It’s a common problem.

You’ve got some cash in a savings account earning a paltry 0.01%. You plan to spend it to buy a home or a car or something else in a few years. How can you invest the money until then to earn some extra interest?

It’s called short-term investing, and it’s tricky. Put your money in the stock market, and it could be gone when you need it. Put it in a traditional savings account, and it earns practically nothing. So, what should you do?

Recently, a listener to our podcast, Michael, emailed me with just this dilemma:

Hey, Rob. I wanted to get your thoughts or maybe you could point me to a podcast. I am currently in the oil industry and have survived the layoffs at my company. It looks as if things are turning around. Over the past two years I’ve stacked up some cash in my Ally Bank savings account at one percent interest. I don’t currently need the cash at this moment but could need the cash within the next year or two in order to purchase land for my family. If I wanted to invest the cash but be able to have it back in one way or another within two years, what is the best way to go about this? A brokerage account which we currently own? I know there are short and long-term capital gains which might still outgain a one percent interest but I'm just curious on your thoughts.

Let's answer Michael's question.

What is a Short Term Investment?

What exactly is a short-term investment? Well, there is no official definition. There is no governing body that defines what short-term or long-term investing is. It’s arbitrary.

For me, short-term investing is investing money you're going to need to spend in fewer than five years.

If you are really eager to start investing, one of our recommended choices is Wealthfront. They have an easily attainable minimum balance, low fees, and a simple, convenient interface. They're a great choice to start investing easily and quickly.

Why five years? Because most of the time, the stock market doesn't lose money over a 5-year period. It can, of course. Go back to the 1930s and 40s and you'll find 5-year periods where the market was crushed, as this Bankrate slideshow demonstrates... 1932 was the worst. The 5-year period ending that year saw a drop of 60.9%.

But that's rare.

When we have a pretty significant stock market correction or a bear market, it usually takes us at least five years to pull out of it. Of course, that’s not a guarantee. We could hit a bear market, and it could take us 10 years to pull out of it.

Either way, five years is where I draw the line. You may want to draw your own line more conservatively... or even less conservatively, for that matter. What I hope to do today is give you some information that will enable you to make a sound decision.

So, let's begin.

The 10 Best Short Term Investments

1. Lending Club

Lending Club offers a great option with the potential for better returns. This P2P lending platform makes it easy to invest in loans to individuals and companies.

It's also perfect for short-term lending. Loans on the platform are for either three or five years. If you know you won't need the money until then, Lending Club is a reasonable alternative.

I’ve invested in Lending Club loans since the platform was first launched. My current annualized return, including loans that defaulted, is over 8%.

With higher returns, however, comes higher risks. Loans do go into collections and eventually default from time to time. Over the years, I’ve invested in 17 loans that defaulted.

The key is diversity. You can invest in a loan with as little as $25. By diversifying across many loans, you minimize the effect a single default will have on your portfolio.

LendingClub Pros and Cons

Very easy to invest in a diversified loan portfolio

Potential for high returns on a short-term basis

Not FDIC-insured

Cannot liquidate the loans early

Potential for losses

Expected Annual Return: 5.00 to 7.00+%

Read more: Lending Club Review

Lending Club Disclaimer:

2. Certificate of Deposit

The second option for short-term money is a certificate of deposit. CDs give us a lot more options than a savings account. The term of a CD can range from a few months to more than five years, and the longer the term, the higher the rates.

These higher rates, however, come with added risk. Here's why.

A CD can be cashed in before it matures. For example, you could invest in a 5-year CD, but decide to withdraw your money after the first year. If this happens, however, most CDs charge a penalty. The amount of the penalty varies by bank and CD product.

As a result, it's best to keep money in a CD until it matures. For this reason, picking the length of the CD is a critical decision.

So, you end up having this delicate dance- you want a long CD term so that you can make the most interest. But you don’t want to pay a penalty if you take the money out early.

CD Pros and Cons

FDIC insured

CD terms ranging from 6 months to 5 years or longer

Higher interest rates on longer term CDs

Can create a CD ladder

Still relatively low interest rates

Penalty for early withdrawal

Expected Annual Return: 1.00 to 2.50%

Here is a list of banks that offer high-yield CD options:

3. Investing With Betterment

Betterment presents an interesting opportunity for short-term investors. It’s not an investment. Rather, it’s an online company that makes investing in stock and bond ETFs easy.

