Overall Ranking

5/5

Overview

5/5

4.5/5

4.5/5

4/5

Betterment Checking is a new way to manage your money and combine it with the other great products Betterment provides. Should you open an account?

Editor's Note

You can trust the integrity of our balanced, independent financial advice. We may, however, receive compensation from the issuers of some products mentioned in this article. Opinions are the author's alone. This content has not been provided by, reviewed, approved or endorsed by any advertiser, unless otherwise noted below.

Betterment is well known as one of the top robo advisors in the investment industry. They’ve been steadily expanding their product line, recently adding Savings and Cash Reserves. But the latest addition–Betterment Checking–has turned Betterment into a single platform where you can hold and manage your entire financial life in one place.

If you already invest with Betterment, the time has come to bank with them as well. That’s now possible with Betterment Checking. Betterment has joined the growing ranks of banks and investment companies offering all-online and mobile banking. And if Betterment’s past evolution in the robo advisor space is any indication, Betterment Checking is destined to become one of the top online checking account choices available anywhere.

What is Betterment Checking?

Betterment Checking is a “No Everything Checking Account,” as in no monthly maintenance fees, no account minimums, and no overdraft fees. That’s the kind of checking account every consumer is looking for at a time when traditional banks are loading up their accounts with fees for just about everything.

Betterment Checking is an all-online account, which means no brick-and-mortar branches. But that’s typical of all online banks, and the main reason why they can offer no-fee accounts. No branches mean fewer employees, and the combination of both means lower operating costs. That translates into no fees for you as the consumer.

But don’t worry about the lack of physical branches. You can do nearly anything with a Betterment Checking account that you can do with a checking account from a traditional bank.

For example, you can pay bills, transfer money, check your balance, make mobile check deposits and even contact Betterment through the online and mobile banking apps. You can access cash fee-free using the Visa Debit Card that comes with your account.

After a few weeks using your Betterment Checking account, you won’t miss your traditional bank.

Related: List of Free Online Checking Accounts

Betterment Checking Product Features

Here’s what you can expect when you open a Betterment Checking Account:

Minimum Balance Requirement: None – there’s no minimum required to open an account and no minimum ongoing balance requirement.

Account Ownership: Betterment Checking is available for individuals only at the moment. But joint accounts are coming soon.

Link to Peer-to-Peer Payment Services: You can link your account and debit card with Zelle, Venmo, Cash App and other payment methods to quickly and easily send and receive funds to and from family and friends.

Visa Debit Card: The card can be used anywhere Visa is accepted, which is more than 2.8 million locations worldwide. That includes ATM access. And you don’t need to worry about fees charged by ATM owners–Betterment will automatically reimburse those.

The debit card is tap-to-pay enabled, so you can make in-store payments quickly and be on your way. And those foreign transaction fees charged when you use your Visa card? Forget about them – they’ll be reimbursed too.

The debit card also allows you to either activate or lock your card from your phone. If your card is ever lost or stolen, simply lock it to prevent unauthorized use.

The daily ATM withdrawal limit is $500 and the daily debit card transaction limit is $2,000.

Seamless Linking with Other Betterment Accounts: Your Betterment Checking Account links with a Betterment robo advisor investment account or IRA, as well as with the Betterment Cash Reserve account. The Cash Reserve is an excellent companion account with Betterment Checking because it enables you to earn a 2.25% APR on your excess cash and also comes with no fees.

You can easily move excess cash into the Cash Reserve or even into your investment or IRA accounts. There’s no need to maintain different accounts with multiple institutions.

“Two-way Sweep”: Betterment automatically monitors your Betterment Checking Account for the availability of extra funds, in excess of your typical spending patterns. When extra funds are identified, they’ll automatically be swept into your Cash Reserve account to earn interest on the money. Even if funds are transferred to the Cash Reserve, you’ll have until midnight on the following day to cancel this sweep.

Physical Checkbook: Even though paper checks are becoming increasingly rare, Betterment recognizes there are still times when they’re either necessary or desirable. That’s why they’ll soon be adding physical checkbooks to the Betterment Checking Account. Stay tuned!

Betterment Cash Reserve APY Disclosure - Annual percentage yield (variable) is as of 9/26/2022. Cash Reserve is only available to clients of Betterment LLC, which is not a bank, and cash transfers to program banks are conducted through the clients’ brokerage accounts at Betterment Securities.

