Overall Ranking

4.5/5

Overview

4.5/5

5/5

3/5

5/5

Started by entrepreneurs who wanted an easier way to move money, the company claims to have helped over six million people send money across the world.

Editor's Note

You can trust the integrity of our balanced, independent financial advice. We may, however, receive compensation from the issuers of some products mentioned in this article. Opinions are the author's alone. This content has not been provided by, reviewed, approved or endorsed by any advertiser, unless otherwise noted below.

What is TransferWise?

TransferWise is a way to send money internationally. It’s like a bank transfer, but without the exorbitant fees (as long as the amount you’re transferring doesn’t exceed $10,000).

The company was started back in 2010 by Kristo Käärmann and Taavet Hinrikus as a way to cut down on the fees they were paying to send money from London to their homes in Estonia. The company started transferring money in 2011 and says it transfers more than $5 million each month.

TransferWise is a European FinTech company that’s gotten a lot of good press – it’s one of those rare FinTech startups that seems to be making money, even during these turbulent times.

Their customers are both individuals and businesses. Businesses can use it to pay their employees or their expenses in more than 70 countries.

How TransferWise Works

You’ll need to sign up for an account. Once you have that, you can start transferring money.

How long it takes to send money depends on where you are and where it’s going. Converting money can take as long as two days. But how fast the recipient gets the money depends on the speed of their bank. I’ve found that transfers typically take less time than the estimated arrival date the company gives me when I initiate a transfer.

If you’re using TransferWise as a business, you’ll need to set up a Business account. Once you’re set up on the platform, you can start transferring money to your employees or pay invoices. You can even automate payments.

TransferWise doesn’t actually wire the money. Instead, they have bank accounts in countries around the world. When you go to transfer $1,000 to Europe, you pay into one of TransferWise’s American accounts. Then, TransferWise pays out the equivalent of $1,000 from one of its European accounts. This cuts down on both the fees and the time it takes to move money.

Related: How to Send Money to Friends and Family for Free

Key Features

Transferring Money

This is the bulk of what TransferWise does – the company lets you send money from one country to another. There are a few types of transfers to choose from when moving money from the U.S.: bank debit, wire transfer, debit card, and credit card.

Business Accounts

If your business needs to transfer money internationally, there is a business option where you can set up reoccurring payments.

Debit Card

TransferWise also offers a debit card that allows you to spend or withdraw money with the real exchange rate. If you travel often and get hit by poor conversion rates, this card would help you avoid those. The cost to order a card is $9.

Related: How to Transfer Money from a Bank Account to a Prepaid Debit Card

Jars

If you want to use TransferWise to save some of that money you’re moving around the globe, the company offers jars. These are places to store money. If you need to access the money in one of your jars, you can transfer it out to one of your accounts. The jars don’t earn any interest – it is just a place to store money.

