So you’re thinking about buying a new car? Unless you’re paying in cash, you’re probably up to your ears in cost estimates. How much will your monthly payments be? What about the interest charges for financing the car? And how much can you really afford?

Even if you’re paying in cash for your car, you’re probably swimming in numbers. How much do you have in your bank account? How much can you expect to negotiate? Do you really want to spend your whole savings balance on a car?

Unfortunately, we’re here to add more numbers to your thoughts: the cost of insurance.

When calculating how much car you can afford, it’s common to think only of your car payment. But you also need to look at other costs, including the cost of registration and taxes, the financing costs, and, you guessed it, the cost of insurance.

Car insurance companies account for a variety of factors when they decide how much to charge for your vehicle. And one major factor is the car in question. And it’s not just about the cost of the car. It’s also about things like the car’s make and model, the year of the card, and any additional features the car might have.

Here, we’ll talk about the car-related factors that affect your insurance costs. Then well talk about how to shop for car insurance before you head to the car lot.

Compare Car Insurance Plans

Car Characteristics and Insurance Price

So what characteristics of a vehicle affect insurance costs? Here are a few to consider:

- Price: The more expensive the car, the more expensive it will be to insure. After all, if you have comprehensive coverage, your auto insurer will have to give you the value of your car if you total it. A more expensive vehicle means a bigger payout for the insurance company. And they’ll gladly pass those potential costs on to you in the form of higher premiums.

- Cost of Repairs: High-end and foreign cars are often more expensive to repair. This is especially true if it takes particular expertise to fix the car in question. So if you’re looking at a car with more expensive parts or specialized labor required, you’ll have higher insurance costs.

- Age of the Car: Very old and very new cars can be more expensive to insure. Although very old cars are cheaper if you don’t finance them and, therefore, don’t need comprehensive coverage.

- Driver Assumptions: Unfortunately, car insurers make assumptions about you, the driver, based on the car you choose. Those who drive fast, sporty cars may be more likely to take risks and wind up in accidents. So these cars can be more expensive to insure than family-centered minivans and hatchbacks.

- Body Type: A car that is larger and heavier is more likely to do major damage in an accident. This can make cars like SUVs more expensive to insure.

- Theft Statistics: Vehicles that are more likely to be stolen are more expensive to insure. Insurance companies stay on top of theft reports, and which types of vehicles are most popular for thieves to take or attempt to take.

- Safety Features: Most cars today, even older models, have basic safety features like airbags and anti-lock brakes. But you can get more insurance discounts if your vehicle has additional safety features like a backing camera or blind spot alerts.

- Anti-Theft Features: You’ll see a discount on your car insurance if the car in question has anti-theft features, such as a built-in alarm system.

These are the types of features to keep in mind when you’re shopping around for a vehicle. In general, choosing a moderately-priced, new-ish sedan with extra safety and anti-theft features will net you much lower insurance costs than choosing a high-priced, cherry-red sports car.

Most and Least Expensive Vehicles to Insure

Each year, Insure.com puts together a list of the most and least expensive vehicles to insure. If you’re particularly concerned about insurance costs, this is a good place to start.

For 2017, the least expensive cars to insure include the Honda Odyssey LX minivan, the Jeep Renegade Sport, the Jeep Wrangler Black Bear, the Honda CR-V LX, Jeep Compass, and the Subaru Outback. The list of 2017 most expensive cars to insure includes several high-end models from Mercedes, of course. At the top of the list are the Mercedes 365 AMG Convertible, Dodge GTS Viper, Mercedes s63 AMG 4Matic Convertible, and Maserati Quattroporte GTS.

Maybe you’re already in the market for an Odyssey. If so, great. You know you’re looking at the cheapest car to insure. But if your car isn’t on the most or least expensive list, try the next few steps for estimating insurance costs.

Narrowing Down Your List

So with that in mind, start putting together a list of the vehicles that will work for your needs and wants. You really don’t want to have to run insurance quotes for fifteen different makes and models, though. So, instead, try to narrow your list down to five or fewer makes and models that you’re interested in.

This will, of course, depend on how much you’re planning to spend on a car, how much room you need in your vehicle, and other personal factors. Once you have your list, you can start looking at actual quotes.