For Cash Reserve (“CR”), Betterment LLC only receives compensation from our program banks; Betterment LLC and Betterment Securities do not charge fees on your CR balance.

Related: Best Robo-Advisors

Betterment Checking Pricing & Fees

Not only are there no fees charged on a Betterment Checking Account, but Betterment goes even further than the competition–they reimburse you for fees charged by other institutions.

For example, you’ll receive unlimited reimbursements for ATM fees and foreign transaction fees. Those reimbursements apply worldwide, which is anywhere Visa is accepted. What’s more, the reimbursement is automatic–you don’t need to do anything extra to get the reimbursement.

Once you’ve incurred a fee, you’ll receive a push notification confirming that the fee will be reimbursed by Betterment. That means no tracking fees and no submitting requests for reimbursement. It all happens automatically, making you free to go about your business on the go.

Related: Best Free Business Checking Accounts

Betterment Checking Sign Up

You can sign up for Betterment Checking either online or through your mobile device.

To be eligible, you must reside in the U.S. full-time, and use Betterment services. You must also be at least 18 years old.

If you open a Betterment Checking Account, a Cash Reserve account will automatically be opened for you.

Betterment will not run a credit check to determine your eligibility for an account. But they will collect personal information as required by regulators and the IRS. At this time, you can only open an individual account. Joint accounts will be available in the near future.

Once you open a Betterment Checking Account you’ll need to link an external bank account. That will be a requirement even if your account is linked to your Betterment investment account. It will give you the ability to transfer funds to and from an external institution.

You’ll also be able to set up direct deposits from your paycheck. To do so, you’ll need to follow whatever procedures are required by your human resources department. You’ll likely be given a form that will require your account and routing numbers from your Betterment Checking Account. But Betterment also has a blank direct deposit form that you can use to set up direct deposits.

Betterment Checking Security

Betterment Checking is covered by FDIC insurance for up to $250,000 per depositor.

To protect your account, Betterment requires two-factor authentication to make it more difficult for hackers to access your account even if they have your password. When you attempt to access your account, a security code will be sent to your mobile device as a secondary activation requirement.

Betterment also employs biometric account login for both iOS and Android mobile devices. (Biometric authentication systems compare a biometric data capture to stored, confirmed authentic data in a database.)

The account also uses aggregated app passwords. That will provide an extra layer of security if you want to include the account with a budgeting platform, like Mint. You can also include your Betterment account with TurboTax to file your tax returns. In either case, neither Mint nor TurboTax will have access to your Betterment password.

Betterment Checking Mobile Support & Accessibility

The Betterment Mobile App is available for Betterment Checking, Betterment Cash Reserve and Betterment investment accounts. It has all the functionality of the online version.