Pricing & Fees

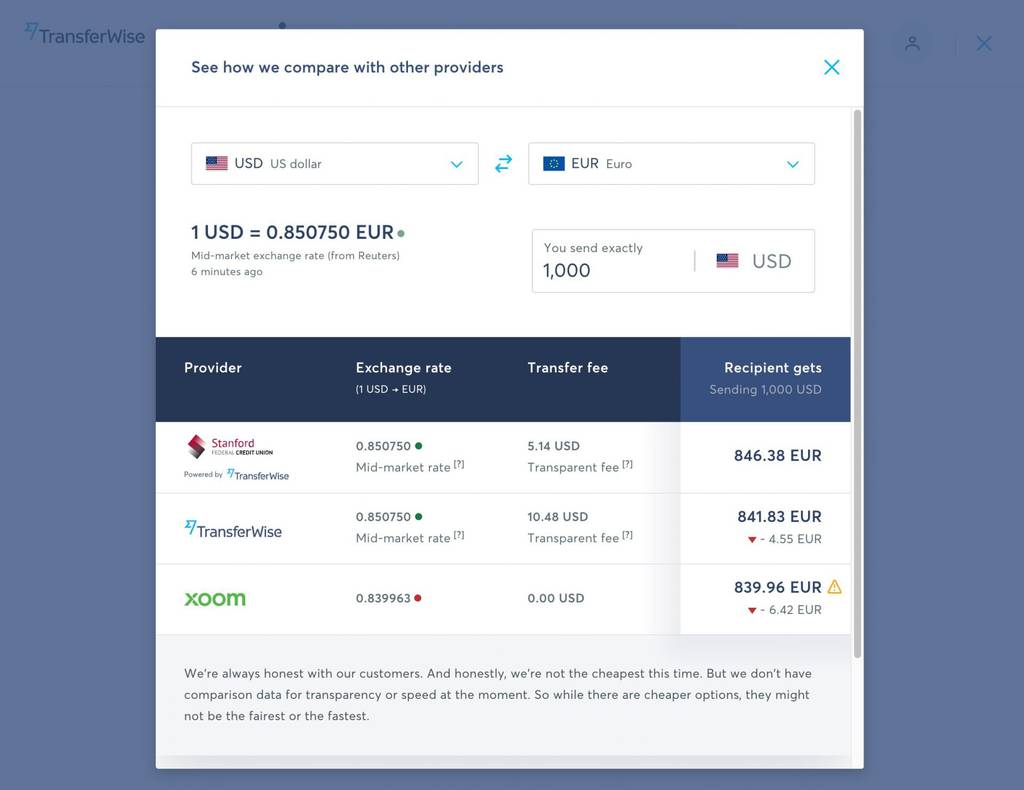

One of the main benefits of using TransferWise is exchange rates. The company claims never to mark these up. Instead, it uses the real rate (or the mid-market rate). This is the midpoint of the prices bankers and traders are buying and selling currencies at, meaning users get rates that are typically reserved for bankers. In contrast, your bank might use a markup of the mid-market rate (and may or may not disclose that). TransferWise uses currency rate data from Reuters, which updates the rates in real-time.

When comparing TransferWise to other services, it’s worth paying attention to what exchange rate each company is using. Instead of just looking at what fees a bank or service charges to send money, you want to look at the whole cost to send the money – so if another service has “zero fees,” make sure you understand the exchange rate. If you’re getting a poor exchange rate, you are likely paying too much for the service.

TransferWise charges a fee for transfers – this fee depends on where you’re sending money to and from.

