Overall Ranking

4.5/5

Overview

4.5/5

4.5/5

4/5

5/5

NorthOne is a banking app for small business owners with standout features that even help with bookkeeping and payroll. Find out if it’s the right choice for you.

Editor's Note

You can trust the integrity of our balanced, independent financial advice. We may, however, receive compensation from the issuers of some products mentioned in this article. Opinions are the author's alone. This content has not been provided by, reviewed, approved or endorsed by any advertiser, unless otherwise noted below.

NorthOne offers a digital business bank account for freelancers and small business owners. Launched in 2019 by Justin Adler and Eytan Bensoussan, the platform is trusted by more than 190,000 businesses across America. Our NorthOne review has everything you need to know to determine if the NorthOne app is right for you.

About NorthOne

Adler and Bensoussan started NorthOne to help small business owners. They created a challenger bank, also known as a digital bank, to solve some of the most common problems facing companies. NorthOne interviewed thousands of small business owners across America in building their platform. The duo has made its mission to “eliminate financial administration for business owners” and enable them to grow their companies.

The easy-to-use app works on any smartphone or tablet. Its intuitive interface lets you check your bank account, make mobile check deposits, or live chat with customer service. It has all the essential features of a traditional bank with the convenience of a smartphone.

Also, NorthOne recently deployed its new Web Banking feature. So those who have checked out NorthOne in the past will not only see new branding and a mobile app, but the ability to now access your account via desktop and laptop computers. This changes the way users bank with NorthOne and adds an option for those who don’t want to do everything from their phone.

NorthOne is part of the transformational shift from traditional to digital banks. According to a survey from Statista, 69.3% of Millennials now use a mobile app to monitor their bank account. By comparison, only 24% of Baby Boomers do the same.

The chances are that you already do everything on your smartphone. Why not add your bank account? In the increasingly competitive world of finance, NorthOne decided to focus its mobile-friendly services on freelancers and small business owners.

It offers cost-effective ways to run a company and handle bookkeeping. NorthOne connects people with the essential tools they need to manage their business’s money. Its combination of affordability and accessibility is why many people already use NorthOne.

NorthOne Features

The platform has many notable features, which we’ll cover below, but let’s focus on the big ones first. NorthOne’s financial tools stand out as one of the most appealing features for freelancers and entrepreneurs.

NorthOne streamlines financial services so that business owners can focus on, you know, running their business. NorthOne works with bookkeepers and accountants to make money management as straightforward as possible. The best part is that you don’t need a finance degree to understand this app’s tools.

It also makes payroll a breeze. NorthOne lets you connect your business checking account with a third-party payment processor, so employees get their paychecks on time. That includes sending ACH and wire transfers in seconds. Domestic wires are only $10 to send, a major savings over the $25 to $30 some banks charge.

If you have a small-business checking account with NorthOne, you can connect it with your accounting software. The synchronization ensures that you never miss a beat when managing company finances. NorthOne also works with different point-of-sale terminals, payment processors, and e-commerce platforms, such as:

- Airbnb

- PayPal

- Shopify

- Square

- Stripe

- TouchBistro

- Uber

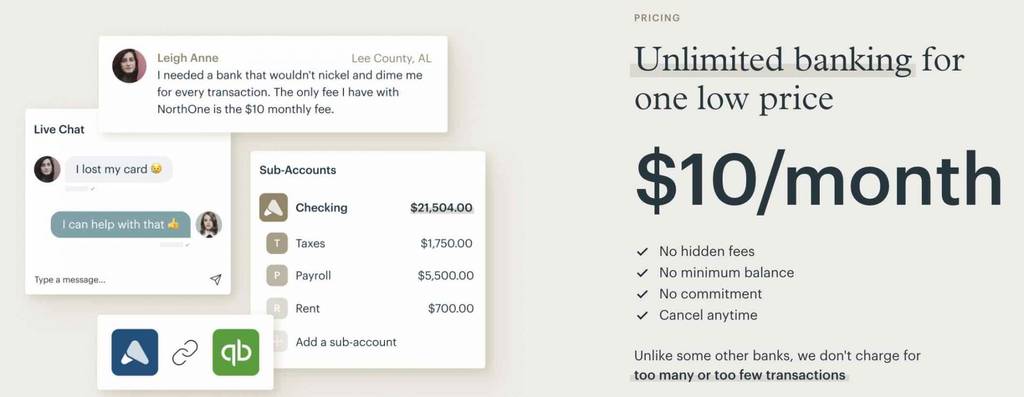

NorthOne gives you complete control over your finances. You can even create sub-accounts within your bank account for different purposes, such as taxes and payroll. Also, you can set up recurring transfers, or a percentage of all deposits, to automate your dividing of money. The organizational bent allows you to stay on top of your cashflow.

If you have any questions, NorthOne’s customer service team is standing by to assist you every day from 8 AM to 10 PM Eastern time. The company answers live chats in the app within a minute or two, and since you’re already logged in you don’t have to waste time verifying your identity. All you have to do is click if you need to connect with a NorthOne associate.

