P2P lending and investing eliminate the middleman. It creates a platform where consumers can come to borrow money, while investors come to invest money in the same loans. The process removes the banks, enabling both borrowers and investors to work directly together. This absence of the middleman produces higher returns for the investor, and often lower interest rates for the borrower.

There are two sides to the LendingClub story, LendingClub for borrowers and LendingClub for investors. Let’s take a look at how LendingClub works for each.

LendingClub for Borrowers

LendingClub offers several benefits for borrowers. One benefit involves your credit score. Typically, when you apply for a loan your credit score takes a small hit. With LendingClub, you can apply without affecting your credit score.

That’s because when LendingClub evaluates your creditworthiness, they do a “soft inquiry.” Soft inquiries do not hurt your credit score.

How the Process Works

Borrowing for a loan works like this:

1. You apply for a loan, supplying your income and credit quality level. LendingClub puts your request out to their investors to see if the loan is eligible for funding. If it is, LendingClub presents you with the loan amount and rate that investors are willing to accept.

2. If you accept the loan terms, a formal application process will begin. Lending Club makes a hard inquiry on your credit report, and asks you to supply income and identifying documentation.

3. If everything checks out, your loan will be available in a matter of days.

It’s actually a pretty simple process, which distinguishes it from traditional bank lending. Also, your actual identity is never revealed to investors, even after the loan is funded. Your information is presented to investors as an anonymous loan profile.

Features of LendingClub for Borrowers

Personal Loan Amounts. You can borrow up to $40,000, as long as your income and credit support that loan amount.

Loans are Unsecured. Despite the potentially large loan amount, your loan is completely unsecured. That’s true even if you use the proceeds to purchase a tangible asset, such as a car.

Loan Terms. Personal loans come in terms of either 36 months or 60 months. All loans are fixed-rate, fixed monthly payment and fully amortizing. That means there is no need to concern yourself with the instability of variable-rate loans. Put another way, LendingClub Personal Loans are completely unlike credit lines and credit cards.

Loan Proceeds Can Be Used As You Wish. As a personal loan, the proceeds can be used for what you deem necessary. You can use the money to consolidate credit card debt, purchase a car, renovate your home, or even start a business.

No Prepayment Penalties. There are no prepayment penalties on any LendingClub loans. That means you can pay the loan off anytime you want.

Pay by Automatic Draft. Not only does this make paying your loan incredibly easy, but it virtually eliminates the possibility of making late payments. LendingClub does report to the credit reporting agencies, so your good payment history will help improve your credit score.

Related: Fiona Review – Loan Offers in Minutes

LendingClub Personal Loan Rates & Fees

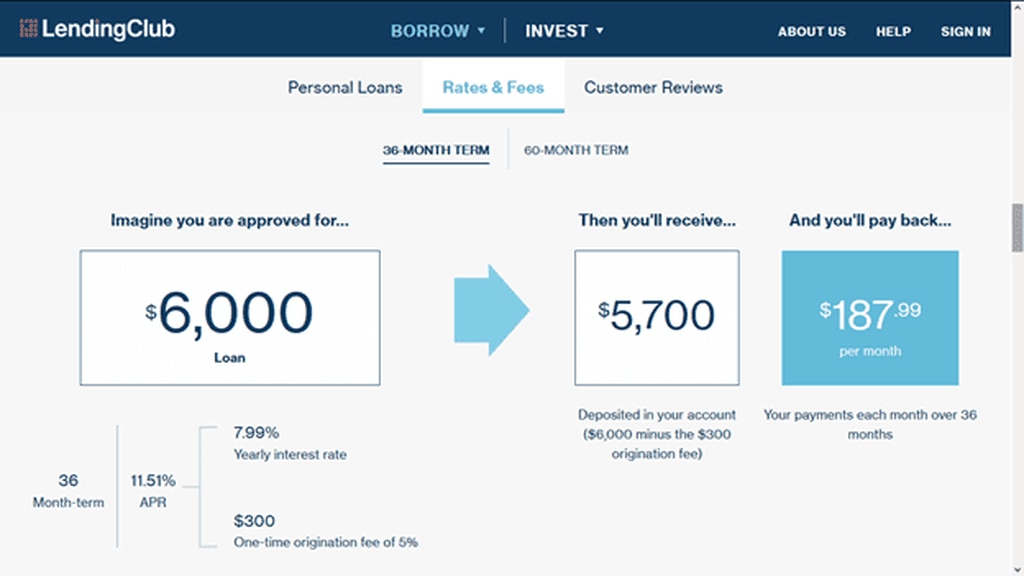

There are no application fees when you apply for a personal loan. LendingClub charges interest on the loans, as well as an origination fee.