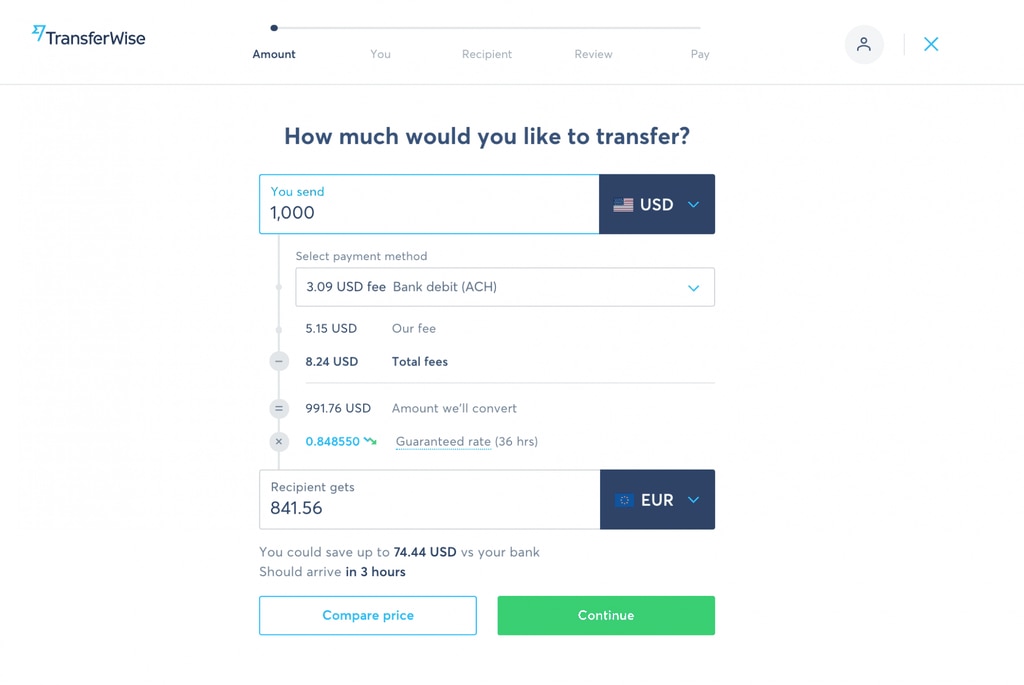

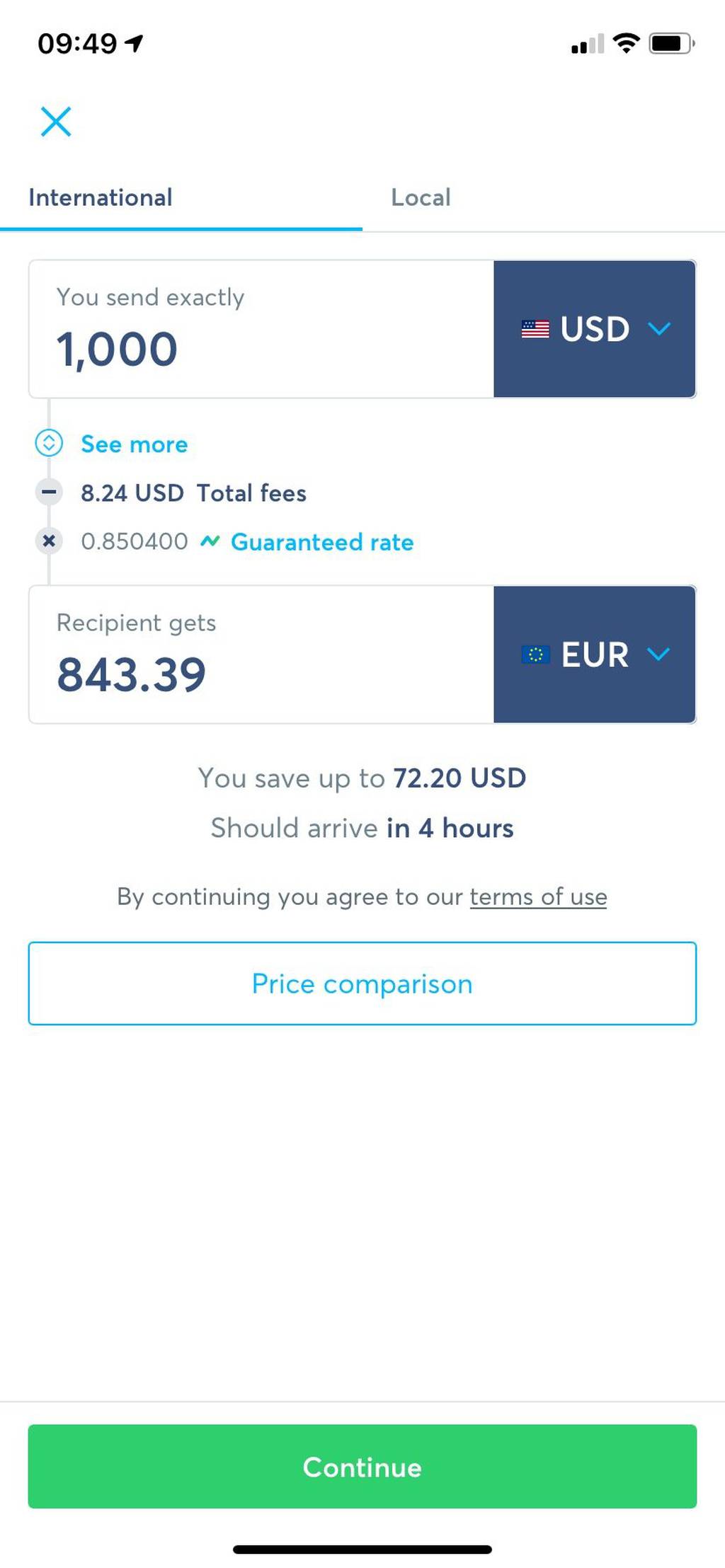

For example, at the time of writing, sending $1,000 from the U.S. to Europe cost $8.24 with the bank debit (the cheapest option) and the recipient would receive €841.56. Looking at the Reuter’s exchange rate data for the same day, the exchange rate was between 0.8463 – 0.8490 (meaning somewhere around €846 – €849). The difference between the real exchange rate and the amount received is the fee.

For that same transaction, the other options were more expensive. They include:

- Wire transfer – $10.48

- Debit card – $11.56

- Credit card – $42.45

While the bank debit was the cheapest, if you needed to pay something with a card, TransferWise gives you that option.

