Overall Ranking

4.5/5

Overview

5/5

4/5

4.5/5

4.5/5

Not rich? No time to spare? No investment experience? No problem. You can begin investing today with just $10. But is it worthy? Yes! It’s at least worth the read. Here’s how Worthy Bonds works.

Editor's Note

You can trust the integrity of our balanced, independent financial advice. We may, however, receive compensation from the issuers of some products mentioned in this article. Opinions are the author's alone. This content has not been provided by, reviewed, approved or endorsed by any advertiser, unless otherwise noted below.

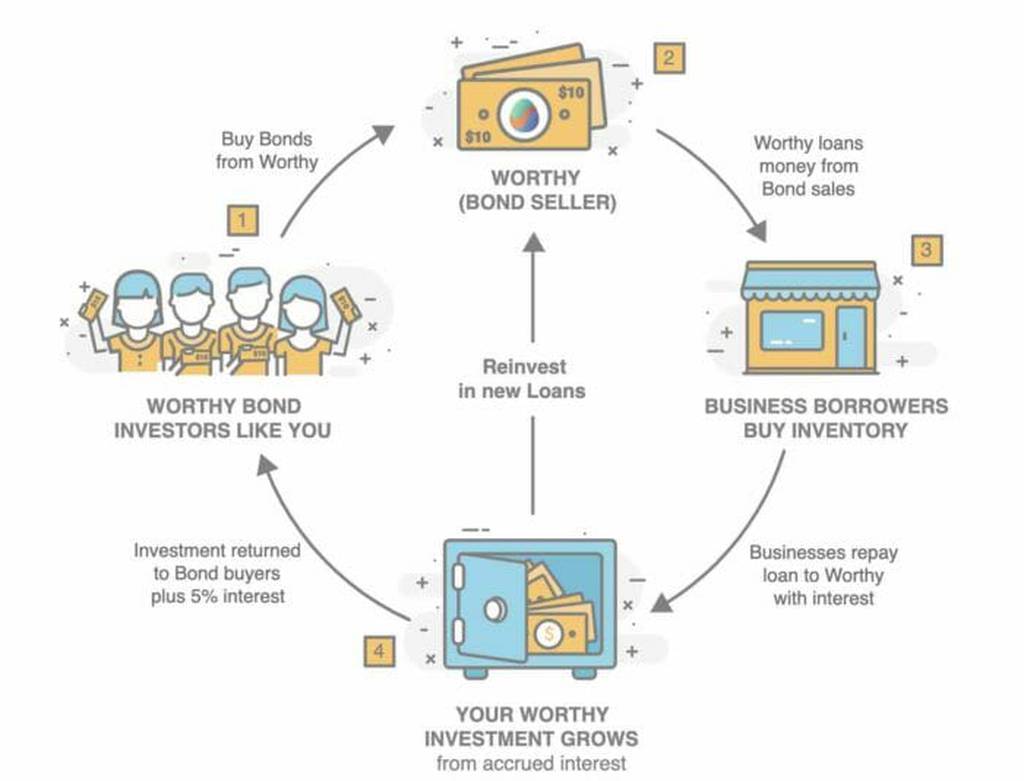

For those unfamiliar with Worthy Bonds, it is an investment platform that lends money to small businesses. As an investor, you can gain satisfaction and fulfillment by investing in the company’s bonds. That’s because your funds will support small businesses. More important, Worthy Bonds offers a decent rate of investment return.

If you want to invest in small businesses but don’t know where to start, Worthy Bonds is the right platform for you. You can easily purchase Worthy Bonds and earn a 5% interest rate.

Besides supporting small businesses and earning interest, you’ll get a free service from Worthy Peer Capital. Other benefits of purchasing the bonds include great flexibility, high liquidity, and you can withdraw your cash anytime you like.

With Worthy Bonds, you can put your money to good use both for yourself and your community.

About Worthy Bonds

Worthy Peer Capital is owned and operated by Worthy Financial Incorporated, which is headquartered in Boca Raton. Inaugurated in the first quarter of 2016, the firm offers Worthy Bonds as its main financial product.

Sally Outlaw is the CEO of Worthy Peer Capital. She has also served as CEO at peerbackers.com and has experience in the finance industry. Sally is a registered investment advisor and has a series 65 license and a real estate broker’s license.

Worthy funded its initial operations with a seed capital worth $600,000 in July 2017. The company also registered its bonds at the U.S. Securities and Exchange Commission. Worthy was launched on StartEngine in July 2018, which allowed ordinary people to invest in Worthy Bonds online.