Loan Grading. You’re assigned a credit grade based on your credit, income, debt level and the amount that you want to borrow. The grades range from A through G, and there are five levels at each range.

LendingClub advertises that the interest rate that you will pay ranges from 6.95% to 35.89% APR. However, the interest rate that you will pay will depend on your grade, and are currently in the following range for each grade:

- Loan Grade range: A1 A5, 6.11% - 8.46%

- Loan Grade range: B1 B5, 10.08% - 12.73%

- Loan Grade range: C1 C5, 13.56% - 16.91%

- Loan Grade range: D1 D5, 17.97% - 22.35%

- Loan Grade range: E1 E5, 19.99% - 27.27%

- Loan Grade range: F1 F5, 24.24% - 30.75%

- Loan Grade range: G1 G5, 28.55% - 30.99%

These rates are subject to change, so check the LendingClub Borrower website for current rates.

Loan Origination Fee. LendingClub charges this fee, which ranges between 1% and 6% of the amount of your loan (it will be at the higher end for all but the highest credit grade range). LendingClub deducts the fee will be deducted from your loan proceeds at the time of funding.

That means that if you take a $10,000 loan, and you have a 5% origination fee, your net loan proceeds will be $9,500.

LendingClub Auto Loans

You can always use a Personal Loan to buy a car. But LendingClub also offers its Auto Loan program specifically for this purpose. The program is set up to refinance existing car loans.

The terms of the LendingClub Auto Loan are as follows:

Loan Amount: $5,000 to $55,000.

Loan Term: The current loan must be in existence for at least three months, and have a remaining term of at least 24 months.

Interest Rate: 2.24% to 24.99% APR.

Eligible Vehicles: Personal use vehicles only, 10 years old or newer, and with not more than 120,000 miles.

Medical Loans--LendingClub Patient Solutions

These are loans that LendingClub offers specifically to pay for what are typically uncovered medical expenses. That can include dentistry, fertility, hair restoration, and weight loss surgery.

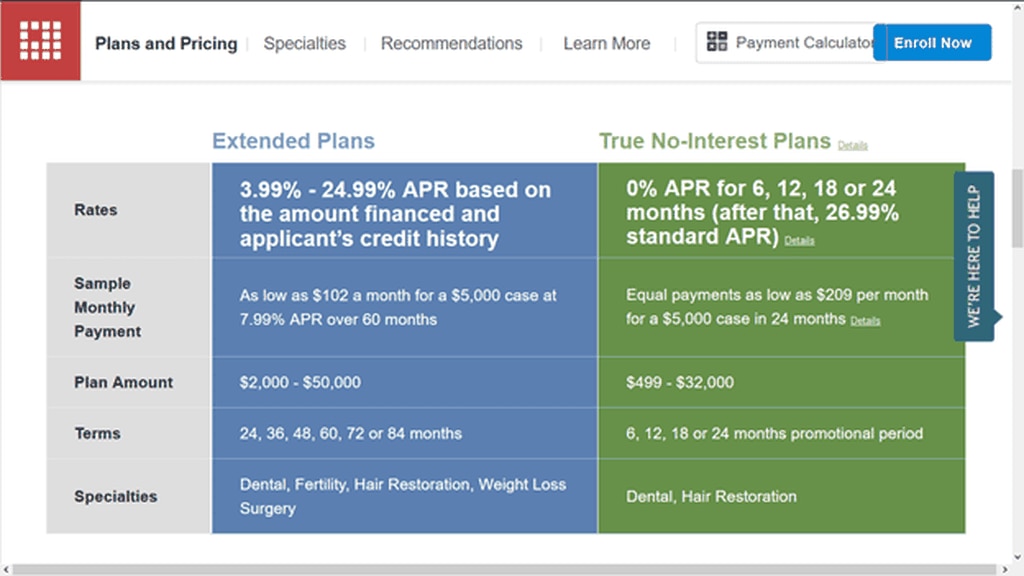

LendingClub offers two loan plans for this purpose. The first is the Extended Plan, which comes with terms of up to seven years, a loan amount of up to $50,000, and an interest rate of between 3.99% and 24.99% APR.

The second is the True No-Interest Plan. This loan comes with an interest-free term of anywhere from six months to 24 months. Not only is no interest due during that term, but none accrues either.

At the end of the interest-free term, your interest rate goes to 26.99% APR. It works on the idea that you can pay off the loan amount during the interest-free term. This loan is restricted to dental and hair restoration procedures and is limited to $32,000, for an interest-free term not to exceed 24 months.