The service can be used for all types of investing, including long-term retirement investing. To use Betterment in the shorter term, you must get the asset allocation right.

Learn More: The Perfect Asset Allocation Plan

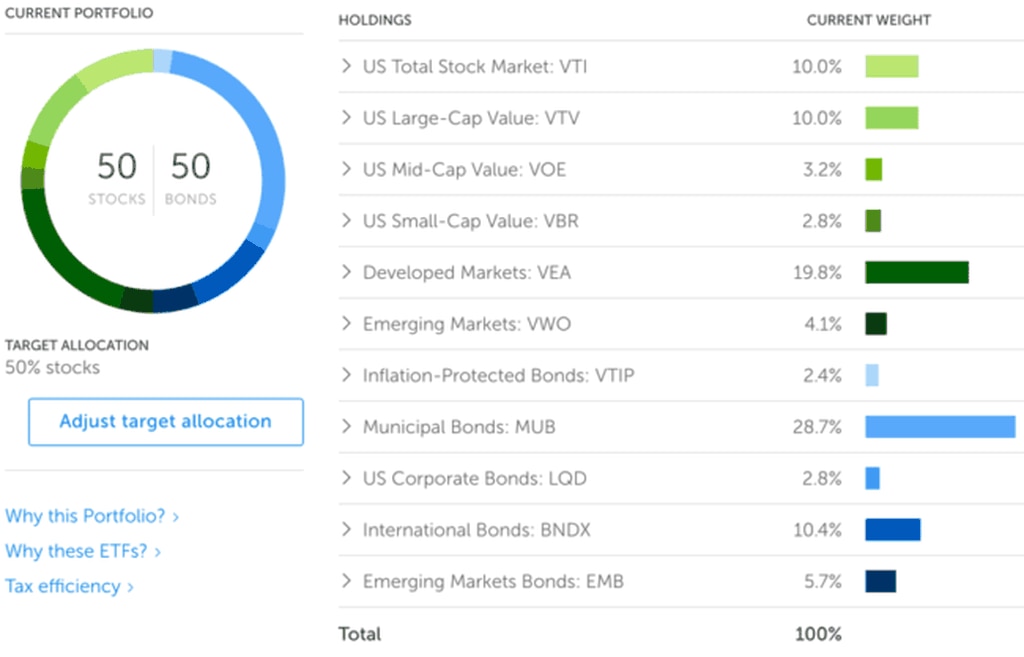

Betterment lets investors decide how much to put in stock ETFs and how much to put in bond ETFs. For short-term investing, a 50/50 allocation protects against the downside while allowing for potentially higher returns.

Here's the 50/50 asset allocation with Betterment:

The 50% in stocks gives us a chance to earn greater returns. The 50% in bonds helps protect short-term investors from a market crash.

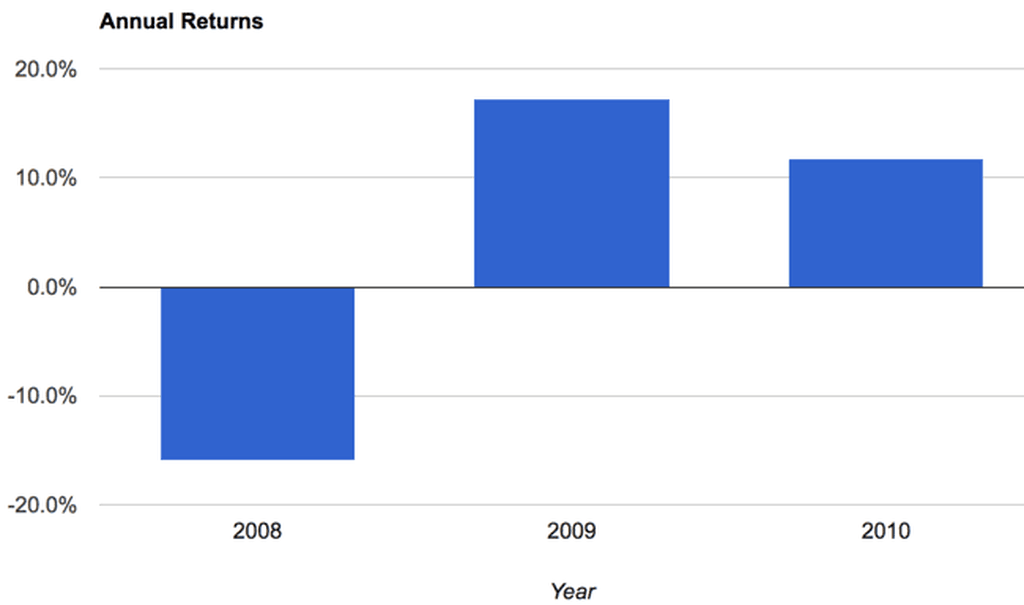

There are no guarantees, of course. But looking at a 50/50 portfolio during the 2008-2009 market crash gives us some comfort.