Worthy earned revenue worth $1,000,000 in the initial six months of its operations. Although the company may not have a long history, the revenue seems promising.

Worthy Bonds Key Features

Appealing Business Model

Worthy Peer Capital offers an excellent business model. With Worthy Bonds, you not only get a great rate of return, but you also get to strengthen your community. Your money will circulate in the domestic economy as it’s used to grow small businesses.

Banks, on the other hand, do little for the community and the domestic economy. They lend almost exclusively to big corporations and seldom offer loans to small businesses. Besides, bank saving accounts offer low-interest rates.

The community-focused approach of Worthy Bonds makes it stand apart from other financial institutions. The company earns revenue purely through interest on its loans.

5% Interest Rate

Worthy offers a relatively high-interest rate of 5%, but this comes at a higher risk level.

U.S. savings accounts offer a modest yield of just 1% to 2%. This is lower than the inflation rate. Therefore, your bank account deposits will be eroded by inflation. Bank savings accounts are considered safe. But such investments face a virtually guaranteed reduction from inflation. This shows that all investments carry risks.

Worthy Bonds have a 5% interest yield, which is approximately 2.5% more than the inflation rate. In theory, your savings can keep up with inflation. The value of your savings will not go down with time as your investments accrue interest every week.

High Liquidity

Worthy Bonds investments offer a high degree of liquidity. Most bonds have a 36-month (or a 3-year) maturity date. However, on all bonds, you can withdraw cash sooner if you need it. Remember, you will incur no penalty or late fees for early withdrawals.

However, you may have to wait if your withdrawal is above $50,000. The process can continue for a few weeks before your funds are deposited into your bank account. For smaller withdrawals, the funds will be deposited instantly with no delays.

The company CEO, Sally Outlaw, envisioned the Worthy Bonds app as a micro-investment tool for ordinary people. She wanted to offer bond investments that provide the flexibility of a savings account. Investors can, therefore, withdraw money without incurring fees or penalties.

Investment Limits

Worthy Bonds divides investors into two categories: accredited and unaccredited investors.

Accredited investors are those that meet certain conditions for income. Those who do not meet these conditions are regarded as non-accredited investors.

Both types of investors can get Worthy accounts. But their limits will be different. Accredited investors can purchase a maximum of $50,000 in bonds, while non-accredited investors can buy bonds up to 10% of their net worth or annual income.

Risk Mitigation

Secure assets back all Worthy Bonds small business loans. Therefore, the risk to your investment is relatively low. The interest rate is good as compared to the low-risk profile. The bonds are not insured. However, Worthy Bonds mitigates risks by securing company assets to back up its loans.

Borrowers’ inventories back Worthy Bonds, meaning they are asset-backed. If loan default occurs, inventory will be sold off to recover the amount. This method will not be effective if a business does not have inventory, and Worthy Bonds has a lack of information on what would happen to the principal amount if a default occurs.

Worthy Bonds are unrated, meaning credit rating agencies have not assessed them. Remember that unrated bonds are not necessarily risky. Certain finance firms avoid credit rating agencies due to high expenses.

The basic idea behind ratings is to show you the risk level–bond issuers can try to ensure financial security for their unrated bonds. Since Worthy Bonds is not a bank, the bonds cannot be insured by the FDIC.

However, like other investment firms, it is registered with the SEC. Therefore, the bonds are SEC-registered. Since these bonds are not publicly traded, they resemble corporate bonds. Worthy Bonds investments still carry risks like other investments, therefore, it’s smart to talk to your financial advisor before investing in the bonds.

Worthy Bonds Pricing/Fees

Worthy Bonds does not charge investors any fees. The service is free.

App and Mobile Support

You can buy Worthy Bonds online via the free app. The app is available for both iOS and Android. It is easy to use, and has an intuitive interface. Once you create an account with the app, you can link your credit or debit card to this account.

Here is how the app works:

As you keep spending, the app rounds off your purchases to the nearest whole number. The difference between this amount and the actual purchase amount is invested in Worthy Bonds.

The app allows you to automate the investment of your loose change. The amount invested may not appear substantial, but it can build up considerably. The app is a great way to invest effortlessly.

Using the Worthy app probably won’t lead to sizeable funds you can rely upon for retirement, but it’s better than not investing at all.

Here is a practical example of how it works.