LendingClub Business Loans

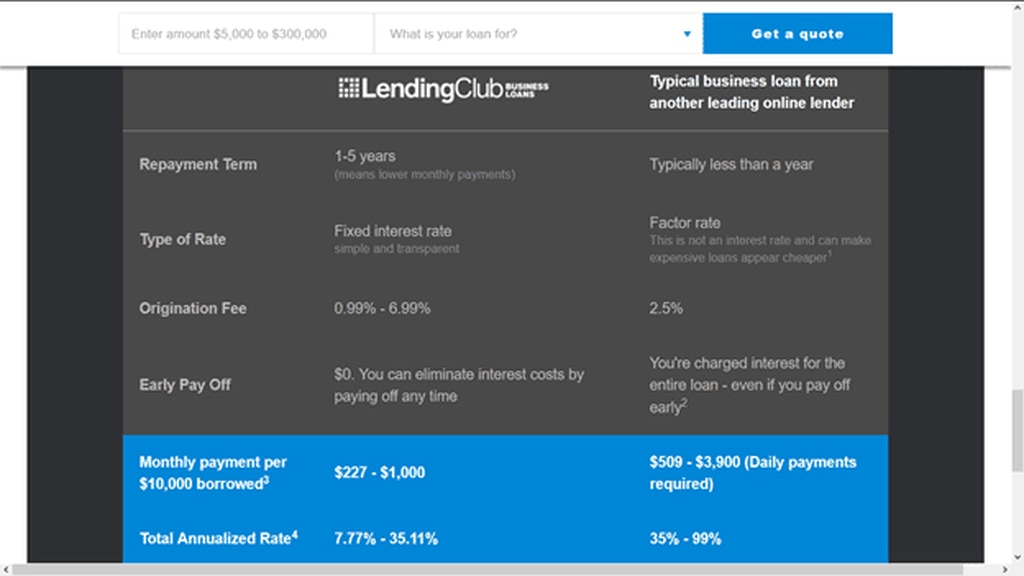

LendingClub also offers two options for their business loans–Loans and Lines of Credit. There is no prepayment penalty on either loan type.

With the Loan, the proceeds can be used to purchase equipment, hire new employees, consolidate debt, expand your current location, or expand to a new location. You can borrow as much as $300,000, on a fixed-rate loan with a term of anywhere from 1 to 5 years. There is an origination fee of between 0.99% and 6.99% of the loan amount.

With the Line of Credit, the proceeds can be used to purchase inventory, for working capital, to manage seasonal cash flow fluctuations, or just to have instant liquidity. You can qualify for a line of up to $300,000. You can access the line by taking draws. Each individual draw must be repaid within 25 months. The line comes with variable interest rates, ranging between 7.0% and 22.60% APR.

In order to qualify for either loan, you must have the following:

- Two years or more in business

- At least $75,000 in annual sales

- No recent bankruptcies or tax liens

- Own at least 20% of your business

- At least fair or better personal credit

Should You Borrow Through LendingClub?

Whether or not you should borrow through LendingClub will depend upon alternative sources of credit. For example, if you can get a credit card from a bank that offers you a reasonable interest rate on the loan amount you need, but does not charge an origination fee, that could be a better situation for you.

What P2P loans work best for is debt consolidation. If you have a lot of credit card debt, your average interest rate is probably high enough to justify a P2P loan, even with an origination fee. Why?

LendingClub Personal loans are fixed-rate loans, with a definite term. For example, you can take a 60-month loan, with a guaranteed rate and monthly payment. And at the end of five years, the loan will be paid off and you’ll be completely out of debt.

Related: Best Peer-To-Peer Lending Sites For Borrowers and Investors

Credit Score Impact: There’s another advantage to taking a Personal Loan to pay off credit cards, and that’s the effect that it can have on your credit score. Since credit card debt is considered the highest risk type of debt, you can actually get a jump in your credit score by paying it off with a fixed-rate loan.

This will be somewhat offset by the fact that you will have a new personal loan. But credit scores have been known to improve by at least a few points immediately, and even more, as time passes and the history on the new loan grows.

LendingClub’s Patient Solutions can be a real asset since it specifically provides financing for noncovered medical expenses. LendingClub’s Business Loans offer a very high loan amount as well as flexible terms. Since business loans are very difficult to get through local banks, LendingClub could prove to be a real alternative financing source.

LendingClub for Investors

LendingClub offers an opportunity for investors to invest in fixed income securities that have a substantially higher rate of return than what they can get on more traditional investments, like certificates of deposit or US Treasury securities.

