If you’re a homeowner who might soon sell a home or an investor with money in stocks, bonds, or real estate, you’ll need to be familiar with the tax form Schedule D.

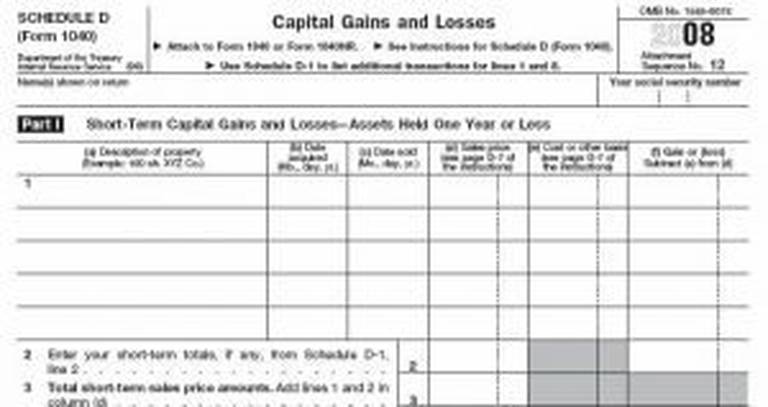

Tax form 1040 Schedule D is used to report capital gains for the purpose of income tax. A capital gain is any profit made from the sale of an investment for more than the purchase price.

Related: Credit Karma Tax Review

So, if you purchase a home or investment property for $250,000 and sell it for $300,000, you have a capital gain of $50,000. (In reality, the tax aspects of selling a home are a little more complicated.)

For tax purposes, the purchase price of your main home includes a number of things, including upkeep costs, purchase costs, and sale costs, minus accumulated depreciation.

You can also exclude up to $250,000 of profit, or up to $500,000 if you file a joint return with your spouse if you’ve lived in the home for two or more years. If you’re selling a home at a gain, you almost certainly need to meet with a tax adviser to get advice on how to reduce your liability.

Schedule D isn't just used to report capital gains when you sell a home. It's also used to report:

- The sale or exchange of a capital asset not reported on another form or schedule

- Gains from involuntary conversions (other than from casualty or theft) of capital assets not held for business or profit

- Capital gain distributions not reported directly on Form 1040, line 13

- Non-business bad debts

Using Schedule D

If you have a relatively simple investment situation, you may be able to navigate Schedule D on your own, or with the assistance of an online tax service. However, if you are selling a variety of assets, the safe bet is to consult a professional.

Besides the many details to keep track of in capital gains, short and long-term gains are taxed differently, further complicating the issue. You don’t want to miss any opportunities to reduce your liability or, worse, miscalculate the amount you owe and wind up paying interest or penalties.

To fill out the Schedule D, you or your accountant will need to have any documents your broker has sent you regarding the sale of assets, and anything and everything related to the costs of buying and selling any real estate property.

Planning for Capital Gains

Now that we’ve discussed Schedule D, it’s a good time to briefly discuss planning your investment sales around capital gains and losses. Let’s say, for example, that you need $20,000, and need to sell that much in investment assets.

We’ll say that your stock in Widgets R Us has appreciated up to $25,000 from an initial investment of $20,000, and your investment in Kingpin Bowling Supplies has dropped to $15,000 from an initial investment of $20,000. A sale of $12,500 in Widgets stock and $7,500 in Kingpin stock would end up with a total gain of zero.

Now, understand that you should closely consider these decisions and discuss them with your broker. You need to take taxes into account, but letting them completely dictate your investing decisions can be a recipe for disaster. And you should never sell stock in a company you still believe is well-poised for growth and return.

But, if you find yourself convinced that a stock you’re holding is a lemon and you’re looking for a good time to sell, you may be able to use that sale to offset a capital gain.

Should you need help filing your taxes this year, you may want to consider both Turbo Tax and H&R Block. Their free online tax software can make your tax nightmares disappear.

The Best Free Tax Software

| Brand | Best For |

|---|---|

| Cash App Taxes (formerly Credit Karma Tax) | All Individual Filers |

| Turbo Tax | Overall Features |

| TaxACT | Freelancers |

| H&R Block | Free Filers |

Read More: What Is The Cheapest Tax Software