Promotions

At the time of publication, NorthOne is running several promotions and special offers. You can earn $75 if you refer another business owner. Ensure that your friend or family members make the $50 minimum deposit using a debit card from another bank account.

NorthOne has similar offers for affiliates and partners. If you’re a blogger, digital marketer, or consultant, you can earn a small commission for every person you recommend to the platform. NorthOne also has a partnership program that offers opportunities for business collaborations.

Related: Best Small Business Credit Cards

Pricing/Fees

One of the phrases that caught our eye on NorthOne’s website was “radically transparent.” It’s in the company’s mission statement, which talks about the company’s desire to simplify aspects of traditional banking. Part of that process involves a transparent and honest dialogue with users.

NorthOne says it doesn’t want to surprise or confuse people with its fees or complex language. With a record number of people banked as of 2018, the philosophy makes sense. The more accessible NorthOne makes banking, the more people it can attract to the platform. It’s hard to get excited about a banking app if you have no idea what the heck an APR or expense ratio is.

If you download the app and open an account with NorthOne, you pay a $10 monthly service fee. It’s a reasonable price considering that you get an unlimited number of transactions, deposits (including cash, which some banks charge for after a few thousand dollars a month), and transfers each month. Perhaps the biggest money-saver is NorthOne’s integration with third-party accounting software.

Some of the other fees include:

- $10 for domestic wire transfers

- $25 for international wire transfers

- $2 for ACH and PAD returns

- $25 for insufficient funds

- $5 overdraft fee

NorthOne connects users with 300,000 ATMs across America. Many ATMs charge a withdrawal fee, but not NorthOne—you won’t pay a penny. The mobile app reimburses you each time you make a transaction.

Related: Best ATM Locator Apps

Signing Up

Opening a NorthOne account is pretty straightforward – you can either sign up on their website from your computer’s internet browser or from your mobile phone. To open an account on your smartphone, start by downloading the NorthOne App from the App Store or Google Play.

Enter your phone number and email address before creating a password. NorthOne will ask you for some necessary personal and financial information. For instance, NorthOne requests some information about your business, such as the address, number of employees, EIN and incorporation date, and there’s no impact on your credit score.

The whole process takes less than ten minutes. If you had time to read this entire review, we promise that you’ll have time to set up an account. Opening an account with NorthOne is fast and straightforward.

Learn More: How to Open a Business Bank Account

Security

NorthOne provides multiple ways to keep your personal and financial information safe. You can freeze your credit and debit cards if they’re lost or stolen. NorthOne will send you a new one within five business days.

Funds in a NorthOne account are FDIC-insured to at least $250,000 through the Bancorp Bank (a federally-chartered bank). This means that any deposits are protected for this amount against bank failure or theft.

The platform offers biometric security, so you can choose to have your face or fingerprint ID to open the account. It’s part of the company policy to secure sensitive information. NorthOne also offers two-factor authentication and only contacts users through secure channels.

NorthOne constantly monitors accounts for suspicious activity, and will immediately notify customers if suspicious activity is detected. If money is stolen, it is protected by the insurance mentioned above.

Related: Is Online Banking Safe?

Mobile Support

NorthOne is a fully digital bank. You won’t find physical branches in your hometown, and you can only use your desktop computer to create an account. The only way to use your business checking account is to either access it from your web browser from your desktop or laptop computer, or download the app from the App Store or Google Play.

The app has all the features you know and love from online banking, so you can:

- Send and receive payment

- Order new debit cards

- Open sub-accounts for company purchases, payroll, and taxes

- Deposit checks with your phone

- Talk with customer service

- Make debit card transactions

- Locate the nearest ATM out of more than 300,000 locations

- Review your bookkeeping

Even if you’re not technologically inclined, you’ll have no problem navigating NorthOne digital banking. The platform has easy-to-use features, so you don’t struggle to find what you need. Its thoughtful design puts you in complete control as a small business owner or freelancer.

If you have an urgent problem, the support staff is a click away. Open the live chat, briefly describe your issue in the subject line, and send your message. An associate will get back to you as soon as possible.

Related: Best Mobile Banking Apps

Customer Service

NorthOne’s Customer Care team is available seven days a week, from 8 AM to 10 PM Eastern Time, to answer any of your questions. Whether you need to open an account, move money or understand how a feature works, the Customer Care team can help.

You can connect with the Customer Care team via either of the following channels:

- In-app chat

- Email (support@northone.com)

- In-app scheduled phone call (we’ll call you at a time that’s convenient for you)

- Social media (Twitter, Facebook or Instagram)

It’s worth noting NorthOne has mixed reviews online. While it has a 4.7 rating on ConsumersAdvocate.org, it hasn’t fared as well on AppGroves.com or ProductHunt.com. Some of the common complaints include people getting locked out of their accounts, resulting in inaccessible funds. These do not appear to be red flags, but you should always look at customer feedback before committing to a financial service provider.

Pros and Cons

300,000+ ATMs — NorthOne has you covered wherever you live, with over 300,000 ATMs where you can withdraw cash, and over 10,000 where you can deposit cash and checks fee-free.

