Overview

5/5

4.75/5

4.75/5

4/5

4.75/5

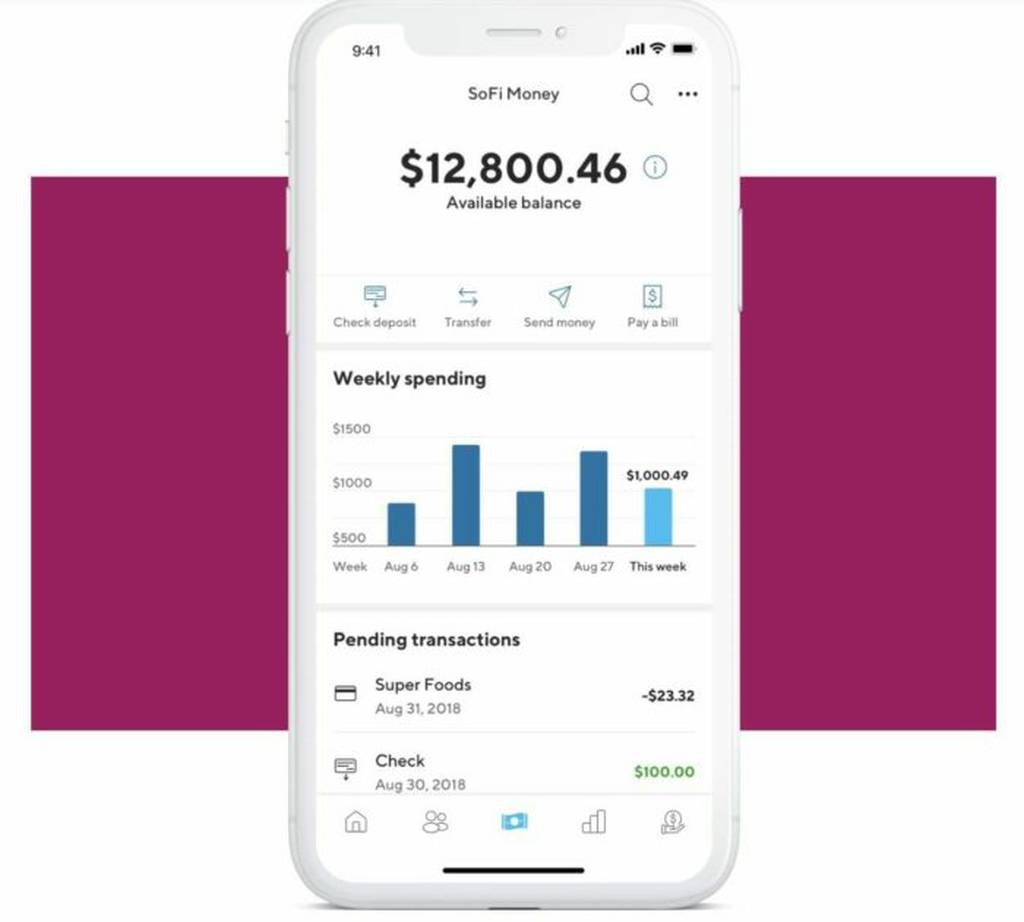

Some people lose money with the wrong checking account. Others get SoFi and make money. If you don’t have a solid checking account and especially if you are a student, you’ll want to read our review on SoFi Money–pay zero fees and earn 2.00% APY.

Editor's Note

You can trust the integrity of our balanced, independent financial advice. We may, however, receive compensation from the issuers of some products mentioned in this article. Opinions are the author's alone. This content has not been provided by, reviewed, approved or endorsed by any advertiser, unless otherwise noted below.

SoFi is one of the best low-interest-rate lenders, especially with student loan refinances. The lender is not a complete bank but they have been improving their loan products and services, making them just as good as any high-street bank.

The company is based in San Francisco, CA, and offers banking services in all 50 states of the country. It was formed in 2011 and aimed to help students finance their education loans.

Types of SoFi Checking Accounts

SoFi offers two types of checking accounts. There is a regular checking account with an APY interest rate of 1%. The company also provides a high-interest (2.00% APY) SoFi account without any monthly or ATM fees, and there is no overdraft fee either.

We will focus on the SoFi Money 2.00% checking account for this review.