This is true once again due to the fact that there is no intermediary in the investment arrangement. You earn a higher rate of return on your investment because there is no bank in the middle taking a big chunk out of the return on the loans.

Features of LendingClub for Investors

Investor Eligibility: In order to invest in LendingClub you must be at least 18, have a valid Social Security number, and have your identity successfully verified by LendingClub. Residents of Pennsylvania, Ohio, North Carolina in New Mexico are not eligible to invest in LendingClub.

You must also qualify based on Financial Suitability, which is defined as follows:

Investors who are residents of states other than California must have:

(a) an annual gross income of at least $70,000 and net worth (exclusive of home, home furnishings, and automobile) of at least $70,000 or

(b) have a net worth of at least $250,000 (determined with the same exclusions).

Investors who are residents of California must have:

(a) an annual gross income of at least $85,000 and a net worth of at least $85,000 (exclusive of home, home furnishings, and automobile) or

(b) have a net worth of at least $200,000 (determined with the same exclusions) or

(c) invest no more than $2,500 in Notes if the investor does not meet either of the tests set forth in (a) or (b).

The reason these limits are necessary is that P2P investing is considered to be higher risk than other types of fixed-income investments.

Eligible Accounts: Individual and joint accounts; trust, corporate and custodial accounts; as well as traditional, Roth, rollover, SEP and SIMPLE IRAs.

Minimum Initial Investment: $1,000.

Account Fees: There is a $100 annual account fee that’s due when you open your account. However, LendingClub will pay the fee on your behalf if you have a minimum balance of $5,000, and maintain that minimum for the following 12 months. Following the first year, LendingClub will pay the fee if you maintain a minimum balance of $10,000 in your account.

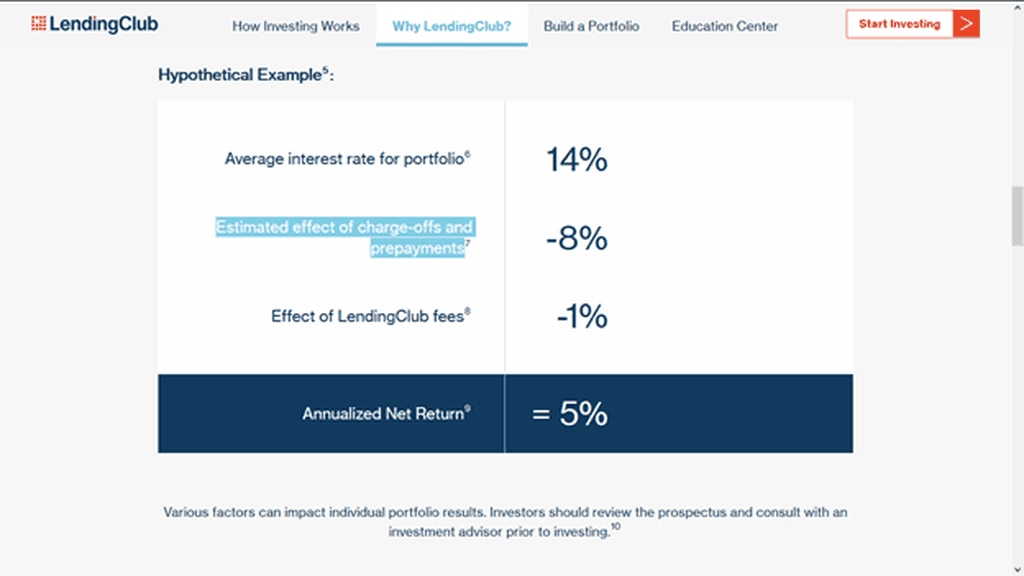

LendingClub also charges a fee of 1% on every loan you invest in. That means if a particular loan has an interest rate of 10%, LendingClub will take 1%, giving you a net return of 9% (less the estimated effect of charge-offs and prepayments).

Your net return on investment will be calculated something like this:

How Loans are Purchased: You don’t actually purchase loans outright. Instead, you invest in slivers of each loan that are referred to as “notes”. Each note comes in a denomination of $25. That means that if you have $1,000 to invest, you can spread that investment across 40 different loans.

Account Liquidity: Generally speaking, when you purchase notes on LendingClub, you’re expected to hold them until they mature. But LendingClub works with Folio Investing, which operates a Note Trading Platform where you can both buy and sell LendingClub notes to and from other investors.

The Note Trading Platform provides some liquidity, but not total. There is no guarantee that you will be able to sell your notes before they mature, or what price you will get for the notes when you do.