Using PortfolioAnalyzer, I assumed we invested $10,000 at the start of 2008. Assuming we needed the money three years later, how would our 50/50 portfolio perform over a 3-year period. Remember that in 2008, a total U.S. stock index fund lost more than 37%.

Here are the backtested results of our 50/50 portfolio:

The portfolio still lost money in 2008, although far less than the 37% that the market dropped. And what was our final portfolio value at the end of 2010? It grew to $11,014, for an annual return of 3.27%.

While 3.27% is not a great return, remember that 2008 was a very bad year for stocks. Shift our time period one year forward (2009-2011) and our annual return jumps nearly 11%.

As a result, a 50/50 portfolio with Betterment is a reasonable choice for those needing the money in three to five years.

Betterment Pros and Cons

Very easy to implement

Money can be withdrawn at any time

Potential for much higher returns

Fees are very low

Not FDIC-insured

Potential for capital losses

Expected Annual Return: 0 to 10+%

Learn More: Betterment Review

4. Online Savings Account

Traditional banks pay as little as 0.01% on a savings account. That's as close to zero percent as you can get.

One option for short-term savings that pay more is to go with an online bank. While the rates are still nothing to brag about, the top online savings accounts today pay about 0.50%. Chime® is now paying an APY of 2.00%, which is right in line with the best online savings accounts available. Chime offers a terrific online savings and checking account geared toward savers. You can see the top current rates here.

Chime Disclosure - Chime is a financial technology company, not a bank. Banking services and debit card provided by The Bancorp Bank, N.A. or Stride Bank, N.A.; Members FDIC.

1Chime cannot guarantee when files are sent by the IRS and funds can be made available.

^Early access to direct deposit funds depends on the timing of the submission of the payment file from the payer. We generally make these funds available on the day the payment file is received, which may be up to 2 days earlier than the scheduled payment date.

Online Saving Account Pros and Cons

FDIC insured

Funds can be withdrawn at any time

Rates better than a brick and mortar bank

No monthly fees

Interest rates are still low

Inflation exceeds the rates

Expected Annual Return: 1.30%

Here are some high-yield savings account options:

5. Municipal Bonds

There is a significant downside to bonds: taxes. Interest earned on bonds is taxed, as are any capital gains.

One option to reduce the tax burden is municipal bonds (known as “munis”). These bonds are typically free of federal income tax and may be free from state income tax, too. Munis are an excellent option for those in the higher federal tax brackets.

I’ve invested in Vanguard’s Intermediate-Term Tax-Exempt Fund (VWIUX) in the past. SEC yields on these funds are lower than similar taxable bonds. The comparison must be made on an after-tax basis. This fund currently sports an SEC yield of almost 2%.

Municipal Bonds Pros and Cons

Potential for higher returns

Tax advantages

Easy access to funds without penalty

Potential for losses

Not ideal for those in lower tax brackets

Expected Annual Return: 2 to 5% (after tax)

6. Short Term Bonds

Our third option is short or intermediate-term bond funds. More specifically, we want to look at low-cost index mutual funds and ETFs. Both Vanguard and Fidelity offer several options.

Here, you have some important choices to make. Do you want a fund that invests just in U.S. government bonds or one that also invests in corporate bonds? Do you want a short-term bond fund or an intermediate-term bond fund?

Like everything else in life, these choices involve trade-offs.

U.S. Government bonds are more secure than corporate bonds, but they pay less. Short-term bonds are less sensitive to interest rate fluctuations than intermediate-term bonds, but they pay less. Today, short-term government bonds do not pay much more than an online savings account. For example, the SEC yield on Vanguard's short-term Treasury fund is just 1.25%.

