If you’re a typical wage- or salary-earning employee, read no further. If you’re an employer, small or large, if you have any traditional employees (as opposed to contractors) then you’ll need to file a W-3.

Read on, novice business owners, for a run-down on what sort of requirements you can expect from a W-3.

Anyone who has earned wages is probably familiar with the W-3′s cousin, the W-2. By the end of January of every year, employers must file a W-2 for every employee.

Form W-2 contains all wages earned that year, and all taxes withheld. Every year, an employer sends one copy of every employee’s W-2 to the IRS. (In addition to the copies given to employees to be used when filing taxes.)

Deal of the Day: Cash App Taxes offers 100% free Federal and State tax filing with a Maximum Refund Guarantee and Audit Defense. Never pay a penny to file your income taxes. Learn More at Cash App Taxes

Related: Cash App Taxes Review

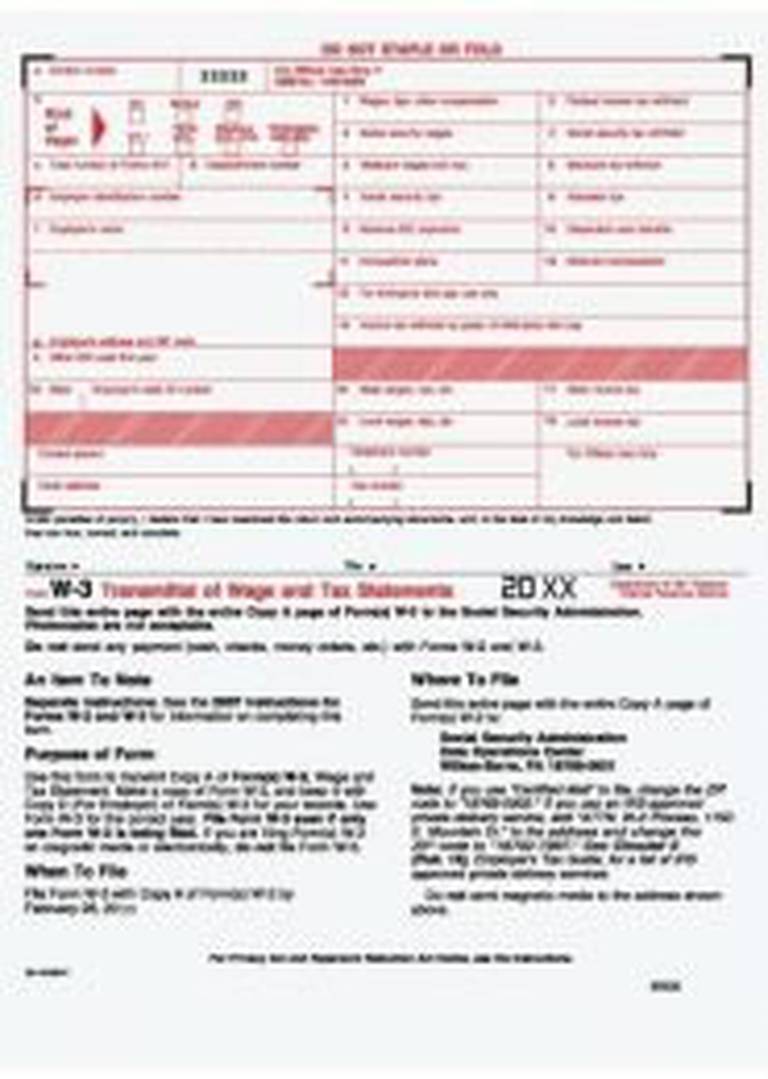

By March every year, employers are required to submit a transmittal form containing a summary of ALL wages paid to employees and ALL federal taxes withheld from them. This information is contained in form W-3. The W-3 form gathers totals of all wages paid and taxes withheld.

To fill out a Form W-3, you’re going to need basic accounting information about your business. Your business name, employer identification number (EIN), address, phone, fax, contact person, and email address.

The bulk of the information contained in the form is straightforward, but extensive. You will need to list:

- Total wages, tips and other compensation paid

- Total federal income tax withheld

- Total social security wages

- Total social security tax withheld

- Total Medicare wages and tips

- Total Medicare tax withheld

- Total Social Security tips

- Total allocated tips

- Total advance earned income credit payments

- Total dependent care benefits

- Total non-qualified plans

- Total deferred compensation

- Totals of third party sick pay paid

- Total HIRE exempt wages and tips

- Total income tax withheld by payer of third party sick pay

- Total state wages, tips, etc.

- Total state income tax

- Total local wages, tips, etc.

- Total local income tax.

Quite a mouthful. As you can see, all the information above is pretty straightforward. On the other hand, the process of gathering the information and drawing up totals can be very labor-intensive. Even a small shop with a few employees has to tackle the work heavy process of totaling wages and taxes. (Note: even if you employ only one employee, you are still required to file a Form W-3.)

Further, you want to make sure that your W-3 is accurate and truthful. The last thing any business owner wants is to open themselves up to audits or penalties.

To make sure that your books pass IRS muster, ask your accountant any questions you have over the course of the year. Explain that you want to ensure you collect all the necessary information over the year so that you aren’t left scrambling come filing season.

If you use, or are shopping for, a payroll service, ask their representative if W-3 services are included. If not, ask about the cost of adding them. That sort of service could take a huge burden off of you, leaving you free to conduct all the other aspects of your business. And really, isn’t that what every business owner wishes he or she could do?

If you need help filing your taxes this year, you may want to consider both Turbo Tax and H&R Block. Their free online tax software can make your tax nightmares disappear.

The Best Free Tax Software

| Brand | Best For |

|---|---|

| Cash App Taxes (formerly Credit Karma Tax | All Individual Filers |

| TurboTax | Overall Features |

| TaxACT | Freelancers |

| H&R Block | Free Filers |

Read More: What Is The Cheapest Tax Software