Are your retirement savings going to be enough for you to live comfortably during your golden years?To address this question, we are going to look at the standard rules of thumb on retirement savings. But we are going to go further. We are then going to look at the math and assumptions behind the rule of thumb. Finally, we cover those difficult times where the assumptions don’t make sense for specific situations.

Rules of Thumb

The most common rule of thumb is that families should save 10% to 15% of their gross (before taxes) pay. Fidelity, for example, recommends that retirement savings eventually hit 15% of income. Liz Weston of MSN recommends saving 10% for the basics, 15% for comfort, or 20% to escape. An article on BrightScope written by CFP James Kinney recommends 15%.

The Math

So just how do these rules of thumb work? Why 10% to 15% versus some other number. To answer that question, let's first look at the math. In this hypothetical example, we'll assume the following:

- A family makes $100,000 a year

- They save 10%, or $10,000 a year

- There is no inflation, so their income and annual savings amount remain constant

- They earn 5% on their investments (remember, we are ignoring inflation)

- They save for 40 years, from age 25 to retirement at 65

With these assumptions in place, this hypothetical family will, after 40 years, have accumulated about $1.2 million in savings.

Now we need to make a few more assumptions. First, we assume that in the first year of retirement our family can safely withdraw 4% of their nest egg, or about $48,000. (You can read more about the 4% withdrawal rule.) Second, we assume that they will receive about $33,000 in Social Security benefits (check out this calculator to estimate your benefits). And finally, we assume that they can maintain their pre-retirement lifestyle on about 80% of their pre-retirement income.

Changing the Assumptions

In the above example, you'll need to replace $47,000 of income ($80,000 minus Social Security benefits of $33,000) with your retirement savings. At a 4% withdrawal rate, you'll need to amass $1.175 million by the time you retire ($47,000 / 4% -- or if you hate division, $47,000 * .25).

The 4% withdrawal rate has become a fairly accepted conservative estimate of how much you can take from your retirement savings if you want your money to last 30 years. Using a 4% withdrawal rate, simply multiply how much money your savings will need to pay you each year by 25, and you have the amount you’ll need in savings at the time of retirement.

Let's look at some common changes to the underlying assumptions that many will need to make.

Saving for 40 years

For many people, they have waited to the point where they no longer have 40 years to save for retirement. For these folks, they may need to save more than 15% a year. There are several resources that can help you assess where you stand and what you need to do:

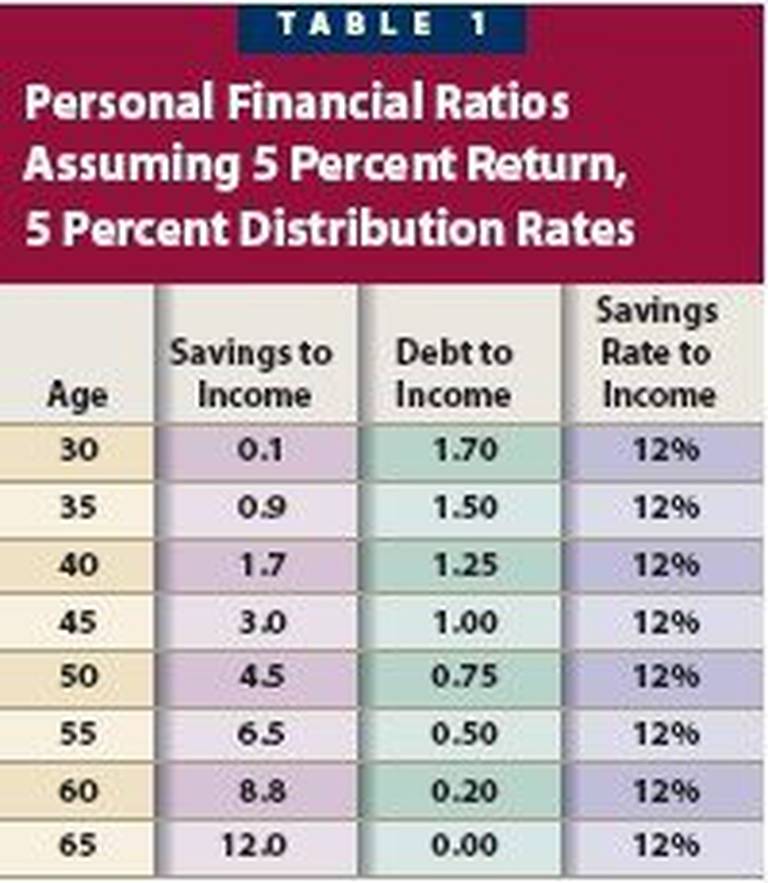

Money Ratios: In his book, Money Ratios, Charles Farrell walks through how much you should have saved based on your age and income. It’s a great way to assess where you stand and what you need to do to get back on track. I discussed his work on Podcast 31.

The chart to the left provides some guidelines. At age 35, for example, you should be saving 12% and have retirement savings equal to 0.1 of your income.

You’ll note that the chart starts at age 30. This is an important point. In Farrell’s original paper, he assumed a 5% withdrawal rate; most assume a 4% withdrawal rate. And if you think just 1% is no big deal, think again. At 4%, you need 15 times your pre-retirement income ($100,000 in our example) at retirement to produce 60% of this amount (remember social security covers 20%). But at a 5% withdrawal rate, you “only” need 12 times current income. In our $100,000 hypothetical, the difference in retirement savings is $1.5 million versus $1.2 million.

Which assumption is best? I don't think there is a best here. Four percent is more conservative than five percent. The logic behind the 4% rule is that you will earn 8% a year with a relatively conservative mix of stock and bond investments. Four percent stays in savings to keep up with inflation, and 4% comes out to pay for your living expenses.

So, seeing what you make now and what you think you will need to live comfortably later on... are you saving enough for retirement?

Related: Savings by Age: How Much to Save in Your 20s, 30s, 40s, and Beyond

Early Retirement: For those late to the game, you can learn a lot from those that retired early. In Podcast 7, I interviewed Mr. Money Mustache. He retired at age 30 after just 9 years of work. The steps he took to retire young can help those who need to catch up on their retirement savings.

Related: What is Semi-Retirement

Saving 10 to 15%

For those just starting out, saving 10% or more of gross income is a real challenge. In addition to paying school loans, many are starting a family and buying their first home. The key, however, is to get to this level (or more) as quickly as you can. If it seems like there's no money left over to save, check out my One-N-Done method of saving money.

Earning a 5% real rate of return

We can’t control market returns. But we can control several very important factors. We can control our asset allocation (with an emphasis on equities for long-term growth); we can control our investing costs, and we can control our behavior when the markets go crazy.

Five percent isn't guaranteed. The actual returns over the next several decades may be higher or lower. But we should focus on what we can control.

4% Withdrawal Rate

The 4% withdrawal rate rule of thumb is commonly accepted as a reasonable approach to retirement spending. But it’s not without its detractors. Some believe future market returns will be insufficient to justify 4%. For more on this rule and its alternatives, check out Podcast 46.

The key is to evaluate the assumptions in light of your own circumstances. The answers may not be easy, particularly if you started saving late in life, but at least you'll know where you stand and what you need to do.

Related: What is a Good Retirement Income?