Though it may only seem like last year, which it was, the 2023 tax season is upon us. It’s never too soon to begin preparing for the storm that lies ahead. After all, the better prepared you are, the less difficult filing your taxes will be.

Major Tax Changes for 2022

Standard deductions increased. The standard deductions have been increased for all filers for inflation. For single filers the standard deduction is now $12,950. Married filers have a standard deduction of $25,900 and Head of household’s standard deduction is $19,400.

Retirement contribution limits increased. For 2022 you could contribute a little more to your 401(k) or 403(b) as limits increased by $1,000 per year to $20,500. However, it’s too late to contribute to your 2022 401(k) now. So if you are planning to max out your 401(k) this year know that the limits for 2023 contribution limit is $22,500 and those 50 and over can make a catch up contribution of an additional $7,500.

IRA contribution limits stayed the same for 2022 at $6,000 per year, but have increased for 2023 contributions to $6,500.

SEP IRA 2023 contribution limits increased to $66,000 but still must be no more than 25% of income.

HSA contribution limits increased. In 2022 you can contribute an extra $50 to your HSA for a total of $3,650 for self coverage. If you have family coverage you can contribute up to $7,300, which is a $100 increase. You have until the tax filing deadline to make prior year contributions. If you are looking to max out your 2023 contributions the limits are $3,850 for singles and $7,750 for families.

Child tax credit. The child tax credit has been reverted to 2020 levels at $2,000 per qualifying child.

1099-K forms sent to more people. Starting in 2022, third-party payment services like Paypal and Venmo now must send a 1099-K if payments received were more than $600. This threshold was previously $20,000.

Residential clean energy credit increase. Starting in 2022, you can receive a tax credit equaling up to 30% of the cost to install qualifying sustainable energy systems

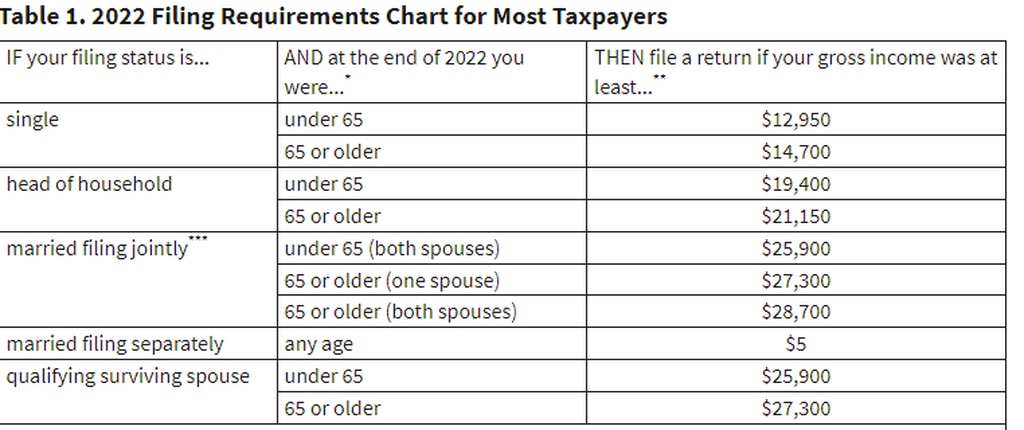

Do you need to file a 2022 income tax return?

Generally, yes. Just about everyone who earns money should file a tax return, even if it’s not required it’s likely still to your benefit to file. Below are the tax threshold amounts for 2022. However, read a bit further down for additional situations where you may still need to file, even if your income is below the thresholds.

If your 2022 income is above the following amounts you’ll need to file a tax return.

Even if your income is below these thresholds, you may still need to file a return if any of the situations below apply to you:

- You had at least $400 in self-employment income

- You owe household employment taxes

- Social Security and Medicare taxes are owed on unreported tip income

- You received a distribution from a medical savings account (MSA) or a health savings account (HSA)

- You received an advance payment on the Premium Tax Credit

- Expect to qualify for the earned income tax credit (EIC)

- You had wages of $108.28 or more from a church or qualified church-controlled organization that is exempt from employer Social Security and Medicare tax.