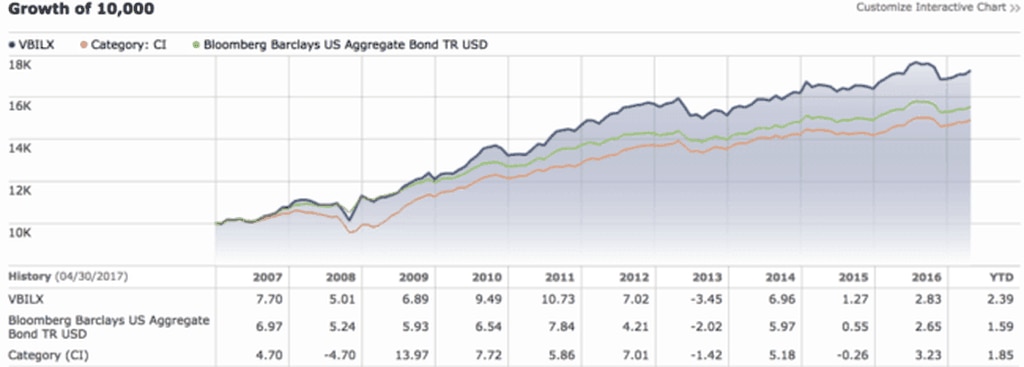

For my money, I want to do better than that in a bond fund. While intermediate-term funds can lose money in a given year, they are reasonably stable. Vanguard’s Intermediate-Term Bond Index Fund (VBILX), for instance, costs just 0.07% and sports an SEC yield of over 2.50%.

A review of the performance of VBILX shows that it lost money in only one of the past ten years:

Short Term Bonds Pros and Cons

While not FDIC-insured, still reasonably secure

Intermediate-term bonds can yield significantly higher rates than a savings account

Money can be withdrawn from the fund when needed

Not FDIC-insured

Can lose money

Rates are historically low

Expected Annual Return: 1.00 to 6.00%

7. Bulletshares

There is a downside to traditional bond funds. They can experience capital losses as funds sell some bonds to buy new ones. If interest rates have risen, the fund incurs a loss on the sale of bonds.

Enter Guggenheim’s Bulletshares. These ETFs combine the potential returns of a bond fund with the fixed maturity of a CD. I first learned about Bulletshares from Jeanne J. Fisher, MBA, CFP, CPFA of ARGI Financial Group.

Traditional bond funds continue in perpetuity. The fund management regularly sells bonds as maturities age and replaces them with new bonds with longer maturities. In contrast, Bulletshares have a defined term of one to ten years.

At the end of the term, assets are returned to existing shareholders. And unlike CDs, a shareholder can sell his or her ETF shares at any time without penalty.

Related: What Are ETFs (and Are They a Strong Investment Option)?

Bulletshares come in two flavors: (1) corporate bonds and (2) high-yield corporate bonds. The first invests in investment-grade corporate bonds. The second buys bonds issued by corporations with a credit rating below investment grade. It involves more risk but offers higher returns.

As an example, the Guggenheim BulletShares 2020 High Yield Corporate Bond ETF has a current yield to maturity of over 5%.

Bulletshares Pro and Cons

Potential for higher returns

ETF shares can be sold at any time

Fixed maturity dates

Not FDIC-insured

Funds can lose money

Expected Annual Return: 1.50 to 5.50%

8. Wealthfront

Like Betterment, Wealthfront is a robo-advisor that makes investing easy. I list it here in addition to Betterment for one reason: It’s free.

Well, it's free for your first $5,000 if you sign up using a DoughRoller link. After that, the cost is similar to Betterment. For both, you pay the very low fees charged by the ETFs. You also pay a Betterment or Wealthfront fee of about 25 basis points.

With Wealthfront, however, the 25 basis point fee is waived for the first $5,000.

Wealthfront Pros and Cons

Very easy to implement

Money can be withdrawn at any time

Potential for much higher returns

Fees are very low

Not FDIC-insured

Potential for capital losses

Expected Annual Return: 0 to 10%

Read more: Wealthfront Review

9. Worthy Bonds

Worthy Bonds offers you an opportunity to earn 5% on your money, with an investment of as little as $10. It’s a peer-to-peer investment site, where you can invest money in bonds issued by small businesses. The bonds aren’t guaranteed by a government agency, like FDIC, but many of them are collateralized by business inventory.