Similarly, sending $1,000 from the U.S. to Hong Kong costs $11.28 and the recipient would get 7,679.99 HKD with fees of $9.04.

Fees from other parts of the world back to the U.S. are even lower. At the time of writing, here are some of the fees to send to the U.S.:

- $1,000 Australian dollars – fee of $6.01 Australian dollars, the recipient gets $714.43

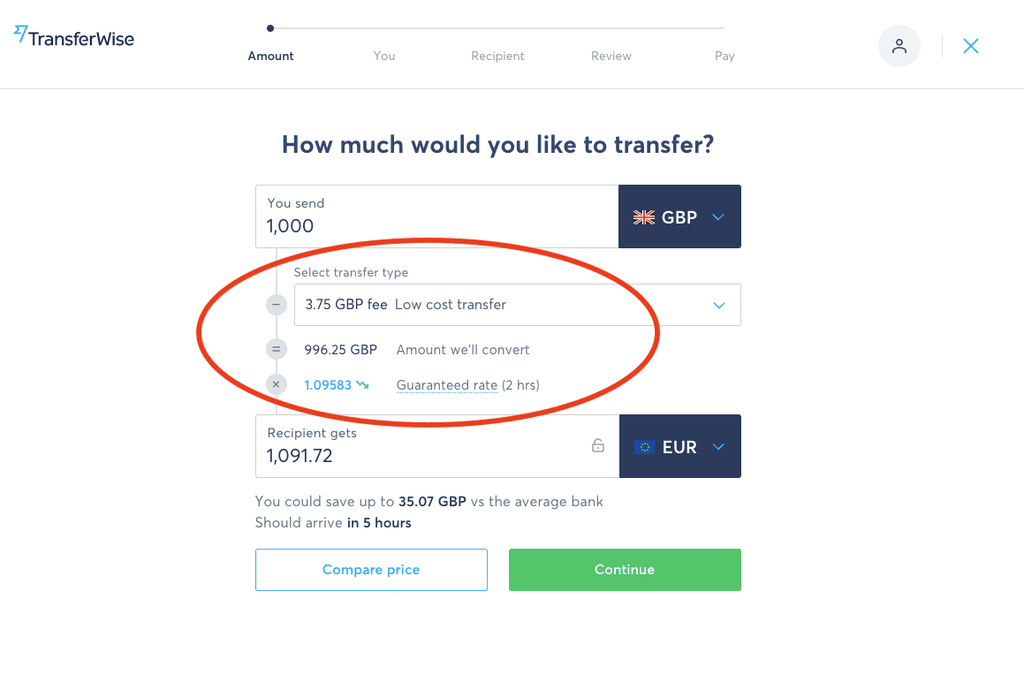

- £1,000 – fee of 4.25 GBP, the recipient gets $1,296.57

- 1,000 Canadian Dollars – fee of 11.78 CAD, the recipient gets $753.56

- 4,000 United Arab Emirates dirham – fee of 40.47AED, the recipient gets $1,077.99

TransferWise always shows the fee and how it is calculated.

