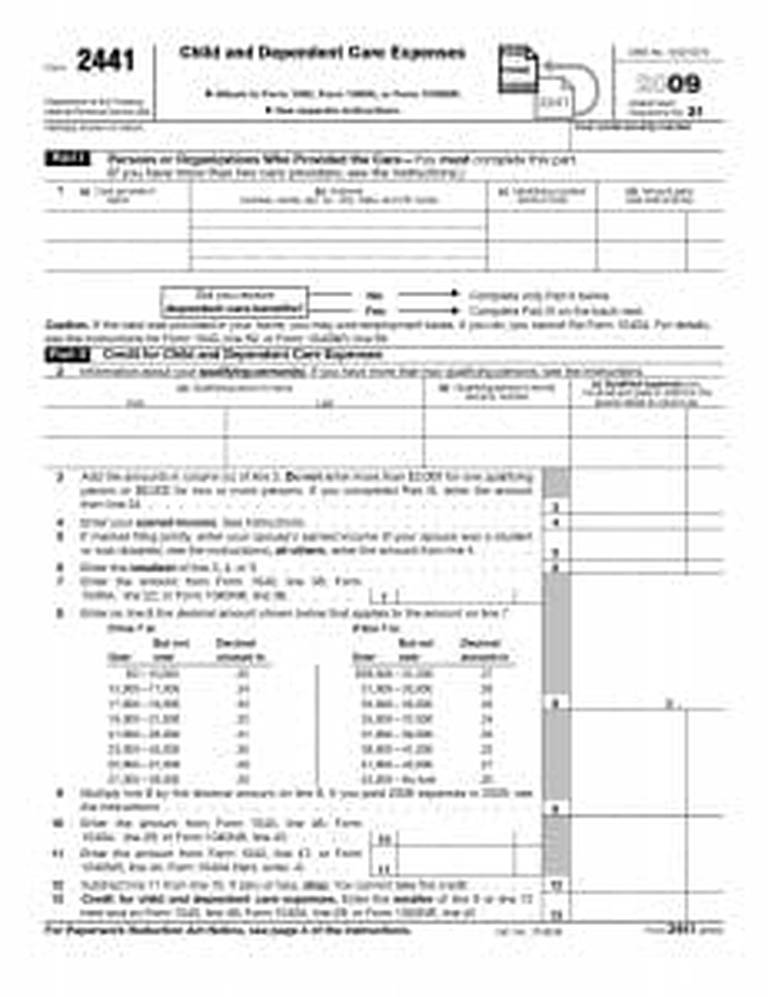

If you (or your employer) paid anyone to care for your child this year so that you could work, you may be in line for a tax credit. If you’re able to take the credit, you’ll claim it on Form 2441.

To qualify, the care must have been provided so that you could work or look for work. (Unfortunately, mom’s day-out programs so you can grocery shop or go to the spa don’t qualify.)

Also, the person who provided the care cannot have been your spouse, the parent of the qualifying person, or someone you claim as a dependent. (ie. If you paid your teenager to babysit your younger kids, you can't claim those payments, either.)

To fill out the form, there are a few things you’ll have to know.

First, is the definition of dependent care benefits. These include: amounts your employer paid either directly to you or your care provider for the care of a qualifying person (more on this below) while you worked, the fair market value of care provided by a facility provided by your employer, and pre-tax contributions you made under a dependent care flexible spending account.

You should know that your salary may have been reduced to pay for these benefits. If you received any dependent care benefits as an employee, they’ll show up in your W-2. If you received any as a partner, they’ll be listed in your Schedule K-1.

Now, let’s take a look at the definition of a qualifying person. A qualified person generally refers to a dependent child age 13 or younger when the care was provided. Certain other individuals, such as spouses who are incapable of self-care, may also be considered qualifying persons. Also, if you claim a disabled person who is unable to care for himself or herself as a dependent, they qualify, as well.

Related: Credit Karma Tax Review

Disabled individuals incapable of self-care also qualify if you could claim them as dependents except for the fact that they are claimed on another tax return as a dependent, or that they made more than $3,650. So if you have an older disabled child whom someone else is claiming, or who made money this year, they may still count as a qualifying person.

Before we go over the information you’ll need for the form, a quick look at qualifying expenses is in order. These expenses include:

- Amounts paid for care or household services while you worked or looked for work. Household services can include a maid, babysitter, housekeeper, or cleaning person if their services were at least partly for the care of your qualifying person(s).

- Your share of employment taxes paid for the care of the qualifying person. Care expenses include anything paid for the person’s well-being or protection.

- Cost of care outside of your home for person(s) 13 and under

- Care provided by a care center can be included, provided the center meets all state and local regulations.

- Costs of day camps, even if they specialize in activities, such as sports or theater arts. However, do not include the cost of night camps, summer schools, or tutoring programs

To fill out the form, you’ll need standard identifying information about yourself, your qualifying person(s), and your care provider. This includes name, address, and a Social Security number or Employer Identification Number. You’ll also need the total amount paid to them.

Plus, you’ll also need the amount of your earned income, your gross adjusted income, and the amount of dependent care benefits you received. (It will be helpful to have your tax return, as well as your form W-2.)

The Form 2441 worksheet will lead you through recording this info, and using it to figure out how much of a credit you can claim. The process of calculating your credit is a simple addition, subtraction, and multiplication.

One last note: to qualify, you must file as single, married filing jointly, or head of household. However, you may also qualify for the deduction if you are filing separately but lived apart from your spouse during the last six months of the year, the qualifying individual lived in your house for more than half of the year, and you provided over half the cost of keeping your home.

References

Should you need help filing your taxes this year, you may want to consider both TurboTax and H&R Block. Their free online tax software can make your tax nightmares disappear.

The Best Free Tax Software

| Brand | Best For |

|---|---|

| Cash App Taxes (formerly Credit Karma Tax) | All individual filers |

| Turbo Tax | Overall Features |

| TaxACT | Freelancers |

| H&R Block | Free filers |

Read More: What Is The Cheapest Tax Software