When you use the Worthy Bonds mobile app, you can automatically add funds to your investment account. Similar to many micro-savings apps, Worthy Bonds uses spending round-ups to move small amounts of money into your investment account as you spend. For example, if you pay $4.10 for a cup of coffee, the app will charge your account an even $5. $4.10 will go to pay the merchant, and $0.90 will go into your investment account. Once you accumulate an even $10 in round-ups, the funds can be used to purchase a bond.

Worthy Bonds Pros and Cons

Invest with as little as $10

An investment of $1,000 can be diversified across 100 different bonds

Interest is credited weekly

There are no fees charged on your account

Earn interest at more than twice the rate of inflation

Pays simple interest only, and does not compound for higher returns

The maximum investment is not more than 10% of your net worth or annual income, or $100,000

Expected Annual Return: 5%

Read more: Worthy Bonds Review - A Worthy Investment for Everyone

10. SmartyPig

The final investment option on our list offers an interesting twist to online savings accounts. SmartyPig combines a high yield with savings goals. As of August 2018, SmartyPig currently offers a high yield savings APY of 1.55%.

Now, the savings goals. With SmartyPig, you set specific savings goals. You can set multiple goals, or just one. You then add to the account until you reach your goal. In this way, SmartyPig is ideal for short-term savers.

Related: 6 Keys to Setting Financial Priorities

SmartyPig Pros and Cons

FDIC-insured

Potential for returns higher than most online banks

Makes saving for a specific goal very easy

Low rate compared to other options

Expected Annual Return: 1.00+% (depending on account balance)

Is the Stock Market a Good Place for Short-Term Investing?

We could stop here. After all, the above short-term investing options should cover most situations. Yet many will ask one remaining question: Why not just put all our money in the stock market?

It's an understandable question. Particularly when the market is rising, missing out on money can be painful. It's funny, though. Nobody asks me this question in a bear market.

And that's the point. With the stock market, you can lose money over a short period of time.

Thinking Long Term: Sweat In Up Markets So You Don't Bleed In Down Markets

Let's return to 2007 and run a test. We'll use the Vanguard S&P 500 index fund as a proxy for the market. And we'll assume we have $10,000 at the start of 2007, that we'll need to use in three to five years.

How would a $10,000 investment have performed? At the end of three years, we would have $8,395, for an annual return of -5.66%. At the end of five years, we would have $9,837, for an annual return of -0.33%

Yes, 2008 was a bad year. But again, that’s the point. Investing 100% of short-term money in the stock market presents a significant risk of loss of capital. Fortunately, we have better ways to invest for the short term.

Public is an app that helps you invest in individual stocks, even if you don’t have much money to commit. What makes it good for short-term investments is its lack of fees. There is no commission to buy or sell a stock so you can move your money in and out of the market at will without worrying about minimum investment terms. Read our Public app review

How to Manage Your Short Term Investments

Track and Analyze your Short-Term Investments for Free: Managing investments can be a hassle. You may have multiple IRAs, multiple 401ks, as well as taxable accounts. And then there are bank accounts. The easiest way to track and analyze all your investments, regardless of where they are located, is with Empower’s free financial dashboard.

Empower enables you to connect all of your 401(k), 403(b), IRAs, and other investment accounts in one place. Once connected, you can see the performance of all of your investments and evaluate your asset allocation.

With Empower’s Retirement Fee Analyzer you can see just how much your 401k and other investments are costing you. I was shocked to learn that the fees in my 401(k) could cost me over $200,000!

Empower also offers a free Retirement Planner. This tool will show you if you are on track to retire on your terms.

If all of this is overwhelming and not something you want to handle on your own, you may want to think about working with a financial advisor or investment advisor. We suggest visiting Paladin Registry, where you can fill out a form online to tell them what you are looking for. It’s free to use and Paladin Registry will email you a list of three highly-rated professionals that match your needs. From there you can interview each one and choose the best fit.

Happy investing!

Listen to the podcast on this topic:

DoughRoller receives cash compensation from Wealthfront Advisers LLC (“Wealthfront Advisers”) for each new client that applies for a Wealthfront Automated Investing Account through our links. This creates an incentive that results in a material conflict of interest. DoughRoller is not a Wealthfront Advisers client, and this is a paid endorsement. More information is available via our links to Wealthfront Advisers.

(Personal Capital is now Empower)

Empower Personal Wealth, LLC (“EPW”) compensates Webpals Systems S. C LTD for new leads. Webpals Systems S. C LTD is not an investment client of Personal Capital Advisors Corporation or Empower Advisory Group, LLC