P2P Lending Risks: Loans are subject to either prepayments or charge-offs. In the case of prepayments, if the loan is paid off sooner than the 36 or 60-month loan term, that will end the revenue stream from that loan. Similarly, if the loan is charged off, not only will you lose future interest income, but also at least part of your investment in the loan.

NOTE: Since P2P loans are unsecured, the default rates are high.

P2P Reinvestment: There’s one other risk associated with LendingClub loans and all P2P loans, and that’s the loan payoff process. The loans that you are investing in are self-amortizing. That means that as you receive income from monthly payments, the underlying loan is being paid off.

For this reason, you should plan to reinvest your income payments into more loans. If you take the monthly payments as income, your account will eventually be paid out.

Investment Returns: LendingClub claims that you can earn a net return on your investment of between 4% and 6% per year. This represents the interest rate being paid by borrowers, the 1% annual fee on each loan paid to LendingClub, and the rate of charge-offs.

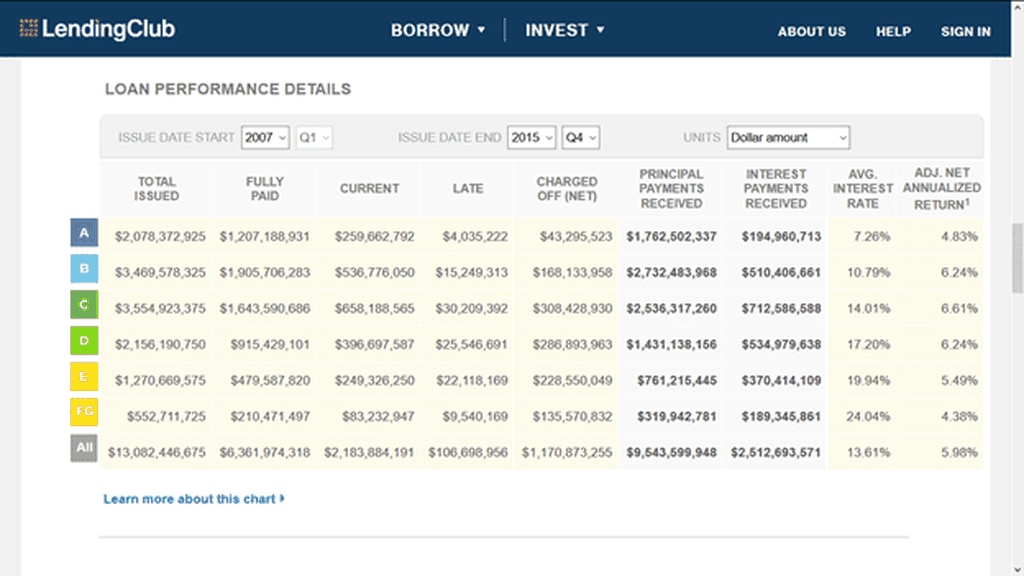

For the timeframe running from March 31, 2007, through December 31, 2015, Adjusted Net Annualized Returns for all Loan Grades looked like this:

Notice that the higher rates of return–greater than 6%–were in the B, C and D Loan Grades. For this reason, it’s important to diversify your LendingClub portfolio not only across many different loans but also across the different credit grades.

Should You Invest Through LendingClub

As you can see from the information above, LendingClub not only provides higher rates of return than what you can get on traditional fixed-income investments, but there is also substantially more risk. For that reason, you shouldn’t want to invest all or even most of your portfolio in P2P loans.

P2P investing is best used as a diversification for the fixed income portion of your portfolio. In that way, the higher net returns on your P2P investment can help improve the overall return on your fixed-rate investments.

For example, if most of your cash is invested in CDs paying an average annual rate of return of 1%, but you put a portion of your fixed-income portfolio into P2P loans averaging 5%, you might raise the overall return on your fixed-income portfolio to something more like 2% to 3% per year.

Think of LendingClub investing as a way to get higher returns on your fixed-income investments. But at the same time, the lack of liquidity makes it unsuitable for an emergency fund, or even for a savings fund dedicated to a short-term purpose, such as saving for the down payment on a house.

LendingClub Pros and Cons

Investing Returns Above 5%

Variety of Notes Available

Terrific Visibility in Loans

High APR for Average Credit Borrowers

Average Credit Loans Very Risky

Final Thoughts

LendingClub offers an excellent option for both borrowers and investors. The founder of Dough Roller, Rob Berger, has invested in LendingClub notes for years earning a rate of return above 7%.

If you’d like more information on LendingClub for borrowing or for investing, or if you’d like to open up an account, visit the LendingClub website and see all that they have to offer.