Suppose you purchase a coffee for $1.50. Worthy Bonds will track the change (that is $0.50). Suppose that you buy fast food the next day for $7.20. The Worthy Bonds app will again collect the change, which is $0.80. Worthy will keep collecting change until it reaches $10. It will then purchase a $10 bond with 5% interest and 3-year maturity.

Security

The Worthy website keeps your data safe through robust information security protocols. Your transactions are safeguarded with 128-bit SSL encryption, which is the industry standard for online security.

Sign up/Application

You can apply online for a Worthy account by clicking on this link. Select the ‘Get Started’ icon. Enter your email, set your password, and agree to the stated terms.

You may have to provide more personal information on the next page, including your bank account number. Verification can take 2 to 3 business days. Once your account is verified, you can use the Worthy Bonds app.

Customer Support

Worthy Bonds offers customer support via live chat, phone, email, and social media. For live support, click the live chat icon on the support page. You can dial these numbers for phone support:

- 1-833-WORTHY1

- 1-833-967-8491

- You can also send them a message through email: support@worthybonds.com

Worthy Bonds Pros and Cons

Worthy Bonds has recently added a compound interest feature. All bonds now generate compound interest, automatically.

Related: The Power of Compound Interest – Even Math Geeks will be Amazed

No fees: The app is free to use. It's hard to beat that!

Great return on investment: 5% interest compared to just 1% or 2% you'll get with a savings account.

$10 minimum investment: This is perfect for new investors and makes it easy to get started. You likely won't feel like you're risking much with a $10 investment.

Interest credited weekly: This is a great opportunity to actually see your investment pay off, even if it's in a small way. If you like instant gratification, this should satisfy you.

Open to all investors: Big investors, small investors, low-income or high-income, even inexperienced investors can appreciate Worthy Bonds.

Limits on investments: The maximum for accredited investors is $50,000 in bonds and for non-accredited investors the limit is 10% of their net worth or annual income.

Are Worthy Bonds for You?

Worthy Bonds may be a worthwhile investment for you if:

You Are Looking for Automated Investments

Managing investments is not an easy task. Not everyone enjoys it. If you are one of these people, then Worthy Bonds may be the right choice for you.

The app takes care of everything. You can link your Worthy account to your credit and debit cards. For each purchase, the app will automatically skim off your loose change. It will consider the difference between the exact purchase amount and the rounded amount.

You Don’t Want to Pay Fees

Nobody likes to pay fees. Worthy offers great value to investors by providing a free service. The company earns revenue by charging additional interest on its small business loans.

There are no hidden fees or penalties involved. You will not have to pay anything for early withdrawals. You can withdraw any time before the 36-month maturity date of the bonds.

You Have Just Started Investing

The minimum investment requirement is just $10. Therefore, Worthy Bonds is ideal for new investors. You can set the app to invest loose change automatically. You can also invest more.

You Need to Diversify Your Portfolio

Worthy Bonds can bring diversity to your investment portfolio. The bond is relatively safer than stocks. It also offers better liquidity and returns higher than other bonds.

Alternatives

LendingClub

This peer-to-peer lending platform offers good returns. You can screen individual borrowers and then offer them a loan. You will earn interest and can withdraw your income immediately or deposit it in an IRA.

Read more: LendingClub Review: Invest on the Largest P2P Lending Platform

Noble Funding

This platform specializes in offering working capital loans to small businesses. It extends loans ranging from $50,000 to $2,000,000. The loan application process is simple and straightforward. The firm provides funds in only 2-3 business days. Since it provides such a high amount in less time, the firm is becoming more popular.

Crest Capital

Primarily provides equipment financing up to a maximum of $1,000,000. For loan amounts below $250,000, financial documents are not required from applicants. The lender also provides lease options and other lines of credit. The approval process is just 4 hours long.

Bottom Line

Worthy Bonds offer a simple yet effective way to support local businesses and invest your loose change simultaneously. The 5% yield of the bonds makes them an ideal investment opportunity. Being that it’s free to try, you really can’t go wrong with testing out this cool, new service for investing. In fact, now that I’ve written this article, I am going to start using it.

However, take note of the risks. Worthy’s business model is based on lending your investments to small businesses. These entities are hit the hardest during a recession. If an economic downturn occurs, you can lose a lot of your investment amount.

Worthy investments should be part of your portfolio’s high-risk investments. According to conventional wisdom, limit high-risk investments. This way, you will not lose a substantial piece of your portfolio due to a recession. Since Worthy invests your loose change, Worthy Bonds may not be a big part of your portfolio anyway but it’s still a worthy investment.