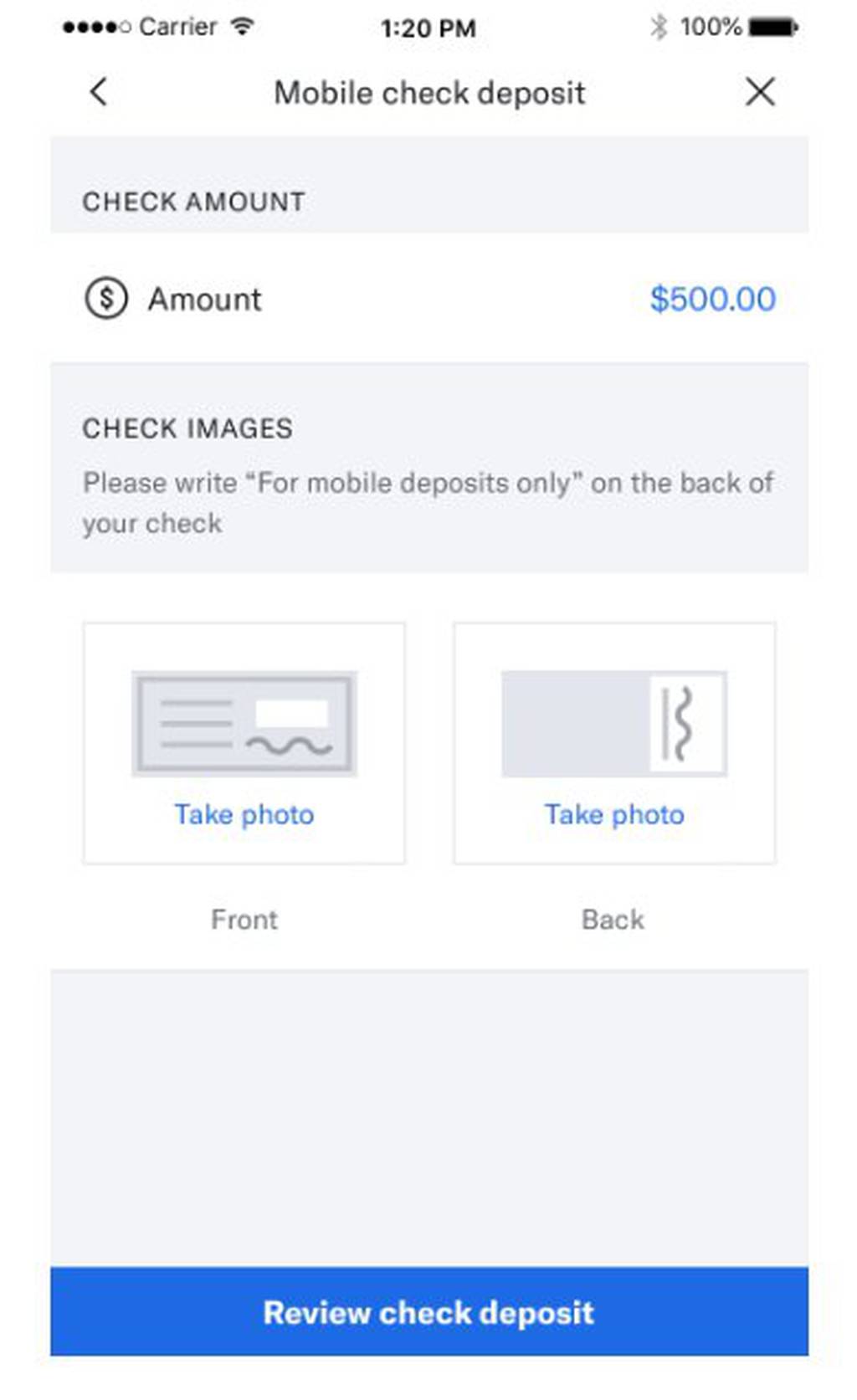

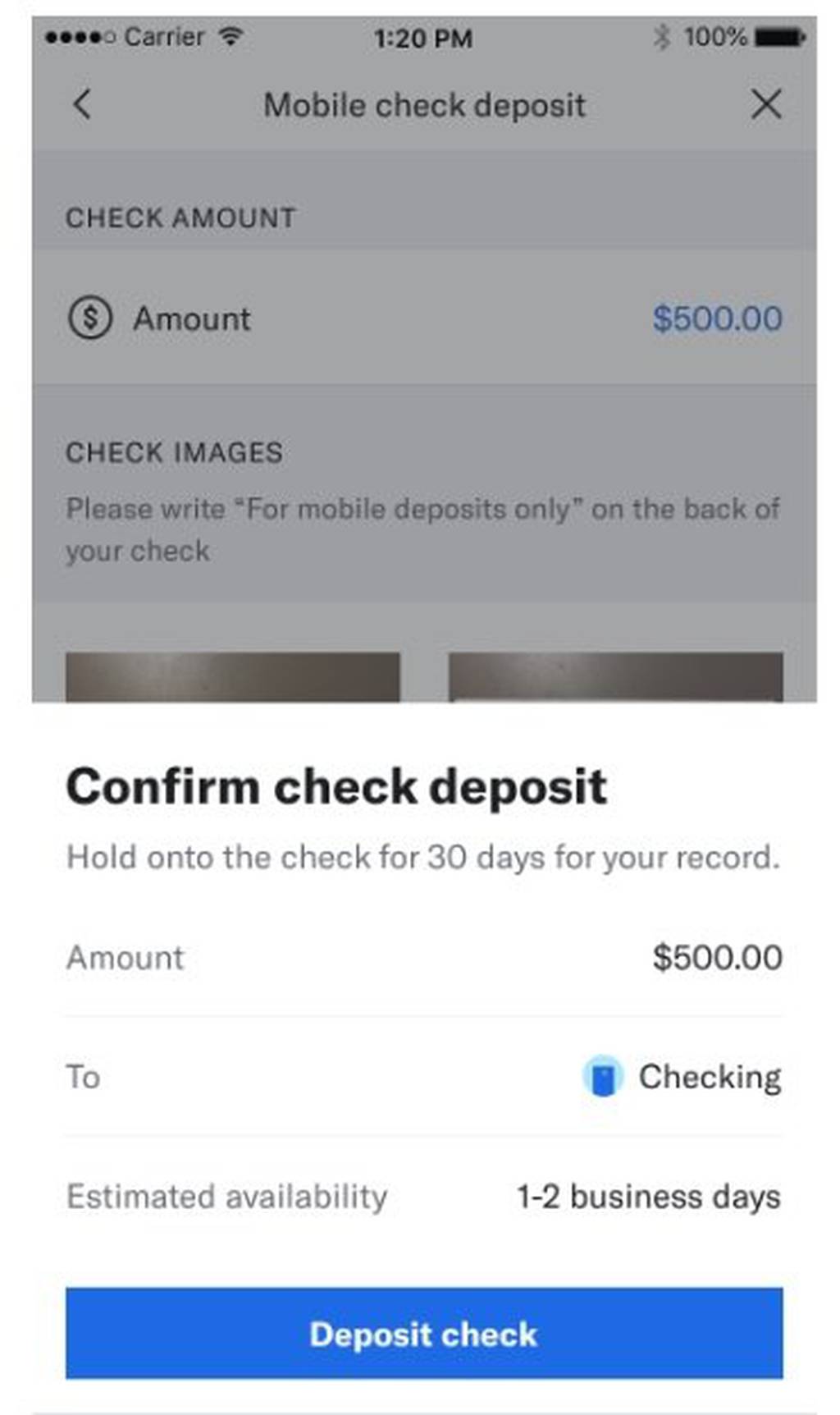

The Mobile App comes with a mobile check deposit, so there’s no need to go to a bank branch or an ATM. You can simply take a photo of the check and deposit it into your account from wherever you are. There is currently a daily mobile check deposit limit of $1,000.

The Betterment Mobile App is available on Google Play for Android devices 6.0 and up, on the App Store for iOS devices 11.0 or later, and is compatible with iPhone, iPad, and iPod touch.

The Betterment Mobile App has received 4.3 out of 5 stars among more than 4,700 users on Google Play, and 4.8 stars out of 5 by well over 20,000 users on the App Store.

Betterment Checking Customer Service & Support

Customer service is available by live chat, email and phone, Monday through Friday, from 9:00 am to 8:00 pm Eastern time.

Betterment Checking Pros & Cons

No account fees — There are no monthly maintenance fees, ATM fees or overdraft fees.

No account minimums — There is no minimum initial deposit requirement and no minimum ongoing account balance.

Excellent travel card — The combination of reimbursements for both ATM fees and foreign transaction fees make the Visa debit card a go-to debit card for foreign travel.

Use your Visa Debit card anywhere in the world — The card can be used anywhere Visa is accepted, which includes millions of locations.

Seamlessly link with other Betterment accounts — That includes the Betterment Cash Reserve and Betterment robo-advisor investment and IRA accounts.

No interest on your account — Betterment Checking is not an interest-bearing checking account. But even the ones that are interest bearing tend to pay microscopic interest rates.

No bank branches — This is typical of all online-only banks and is fast becoming the future of banking.

Brand new account offering — As a new product rollout, Betterment is still working out details. For example, while joint accounts are in the works, they’re not available right now.

Deposit options are limited — You cannot deposit cash or paper checks through an ATM or make deposits by wire transfer.

Betterment is not a bank — Though Betterment is offering banking services, like Betterment Checking and Cash Reserve, they are not a bank. Other banking services, including certificates of deposit, loans and credit cards, are also not available.

Alternatives

Betterment isn’t the only investment firm offering a checking account. If you don’t believe Betterment Checking is the best option for you, check out the following alternatives:

Wealthfront Cash Account. This is Betterment’s primary competitor among independent robo advisors. They offer their Cash Account, which is an interest-bearing, no-fee account, with both a debit card and checking features. Plus, you’ll be able to pay bills online and direct deposit your paycheck right into the account. And of course, you’ll be able to connect the Cash Account to the Wealthfront robo advisor investment account.