- If for any reason you may be subject to the Alternative Minimum Tax (AMT).

- You are subject to additional tax on a qualified retirement plan, including an IRA

If you’re still not sure whether or not you need to file a return, you can use the Do I Need to File a Return tool offered by the IRS.

Why You May Want to File Even if it’s Not Required

Just because you don’t have to file doesn’t mean you shouldn’t. If you had taxes withheld from your paycheck you may qualify for a refund if you overpaid. No reason to let the government keep that money.

Also, if you qualify for tax credits you could get more money back than you paid. Some tax credits are “refundable”, meaning that you will get the full amount of the credit even if it’s more than you actually paid in taxes. For example, let’s say you only paid $1,000 in taxes and you qualify for the $2,000 child tax credit. Because this is a refundable tax credit you will get all $2,000.

If it were a non-refundable tax credit you would only get $1,000 which would bring your tax liability down to zero.

Related: FreeTaxUSA Review

How do you know if your child may be subject to the Kiddie Tax?

The Kiddie Tax applies only if your child has investment income that exceeds certain thresholds. It only applies to dependents who are either under the age of 19, or are full-time students under the age of 24.

Earned income limits for your child or children are the same as they are for adults. But if your child has significant investment income, the Kiddie Tax may come into play. That’s true even if his or her earned income doesn’t rise to the level of needing to file a return.

Below are the thresholds for 2022:

- First $1,150 no tax due (unearned income exemption)

- The next $1,150 is taxed at the child’s rate

- Above $2,300 income taxed at the parent’s tax rate

You might be able to report your child’s interest, dividends and capital gains distributions on your return. If you do that, your child won’t have to file a tax return, but it could affect your AGI.

Important 2023 Tax Dates to be Aware of

Below are important dates for filing your 2022 income tax return, as well as additional dates that may be important for filing your 2022 return next year:

April 18, 2023: Deadline for filing 2022 Individual Income Tax returns and make 2022 IRA contributions. Also, first quarter federal income tax estimate due for the 2023 tax year

June 15, 2023: Second quarter federal income tax estimate due for the 2023 tax year

September 15, 2023: Third quarter federal income tax estimate due for the 2023 tax year

October 16, 2023: Extended individual income tax return due for 2022 and last day to make Keogh and SEP contributions if you filed for an extention.

January 17, 2024: Fourth quarter federal income tax estimate due for the 2023 tax year

Related: Best Free Tax Software

What Kinds of Income are Taxable?

The most common forms of taxable income include:

- Wages and salaries

- Income from self-employment

- Tips and gratuities

- Unemployment benefits

- Moving expense reimbursements

- Canceled or forgiven debt

- Alimony (which is only includable pursuant to a divorce decree executed before December 31, 2018)

- Income from bartering arrangements

- Gambling winnings

- Pension, annuity, and retirement plan income

- Social Security benefits

- Interest and dividends

- Capital gains on the sale of investments or investment securities

Income sources that are NOT taxable include:

- Child support

- Alimony received pursuant to a divorce decree executed after December 31, 2018

- Insurance proceeds received from a policy on which you paid the premiums (they may be taxable if the premiums were paid by another party, like your employer)

- Veterans benefits

- Aid to Families with Dependent Children (AFDC)

- Meals and lodging for the convenience of your employer

Related: H&R Block Review

What You’ll Need to File Your 2022 Income Tax Return

Gathering all the necessary documentation to file your income tax return is probably the most complicated part of the process. But once you have all the documentation you need in one place, it’s just a matter of filling in the blanks, at least if you’re using tax preparation software.

Basic information you’ll need to have available includes:

- Complete copies of your 2021 income tax return. You may need this to provide certain information, particularly any carryforward numbers, such as those related to business losses or capital loss carryforwards.

- Social Security numbers for you, your spouse (if you’re married filing jointly or separately), as well as each of your children or other dependents.

- Your ex-spouse’s Social Security number if you receive or pay alimony or child support.

Income documentation you’ll need to prepare your return includes:

- W2s from any employment sources

- Income information for your dependent children (W2s, 1099s, etc.)