Intuitive mobile app — The seamless design makes digital banking more accessible than ever. Once you set up your account, you’ll be sending wire payments and making mobile deposits in no time.

24/7 customer support — You have questions. NorthOne has answers. Reach out to an associate via live chat, phone, or email to resolve your issue.

Accounting and business integrations — NorthOne gives freelancers and business owners all the tools they need in one place. That includes Stripe, Shopify, Square, and Quickbooks, to name a few.

Unlimited banking — For a $10 monthly flat fee, you get an unlimited number of transactions.

No paper checks — Though this is true of many digital banks. And you can still mail a check via the website or app.

Mixed reviews — While NorthOne has plenty of positive reviews, it has its fair share of negative ones. A single negative review shouldn’t make or break your decision to download NorthOne, but we recommend independently reading other customers' experiences.

No in-branch services — This point should be obvious, but it bears mentioning. NorthOne only exists as a mobile app and web banking on desktop and laptop computers. You can’t sit down with an associate to discuss your financial future. If you want to meet bankers face-to-face, you should look elsewhere.

Alternatives to NorthOne

Novo

Novo is a mobile banking app that offers digital services to small business owners and freelancers. The platform caters to modern entrepreneurs in search of simple and user-friendly banking. The independent tech company works with Middlesex Federal Savings, a Massachusetts bank, to provide its services.

Novo lets users make mobile deposits, send money abroad, and integrate with third-party apps like Xero. It comes with various perks, like feed-free card processing with Stripe and $3,000 in credits toward Google Cloud services. The only fee you’ll ever pay is a $27 penalty for insufficient funds.

Some standard banking features do not exist on Novo. Like Azlo, it doesn’t offer any checkbooks or outgoing wire transfers. You also cannot accumulate interest on the money in your checking account.

Read more in our Novo Review

Learn More: Best Business Checking Accounts

LendingClub Banking

LendingClub offers an online business checking account targeted at business owners. The platform competes directly with NorthOne, and offers a number of similar advantages.

Like NorthOne, there is a $10 monthly fee, although Lending Club will waive the fee if you have a balance over $5000. There are unlimited fee-free transactions, and LendingClub also offers a 0.10% APY on any balance $5000+, with no monthly maintenance fee. There is a selection of free ATMs, and LendingClub rebates ATM fees charged by other banks.

LendingClub also offers customers the potential to receive 1% cash-back on select purchases made with their debit card.

The LendingClub mobile app and desktop platform are streamlined and intuitive. They offer a full-fledged suite of features to organize and manage your money. There are handy “visualization” charts to document and plan your spending, among many other organization tools.

Overall, LendingClub is a strong choice, and a worthy competitor to NorthOne.

Read more in our LendingClub Bank Review

Bluevine

Bluevine’s business checking account also offers a suite of features that are well-suited to compete against NorthOne. Particularly notable is that there is no monthly fee and no minimum opening deposit requirement.

Of course, the absence of a monthly fee means there are other fees to consider, but Bluevine is quite transparent in this regard. The only fees are those associated with using non-partner ATMs, fees for outgoing wires ($15/transaction), and fees for cash deposits at Green Dot partner retail locations ($4.95/transaction).

Like most accounts on our list, Bluevine is online-only, and there is no physical branch access.

Bluevine also holds the edge in interest rates, offering a very competitive 2.0% interest rate on your balance up to $250,000 - Eligibility requirements apply.

Bluevine has an intuitive desktop platform and mobile app, with a diverse set of tools for managing and monitoring your money. There’s also a support line that you can call or email if you experience difficulties.

Overall, Bluevine is a solid alternative to NorthOne if you are looking for a business checking account without monthly fees.

Read more in our Bluevine Review

Choosing a Bank

Choosing among the above options can be a difficult undertaking. In choosing a business bank account (or any bank account), we recommend you take some time and consider how you like to bank. Consider how you like to manage your money, and how often you expect to perform certain transactions. Also, consider whether you are comfortable with a platform that is online vs. a physical branch.

In examining your own usage, you can compare this against the terms offered by each bank account, to see which best aligns with your personal usage, and which would net you the lowest fees. Choosing a bank account is very much a personal decision, and the right choice will vary by person.

Is NorthOne Safe?

You don’t need a comprehensive NorthOne review to know it’s a legitimate app. The platform insures all accounts through the Federal Deposit Insurance Corporation (FDIC).

Bottom Line

If you’re a small business owner or an entrepreneur, NorthOne deserves your consideration. It provides the tools necessary to run your business without making accounting a full-time job. The platform’s array of features ensure that you can send, deposit, and withdraw money when and where you need it.

More than 190,000 businesses across America trust their finances to NorthOne. It has FDIC insurance and delivers traditional banking services. NorthOne has also earned features in Forbes, The New York Times, and American Banker.

NorthOne does have some mixed reviews. However, we believe that the positive attributes far outweigh the negative ones. You should consider NorthOne as a viable platform for your mobile banking needs.