Overview

4.5/5

4.5/5

4.75/5

4.5/5

What if you could forecast your cash flow and stay ahead of possible storms? You can now, with PocketSmith. Connect your accounts to a budget, run what-if scenarios, and schedule upcoming bills. We put this tool to the test in our PocketSmith review

Editor's Note

You can trust the integrity of our balanced, independent financial advice. We may, however, receive compensation from the issuers of some products mentioned in this article. Opinions are the author's alone. This content has not been provided by, reviewed, approved or endorsed by any advertiser, unless otherwise noted below.

What is PocketSmith?

PocketSmith is a personal finance software app that enables you to view all of your financial accounts in one place. This includes bank accounts, investment accounts, loan accounts and credit cards. But it doesn’t just aggregate all your accounts. It also enables you to forecast where your accounts will go, based on certain expected outcomes.

The basic idea is that most people have their financial accounts held by several different service providers. This can complicate understanding how they all work holistically. By bringing them together on one platform, you are able to see and understand the big picture of your finances. That will make it easier for you to make plans, such as increasing investment accounts, and lowering debt balances.

The service is similar to Mint.com, except that where Mint is free, PocketSmith does charge a monthly fee. (Though there is a free version that’s very basic.)

PocketSmith can be used from anywhere and does not require the installation of special software. The service is completely cloud-based. They can accept bank feeds from 36 countries, with flexible import options.

Special offer: Dough Roller readers can get 50% off a Premium monthly subscription for the first two months. Learn more here

How PocketSmith Works

Live Bank Feeds

Available on the Premium and Super packages, you get automatic live bank feeds by connecting to more than 12,000 financial institutions worldwide. That includes all major banks in the US, UK, Canada, Australia and New Zealand. You can even import multiple accounts with the same institution. And once the information is imported, your transactions will be automatically categorized.

Multi-currency capability

PocketSmith can include bank accounts, assets and liabilities from different countries, and provide automatic currency conversion based on daily exchange rates. The app shows both the native balance for the foreign-based accounts, with conversions to the country of your choice. Your net worth will be recorded in your base currency. There’s even exchange rate support for gold, silver and Bitcoin.

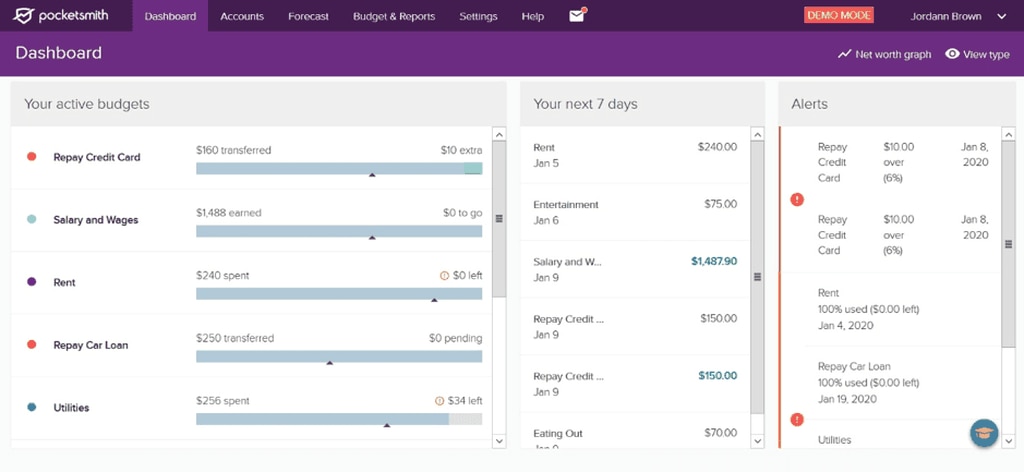

Budgeting

Create custom flexible budgets for daily, weekly and monthly time frames. You can set it up any way that works for you. You can even set up financial alerts, notifying you when you are close to going over your budget.

Budget Calendar

Here you can schedule upcoming bills so you can be sure to pay them on time. This feature gives you the ability to prevent cash flow problems in the future. Unfortunately, this is only a calendar to keep track of when your bills are due, it doesn’t actually pay your bills for you.

Projected daily balances

Project future balances up to 30 years out, based on current trends (Super version only). You can even run “what-if” scenarios, such as a higher or lower income, or the outcome if you spend less money on fast food or some other category.

Income and Expense Statements

This feature can be customized to show your income and expenses for any specified time frame. You can even set alerts to let you know when you’ve exceeded budgets for individual categories.

Net Worth

PocketSmith shows you the difference between your assets and your liabilities. Your net worth is probably the single best indication of your financial position at any given time. And PocketSmith enables you to pull up that information in a matter of seconds. As noted above, it can even account for accounts held in foreign currencies.

“Killer Search Engine”

With this feature, you can quickly and easily find transactions, even old ones. No more scrolling through long lists of repetitive transactions, you can find them in seconds.

Other PocketSmith Features

No advertisements!

As a paid service, PocketSmith doesn’t crowd your screen with advertisements the way free budgeting apps do.

Mobile app

PocketSmith’s mobile app is designed as a companion, but not as a sole interface. It will not include all the features found on the web and desktop applications. It’s available for iOS and Android.

PocketSmith Security

PocketSmith doesn’t directly connect with your bank or sync your accounts and transactions. Instead, they use Yodlee, which is a bank feed provider.