- 1099-MISC for additional income for which income taxes were not withheld (like contract, gig, or freelance income)

- 1099s reporting Social Security income, interest and dividends; pension, IRA or annuity income; state income tax refund or unemployment insurance; reporting the sale of stock or other securities; or cancellation/forgiveness of debt income

- K-1s reporting partnership or S-Corporation income

- W-2G reporting gambling winnings (you should also have records proving gambling expenses)

- Documentation of alimony received, including the Social Security number of the payee

- If you’re self-employed, a complete accounting of all your business income and expenses

- Evidence of rental income received if you own investment property

Related: What to do if You are Missing a Tax Form

Documentation You’ll Need for Tax-deductible Expenses

As noted earlier, far fewer people will be able to itemize their deductions under the new tax law. But if you think you still can, you’ll need to gather the following documents:

- 1098 reporting mortgage interest and property taxes paid, educational expenses, and student loan interest paid

- Statements from charities reporting contributions

- 1095-A, 1095-B, or 1095-C, reporting health insurance premiums paid, and to whom

- Various forms 5498 reporting IRA, HSA or ESA payments made during the year

- Home office information (if you plan to take the deduction) square footage of your office, and of your home

Related: TaxSlayer Review

Additional Expense Documentation You May Need

There are additional expenses that may be tax-deductible, however, they may not be provided by a third-party reporting source. If that’s the case, you may also need to gather the following documents:

- Expenses for rental property

- Documentation for the purchase of depreciable assets for business or investment activity

- Property taxes paid but not reported on Form 1098 by a lender

- Federal and state estimated tax payments made for the tax year

- Cost basis of investments sold (if the information is not provided by a broker)

- Indirect expenses related to investment activity

- Documentation of alimony paid

- Receipts from the purchase of energy-efficient equipment installed in your home

- Charitable contributions made but not reported by the receiving organization

- Mileage driven for business, employment, medical or charitable activities, as well as records of payment for tolls, parking, and ad valorem taxes

- Evidence of payment of health insurance, out-of-pocket medical, dental, and vision expenses, medical mileage, and long-term care insurance

- Childcare expenses paid, if not supplied by the provider (including the provider’s tax id number)

- Wages paid to a domestic care provider, including that provider’s tax ID number

- An itemized list of higher education expenses paid out-of-pocket, with documentation

- Cost of preparation of last year’s income tax returns

- Sales tax paid on major purchases (which may not apply due to the new limit on state and local taxes)

Income Tax Brackets for 2022

The various income tax brackets for 2022 are only slightly changed from 2021. There are seven tax rates: 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

Resource: Federal Income Tax Brackets and Standard Deductions

Other Changes in Deductions for 2022 (Filing in 2023)

The mortgage interest deduction. December 15, 2017, is an important date with regard to the mortgage interest deduction. If you secured a home mortgage prior to that date, you can deduct the interest on that indebtedness on loans up to $1 million.

But if you’ve taken on mortgage indebtedness after that date, you can take a deduction for mortgage interest paid on indebtedness up to only $750,000. If you’re married filing separately, the interest deduction is limited to indebtedness of no more than $375,000.

Mortgage interest on a second mortgage or home equity line of credit is deductible, but the proceeds must be used to buy, build, or substantially improve your home. You won’t be able to deduct interest paid on secondary financing if the funds were used for purposes not related to your home.

Also, you can no longer deduct homeowners insurance premiums.

Deduction for state income, real estate, and sales tax limited. Referred to as the SALT deduction (for State And Local Taxes), your deduction is limited to $10,000, or $5,000 if you’re married filing single. That includes all non-federal taxes, such as state income tax, sales tax, and real estate taxes on your primary or secondary residence.

Medical expense deduction. Taxpayers who itemize their deductions have limits on deductions for medical expenses. For 2022, you can deduct unreimbursed medical expenses that exceed 7.5% of your adjusted gross income.