They even show the cost of some of their competitors.

But, if you’re transferring a larger amount, TransferWise’s fees become exorbitant.

Let’s say you wanted to transfer €250,000 to the U.S. At this point, the fees top more than €800 and you’d be much better off using a wire transfer through your bank.

Sign Up

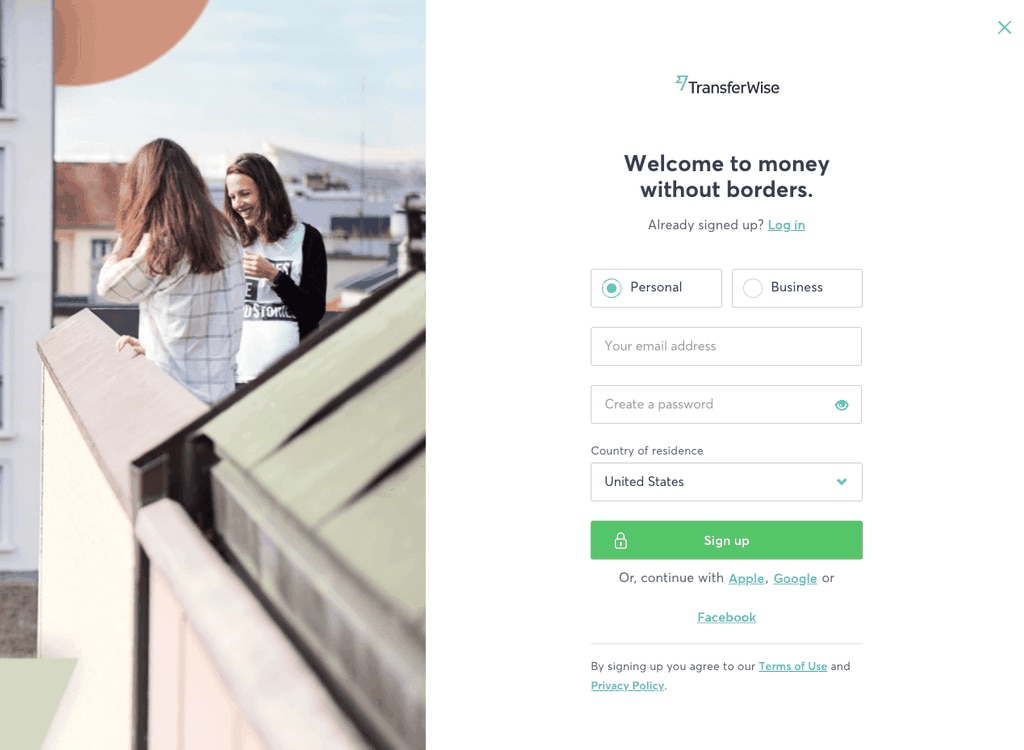

Sign up is relatively easy.