Look at Apples-to-Apples Quotes

It can be difficult to find out exactly what a vehicle will cost to insure until you actually purchase the vehicle. After all, you may not know what safety features will be available or exactly how much you’ll pay for the car until you’re ready to buy one. But that doesn’t mean you can’t estimate your insurance costs.

One way to do this is to make a list of all of the top makes and models for which you’ll be shopping. Look at the standard safety and anti-theft features that come installed in those vehicles so you can include those in your quote. Then figure out about what year of the vehicle you’ll be looking at based on what you need and what you can afford.

So your list might look something like this:

- 2015 Honda Odyssey with brake assist and rearview camera

- 2014 Toyota Sienna with rearview camera, lane departure warning, and adaptive cruise control

- 2015 Kia Sedona with rearview camera

Then, you’ll want to run these scenarios through a calculator. Hold everything constant--including the type of insurance coverage, your own personal information, etc. But just change the vehicle’s make, model, year, and safety features.

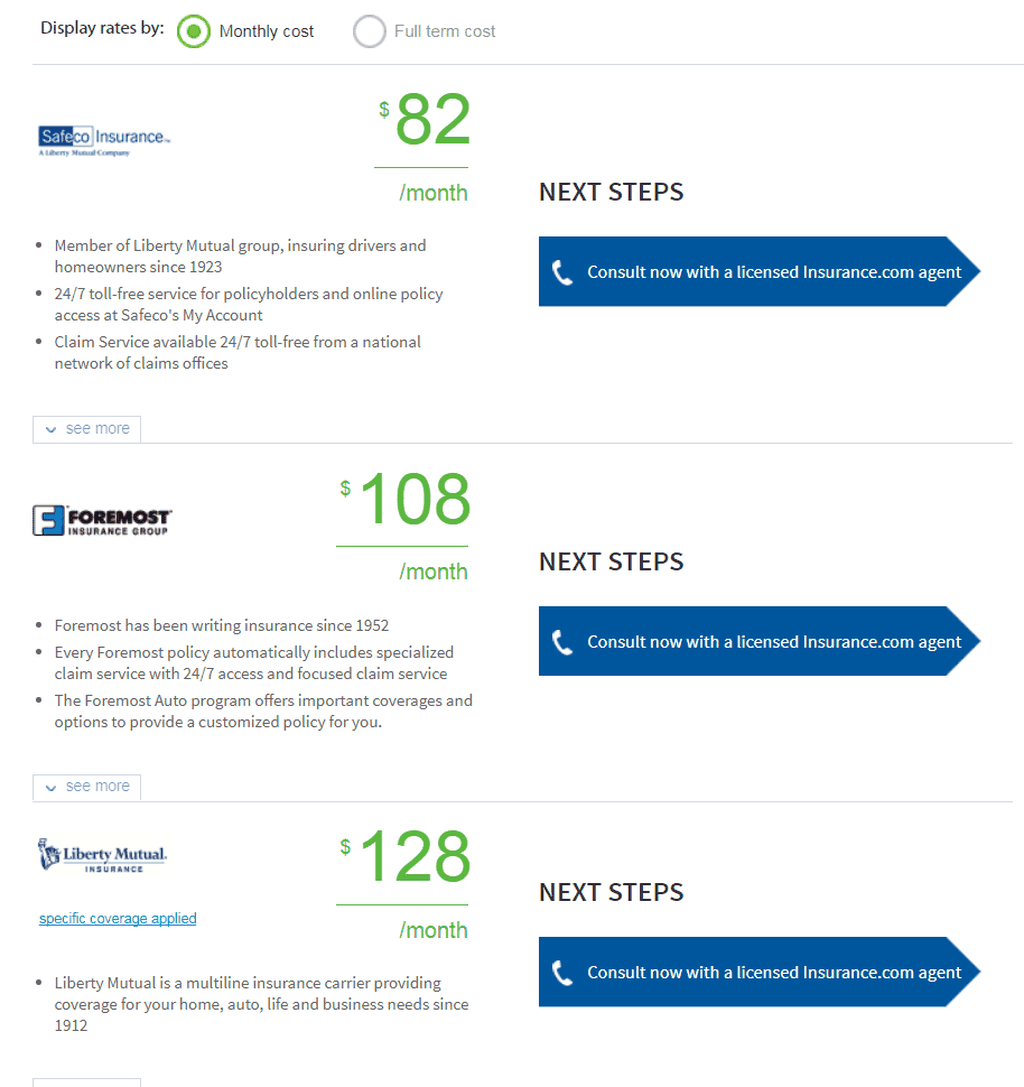

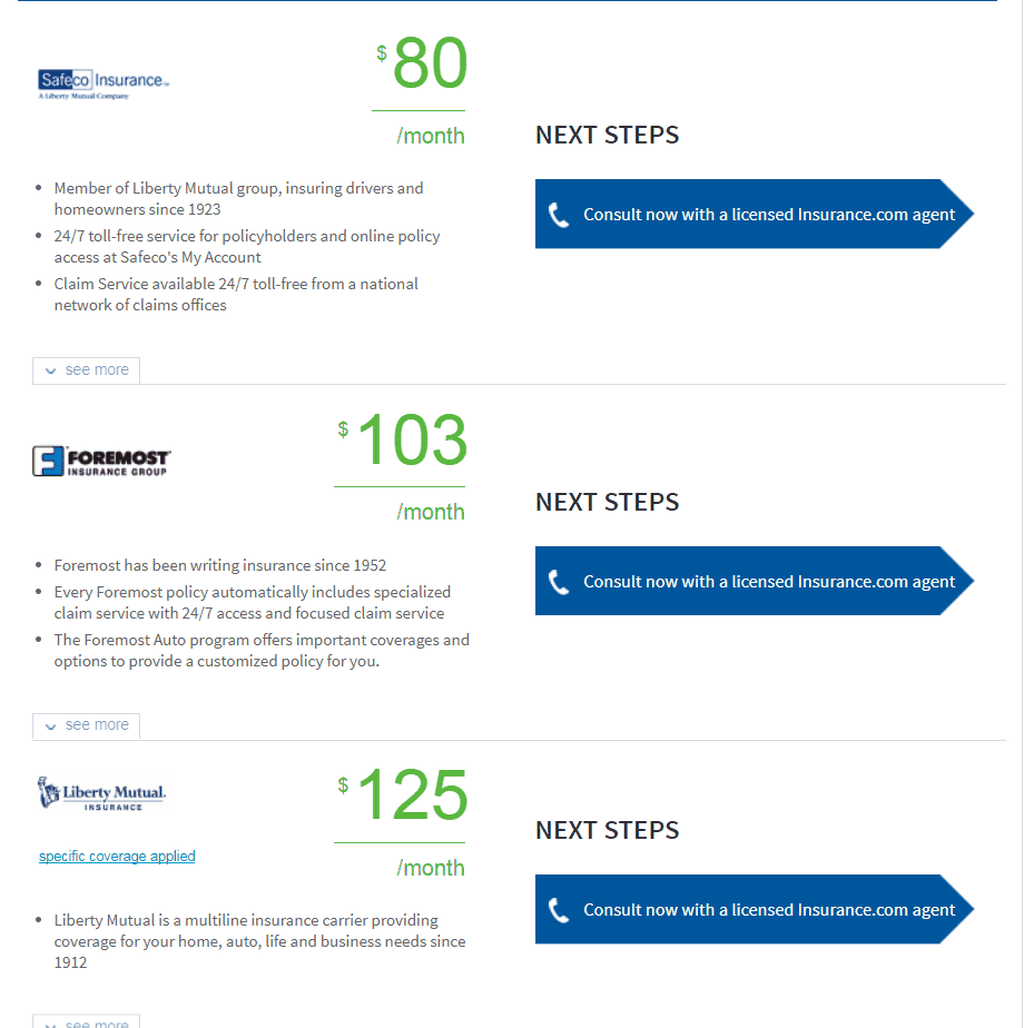

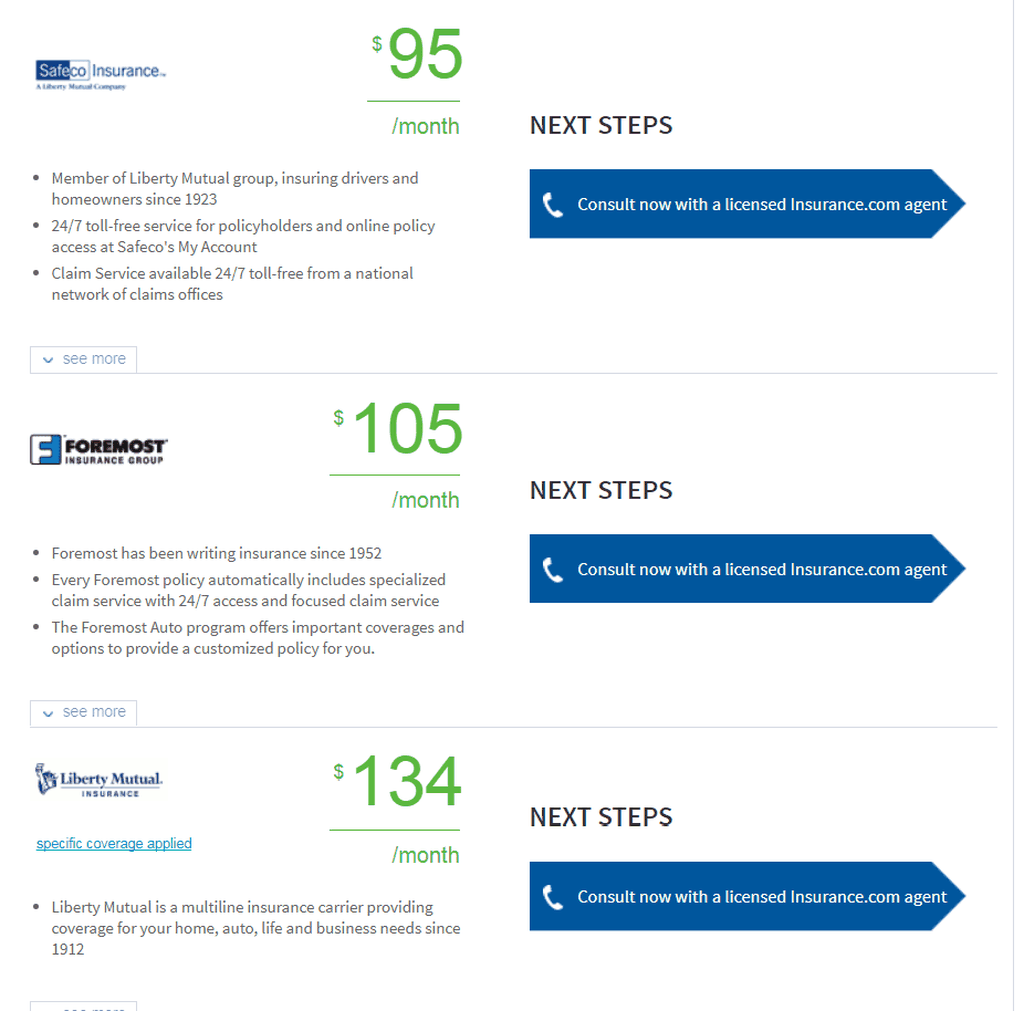

Then, see what you come up with. You can use an insurance quote aggregator like Insurance.com to get several quotes at once. Or you can look at individual insurance companies’ websites and compare their quotes. Make yourself a spreadsheet so you don’t forget the rates you’ve looked at.

You will want to get a variety of quotes, though. Most insurers have different ratings, so a car that’s cheaper in one place may be more expensive elsewhere.

A Quick Example

Really, that’s about it. You just have to figure out what vehicles you’re interested in and then check out insurance rates for those vehicles. But here’s a quick example of running the above-named minivans through insurance.com. I used my own information as a 31-year-old married female living in Indianapolis, just for the record.

I noted that I’m driving the vehicle about 6 miles a day, five days a week. I didn’t add my husband to the quotes, just for simplicity’s sake. And I noted that we own our own home. These insurance policies automatically went to $100,000/$300,000/$50,000 policies. So you’ll want to also make sure you’re getting quotes for the coverage amounts that suit you best.

Honda Odyssey

Toyota Sienna

Kia Sedona

Things to Remember

It’s important to remember, again, that a few changes to your car’s make and model and features could mean dramatic changes in your insurance costs. So when you find a vehicle that you’re really interested in, run the numbers for that specific vehicle. But going through this cost comparison process before you start shopping can help you find a car that is cheaper to insure from the start.

I would also note that insurance aggregators don’t give you access to all insurance companies out there. So you’ll want to look at a couple of different aggregators, and probably look at quotes directly from a few insurance companies that interest you. Check out our list of top car insurance companies for a place to start.