worth it in the end if you have an accident especially if you have a house, savings and investments, all of which could be put at risk if you were at fault in an accident.