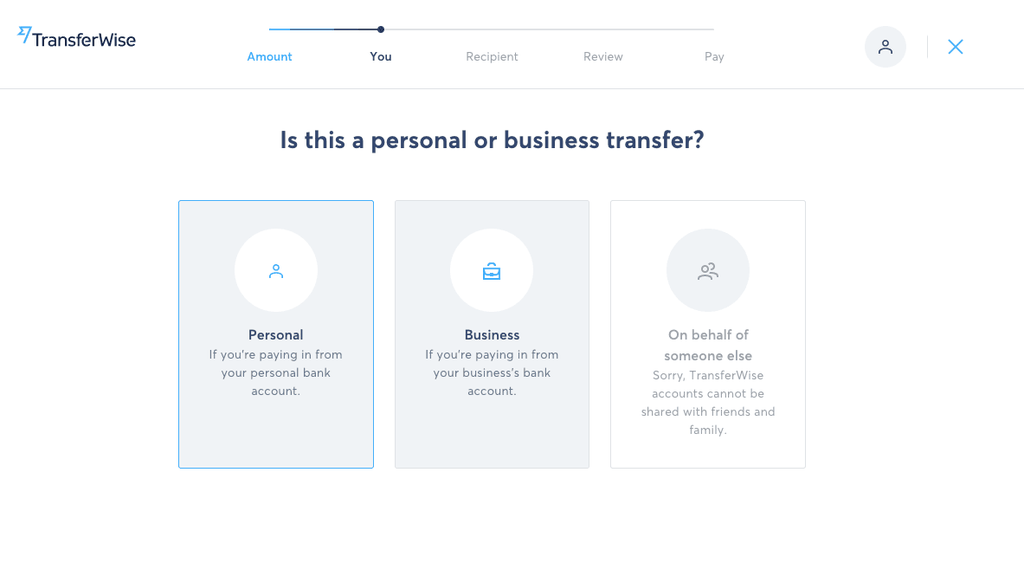

You’ll need to answer a few simple questions: whether you’re signing up for personal or business reasons, your email address, a new password, and your country of residence.

Then, TransferWise will ask how much you want to send. Make sure you choose the correct currencies. If you’re just signing up to check out the platform, pick whatever currency and just continue on with the process until you actually need to confirm that you want to send money.

You’ll be asked if your transfer is for personal or business reasons.

