Overall Ranking

5/5

Overview

5/5

5/5

4.5/5

5/5

5/5

In our Discover it® CashBack Match™ card review, we look at its cash back rewards, double cash back offer, introductory 0% APR, and other features. No annual fee and free FICO score make it a top rated credit card that I’ve used for years.

Editor's Note

You can trust the integrity of our balanced, independent financial advice. We may, however, receive compensation from the issuers of some products mentioned in this article. Opinions are the author's alone. This content has not been provided by, reviewed, approved or endorsed by any advertiser, unless otherwise noted below.

I’ve carried the Discover card for longer than I can remember. Originally called the Discover More Card, it’s now known as the Discover it® CashBack Match™. It’s one of my favorite cash back credit cards.

Historically, Discover is known for two things: (1) excellent cash back rewards, and (2) excellent 0% APR introductory rate offers on balance transfers. And based on my review of the new card, it doesn't disappoint in either category.

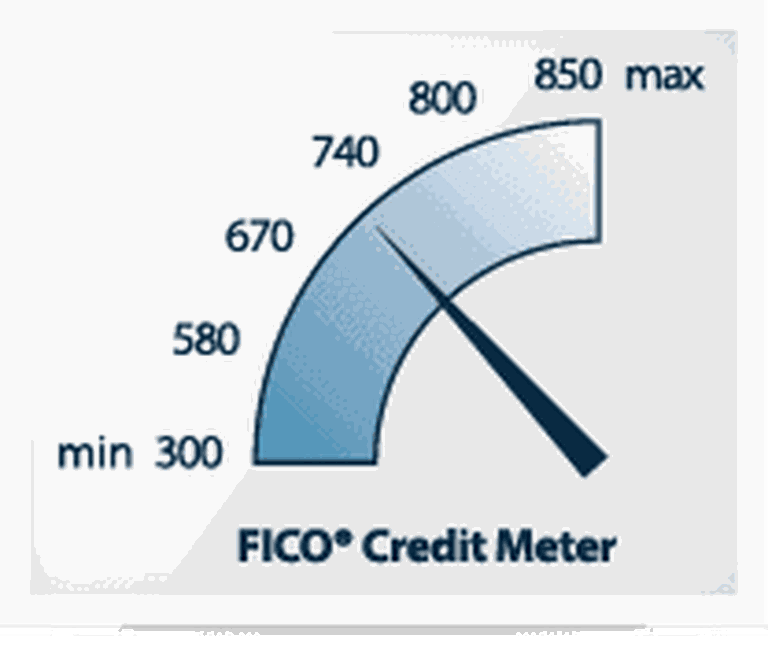

Now we can add a third feature--Discover now offers cardholders free access to their FICO credit score. This is a first, as far as I know, and I'll cover the details below.

First, let's look at the cash back rewards.

Discover it® CashBack Match™ Rewards

The cash back rewards are similar to Discover's previous cards, with a couple of exceptions.

First, the familiar 5% cash back on categories of purchases that change throughout the year is a feature of the card. These categories change each quarter. The five percent is capped at $1,500 in purchases each category. Thus, its potential value is $75 every three months.

Second, the Discover it® CashBack Match™ card pays 1% on all other purchases. Back in the day, Discover paid just 0.25% until you spent $3,000 on the card. That limitation is now gone. You earn 1% on all purchases right from the start.

Third, Discover has added a "Cashback Concierge" service. You can now get on the phone with a Discover representative, and they will look at your account to help you get the most out of your cash back rewards.

Forth, Discover will now double the cash back you’ve earned at the end of the first year. Earn $1,000 in cash back the first year, for example, and Discover will match it. We’ll come back to this feature in a minute.