Mileage allowances. The mileage allowances changed mid-year due to increased fuel costs. So the year is split in half with two different rates. They are as follows:

- Business mileage Jan 1st through June 30th 2022: 58.5 cents per mile

- Business mileage Jan 1st through December 31st 2022: 62.5 cents per mile

- Medical and moving mileage Jan 1st through June 30th 2022: 18 cents per mile

- Medical and moving mileage Jan 1st through December 31st 2022: 22 cents per mile

- Charitable mileage: 14 cents per mile

Related: TaxAct Review

Net Investment Income Tax (NIIT) Thresholds on Higher Incomes

When the Affordable Care Act (ACA) was rolled out in 2010, various funding mechanisms were put in place to help pay for it. One is known as the Net Investment Income Tax, or NIIT. It extends the Medicare tax on investment income, at an annual rate of 3.8%.

The tax is imposed on investment income if you earn in excess of certain thresholds. Those thresholds are as follows:

- Married filing jointly $250,000

- Married filing separately $125,000

- Single $200,000

- Head of household $200,000

- Qualifying widow(er) with dependent child $250,000

If your adjusted gross income exceeds these thresholds, the tax will be applied to net income from rents, royalties, interest and dividend income, capital gains, and annuities. It will also apply to any passive income from your trade or business.

Fortunately, the tax doesn’t apply to all unearned income. For example, it is not assessed on income from Social Security, pensions, or on any gain on the sale of your primary residence.

The Alternative Minimum Tax (AMT) for 2022

Basically, the AMT is designed to prevent taxpayers from escaping their fair share of tax liability through tax breaks. This can include either preferential income or excessive deductions. It imposes a higher tax rate based on those income and deduction amounts.

The AMT applies beginning at the following income thresholds:

- Married filing jointly and surviving spouse: $118,100; exemption phase-out begins at an income of $1,079,800

- Single: $75,900; exemption phase-out begins at an income of $539,900

If your AGI is exceeds the threshhold for your filing status, then you’ll have to pay the AMT.

The AMT is one of the most compelling reasons to use tax preparation software, particularly if you’re a high-income taxpayer.

Capital gains tax rates for 2022

Investors are given the benefit of a lower federal income tax rate on qualifying dividends and investments they hold for more than 12 months.

The capital gains tax rates for income earned 2022, are as follows:

| Your Filing Status | 0% Tax Rate | 15% Tax Rate | 20% Tax Rate |

|---|---|---|---|

| Single | $0 to $41,675 | $41,676 to $459,750 | $459,751 or more |

| Married filing jointly | $0 to $83,350 | $83,351 to $517,200 | $517,201 or more |

| Married filing separately | $0 to $41,675 | $41,676 to $258,600 | $258,601 or more |

| Head of household | $0 to $55,800 | $55,801 to $488,500 | $488,501 or more |

Long-term capital gains tax rates for income earned in 2023:

| Filing Status | 0% Tax Rate | 15% Tax Rate | 20% Tax Rate |

|---|---|---|---|

| Single | $0 to $44,625 | $44,626 to $492,300 | $492,301 or more |

| Married filing jointly | $0 to $89,250 | $89,251 to $553,850 | $553,851 or more |

| Married filing separately | $0 to $44,625 | $44,626 to $276,900 | $276,901 or more |

| Head of household | $0 to $59,750 | $59,751 to $523,050 | $523,051 or more |

If your income exceeds any of the above thresholds for your filing status, any capital gains income will be subject to ordinary income tax rates, which will range between 10% and 37%. Investments sold within one year of purchase referred to as short-term capital gains will also be subject to ordinary income tax rates.

Related: Cash App Taxes Review.

The Best Ways to File Your Income Tax Return in 2023

Filing manually is not recommended as even with a simple tax return it can be challenging to understand all the deductions and credits you may qualify for.

Luckily, there are a few options for preparing your taxes with assistance. The most common is with tax prep software. If your taxes are even more complicated and you don’t feel comfortable with software you can hire an accountant.

DIY Tax Preparation Software

Tens of millions of people are now preparing their tax returns using tax preparation software. This is an excellent strategy since the software will fully incorporate all tax changes for 2021. You simply have to fill out the information requested, and the software will handle all the technicalities for you.

Most tax software offers the ability to speak to a tax expert for an additional fee. This is a good middle ground if you start to DIY your taxes but then run into questions.