Ally Bank/Ally Invest. Ally Bank is unique among online banks in that it comes closer to being a full-service bank than any of its competitors. Not only do they offer online checking accounts, but also savings accounts and CDs, paying some of the highest interest rates available among online banks. They also provide home loans, a cash-back credit card, and some of the most innovative auto loans available anywhere. You’ll also have the ability to connect the account with Ally Invest, where you’ll have an opportunity to invest both through a robo advisor and by self-directed investing. Ally Invest offers commission-free trades on stocks, exchange-traded funds, and options.

Capital One 360. This is one online bank that does not provide an investment component. But Capital One 360 is fast coming up as one of the top online banks in the industry, and they even have more than 750 branches available in several states. Their Capital One 360 Checking comes with no fees and no minimum balance requirements. It also pays interest, though it’s only 0.10% on all balance levels. But the bank also has high-yield savings accounts and CDs, paying interest rates that are among the highest in the industry. Capital One also provides auto loans, business and commercial banking services, and one of the most popular line ups of credit cards in the industry.

Is Betterment Checking Right for You?

Betterment Checking is a truly outstanding no-fee checking account. But it even goes beyond the no-fee concept, by eliminating common fees, like out-of-network ATM fees and foreign transaction fees. That feature alone makes Betterment Checking a best-in-class checking account.

It’s certainly an excellent option if you already have–or plan to open–a Betterment investment or Cash Reserve account. Not only will it give you checking privileges from your Betterment account, but the Two-Way Sweep feature will provide you with an automatic way to build your savings and investments through regular transfers of excess funds in your checking account.

What’s more, Betterment is an industry leader in the robo advisor space. If you’re not comfortable investing your own money, the Betterment robo advisor is the perfect way to get into investing on a regular basis, without having to concern yourself with investment selection or portfolio management. And it all comes with an incredibly low annual fee.

I can see Betterment–both Checking and investing–being the perfect combination for young adults looking to build a financial future. You’ll have an opportunity to open an investment account for future growth along with a high-interest cash reserve account and checking features–all in the same place.

If you’ve had enough of maintaining separate accounts for every financial purpose in your life, Betterment has done an outstanding job of creating a comprehensive financial platform that can help you achieve your goals and simplify your life at the same time.

One final point: I wouldn’t be too concerned that Betterment Checking is a new product offering. Betterment has a long history of rolling out new products, then steadily improving them to the point of being either the best in their respective category or one of the top two or three. It’s one of those companies that’s demonstrated a consistent history of steadily improving their products and services. You can bank on it!

Betterment Cash Reserve Disclosure - Betterment Cash Reserve ("Cash Reserve") is offered by Betterment LLC. Clients of Betterment LLC participate in Cash Reserve through their brokerage account held at Betterment Securities. Neither Betterment LLC nor any of its affiliates is a bank. Through Cash Reserve, clients' funds are deposited into one or more banks ("Program Banks") where the funds earn a variable interest rate and are eligible for FDIC insurance. Cash Reserve provides Betterment clients with the opportunity to earn interest on cash intended to purchase securities through Betterment LLC and Betterment Securities. Cash Reserve should not be viewed as a long-term investment option.

Funds held in your brokerage accounts are not FDIC‐insured but are protected by SIPC. Funds in transit to or from Program Banks are generally not FDIC‐insured but are protected by SIPC, except when those funds are held in a sweep account following a deposit or prior to a withdrawal, at which time funds are eligible for FDIC insurance but are not protected by SIPC. See Betterment Client Agreements for further details. Funds deposited into Cash Reserve are eligible for up to $1,000,000.00 (or $2,000,000.00 for joint accounts) of FDIC insurance once the funds reach one or more Program Banks (up to $250,000 for each insurable capacity—e.g., individual or joint—at up to four Program Banks). Even if there are more than four Program Banks, clients will not necessarily have deposits allocated in a manner that will provide FDIC insurance above $1,000,000.00 (or $2,000,000.00 for joint accounts). The FDIC calculates the insurance limits based on all accounts held in the same insurable capacity at a bank, not just cash in Cash Reserve. If clients elect to exclude one or more Program Banks from receiving deposits the amount of FDIC insurance available through Cash Reserve may be lower. Clients are responsible for monitoring their total assets at each Program Bank, including existing deposits held at Program Banks outside of Cash Reserve, to ensure FDIC insurance limits are not exceeded, which could result in some funds being uninsured. For more information on FDIC insurance please visit www.FDIC.gov. Deposits held in Program Banks are not protected by SIPC. For more information see the full terms and conditions and Betterment LLC's Form ADV Part II.