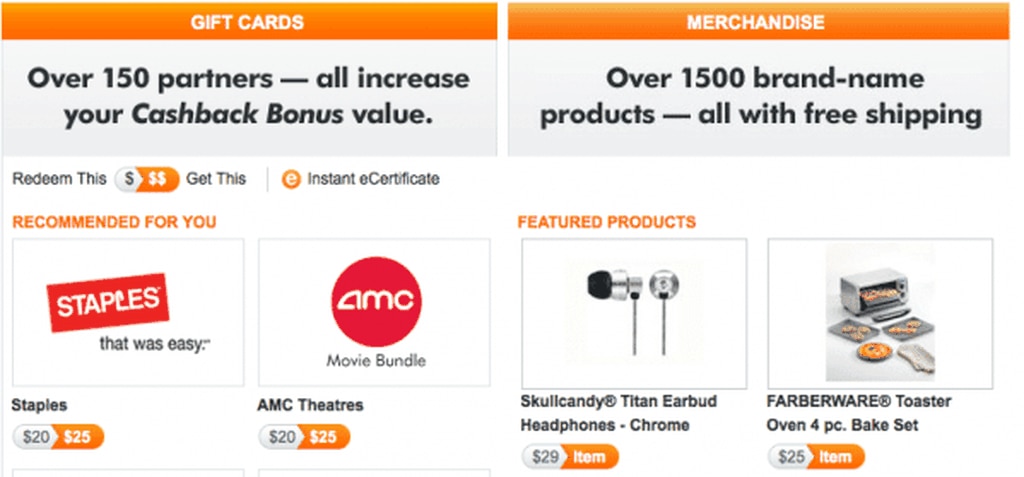

Finally, you have many options on how to redeem your cash back rewards. You can, of course, use the rewards as a statement credit (which is what I do) or get direct deposit of the cash back directly to your bank account. But Discover offers other options as well.

You can, for example, use your rewards to get gift cards or merchandise. With gift cards, you can redeem your rewards for a gift card with a value exceeding the amount of your rewards. For example, $20 in cash back might get you a $25 gift card. Or you can buy merchandise with free shipping.

What's the Value of the Cash Rewards

How much you can earn depends entirely on how much you spend. To give you an idea, however, we’ve taken spending data for an average family from the Bureau of Labor Statistics.

| Spending Category | Spending Amount | Cash Back % | Cash Back Rewards |

|---|---|---|---|

| Groceries | $4,049 | 1% | $40.49 |

| Restaurants | $3,154 | 1% | $31.54 |

| Gas | $1,909 | 1% | $19.09 |

| Other Transportation Expenses | $2,884 | 1% | $28.84 |

| U.S. Department Stores | $1,803 | 1% | $18.03 |

| Entertainment | $2,913 | 1% | $29.13 |

| Health Care | $1,452 | 1% | $14.52 |

| Other Expenses | $2,933 | 1% | $29.33 |

So far we’ve earned $192.94 in cash back. Now we also assumed that these purchases will also earn the 5% rotating category bonus each quarter. That adds an additional 4% cash back (on top of the 1% reflected in the table), on a total of $6,000 in purchases ($1,500 each quarter). That adds another $240 in cash back, bringing our total to $432.94.

But we aren’t done. For the first year only, Discover matches our cash back. The match brings our grand total in year one to $865.88. Not bad for a no annual fee credit card.

Discover it® CashBack Match™ 0% APR Balance Transfer

With the Discover it CashBack Match card, you can choose between two versions of the card. One version offers 0% for 6 months on purchases and 0% for 18 months on balance transfers. The second version offers 0% on purchases and balance transfers for 14 months. The choice is an easy one depending on whether you plan to take advantage of the balance transfer or prefer to use the 0% on purchases. If you use the balance transfer feature, there is a 3% balance transfer fee. There is no fee for taking advantage of the 0% APR on purchases.

Free FICO® Score Offer

Discover is the first major credit card issuer to offer free access to FICO® scores. Each month cardholders will see their FICO® score on their monthly credit card statement. The score will be based on data from TransUnion.

Other Features

Beyond cash back and the no interest features of the card, Discover it® CashBack Match™ also offers some lessor known features. Particularly in the area of fees, the card really shines.

- No annual fee

- No late fee for your first late payment

- No overlimit fee

- No foreign transaction fee

- 100% U.S. based customer service available any time

- Paying late won't increase your APR

- Pay for millions of items with your rewards at Amazon.com

- Pay your bill 'til midnight (ET) the day it's due by phone or online

- Choose your payment due date online or by phone

- Lower rate, lower payment or other help after job loss

- Automatic expedited delivery of your new card

It's perhaps for the above reasons that Discover has been ranked #1 in customer loyalty for 16 years, according to the 2012 Brand Keys Customer Loyalty Engagement Index Report.

Discover Spend Analyzer

The Discover website offers what it calls the Spend Analyzer. This feature looks at the charges to your card over the past one, three, six, 12 or 24 months and analyzes your spending by category. With a click of the mouse, you can drill down into any spending category to understand exactly where your money is going.

Pros and Cons

Up to 5% cash back

No annual fee

Cashback Match

Free FICO score access

Rotating categories

Disadvantages

As with anything, there are always some features that could be better. In the case of Discover it® CashBack Match™, there’s not much room for improvement. Discover could offer a bonus cash reward for new cardmembers. But beyond that, the card is competitive in every respect.

Summary

All-in-all the Discover it® card is an excellent option. I’ve carried a Discover card for a long time and have been very happy with it. The website is extremely easy to use, redeeming cash back rewards is a snap, and Discover gives you a ton of options when it comes to paying your bill.