In addition, you’ll be able to either e-file or print your return, so it will be complete for filing. The software will even direct you where to send your return, as well as prepare a payment coupon if you owe additional tax. It will even calculate the IRS penalty, so you can pay it with your return, and not have to face a disturbing letter from the IRS while you’re trying to relax and enjoy your summer.

Tax preparation software has evolved to the point that it can handle many of the most complicated tax returns. This can include those that involve rental real estate, partnership interests, and self-employment. And if you need to make tax estimates, the software will both print IRS forms 1040ES, as well as instructions on where to send your estimated payments.

You can read all about them in our article comparing the best tax software programs before making your selection.

You can also start by investigating our post What Is The Cheapest Tax Software? This can be an excellent starting point because most tax preparation software plans have free versions. You can investigate those versions, as well as consider any premium services they offer for more complicated returns. In that way, you can construct ta software for you, based on a buffet table of services, and their respective costs.

Using a Professional Tax Preparer

If you don’t feel comfortable preparing your own taxes using one of the popular tax preparation software plans, you can always opt to have your return prepared by a tax professional. This may be the preferred way to go if you have an especially complicated tax situation, and even more so if you’re concerned about the risk of an IRS audit.

If you hire a professional, you should either go with a CPA or an enrolled agent.

Certified Public Accountant. CPAs are trained tax professionals. Not only do they have access to a wealth of information on the tax code, but they also regularly attend training sessions to keep them current on the latest changes and complications, and use some of the most advanced tax software available. They can handle the most complicated tax situations but cannot represent you in court in the event of an audit.

Enrolled agents (EAs). Enrolled agents are CPAs but they also have the ability to represent you in the event of an audit.

What if You Need to File an Extension?

You can request an extension, and it will be granted automatically. You can do this by filing IRS Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return. It must be filed no later than midnight, April 18, 2023.

By filing the form, you’ll get an extension through October 16th, 2023. That will give you a full six months to complete your return. But don’t wait until the last minute if you plan to file by October 16th. There are no more extensions beyond that date.

It’s also important to understand the extension applies only to the filing of your tax return. It does not give you an extension to pay any income tax you owe. If you don’t make your full tax payments by April 18th, interest and penalties will be assessed on the unpaid balance. So only file an extension if you are confident you won’t owe any taxes.

What if You Can’t Pay Your Taxes by the Due Date?

If you owe more than you can pay by the due date, you do have a couple of payment options.

Request more time to pay. The IRS will provide up to 120 days to pay the amount of tax you owe. To do this, you will need to contact the IRS and request additional time to pay. This request must be made and approved prior to the tax filing date.

Set up an installment payment plan. If you won’t be able to pay the tax due within 120 days, you can apply for an Installment Agreement with the IRS. This will give you up to 72 months to pay your tax debt. But if the amount due is greater than $25,000, you will need to complete a financial disclosure.

Whether you’re permitted more time to pay your tax bill, or you set up an installment agreement, interest and penalties will apply to the unpaid balance. It’s not a perfect arrangement, but at least you can rest assured knowing you won’t go to debtors’ prison because you can’t pay your taxes!

How Long Will it Take to Get Your Refund?

If you file your return electronically, the refund is generally processed within 21 days of the e-file acceptance date. In most cases, it will be less. If you file a paper return, it will take between six to eight weeks at a minimum.

You can use the IRS Where’s My Refund tool to track the progress of your refund. However, if you use tax preparation software, the software itself may track your refund, and let you know when to expect its arrival.

Related: Tax Refund Schedule

Final Thoughts on Filing your 2022 Taxes

A good tax prep software will handle most of the details for you. What you want to be aware of is steps you can take during the year to optimize your taxes. One example is how contributing to your 401(k) will reduce your taxable income but it’s not something you can do after the fact. You’ll want to be making those contributions throughout the year.

Another example would be a business owner who can take a mileage deduction. Those records need to be kept on the fly, however, the exact amount of the deduction can be determined by the tax preparer.

Understanding the basics of how your taxes work is an important part of financial planning. However, the small details of the exact credits or deductions you qualify for can be handled by your tax preparer.