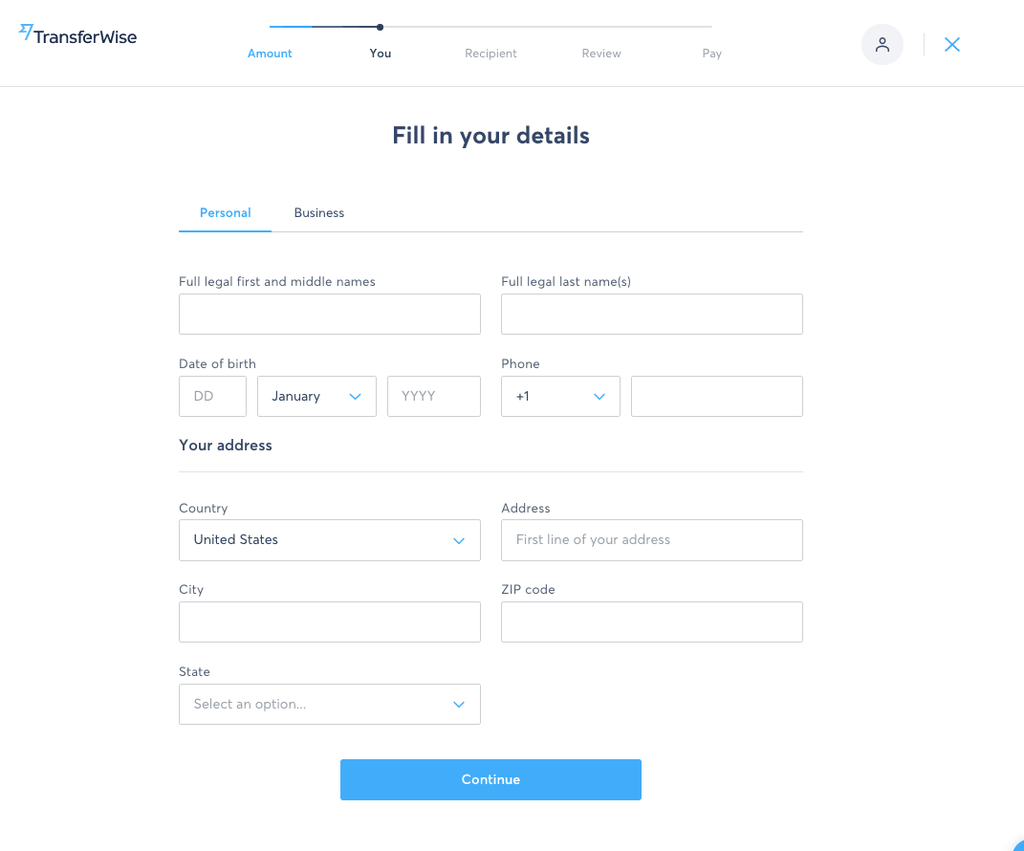

Then, you’ll be asked to fill in some identifying information, including your legal name, birthday, phone number, and address.

TransferWise will then ask you about who you’re sending money to and the recipient’s bank account information.

Next, you’ll need to upload a picture of your driver’s license, passport, or national ID card. For obvious reasons, TransferWise needs to make sure you are who you say you are. The company will check your ID and send you an email when you’re approved. This only took a few minutes.

Security

TransferWise claims to use HTTPS encryption and has bank-level data security. They use a two-step login to protect customers’ transactions.

The company is regulated by FinCen in the U.S., along with similar regulatory institutions in Australia, the European Economic Area, Canada, Hong Kong, India, Japan, Malaysia, New Zealand, Singapore, and the United Arab Emirates. Within the U.S., TransferWise has state licenses in 48 states (not including Nevada and Hawaii).

Communications with the company over the Internet are encrypted using asymmetric encryption. The company may share personal information with third parties – users who want to know who their data has been shared with can request the list by emailing privacy@transferwise.com.

The company claims to move more than $5 million each month

Mobile Support & Accessibility

The mobile app works just as well as the desktop app.

If you sign up for two-factor verification, that means that when you go to make a transfer online, it will ask that you verify it with the app on your phone.

Making a transfer with the app is easy. Like the website, the app is easy to navigate.

Related: Best Payment Apps to Send Money

Customer Service & Support

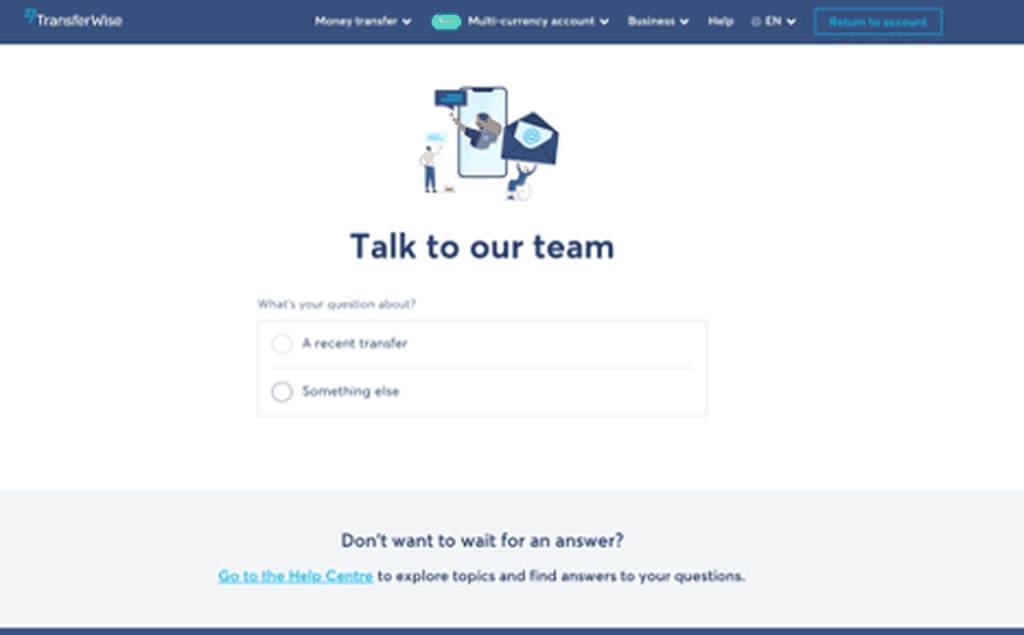

TransferWise doesn’t make it easy to find their contact information on their site. If you click on their help button, it takes you to a page with FAQs.