PocketSmith also uses two-factor authentication. When you log in, you’ll be asked to enter a one-time code generated on your phone. In addition, your connection to the app is always encrypted. Your data is stored on PocketSmith’s physical servers, and is also encrypted. PocketSmith uses around-the-clock monitoring of all entries.

Customer support

This looks to be a potential weak spot for PocketSmith. The company is based in New Zealand and has a small staff. PocketSmith does not offer phone support but you can still contact them by email via the website, with responses taking up to one day. Customer support is available in New Zealand time, which works out to be 5:00 PM to 1:00 AM, Eastern time, in the US and Canada.

Pricing

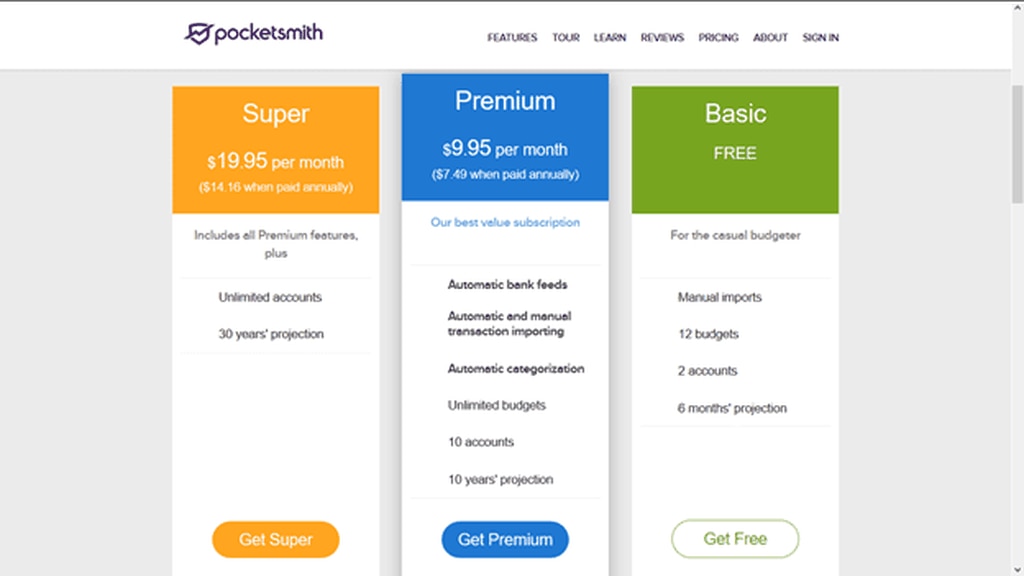

PocketSmith offers three different pricing packages, and each delivers a unique service.

PocketSmith Free Version

This version is very basic. You can add up to two bank accounts, but the process is not automatic. You’ll need to import your bank account information into the app. You may access up to 12 budgets and six months of budget projections.

PocketSmith Premium

With this package, you get the automatic bank feed updates, as well as automatic transaction importing and categorization. It comes with 10 years of budget projections and unlimited budgets. You can add up to 10 accounts to the app. The cost for this service is $9.95 per month or an annual fee of $89.

Right now Dough Roller readers can try the Premium monthly subscription and get 50% off the first two months. Try it here.

PocketSmith Super

This version offers everything available with the Premium service, but you can add unlimited accounts. It also gives you the ability to make 30-year projections and forecasts. The cost is $19.95 per month, or $169 per year.

Signing Up with PocketSmith

The PocketSmith sign-up process is incredibly easy. There are only four steps, all on the same screen page, and you can complete the process in a matter of minutes.

When you sign up, you can choose the plan version that you want–Free, Premium or Super. But you can change your decision anytime. The platform offers you a tour to show you how PocketSmith works.

Once your account has been created, you can add your account information and transactions manually, or you can import the information from select competitors. For example, you can use the Express Migration tool to import information from Mint. This is a big advantage, since Mint is the budgeting app most people start out with. After all, Mint is both well-known and free!

The service also advertises that you can import your data from other personal software programs, including Quicken, Microsoft Money, YNAB, Buxfer, Pocketbook and MoneyWiz.

The service works on a “pay-as-you-go” basis, so you can sign up and cancel any time–there are no long-term contracts. They accept online payments using Visa or MasterCard. American Express and PayPal are not yet available.

Pros and Cons

You can import data from Mint.com and other budgeting platforms, making the transition easy and stress free.

No advertisements. Some budgeting services are offered free, precisely because they involve advertising. Not with PocketSmith.

PocketSmith does not offer investment monitoring.

It doesn’t offer a bill paying feature, which puts it at a disadvantage compared to competitors Mint and Quicken.

It doesn’t provide tax reporting, though that’s a function generally provided by individual financial accounts.

The mobile app version has limited capabilities, though it should provide you with the most basic information.

Customer support is offered by email only, not by phone.

Should You Give PocketSmith a Try?

PocketSmith looks to be one of the better-paid budgeting services. It does offer free service, but it doesn’t provide anywhere near the service level of Mint and some other free budgeting apps. But the Premium and Super versions offer a wide range of budgeting services, including live bank feeds, multi-currency capability, and the ability to include foreign-based financial accounts on the app.

However, PocketSmith has a few drawbacks. The lack of a bill-paying feature is a big one. And adding an investment monitoring feature would be a big plus, since many people are looking to include that capability with budgeting. The customer support feature may also be problematic. Yes, they offer an email contact, but it could take up to 24 hours before you get a response.

If you’d like more information, or if you’d like to sign up for the service, check out the PocketSmith website.