Related: The Best Checking and Savings Account Promotions, Deals, and Offers

The Hybrid Nature of the SoFi Checking Account

The SoFi checking account is a hybrid of a savings and checking account. It has been designed with the needs of students in mind.

It offers a 2.00% annual interest rate that puts it on par with some of the highest yield savings accounts in the market. Unlike a savings account, there is no charge or deduction for spending money through a debit card. You can also issue written checks incurring no costs.

The interest is paid on the average balance you maintain in the account annually.

How to Open a SoFi Money Account

It’s easy to open a SoFi account--the process shouldn’t take over five minutes. You don’t have to visit any bank branches and can open an account from the comfort of your home.

Visit the SoFi website and register for an account online. There is no minimum balance required, and the account can be opened with $0.

There is a minimum age requirement--the account holder must be at least 18 years old. The person must also be a permanent resident or citizen of the United States.

SoFi Money Features

Most checking accounts don’t charge a fee on withdrawals and payments made by clients. ATM card usage is free. There is also no monthly fee, minimum balance requirement, or ATM fees.

With savings accounts, banks need to restrict withdrawals, so they generally charge a small fee on every transaction or ATM cash withdrawal. They also put in a minimum balance requirement.

The SoFi Money account is an exception to regular banking practice. The balance earns interest for the account holder at 2.00%, and there are no additional charges for using most of the account features.

There is no regular fee for using the account or for taking money out of the bank at an ATM. What’s more, the SoFi Money account will stop a transaction that may result in an overdraft. But even if you happen to wind up with a negative balance, SoFi will not charge overdraft fees. The outstanding overdraft balance is still charged interest at the bank rate.

SoFi will also reimburse users for third-party ATM fees when the ATM card is used at a machine with the Visa, Plus, or NYCE logo.

The card can be used abroad and does not charge a foreign transaction fee. However, Visa charges a 1% fee for foreign conversion that doesn’t get reimbursed by Visa.

The bank does charge a $20 fee for an additional debit card replacement, the first replacement card is free--but this shouldn’t be an issue unless you lose your card.

SoFi Money Account Fee Structure

- ATM Fee: In-Network: $0

- ATM Fee: Out-of-Network: $0

- Monthly Fee: $0

- Paper Statement Fee: $0

- NSF Fee: $0

- Overdraft Protection Fee (per transfer): $0

- Debit Card Replacement Fee: $0

- Early Account Closure: $0

- Overdraft Item Fee: $0

- Returned Deposit Fee (Domestic): $0

- Bank Teller Fee: N/A

- Check Cashing Fee: N/A

- Online Bill Pay Fee: $0

- Stop Payment Fee: $20

- Check Image Service: N/A

- Check Copy: N/A

- Foreign Transaction Fee (Debit Card): 0%

- Wire Transfer Fee - Domestic (Outgoing): $0

- Wire Transfer Fee - International (Outgoing): $0

- Wire Transfer Fee - International (Incoming): $0

- Returned Deposit Fee (International): $0

- Wire Transfer Fee - Domestic (Incoming): $0

Pros and Cons of SoFi Money

No Account Fee - SoFi does not have a minimum balance limit and no fee is charged to the users.

High Yield Return and Low Account Requirements — Most high-yield checking accounts require account holders to maintain a minimum balance.

Up to $1.5 Million in FDIC Insurance — SoFi Money account holders can get up to $1.5 million in total FDIC insurance.

ATM Fee Reimbursement — Another major plus is that SoFi does not charge ATM fees for transactions.

Membership with SoFi — Your SoFi account functions as a membership.

Withdrawal Limits — One concerning factor for SoFi account is the withdrawal limit. You can only take out a maximum of $610 in cash from an ATM each day. As for online transactions, you can only send a maximum of $250 in peer-to-peer transactions per day.

Not Directly Backed by the FDIC — The FDIC is a federal regulatory body that provides coverage for account holders if their banking organization closes.

Bottom Line

Experts believe that the days of plain old checking accounts with 0% APY and hidden charges on transactions are over. Businesses like SoFi have millions of active online user accounts, and the volume of transactions is only getting higher.

Given all the benefits offered by companies like SoFi--the higher APY interest rate and reduced charges--it would not surprise us if these companies do well. If you’re in the market for a new checking account, now might be the time to look at SoFi Money.