If you need to contact TransferWise, you can send them an email through their online portal. You can go to https://transferwise.com/help/contact and pick your issue.

Depending on your circumstances, TransferWise will give you the option of an email through their online portal, a chat box, or a telephone number.

For the U.S., customer service lines are open Monday through Friday, 9am – 5pm EDT.

For personal customers, you can also call them at 1-888-908-3833.

For business customers, you can call them at 1-888-829-3669.

But you’ll want to go through their online form to find your membership number, which they’ll ask for on the phone.

How do wire transfers work with TransferWise?

Instead of actually sending your money with a wire transfer across international lines, TransferWise holds accounts in countries around the world. When a customer wants to transfer money from the U.S. to England, they deposit their funds into one of TransferWise’s U.S. accounts. Then, TransferWise takes money out of their British account and into the recipient’s British bank account.

Who regulates TransferWise?

The company is regulated in each market it operates in – so in the U.S., it’s regulated in 48 states (not including Nevada and Hawaii).

How can I find out what fees TransferWise charges?

Just use their site to put in how much money you want to transfer. The company is transparent about its pricing.

Pros & Cons

Real Exchange Rates — TransferWise uses currency data from Reuters, meaning you aren’t getting a bad exchange.

Relatively low fees — The fees for sending money on smaller amounts is relatively low – better than what you’d get with a wire transfer.

Options for fast transfers — Transfers normally take place within a few days, but there is an option for a fast transfer.

Easy to use site and app — The website and the app are well designed, making it easy to send money.

Many payment options — While pulling directly from your bank account tends to be the cheapest option, TransferWise allows users to pull from their debit and credit cards.

Rates get expensive with big transfers — If you’re transferring a lot of money (say $10,000 and up), the fees really add up. At this point, a wire transfer probably makes more sense.

Not all countries are covered — This likely isn’t a huge problem since TransferWise has sent money to 71 countries, but it doesn’t cover every country.

TransferWise Alternatives

Novo

Novo is a fintech company targeted at small businesses and freelancers. It’s an online bank with low fees. Bank Novo uses third-party providers for some of its services, including wire transfers.

In fact, Novo has already integrated with TransferWise to provide international wire transfers. But with Novo, you can access those services within the Novo app, instead of setting up a separate account on TransferWise.

Read our full review of Novo.

LendingClub Bank

LendingClub Bank is an online bank that offers international and domestic wire transfers. Unlike TransferWise, LendingClub Bank offers more traditional banking options, such as checking and savings accounts.

The bank charges $18 for outgoing domestic wire transfers, $40 for outgoing international wire transfers, and $10 for incoming wire transfers.

Unlike TransferWise, LendingClub Bank uses bank rates, not the market exchange rate. I wasn’t able to immediately find these when searching the bank’s website. Additionally, the receiving bank “may elect to pay the beneficiary in foreign currency at an exchange rate determined by the receiving bank.” So while the fees are relatively low for incoming wires and outgoing domestic wires – and the international outgoing wire fee would be lower than TransferWise’s fee when moving large amounts of money – the exchange rate is unclear.

Customers have a daily wire limit of $25,000.

Read our full review of LendingClub Bank.

Bottom Line

If you need to move money internationally and want the real exchange rate, check out TransferWise. The fees go up as the amount of money you transfer goes up, so if you’re only looking to move $1,000 or so, TransferWise is a great way to save on wire transfer fees.